Karnataka Bank Personal Loan Key Features – Jan 2021

Eligibility Criteria |

Details |

| Age | 18-58 years(at loan maturity) |

| CIBIL score | 750 |

| Karnataka Bank Personal Loan Interest Rate | 12.97% p.a. |

| Lowest EMI per lakh | Rs. 2,283 |

| Tenure | 6 to 60 months |

| Karnataka Bank Personal Loan Processing Fee | 1% of the loan amount |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | Rs. 10,000 |

| Maximum Loan Amount | Rs. 5 lakhs |

Each Feature Explained in Detail Below

Karnataka Bank Personal Loan Eligibility Criteria

Personal loan eligibility criteria are given below for your assistance:

| CIBIL score criteria | 750 and above |

| Age criteria | 18-58 yrs(at loan maturity) |

| Min Income criteria | Rs. 20,000 |

| Occupation criteria | Salaried/Self-Employed |

Karnataka Bank Personal Loan Interest Rate and Charges

| Karnataka Bank Personal Loan Interest Rate | 12.97% p.a. |

| Karnataka Bank Personal Loan Processing Charges | 1% of the loan amount |

| Prepayment Charges | NIL |

| Stamp Duty | NIL |

| Cheque Bounce Charges | NIL |

| Penal Interest | NIL |

| Floating Rate of Interest | NIL |

Karnataka Bank Personal Loan Documents Required

| Form | Duly filled application form. |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Karnataka Bank Personal Loan EMI Calculator

Karnataka Bank Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Karnataka Bank | 12.97% | 06 to 60 months | Up to Rs. 5 lakh/1%-2% |

| HDFC Bank | 10.50% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 7.35% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.50% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 10.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh / Up to 2.25% of the loan amount |

Other Loan Products from Karnataka Bank

| Karnataka Bank Gold Loan | Karnataka Bank Car Loan | Karnataka Bank Home Loan | Karnataka Bank Business Loan |

| Karnataka Bank TWL | Karnataka Bank LAP | Karnataka Bank Credit Card | Karnataka Bank Education Loan |

Why should you apply for Karnataka Bank Personal Loan with Dialabank?

Why should you apply for Karnataka Bank Personal Loan with Dialabank?

Dialabank provides the best services all over the country. If you apply for Karnataka Bank’s Personal Loan with Dialabank, you will get your loan approval process faster. Dialabank has the operators for giving you guidance about the procedure of personal loans in a detailed manner.

How to Calculate EMIs for Karnataka Bank Personal Loan

The information required for the calculation of your Karnataka Bank’s Personal Loan EMI is given below::

- Amount of the Loan

- Rate of Interest

- Loan Tenure

Put these values in the calculator below and find your monthly EMIs

Karnataka Bank Personal Loan Processing Time

Karnataka Bank’s Personal Loan Processing Time is the time taken in your loan application process. 2 days is the processing time for the personal loan.

Karnataka Bank Personal Loan Pre-closure charges

Karnataka Bank’s Personal Loan pre-closure is the repayment of the loan amount before the loan tenure. It has the benefit that it will lower your personal loan interest rate

Pre Calculated EMI for Personal Loan

Rate |

5 Yrs |

4 Yrs |

3 Yrs |

| 10.50% | 2149 | 2560 | 3250 |

| 11.00% | 2174 | 2584 | 3273 |

| 11.50% | 2199 | 2608 | 3297 |

| 12.00% | 2224 | 2633 | 3321 |

| 12.50% | 2249 | 2658 | 3345 |

| 13.00% | 2275 | 2682 | 3369 |

| 13.50% | 2300 | 2707 | 3393 |

| 14.00% | 2326 | 2732 | 3417 |

| 14.50% | 2352 | 2757 | 3442 |

| 15.00% | 2378 | 2783 | 3466 |

Different Personal Loan offers by Karnataka Bank.

Karnataka Bank Home Loan

- Karnataka Bank offers home loans.

- The loan amount is up to Rs. 5 crores.

Karnataka Bank Personal Loan for Government Employees

- Karnataka Bank provides the Personal Loan to Govt. Employees.

- The loan amount depends on the reputation of the company and its fame.

Karnataka Bank Education Loan

- Karnataka Bank offers personal loans for education.

- Provides education loans for studies in India as well as Abroad.

