Major Personal Loan Providers in Zirakpur

Feature

HDFC Bank

Private Bank

Bajaj Finance

Interest Rate

10.75% - 17%

11.25% - 18.5%

0.12

Min Loan Amt

Metro : 75000 & Non Metro: 50000

50000

100000

Max Loan Amt

50 Lacs

50 Lacs

1 Cr

Loan Tenure

1 - 5 Years

1 - 5 Years

1 - 5 Years

Processing Fee

0.25% - 2% of the Loan Amt

1% - 2.5% of the Loan Amt

Preclosure Charges

2%, Nil foreclosure charges after 12 months

2%, Nil foreclosure charges after 24 months

Nil

Overdraft Facility

No

No

Yes

Personal Loan Zirakpur Features

Is it cautious to impart simply are operating out of money? you would like not to stress. a private mortgage is a gigantic share of open for you. This enhancement is just not simply of an unbalanced type with the least required papers and typically lesser definitive work. This sees may grasp so long as 48 hours to get gave declaration with honor to later the occasion of the check.

Is it cautious to impart simply are operating out of money? you would like not to stress. a private mortgage is a gigantic share of open for you. This enhancement is just not simply of an unbalanced type with the least required papers and typically lesser definitive work. This sees may grasp so long as 48 hours to get gave declaration with honor to later the occasion of the check.

A private mortgage Ambejogai is a development that provides money associated lend a hand to prospects at lifelike and adjusted financing costs. To get a non-public Loan, the up-and-comer is predicted to possess a stable and reliable wellspring of pay and moreover unusual funds associated records.

In addition, such thing as a such end-utilize major for the usage of the non-public mortgage amount. That makes the most of this score outright in the style you would like to.

Personal Loan Zirakpur Interest Rates

To check Personal Loan Interest Rate for all major banks you can visit: Personal Loan Interest Rates

Bank

Processing Fee

HDFC Bank Personal Loan

0.25% to 1.50%

Axis Bank Personal Loan

0.50% to 1.50%

Nil

Private Bank Personal Loan

0.25% to 1.50%

SBI Personal Loan

500/- to 0.50%

Nil

Kotak Personal Loan

1% to 2%

IIFL Personal Loan

Nil

Nil

Muthoot Personal Loan

Nil

Nil

Manappauram Personal Loan

Nil

Nil

PNB Personal Loan

0.70% to 1%

Nil

Canara Bank Personal Loan

0.01

Nil

Andhra Bank Personal Loan

Nil

Nil

Documents for Personal Loan Zirakpur

Salaried Customers

- ID proof (Aadhar card/driving license)

- Slips for salary for the past three months

- Statement of Bank for the last 6 months

- PAN Card

- Proof of Residence (Own/Rent/Company provided)

- Two Passport-size photograph

Self-Employed Customers

- All financial statements are needed (Balance Sheet, P&L Statement as well as ITR files)

- PAN Card

- Aadhar

- Proof of residence

- Two passport-sized photographs

PERSONAL LOAN

Interest Rate 9.99%

Eligibility Criteria for Personal Loan Zirakpur

Click here to know more about personal loan eligibility.

Salaried Applicants

- The bottom age of the contender ought to not be below 21 years or over 60 years.

- The contender will need to have vocation vitality approximately any occasion three years. The remuneration should be moved off their information metaphorically.

- The up-and-comer should hold an astonishing record.

- The zone of the contender’s development must be presented.

- The borrower will need to have a coarse remuneration of INR 25,000 per month.

Self-Employed Applicants

- The age of a free particular person must be on any occasion 25 years.

- The up-and-comer utility for particular enhancement must have been chronicling ITR way back to three years.

- On the occasion that the up-and-comer is money associated pro, by at that point, the trade is must be competently working from probably the current 3 years.

- The FICO score of the up-and-comer needs to be stunning and there mustn’t ever be any dedication or dedication unavoidable.

- The once a year compensation of the contender should be at any pattern of Rs 2.5 lakh.

- The complete file test occasion of the person score requires the chance to existing his budgetary and his financial institution clarification of the previous a fourth of a year.

Why Apply for Personal Loan Zirakpur?

- There isn’t any requirement of depositing any mortgage or collateral as a safety to the bank.

- A Private Mortgage is a multidimensional loan, thus it might probably be put to make use of for the whole disorders associated with money.

- The quantity of private loans is completely in response to the compensation capability of the individual.

- A Personal Loan does not want any nominee or guarantor.

How to apply for Personal Loan Zirakpur?

- Seek advice from our website Dialabank.

- Then, navigate to the mortgage part and go to the non-public mortgage link.

- You will likely be directed to the detailed facts of the private mortgage the place that chooses your city.

- For more details and free guidance, be at liberty to name on 9878981166.

PERSONAL LOAN

Interest Rate 9.99%

Processing Fee / Prepayment Charges on Personal Loan Zirakpur

All Banks and NBFCs cost an undeniable fee for processing a non-public mortgage application. This cost is 1% of the loan amount.

If you must foreclose your mortgage sooner than the made up our minds mortgage tenure, all lending establishments should cost you a penalty as a prepayment fee. Mostly, you will not be allowed to shut your mortgage sooner than 12 months. later that, the fees range in response to what number of years the mortgage has completed. This cost varies from 4% of the remaining mortgage quantity with 2nd a period of 365 days to 2% with 4th a period of the loan

Personal Loan Zirakpur EMI Calculator

Equated month-to-month Installments or EMI is a month-to-month mounted cost simply are required to pay to the financial institution as month-to-month reimbursement for the mortgage quantity which is borrowed. looking at your profile, the speed of Hobby in your mortgage is set. The EMI in your mortgage is calculated using personal loan EMI calculator on the foundation of the Rate of interest financial institution prices you with and the mortgage quantity you should acquire and the length for which you’re taking the loan.

