Barclays Bank Personal Loan Key Features Jan 2021

| Eligibility Criteria | Details |

| Age | 21-60 years |

| CIBIL | 750 and above |

| Barclays Bank Personal Loan Interest Rate | 7.30% per annum |

| Lowest EMI per lakh | – |

| Tenure | 12-84 months |

| Barclays Bank Personal Loan Processing Fee | 2% |

| Prepayment Charges | 4% of the principal outstanding amount |

| Part Payment Charges | nil |

| Minimum Loan Amount | Rs.50,000/- |

| Maximum Loan Amount | Rs.17,00,000/- |

Each Feature Explained in Detail Below

Barclays Bank Personal Loan Eligibility Criteria

Eligibility criteria for a personal loan:

| CIBIL score | 750 and above |

| Age | 21-60 years |

| Min Income | 25,000/- and above |

| Occupation | salaried/self-employed |

Barclays Bank Personal Loan Documents Required

| Form | Duly filled application form |

| Proof of Identity | Passport copy, driving license, Aadhar Card, and Voter ID card |

| Proof of Address | Rental agreement ( with a minimum of 1 year of stay), utility bills, passport(proof of permanent residence) and ration card |

| Proof of Income | Income tax return of the last two assessment years, salary slip of the last 6 months and bank statement of the last 3 months |

Barclays Bank Personal Loan EMI Calculator

Barclays Bank Personal Loan Compared to Other Banks

| Particulars | Barclays Bank | HDFC Bank | Bajaj Finserv | Axis Bank | Citibank | Private Bank |

| Interest Rate | 7.30% | 10.50% to 21.50% | Starting from 12.99% | 7.35% to 24% | Starting from 10.50% | 10.50% to 19.25% |

| Tenure | 12 to 84 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Loan amount | Up to Rs. 17 lakh | Up to Rs. 40 lakh | Up to Rs. 25 lakh | Rs. 50,000 to Rs. 15 lakh | Up to Rs. 30 lakh | Up to Rs. 20 lakh |

| Processing Fee | Up to 2% of the loan amount | Up to 2.50% of the loan amount | Up to 3.99% of the loan amount | Up to 2% of the loan amount | Up to 3% of the loan amount | Up to 2.25% of the loan amount |

Other Loan Products from Barclays Bank

- Home loan

- Property loan

- School loan

- Auto loan

Why should you apply for Barclays Bank Personal Loan with Dialabank?

Dialabank helps you choose the best of banks by giving you the updated market contrast of other banks so that you can make the right decision. At Dialabank, we have supported thousands of borrowers to take the loan they want without any hassle and look forward to doing so. Apply today to get special offers and deals on Barclays Bank personal loans.

You can call us on 9878981166 to get a Barclays Bank personal loan.

How to Calculate EMIs for Barclays Bank Personal Loan

These are required information to calculate your Barclays Bank personal loan EMI: The amount of the loan, the rate of interest, and the loan period.

Enter these values in the personal loan EMI calculator below to find your monthly EMIs.

Barclays Bank Personal Loan Processing Time

Processing time would tell you how long it would take to process an application under normal situations. It usually starts on the day we receive the application from the bank and ends when we decide what loan we want and the amount to get credited.

Barclays Bank Personal Loan Preclosure charges

This depends on the bank and the amount borrowed by the borrower.

Barclays Bank personal loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can, in like manner, reimburse the got out totally at whatever point the condition is ideal. From this time forward, it is conceivably the most favoured credit choices that benefitted from meeting changing individual supporting necessities unbounded.

Apply for an overdraft office as a Barclays Bank for an unforeseen new development. The adaptable improvement office has all the enormous highlights of a slight overdraft credit.

Pre Calculated EMI for Personal Loan

Different Personal Loan offers by Barclays Bank

Barclays Bank Personal Loan Balance Transfer

A personal loan balance transfer is a procedure in which the applicant transfers the outstanding principal of the personal loan from one lender to another to gain from better terms such as a lower and collective personal loan interest rate on the outstanding loans.

Barclays Bank Personal Loan Top Up

The top-up loan is only given to customers who already have an existing relationship/account with the bank; the eligibility criteria are quite basic for the top-up plan. A customer who has taken a loan from the bank, irrespective of the loan type, is eligible for a top-up loan.

Barclays Bank Personal Loan Status

You can track the status of your Barclays Bank personal loan by using the following methods :

- You could visit the nearest loan branch and ask the bankers for the same.

- Log In to the bank’s net banking portal, click on the loans from the top icon and click on enquire to monitor the status of your personal loan.

- Search for ‘personal loan status’ on google, click on the first link, which will guide you to the loan status tracker webpage of Barclays Bank, and fill in the required information to track the status of your loan.

