Best Banks for Two Wheeler Loan in Allahabad

Two Wheeler Loan Allahabad Features

If you are thinking to buy a bike, then availing of a two-wheeler loan is the most reliable way to go. It is a loan that offers the money required for buying a bike. You can use the loan amount to buy a new as well as a used two-wheeler according to your requirement. This loan is easy to apply for and requires very little documentation.

Features of Two Wheeler Loan Allahabad

- Affordable and cheap interest rates on Two-Wheeler Loan in Allahabad

- Simple and Hassle-free process for availing of a two-wheeler loan in Allahabad

- Easy to pay back by paying EMIs on time.

- The flexibility of payment of EMIs.

- Speedy Approval in 4 hours because it is a secured loan.

- Minimum Documentation is needed for availing of a two-wheeler loan

- Attractive Interest Rates

Two Wheeler Loan Allahabad Interest Rates

Two Wheeler Loan Allahabad Documents Required

For Salaried:-

- Identity Proof: Aadhaar Card, Voters ID card, Passport, Driving License

- Address Proof: Driving license / Voters card / Passport Copy / Aadhaar Card

- Bank Statement: Bank Statement of the Latest 3 months.

- Compulsory Documents: PAN Card

For Self Employed:-

- Identity Proof: Voters ID card, Passport copy, PAN Card, Driving License

- Required Documents: PAN Card

- Address Proof: Voters card / Passport Copy / Driving license / Aadhaar Card

- Bank Statement: Bank Statement of the Latest 3 months.

Two Wheeler Loan Allahabad Eligibility Criteria

For Salaried:-

- Minimum age: the minimum age of the applicant must be 21 years

- Maximum age at loan maturity: the maximum age of the applicant can be up to65 years

- Minimum employment: 1 year in job employment and a minimum of 2 years of job

- Minimum Monthly Income: Rs. 7,000

- High CIBIL Score: You can get the loan easily if you have a CIBIL score greater than 750

For Self-Employed:-

- Minimum age: the minimum age of the applicant must be 21 years

- Maximum age at loan maturity: the maximum age of the applicant can be up to 65 years

- Minimum employment: The person must be employed for a minimum of 3 years

- Minimum Monthly Income: Rs. 6,000

Two Wheeler Loan for Top Selling Bikes in Allahabad

Processing Fees / Prepayment Charges on Two Wheeler Loan in Allahabad

Processing Fees– Processing fees that are charged by bank or NBFC for a two-wheeler loan in Allahabad is Up to 3% of the loan amount (maximum) from the applicant.

Pre-payment charges- Prepayment charges that are charged by any bank or NBFC for providing a Two-wheeler loan in Allahabad are described below:

Within 4 to 6 months – 10% of principal outstanding

Within 7 to 12 months – 6% of the outstanding principal

13-24 months – 5% of principal outstanding

Post 24 months – 3% of the key outstanding

Prepayment within three months of EMI repayment is not permitted.

Two Wheeler Loan Allahabad Contact Number

In case of any queries regarding the two-wheeler loan in Allahabad, you may contact on the number 9878981166 for any sort of assistance.

Visit Dialabank to know more about Two Wheeler Loan from Allahabad.

Pre Calculated EMI Table for Two Wheeler Loan Allahabad

Rate

4 yrs

3 yrs

2 yrs

1 yr

11.83%

2625

3313

4699

8876

12.00%

2633

3321

4707

8884

12.50%

2658

3345

4730

8908

13.00%

2682

3369

4754

8931

13.50%

2707

3393

4777

8955

14.00%

2732

3417

4801

8978

14.50%

2757

3442

4824

9002

15.00%

2783

3466

4848

9025

15.50%

2808

3491

4872

9049

16.00%

2834

3515

4896

9073

16.50%

2859

3540

4920

9096

17.00%

2885

3565

4944

9120

Two Wheeler Loan EMI Calculator Allahabad

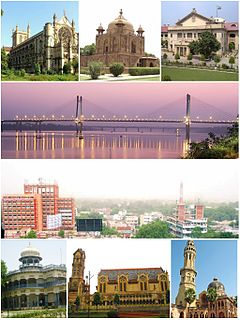

About Allahabad

Allahabad, formally identified as Prayagraj, and also identified as Allahabad and Prayag, is a city in the Indian state of Uttar Pradesh. It is the official headquarters of Allahabad district—the most crowded district in the state and the 13th most populated district in India—and the Allahabad division. The city is the administrative capital of Uttar Pradesh with Allahabad High Court being the most important judicial body in the state. As of 2011, Allahabad is the seventh most crowded city in the state. Allahabad has a wet subtropical environment natural to cities in the plains of North India.

Other Cities For Two Wheeler Loan

| Two Wheeler Loan Howrah | Two Wheeler Loan Durgapur |

| Two Wheeler Loan Vijaywada | Two Wheeler Loan in Vijayawada |

| Two Wheeler Loan Rajamundry | Two Wheeler Loan in Vishakhapatnam |