Latest Personal Loan Interest Rates 2022

| Banks | Interest Rate* | Loan Amount |

| Allahabad Bank | 9.05% onwards | As per the applicant’s profile |

| Andhra Bank | 8.90% onwards | Up to 15 lakhs |

| Axis Bank | 7.35%-21% | 50,000-15 lakhs |

| Bajaj Finserv | 12.99% onwards | Up to 25 lakhs |

| Bank of Baroda | 10.50-12.50% | 50,000-10 lakhs |

| Bank of India | 9.35% onwards | Up to 20 lakh |

| Bank of Maharashtra | 9.55% | Up to 20 lakh |

| CASHe | 30% to 36% | 9,000 – 4 lakh |

| Central Bank | 8.5-10.05% | Up to 10 lakhs |

| Citibank | 10.50-18.99% | 50,000-30 lakhs |

| Early Salary | 24% to 30% | 8,000 – 5 lakh |

| Federal Bank | 10.49% onwards | Up to 25 lakhs |

| Fullerton India | 11.99 onwards | Up to 25 lakhs |

| HDFC Bank | 10.50-21.00% | 50,000-40 lakhs |

| Home Credit | 13-30% | 25000 – 2.40 lakh |

| HSBC Bank | 9.75-15% | Up to 30 lakhs |

| Private Bank | 10.50% onwards | 50,000-20 lakhs |

| IDBI Bank | 9.85-10.10% | 25,000-5 lakhs |

| IDFC First | 10.49% onwards | 1 lakh-40 lakhs |

| Indiabulls | 13.99% onwards | Rs. 1000 to Rs. 15 lakh |

| Indian Bank | 9.05% onwards | As per the applicant’s profile |

| Indian Overseas Bank | 7.05-12.05% | Up to Rs. 5 lakh |

| IndusInd Bank | 10.49% onwards | 50,000-15 lakhs |

| Kotak Mahindra Bank | 10.75% onwards | 50,000-25 lakhs |

| Kreditbee | 10.99-18% | 1000 – 2 lakh |

| MoneyTap | 13-24.03% | Rs. 3000 to Rs. 5 lakh |

| Money view | 1.33% p.m. onwards | Rs. 10,000 to Rs. 5 lakh |

| Muthoot Finance | 14.00% onwards | 50,000-10 lakhs |

| Punjab National Bank | 8.95% onwards | 50,000-15 lakhs |

| RBL Bank | 14-23% | 1 lakh-20 lakhs |

| Standard Chartered Bank | 10.49% onwards | 1 lakh-50 lakhs |

| StashFin | 11.99% to 59.99% | 1000 – 5 lakh |

| SBI | 9.60% onwards | Up to 20 lakhs |

| TATA Capital | 10.99% onwards | 75,000-25 lakhs |

| UCO Bank | 8.45% onwards | Up to 10 lakhs |

| Union Bank of India | 8.90% onwards | Up to 15 lakhs |

| Yes Bank | 10.99% onwards | 1 lakh-40 lakh |

About Personal Loan Interest Rates

Key points about Personal Loan Interest Rates:

- A fixed amount is to be paid every month to the bank of your loan amount

- You can now get easy and quick disbursal of loan within 24 hours also depending on your loan amount and your bank record

- Always maintain your bank accounts, because banks still consider your accounts as your stability to bear the loan amount

- Never try to take an amount of loan which you think will not be possible to repay to the bank in that fixed time period

- Must maintain your documents means your profile is what speaks for yourself, so try not to mess with your papers while submitting them to the bank

- Most of the rejections for a Personal Loan are done based on the documents that you provide, and your current location also matters a lot while opting for a loan

- Try to keep your records as simple as possible. Provide genuine documents

- CIBIL Score plays a vital role in this type of loan. By tracking your credit history, the bank decides whether you have financial stability or not.

What is the best way to get a Personal Loan @ Lowest Rate of Interest?

