Best Banks for Used Car Loan in New Delhi

Used Car Loan New Delhi Features

- Avail of Used Car loan New Delhi up to Rs. 2.5 crore on a wide range of pre-owned cars and multi-utility vehicles

- Get between 3 to multiple times your yearly pay, and get up to 100% of the estimation of the car*

*Age of Car at credit development ought not to cross 10 years, subject to the most extreme advanced residency of 60 months

- Advantage from start to finish warning – from examination to title move

- Get customized help to pick a vehicle that meets your particular needs

- Profit of altered and helpful reimbursement plans with pocket-accommodating EMIs

- Adaptable reimbursement residencies from a year to 60 months

- Fast and simple Processing and endorsement

- Experience straightforward issue free preparing, fast endorsements, and quick disbursals

- Track your application whenever, anyplace. Get announcements about your credit application at each stage

- Appreciate doorstep administration and speedy and simple documentation

- Check your advance qualification in only 60 seconds

- Get 80% of the estimation of the vehicle as to the advance sum for a long time without pay confirmation

- Get 85% of the estimation of the vehicle as to the advance sum for a long time without pay confirmation

Used Car Loan New Delhi Interest Rate

To check Car Loan Interest Rate for all major banks you can visit: Car Loan Interest Rates

Used Car Loan New Delhi Documents Required

An individual must check the documents required for a car loan before deciding.

Salaried Individuals:

Address Proof:

- Substantial Passport

- Lasting Driving permit [recent, decipherable, laminate]

- Citizens ID Card

- Occupation card gave by NREGA

- The letter gave by the National Population Register containing subtleties of name and address

Evidence of salary:

- Most recent Salary Slip

- Most recent Form 16/Latest ITR

- Last 6 months bank statement

Confirmation verification:

- Identification Copy

- Photograph Driving License with DOB (later, readable, covered)

- Financial record with Credit Card Copy

- Broker’s Verification

- Duplicate of Margin Money Paid to the Bank

Self-employed Individuals:

Address evidence:

- Notice and Articles of Association

- Affirmation of Incorporation

- Phone Bill

- Power Bill

Confirmation verification:

- Visa Copy

- Photograph Driving License with DOB (later, clear, covered)

- Financial record with Credit Card Copy

- Investor’s Verification

- Duplicate of Margin Money Paid to the Bank

The following type of companies can also apply for a Used Car Loan New Delhi:

- Sole Proprietorship

- Partnership Firms

- Private Limited Companies

- Public Limited Companies

Used Car Loan New Delhi Eligibility Criteria

The car loan eligibility requirements are as followed:

Salaried Individuals:

- Age Range: Individuals who are a minimum of 21 years of age when applying for the loan, and a maximum of 60 years of age at the end of the loan tenure

- Minimum Work Experience: Individuals who at least have had a job for 2 years, with a minimum of 1 year with the present employer.

- Minimum Earning: Those who earn a minimum of Rs. 2,50,000 per year., The income of the spouse can be considered as one with the applicant’s income.

Self Employed Individuals:

- This includes people who own a private corporation in the business of manufacturing, trading, or duties

- Rs. 2,50,000 per annum should be a minimum earning.

- Individuals who have an office landline.

How to Apply for a Used Car Loan in New Delhi?

Benefiting a Used Car Loan New Delhi is a simple cycle with Dialabank. Follow the accompanying strides to profit from the best offers:

- Visit our site Dialabank.

- Snap-on the vehicle advance alternative accessible in the menu.

- Fill in the insights about the vehicle type and your salary.

- Hold up as our relationship supervisor will before long connect with you on your gave number.

- You may likewise contact our relationship supervisors on the number 9878981166 if there should be an occurrence of any questions with respect to the credit.

- For benefiting a vehicle credit disconnected you should visit the branch by and by, which may go quick.

Used Car Loan for Major Car Manufacturers in New Delhi

TABLE WILL APPEAR

Processing Fees / Prepayment Charges on Used Car Loan New Delhi

CIBIL Score Required for Used Car Loan in New Delhi

The CIBIL score is alluded to as what characterizes your capacity to take care of your credits. A higher Credit score implies a great record as a consumer and makes your vehicle advance application measure smooth and simple to be handled. Generally, banks and NBFCs consider a FICO assessment of 720 or more as a decent score to affirm your credit application measure New Delhi.

This score may again shift from bank to bank. In the event of a low CIBIL score than the necessary worth, you will be needed to pay a high rate financing cost on the credit sum while on the off chance that your CIBIL score is acceptable, at that point you may need to pay a low pace of intrigue. Subsequently, a CIBIL score is a significant factor in vehicle credit.

Used Car Loan New Delhi Contact Number

In case of any queries regarding the car loan in New Delhi, you may contact us on the number 9878981166 for any sort of assistance.

Pre Calculated EMI Table for Used Car Loan New Delhi

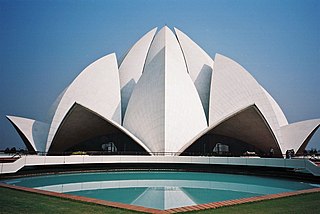

About New Delhi

New Delhi is the capital of India and an executive district of NCT Delhi. New Delhi is also the support of all three branches of the Government of India, which is Executive, Legislature, and Judiciary.

Car Loan EMI Calculator

Car Loans in Other Cities

| Used Car Loan Hodal | Used Car Loan Calangute |

| Used Car Loan Goa | Used Car Loan Margao |

| Used Car Loan Panjim | Used Car Loan Mapusa |

| Used Car Loan Vasco | Used Car Loan Bicholim |