Karnataka Bank Personal Loan for Car

- Karnataka Bank provides a personal loan for cars.

- Offers loan for a new car and used car as well.

Karnataka Bank Personal Loan Balance Transfer

Karnataka Bank’s Personal Loan Balance Transfer is sending off your loan amount from one lending foundation into another. Balance transfer will help you in lowering the interest rate of your loan.

Karnataka Bank Personal Loan Top Up

Karnataka Bank’s Personal Loan Top Up is the supplementary loan amount that adds up in your existing loan amount. You can avail of top-up loans by giving 12 EMIs successively.

Karnataka Bank Home Renovation Loan

Home remodel now to beat the need list for the vast majority of the borrowers yet supports become an impediment simultaneously. Karnataka Bank Home Renovation Loan is acquainted with getting your home repaired whether it is repainting or tiling Karnataka Bank advance covers it all. The critical features of the Karnataka Bank home redesign credit are as per the following:

- The home redesign credit plans and strategies incorporate fundamental documentation and no-multifaceted nature.

- The Karnataka Bank Home credit is accessible for both existing and new clients.

- This individual unstable advance is accessible in any event a financing cost of 8.00% p.a.

- The preparing expense for the advance is charged at an ideal pace of 0.50% alongside added charge.

Karnataka Bank Holiday Loan

An occasion advance is only a credit taken against your voyaging costs and housing administrations needed to add on to your move away. You can check the trademark highlights of the occasion advance just to affirm reserve for your intriguing dream excursion:

- Karnataka Bank guarantees moment disbursal of the credit advance for your vacation fun.

- The preparing expense is charged at a negligible rate.

- The financing cost material to the Holiday Loan is 11.25%, etc.

Karnataka Bank Fresher Funding

Karnataka Bank has quickened in the realm of credit which currently has presented another classification of Advanced Karnataka Bank Freshers Funding. This unique sort of credit is available to graduates who are graduates and recently stamped proficient workers looking for assets to build up a steady future. Coming up next are the key highlights that the Karnataka Bank Freshers Funding display:

- A positive credit whole is given to the candidates.

- The competitor must be 21 years old or more.

- The financing cost charges are reliant on the candidate’s profile.

Karnataka Bank NRI Personal Loan

For various reasons, individuals will generally move out, which regularly incorporate training, clinical office, work, etc. For such up-and-comers monetary costs become a snag, such crisis individual costs are cared for by the uncommon advance class is Karnataka Bank NRI Personal Loan. The significant highlights of the individual advance are as given underneath:

- Profoundly serious rates and adaptable reimbursement residencies for the candidate.

- No insurance or security is requested or the development payment.

- The report verification is needed to be appended for both the Indian occupant (essential borrower) and the NRI competitor (co-candidate).