Follow the steps below to get the lowest rate of interest on your personal loan :

- Increase your Credit Score: Your credit score depicts how creditworthy are you. Applicants with a high credit score get the best offers on their personal loans in terms of the rate of interest charged, processing fee on the loan, etc. Therefore, you should always keep a check on your credit score before applying for a loan. If your CIBIL score is less than 750, you should try and make sure that you improve it. Your probability of getting a personal loan increase if you have a credit score above 750.

- Avoid Missing Repayments: If you miss a loan or credit card repayment, your credit score may be adversely affected. Loan providers usually take your repayment history into account before deciding the rate of interest for a loan. Those who have paid their past EMIs and credit card bills on time are likely to be charged a lower interest.

- Keep an Eye Out for Offers: Banks and financial institutions usually offer special interest rates for a limited period of time during festive occasions. If you apply for a loan while such an offer is running, you may be offered a lower rate of interest.

- Compare Personal Loan Interest Rates: Before applying to a particular bank for a personal loan, it is necessary to compare the interest rates charged by various NBFCs and banks. This will help you avail of a personal loan at a competitive interest rate.

- Negotiate with the Lender: If you are an existing customer of a bank or have a good relationship with the loan provider, you can negotiate for the lowest personal loan interest rate. When doing this, it is advisable to submit a formal written request to the loan provider.

Eligibility Criteria for Personal Loan:

- CIBIL Score: It is the summary of your credit history. The score is derived using a CIBIL report, which is also known as (CIR) Credit Information Report. All the previous payments regarding loans and credit card history get checked through that.

- Salary: The bank decides the loan amount based on your net pay. So, make sure to think wisely while considering the amount of loan that you want to take.

- Location: It is yet another primary concern while opting for a loan. You can get a loan only if there is a branch of the bank near your current living location.

- Tenure of the loan: All banks have a different tenancy for giving credit. So you need to decide for how long you want a Personal Loan.

- Age: A person between the age of 21-60 years can avail of a Personal Loan. The condition applies to both salaried and self-employed people.

- Company’s Profile: For salaried people, it means that your company’s background is checked whether it comes under the list of banks or not. For self-employed people, the age of the company is taken into consideration along with how much profit it makes on an annual basis.

- Special Discounts: It is not always necessary that the bank in which you have your current salary account is going to offer you the best loan interest rate. So try to explore more in this case which bank has to provide what. There might be other banks as well who can give you some other exciting and attractive loan schemes. Don’t get into a trap.

- Processing Fee: Last but not least, all banks charge you some rate of processing fee while sanctioning your loan amount.

- Capability: Only apply for the amount which you can repay to the bank quickly.

- Avoid Multiple Loans: When you take multiple loans (means more than one loan from the same bank or different banks), then the bank thinks that you might not be able to repay the amount of being sanctioned loan timely. Make sure that you are under no multiple loan schemes to avoid rejection of your loan.

- Avoid Reapplication: Several banks do not provide credit to applicants who have applied earlier in the past six months. Try to keep a gap of at least six months for reapplying to take a Personal Loan.

- Stability: Always ensure that you must have the capability of repaying the money to the bank for which you need to be more stable if you are working in a corporate sector and in case of self-employed people your company must earn a handsome amount of profit and must be sustainable in the market.

- Loan Amount: Only apply for the amount you think you are eligible for.

- Eligibility: You can check eligibility by clicking on this link: Personal Loan Eligibility

PERSONAL LOAN

Interest Rate 9.99%

Factors Affecting Personal Loan Interest Rates

- CIBIL Score: Your CIBIL score depicts your creditworthiness and lenders use it as a means of checking your credit history and capability of repaying the said loan on time. A high credit score helps you in getting a low-interest rate.

- Level of Income: After credit score, lenders need validation for your level of income as it indicates your capability of repaying your loan and often gets you a lower rate of interest if your income level is high.

- Credit Utilization Ratio: This is the ratio between the amount of credit that is available to you and the amount of credit you have used. Usually, a credit utilization ratio of up to 30% is considered a good ratio as it indicates a higher repayment capacity.