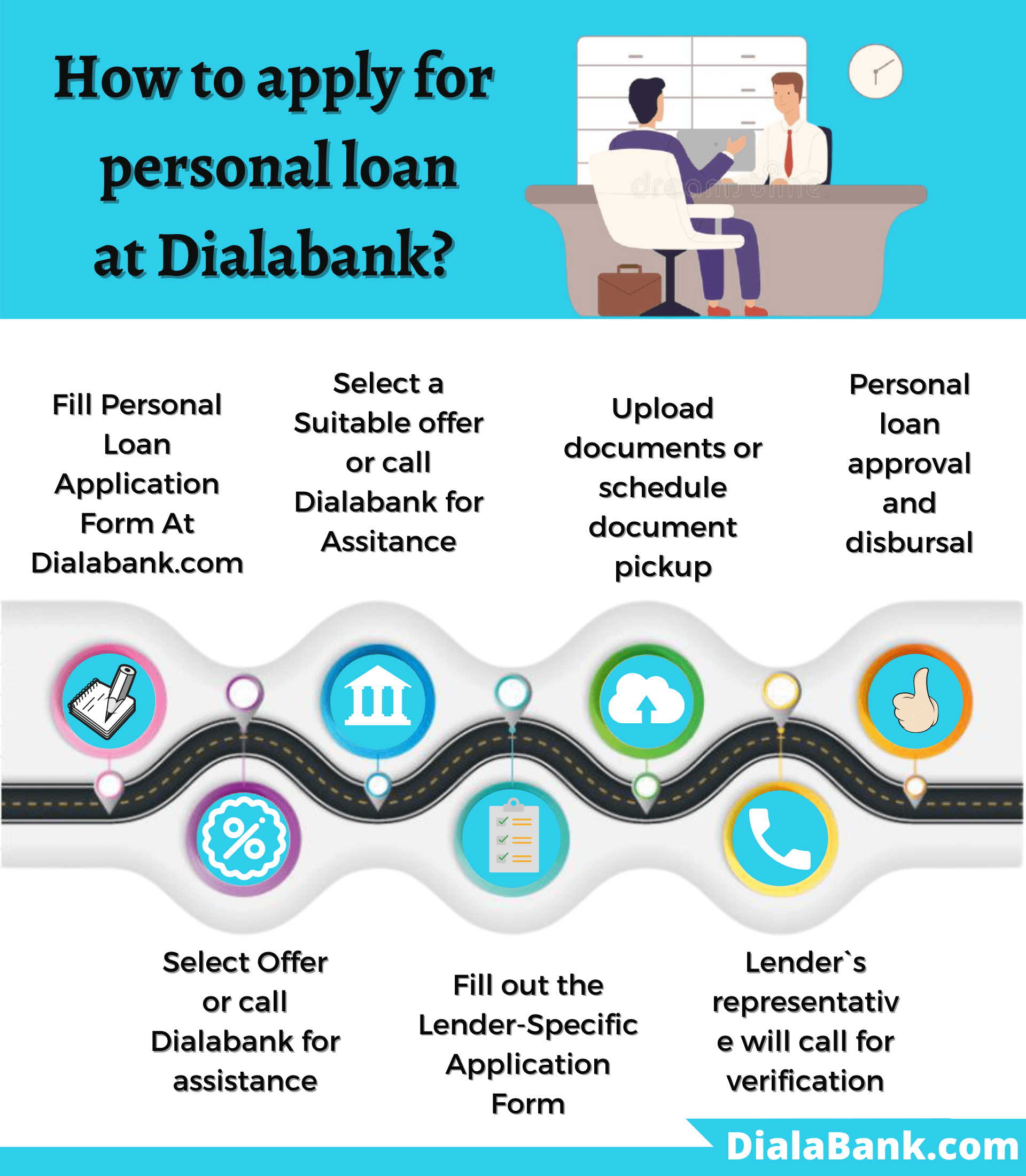

How to Apply for Barclays Bank Personal Loan?

Getting a personal loan is quite simple; you would have to:

- First, visit our website and fill in the application form.

- You would then get a call from us.

- Our experts will then guide you throughout the process and give you the details about the loan.

FAQs About Barclays Bank Personal Loan

✅ How to apply for Barclays Bank Personal Loan?

You can apply for a personal loan with Barclays Bank by visiting the nearest branch of Barclays Bank or by submitting a simple form with Dialabank. With Dialabank, you will get the benefit to apply from anywhere for a personal loan and get quick online approval.

✅ What is the Interest Rate for Barclays Bank Personal Loan?

The interest rate charged by Barclays Bank starts at 7.30% for their personal loan products.

✅ What is the minimum age for getting a Personal Loan from Barclays Bank?

Your minimum age must be 21 to apply for a personal loan with Barclays Bank.

✅ What is the maximum age for getting a Personal Loan from Barclays Bank?

The maximum age for getting a personal loan from Barclays Bank is 60 years.