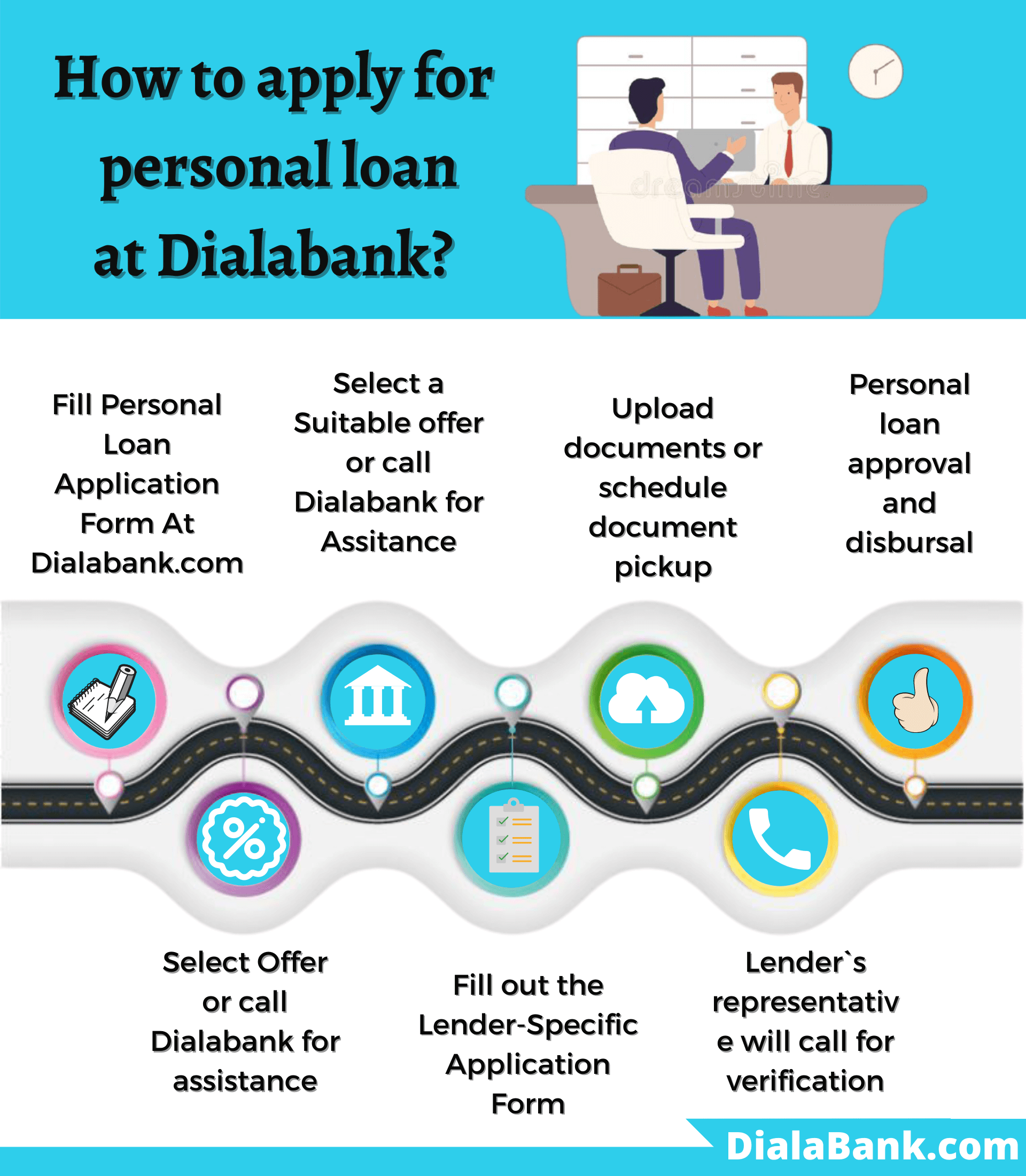

How to Apply Online for Karnataka Bank Personal Loan with Dialabank?

You can apply for Karnataka Bank’s Personal Loan online by visiting the Karnataka Bank’s online portal and filling the form for applying for a personal loan; You can avail of a personal loan by following the given steps:

- Visit Dialabank and fill the application form.

- Our representative will call you.

- Our experts will guide you through the whole procedure and tell you the details of the loan.

Personal Loan Verification Process

The following steps are a must after you apply for a Personal Loan in Karnataka Bank, which is as mentioned below:

- When you complete the application technique with Dialabank, your application for a Personal Loan is additionally continued by the Bank.

- As the bank confirms your application structure, they give you a confirmation call.

- When the confirmation on a telephonic discussion is done, the bank plans a get for archive accommodation.

- When all the necessary archives are joined, a further check happens.

- Presently as the subsequent check passes the bank affirms the last credit sum, financing cost, and the residency for the referenced sum.

- The bank calmly hangs tight for the client’s certification, and once the client affirms the credit sum is right away dispensed.

Check your Karnataka Bank Personal Loan Application Status

The Karnataka Bank Loan application can be tracked in simple, easy steps as follows:

- The Offline strategy applies, the candidate needs to visit the bank office and take reports on the application status.

- From the Karnataka Bank Online, site presents your name and reference proposition number.

- Present the solicitation, and you will get a report concerning your Personal Loan.

How to Login to Karnataka Bank Portal

- Go to the Karnataka Bank Website.

- Enter the Login ID and Password

- Press the login.

Karnataka Bank Personal Loan Statement

Through the portable application, the advanced application can undoubtedly be followed.

- Visit the official site of Karnataka Bank.

- Explore through the page and snap on the “Register New Loan”.

- Fill in all the necessary subtleties.

- Presently click on the submit key.

- After which you will get an OPT that will guide you through enrolling for Loan Statement.