- Fixed Obligation to Income Ratio (FOIR): This is the ratio between the already existing EMI amounts and credit card bills to your total income. It helps to determine how much income you have to repay the further loan that you’re applying for. FOIR should be maintained as low as possible at least less than 50% to get a good interest rate.

- Multiple Loan Applications: You should not apply for multiple loans at once as it negatively impacts your credit score and makes it harder for you to get a loan at a low interest rate.

- Relationship with the Bank: If you’re an already existing customer with the bank having a Savings account or a loan, it impacts the rate of interest that is going to be charged from you as compared to any new customer.

Floating Interest Rates vs Fixed Interest Rates – Which is better?

If you choose a personal loan with a fixed interest rate, you’ll be charged the same rate of interest throughout the repayment tenure of the loan.

The variable or floating interest rate is linked to the MCLR or Marginal Cost of Lending Rate, thus the rate of interest changes as and when the MCLR fluctuates.

In choosing the fixed rate option, you know exactly how much you’ll have to pay each time. Therefore, those who wish to plan their finances should choose this option.

However, you can opt for a floating/variable interest rate as it has the benefit that you’ll have to pay a lesser amount in case MCLR drops.

Total Cumulative Interest Calculation

The annual interest on a loan is calculated using the formula:

I = P x (R/100)

Such that,

- I = interest payable,

- P = Principal (loan outstanding) and

- R = Rate of Interest (annual percentage rate)

While you can apply the above formula to a one-year personal loan, a multi-year loan may have a different principal each year as the loan is repaid. To calculate the total cumulative interest of a personal loan, add the additional interest amount each year. Suppose you want to avoid having to perform such complex calculations. In that case, it is best to use an EMI calculator, which will instantly provide you with information such as the total interest payable on your home loan.

Tips to get a low PL Interest Rate

A personal loan’s interest rate is typically lower if the lender perceives you to be financially responsible. The following are some options for obtaining a low-interest rate on your loan:

- Keep a high credit score and a clean credit history.

- Make sure you have no outstanding debt, i.e. a credit utilisation ratio of 30% or less.

- Apply for a personal loan with a lender with whom you have previously worked.

- Choose a secured personal loan, such as a loan against shares, NSC, KVP, LIC, or similar.

While the suggestions above are a favourable starting spot for getting a lower interest rate on your loan, a low-interest rate is not guaranteed because various factors influence the loan interest rate.

Ways to decrease total interest payout

While it may not be feasible to achieve the lowest interest rate for your loan, there are three ways to reduce the total interest payable on your loan:

- Choosing a shorter term – Higher individual EMIs but the lower genuine interest paid

- Part prepayment/foreclosure – Reduces the loan principal, resulting in more down interest payment.

- Choosing a smaller loan amount – Lowering the loan principal results in lower total interest payment.

Benefits of Prepayment

-

Full PrePayment

When done at the correct moment, a complete prepayment can save a borrower the most money. This relieves you of your loan obligation and saves you money on interest payments, which would otherwise be debited from your account. This will allow you to focus even more on your future. The money saved from a full prepayment can be invested wisely for a better future.

-

Part PrePayment

A percentage of the outstanding loan sum is paid as part of the part payment. It will lower the outstanding principal as well as the EMI and interest payments.

But How Will You Accumulate the Prepayment Sum?

If you’re serious about it, use the Personal Loan EMI Calculator regularly. You can use the calculator to examine the repayment estimate at various periods throughout time. To make a full prepayment, you must be very careful with your money. Set a monthly savings goal and work toward it by reducing wasteful spending.Even if you only want to make a partial payment, follow the same procedure. With the calculator’s guidance, all of this can be planned and accomplished properly. But, to make a successful prepayment, where should you place your money? Your money might be split between fixed deposits, recurring deposits, and even mutual funds.