✅ What is the minimum loan amount for Barclays Bank Personal Loan?

The minimum loan amount for availing of a personal loan from Barclays Bank is Rs. 50,000.

✅ What is the maximum loan amount for Barclays Bank Personal Loan?

The maximum loan amount for getting a personal loan from Barclays Bank of Rs. 17 lakhs.

✅ What are the documents required for Barclays Bank Personal Loan?

Aadhaar card/Voter ID, PAN card, salary slips of the last 6 months, the ITR files of the last two financial years, and two recently clicked photographs are the documents required for a personal loan from Barclays Bank.

✅ What is the Processing Fee for Barclays Bank Personal Loan?

Barclays Bank charges a processing fee of up to 2% of the loan for the personal loan.

✅ How to get Barclays Bank Personal Loan for Self Employed?

There is a provision of special offers for self-employed borrowers to help them economically. You should have the ITR files of the last three years as your income proof.

✅ What is the Maximum Loan Tenure for Barclays Bank Personal Loan?

The maximum loan tenure period for a personal loan from Barclays Bank is 84 months.

✅ What should be the CIBIL Score for Barclays Bank Personal Loan?

The CIBIL score required for getting a personal loan from Barclays Bank is 750 or above.

✅ Do I have a preapproved offer for Barclays Bank Personal Loan?

You can check your preapproved personal loan offers from Barclays Bank with Dialabank. Just fill the form, and we will examine all the offers for you and get back to you to assist you in choosing the best one.

✅ How to calculate EMI for Barclays Bank Personal Loan?

You can use the EMI calculator available at Dialabank’s website to calculate your personal loan EMIs from Barclays Bank.

✅ How to pay Barclays Bank Personal Loan EMI?

Your personal loan EMIs from Barclays Bank are automatically taken from your bank account. You can also use the net banking services of Barclays Bank for your personal loan payments.

✅ How to close Barclays Bank Personal Loan?

You should pay all the outstanding personal loan amount before the loan’s closing and then contact the branch of Barclays Bank to collect your no dues certificate.

✅ How to check Barclays Bank Personal Loan Status?

You have to visit the Barclays Bank branch check to know your personal loan status. Also, you can visit Dialabank and fill a simple form to let us do the hard work for you.

✅ How to close Barclays Bank Personal Loan Online?

Closing of personal loan from Barclays Bank, the given steps are to be followed:

- Visit Barclays Bank’s net-banking page.

- Login with your details.

- Pay your personal loan amount.

- Save the transaction receipt.

✅ How to pay Barclays Bank Personal Loan EMI Online?

Your personal loan EMI can be paid with the net-banking facility provided by Barclays Bank. Dialabank allows you to compare offers and deals from different banks to choose the best to avail of a low-EMI personal loan. All you have to do is fill a simple form, and the rest will do by us.

✅ How to check Personal Loan Balance in Barclays Bank?

To check the personal loan balance in Barclays Bank, you should contact the customer care number of Barclays Bank. If you are seeking low-interest personal loans, you should visit Dialabank and fill a simple form for Personal Loan Balance Transfer, and we will do the hard work for you.

✅ How to download Barclays Bank Personal Loan Statement?

The personal loan statement of Barclays Bank can be downloaded through the Barclays Bank mobile banking app. Also, visit the online platform of Dialabank and fill a simple form to compare and know about all the offers we have for you.

✅ How to Top Up Personal Loan in Barclays Bank?

If you want a top-up on your personal loan from Barclays Bank, you must visit the bank branch and contact the loan officer. You can also fill a simple form with Dialabank at Personal Loan Top Up and leave the rest to us.

✅ What happens if I don’t pay my Barclays Bank Personal Loan EMIs?

Barclays Bank charges penal interest if you are not paying your personal loan EMIs. You must apply for a balance transfer with Dialabank to avail yourself of low-interest personal loans.

✅ What relaxation scheme and moratorium Barclays Bank provides about Personal Loan due to Covid 19?

The Moratorium by Barclays Bank is for 6 months.

✅ How to find the Barclays Bank Personal Loan account number?

You will contact your Barclays Bank loan branch to know your personal loan account number. You can also fill out the form convenient at Dialabank and let us do all the work for you.

✅What is the Barclays Bank personal loan customer care number?

Contact 9878981166 for any queries.

✅What are the Barclays Bank Personal Loan pre-closure charges?

The charges on the pre-closure of the personal loan depend on the decision taken by the bank from time to time.

✅What is the Barclays Bank personal loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting the Personal Loan account pre-closure.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgement of the balance amount you have paid.

✅What is the Barclays Bank Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can, in like manner, reimburse the got out totally at whatever point the condition is ideal. From this time forward, it is conceivably the most favoured credit choices that benefitted from meeting changing individual supporting necessities unbounded.