Karnataka Bank Personal Loan Restructuring (COVID-19)

In the midst of the pressure of COVID-instigated lockdown, The Karnataka Bank showed a drive to reduce the weight on its borrowers. The bank ordered the RBI ban that finished in the period of September. In this way, all the borrowers were foreseen to continue back to the past EMI plans.

Nonetheless, the borrowers were as yet in anarchy concerning reimbursing the exceptional with progressing monetary crunches. Considering the unfavourable circumstance, Karnataka Bank presented another system that bolsters its borrowers’ reason passable by the RBI.

The help system is pointed toward destressing the borrowers by diving monetary pressure. This new system gives the borrower freedom to stretch out the reimbursement residency for 2 years at specific outcomes. The all-encompassing unwinding will invite an additional financing cost on the extraordinary sum.

Along these lines, the advance will be named “Rebuilt” in the recipient’s credit report. Bringing about a comment on the borrower’s FICO assessment, the borrowers are subsequently encouraged to select the instrument in the most troublesome conditions if the reimbursement plans must get the strings as in the past.

Karnataka Bank Customer Care

- Phone: The customers get in touch with the bank via call on 9878981166

- Via Chatbox: The chatbox is open for any suggestion or query on the official site.

- Branch Visit: The applicant can visit the bank branch for any information on loan approval.

Benefits of Applying for Personal Loan on Dialabank

- Easy Access: At the point when the up-and-comer applies for an individual credit with Dialabank. The client can without much of a stretch connect with the bank and have 24*7 openness.

- Super Easy Documentation: While applying for a Personal Loan with Dialabank, the candidate experiences a basic strategy alongside fundamental documentation’s advantages.

- Advanced with multiple Bank Information: The candidate is prescribed not to restrict their alternatives as Dialabank gives you the freedom to choose and think about various monetary establishments without a moment’s delay.

- EMI Calculator: You can easily know the applicable EMI on your Personal Loan with Dialabank’s customer-friendly personal loan EMI calculator that gives accurate EMI Payable on your Personal loan based on the interest rate.

Important Aspects

The mentioned below are a few points that should be taken into consideration before you apply for a Personal Loan:

- It is prudent to keep the advance sum as least as could reasonably be expected. Since the reimbursement of a lesser sum is simple and brief. The candidate’s reimbursement limit is of most extreme significance while applying for a Personal Loan so the advance sum should be profited according to the prerequisite as opposed to benefiting higher advance sum because of its simple accessibility.

- The FICO rating decides whether the candidate is qualified for the given credit, so it is prescribed to investigate the Credit Score before pitching a Loan application. In most situations, the feeble FICO assessment just prompts a straight dismissal of the application.

- Go for the bank or foundation offering the top tier administration and financing cost for the advance sum you require. Look at and investigate before agreeing to one bank. In the Credit World, the banks offer serious financing costs and residencies for the advance sum so a second investigation of the banks will just profit you.

FAQs About Karnataka Bank Personal Loan

✅ How to apply for Karnataka Bank Personal Loan?

You can apply for a personal loan from Karnataka Bank by visiting the nearest Karnataka Bank branch or submitting the form with Dialabank. You can get the benefit to apply from anywhere with Dialabank.

✅ What is the Interest Rate for Karnataka Bank Personal Loan?

The interest rate for a personal loan from Karnataka Bank is 12.97% p.a.

✅ What is the minimum age for getting a Personal Loan from Karnataka Bank?

The minimum age for getting a personal loan from Karnataka Bank is 18 years.

✅ What is the maximum age for getting a Personal Loan from Karnataka Bank?

The maximum age for getting a personal loan from Karnataka Bank is 58 years.

✅ What is the minimum loan amount for Karnataka Bank Personal Loan?

The minimum loan amount for a personal loan from Karnataka Bank’s Personal Loan is Rs. 10,000.

✅ What is the maximum loan amount for Karnataka Bank Personal Loan?

You can get a maximum loan amount for your personal loan from Karnataka Bank of Rs. 5 lakh.

✅ What are the documents required for Karnataka Bank Personal Loan?

The documents required to apply for a personal loan from Karnataka Bank’s Personal Loan are the Aadhaar card, driving license, voter ID card, PAN card, salary certificate and form number 16, bank statements of last 3 months, ITR files of the last two years.