Compare Latest Personal Loan Interest Rates

HDFC Bank |

||

| Cat A | Rates | 10.99% – 15% (For Special Companies) 15% (For 75,000 & above salary) 15.5% (For 35,000-75,000 salary) 17.45% (For 20,000-35,000 salary) 11.29% – 12.5% (Special Rates for Loan Amount b/w 10lakhs – 30lakhs) 11.39% – 11.8% (BT for Listed Companies) |

| Emi (4years) | Rs.2584 – Rs.2783 (For Special Companies) Rs.2783 (For 75,000 & above salary) Rs.2808 (For 35,000-75,000 salary) Rs.2909 (For 20,000-35,000 salary) Rs.2599 – Rs.2658 (Special Rates for Loan Amount b/w 10lakhs – 30lakhs) Rs.2604 – Rs.2624 (BT for Listed Companies) |

|

| Cat B | Rates | 10.99% – 15% (For Special Companies) 15% (For 75,000 & above salary) 15.5% (For 35,000-75,000 salary) 17.45% (For 20,000-35,000 salary) 11.29% – 12.5% (Special Rates for Loan Amount b/w 10lakhs – 30lakhs) 11.39% – 11.8% (BT for Listed Companies) |

| Emi (4years) | Rs.2584 – Rs.2783 (For Special Companies) Rs.2783 (For 75,000 & above salary) Rs.2808 (For 35,000-75,000 salary) Rs.2909 (For 20,000-35,000 salary) Rs.2599 – Rs.2658 (Special Rates for Loan Amount b/w 10lakhs – 30lakhs) Rs.2604 – Rs.2624 (BT for Listed Companies) |

|

| Others | Rates | 10.75% – 17.5% |

| Emi (4years) | Rs.2572 | |

| Pre Payment Charges | Up to 4.00% | |

| Processing Fees | Up to Rs.3999/- + GST | |

Points to Remember

While choosing a personal loan with a low rate of interest, you should consider the following points:

- Processing Fee: Lenders charge a one-time charge called the processing fee, which increases the loan cost. The processing fee is also important while selecting a personal loan and not only the Rate of Interest.

- Prepay Charges: Some lenders may charge pre-payment or preclosure charges if you repay the entire loan amount before the end of the repayment loan tenure. Keep in mind to check whether your lender charges any pre-payment charge or not.

- Customer Service: Make sure the lender that you have chosen for your loan offers good customer service to the end consumer. Before applying for a personal loan, you should keep in mind the customer service options and how to contact them.

- Eligibility Criteria: While the lender offers personal loans at low rates of interest, you should always check the eligibility criteria of the lender and whether your ‘e eligible for the loan or not.

- Loan Disbursal: If you have to take a personal loan for any emergency, it is important to make sure that the lender gives the loan disbursal quickly. Many leading banks and financial institutions provide the loan disbursal within a matter of seconds.

- Other Charges: Some banks and financial institutions may charge you a slightly higher rate of interest, you may be able to save on the overall cost of the loan if the processing fee, default charges, pre-payment fee, Loan Cancellation Charges, etc., are low. Therefore, keep in mind the different offers from various lenders to avail of the best offer.

- Discounts: Although the bank/financial institution may have specified a high interest rate, you can try to negotiate with the bank for the lowest interest rate. Many-a-times, lenders will give a discount to existing customers and to those who have maintained a healthy relationship with them.

- Offers: Several banks and financial institutions provide the best offers on their financial products during the festive season.

Benefits of Personal Loan

- Easy Disbursal: There is an easy disbursal involved in the process of a Personal Loan. You can now get the loan disbursed in just one-two day and sometimes within one day only.

- No need for any guarantor: The best thing about this type of loan is that you don’t have to show or keep any confidential papers.

- Personal Documents: When you go for this loan, make sure that all your documents are genuine as your documents speak for yourself.

- Simple Application Process: Your few documents, along with your passport-sized pictures, are required for filing your application form for a Personal Loan.