CIBIL Score required for Personal Loan Zirakpur

The whole lending establishments own their very own conditions for a minimal CIBIL rating that is required to course of a non-public mortgage software in Zirakpur. Mostly, the establishments want a minimal ranking of no less than 750 to more course of an application.

No establishment handiest appears at the general score. They besides take an elaborate view of the outdated loans. the main points encompass the form of loans and the amount of cash that was borrowed. If there exists any extend with funds of the old loans, it could possibly hinder the approval of the current loan.

PERSONAL LOAN

Interest Rate 9.99%

Personal Loan Zirakpur Agents

Dialabank is most main brokers for availing private Mortgage in Zirakpur. You can effortlessly observe on-line at Dialabank or allocate a name at 9878981166.

Dialabank assists you to go looking for the most effective choice of Banks and NBFCs by supplying you with get entry to an in-detail market comparative diagnosis of quite a few banks to show you how to choose the correct one. Talk over with our web page Dialabank and fill out an easy shape with the small print of non-public and work data. Our buyer relationship managers might be in contact with you shortly.

Personal Loan Zirakpur Contact Number

Contact us at 9878981166 and get well-timed help and popularity of a non-public Mortgage in Zirakpur.

Pre Calculated EMI Table for Personal Loan Zirakpur

Click here for personal loan EMI calculator

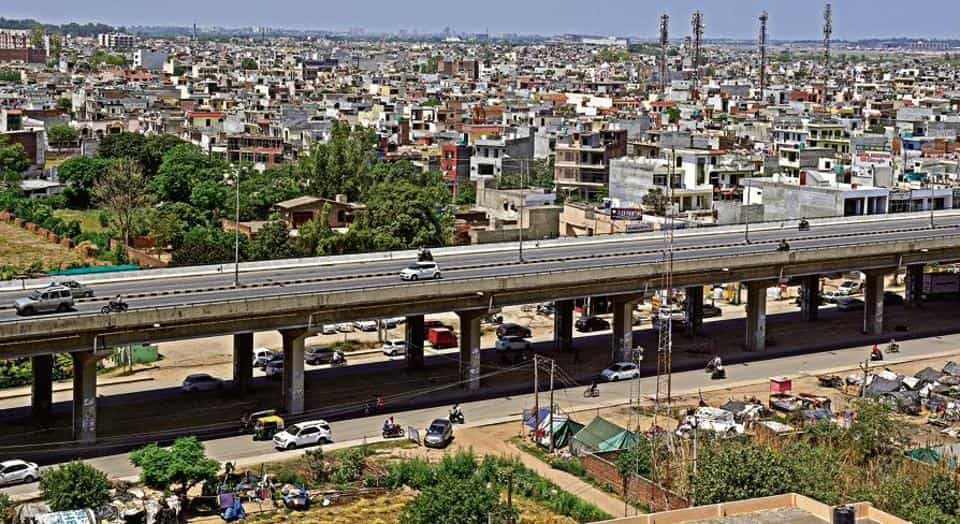

About Zirakpur

Zirakpur is a satellite town, in Mohali District, Punjab, neighbouring Chandigarh in India. It is determined to the lower regions of Shivalik slopes. It is essential for the tehsil Dera Bassi. It is the passage to Chandigarh from Delhi. It contains chiefly the accompanying zones close to Chandigarh Airport including Dhakoli, Lohgarh, Bhagat, Bishanpura, Kishanpura, Nabha, Gazipur, Baltana, Singapura, Peer Muchalla, and Dyalpura.

This town is arranged on the intersection of public parkways Himalayan Expressway, National Highway 5 (India) towards Shimla, Ambala Chandigarh Expressway towards Ambala, and National Highway 7 (India) towards Patiala.

FAQs About Personal Loan Zirakpur

✅ Who can apply for a Personal Loan in Zirakpur?

People that possess a pressing want for money and own a standard supply of proceeds (from occupation or business) can follow for a non-public mortgage in Zirakpur.

✅ What is the tenure of Personal Loan in Zirakpur?

Most of the Banks and NBFCs present a private mortgage for a min duration of 1 Yr and a Max length of 5 Years. There are some Banks which prolong the utmost duration to 7 Years also. The tenure is mounted and can’t be extended. The reimbursement must be performed in the same as month-to-month installments inside the agreed tenure of the loan.

✅ Are there any other charges involved in Personal Loan Zirakpur?

Yes, there are 2 kinds of expenses that one must pay in an effort to avail a non-public mortgage in Zirakpur:

Processing Fee: For each financial institution or lending establishment just borrow from, there are all the tiny fees that they cost from the customer. That is often a Processing Fee. The quantity of processing fees varies for and every lending establishment and is 1% of the amount.

Pre-closure Charges: Every time it’s good to secure a working mortgage prior to its agreed tenure period, the Banks and NBFCs cost an additional quantity often pre-closure prices on the borrowed mortgage amount. completely banks hold completely pre-closure charges. The pre-closure fees change reckoning on what number of years has your mortgage carried out prior to you deciding to pre-close it.

✅ Can my application for Personal Loan Zirakpur get rejected due to my CIBIL score?

Since Private Mortgage is an unsecured loan, some of the major resolution conditions for getting your own Mortgage utility licensed are your CIBIL Score. Having a soaring CIBIL Rating turns into extraordinarily essential if you must avail of a private Mortgage with the future. you’ll want to do not skip any of your Mortgage EMI funds or any bank card funds as that may end in reducing your CIBIL score. A lot of the Private Mortgage rejections occur because of a low CIBIL Score.