✅ What is the Processing Fee for Karnataka Bank Personal Loan?

The processing fee charged by Karnataka Bank is 1% of the loan amount for their personal loan products.

✅ How to get Karnataka Bank Personal Loan for Self Employed?

Karnataka Bank provides special offers for self-employed borrowers to aid them financially. You will need to show the ITR files of the last two years for income proof.

✅ What is the Maximum Loan Tenure for Karnataka Bank Personal Loan?

The maximum loan tenure for a personal loan from Karnataka Bank is 60 months.

✅ What should be the CIBIL Score for Karnataka Bank Personal Loan?

The CIBIL score required for getting a personal loan from Karnataka Bank is 750 and above.

✅ Do I have a preapproved offer for Karnataka Bank Personal Loan?

You can check out your preapproved personal loan offers from Karnataka Bank with Dialabank. Visit the online platform of Dialabank and check out offers for you.

✅ How to calculate EMI for Karnataka Bank Personal Loan?

To calculate your personal loan EMI for Karnataka Bank, you can use the EMI calculator available for you at Dialabank’s website.

✅ How to pay Karnataka Bank Personal Loan EMI?

Your personal loan EMIs from Karnataka Bank subtracted automatically from your bank account. You can also use the net-banking service of Karnataka Bank.

✅ How to close Karnataka Bank Personal Loan?

You must have paid your outstanding personal loan amount to close the loan and then collect no dues certificate through contact with the Karnataka Bank branch.

✅ How to check Karnataka Bank’s Personal Loan Status?

To know your personal loan status, you will require to visit the Karnataka Bank branch. Also, you can visit Dialabank and fill a form to allow us to do work for you.

✅ How to close Karnataka Bank Personal Loan Online?

The following steps for closing the personal loan from Karnataka Bank:

- Visit the net-banking page of Karnataka Bank.

- Log in by filling in your details.

- Pay for your personal loan.

- Save the transaction receipt.

✅ How to pay Karnataka Bank Personal Loan EMI Online?

You can pay your personal loan EMIs online using the net-banking facility provided by Karnataka Bank. To get a low-EMI personal loan, Dialabank will provide the best services for it.

✅ How to check Personal Loan Balance in Karnataka Bank?

You will contact the customer care number of Karnataka Bank to check the personal loan balance. If you are looking for low-interest personal loans, you must visit Dialabank and fill a simple form for Personal Loan Balance Transfer.

✅ How to download Karnataka Bank’s Personal Loan Statement?

The personal loan statement of Karnataka Bank can be downloaded through the Karnataka Bank’s mobile banking app. You can visit the online platform of Dialabank.

✅ How to Top Up Personal Loan in Karnataka Bank?

If you want a top-up personal loan from Karnataka Bank, you will visit the bank branch and contact the loan officer. You can also fill a form with Dialabank at Personal Loan Top Up.

✅ What happens if I don’t pay my Karnataka Bank Personal Loan EMIs?

If you don’t pay your personal loan EMIs of Karnataka Bank, you will have to pay a penal interest. To get low-interest personal loans, you must apply for a balance transfer through Dialabank.

✅ How to find Karnataka Bank Personal Loan account number?

To know your personal loan account number, you will contact your Karnataka Bank loan branch. Also, fill a form at Dialabank.

✅ What is the Karnataka Bank personal loan closure procedure?

Visit the bank with the complete set of documents (as mentioned above). You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account. Pay the pre-closure amount. Sign the required documents, if any. Take acknowledgement of the balance amount you have paid.

✅ What is Karnataka Bank personal loan maximum tenure?

The maximum tenure of the Karnataka Bank personal loan is 60 months.

✅ What is Karnataka Bank personal loan minimum tenure?

The minimum tenure of the Karnataka Bank personal loan is 12 months.

✅ What is the Karnataka Bank personal loan customer care number?

The customer care number of the Karnataka Bank personal loan is 9878981166.

✅ What are the Karnataka Bank Personal Loan pre-closure charges?

Karnataka Bank gives you the option of pre-closing your loan after a period of a minimum of 12 months of taking the loan and paying 12 successful EMIs on your mortgage. However, Karnataka Bank charges a Prepayment or Pre-closure charge. Refer to the table mentioned above.