- Hassle-Free Process: There is no need to get confused while the process is ongoing as the bank executives help you with all your queries in one go. Just sit back and relax while the bank is doing all the formalities.

Current Personal Loan Rates for Pensioners

In contrast to the general public, various lenders, such as SBI and PNB, offer concessional personal loan interest rates to pensioners. The personal loan rate discount may be much higher as pensioners repay a loan from the same bank when keeping a pension account. The lowest personal loan interest rate, though, is 10.40 percent.

Today’s personal loan rates for women Apr 24 2024

Many top lenders offer subsidized personal loan rates to female borrowers to increase the desire for financial freedom among women in the world. Discounted rates for female borrowers can improve job opportunities for female employees, self-employed workers and entrepreneurs. With the lowest personal loan rates, some of the top personal loan providers are:

| Bank | Interest Rate | Processing Fee |

| PNB | 8.95% -11.80% | 1.8% + Taxes |

| SBI | 9.60% -16.40% | 1.00% |

| Kotak Bank | 10.40% -17.99% | Starting from Rs.999 |

| Yes Bank | 10.40% -20.00% | Min-Flat Rs.2021 |

| Axis Bank | 10.49% -16.75% | Up to 1.75%, Min Rs.4,999 |

How to calculate EMI on your Personal Loan?

The Interest Rate that is charged on your Personal Loan depends on several factors that influence the interest rates. Usually, the interest rates that apply to the Personal Loan are mentioned on the specific bank website other than that, some websites provide information on the same.

The Interest Rate that is charged on your Personal Loan depends on several factors that influence the interest rates. Usually, the interest rates that apply to the Personal Loan are mentioned on the specific bank website other than that, some websites provide information on the same.

The EMI of your Personal Loan is directly impacted by the Interest Rate that the bank is charging and it instantly needs to be paid as soon as the loan amount is disbursed. Therefore, it is recommended to utilize the personal loan EMI Calculator before you apply for a Personal Loan to know all about the net EMI applicable to your loan.

To get access to the EMI Calculator for your Personal Loan, you are required to adhere to certain criteria that include visiting the Dialabank website and from the loan segment, find the EMI Calculator, you need to fill in the necessary details. Which are: the loan amount, tenure for repayment, and interest charged on the given amount for the given tenure. Once these details are submitted the EMI Calculator will display the net EMI that is payable every month on your Personal Loan.

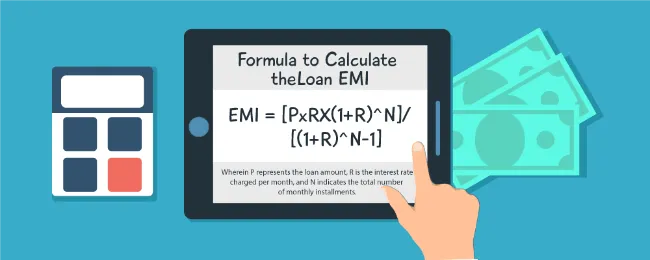

Formula to Calculate Personal Loan EMI

The formula that is applied to extract the EMI for Personal Loan is; EMI = [PxRX(1+R)^N]/[(1+R)^N-R], where P denotes the loan amount, R denotes the interest rate charged per month, and N denotes the total number of monthly instalments.

Illustration

A 33-year-old man named Mr Mehta (IT Engineer) is seeking a Personal Loan to cover the expenses of his wedding. He is looking forward to applying for a loan amount of Rs. 10 Lakh and wishes to repay it within a tenure of 36 months. He is anticipating an interest rate of 14% p.a. on the given amount.

Now, to calculate the EMI applicable to the loan amount, he is required to either navigate through the website of the bank that is offering the loan or visit Dialabank to get access to the EMI calculator. Hereafter, he must fill in the details like the loan amount Rs. 10 lakh, the repayment tenure 36 months, and the interest rate charged on the loan amount 14% p.a.

Subsequently, the EMI Calculator will then display the EMI applicable to the loan that is Rs. 34,177.63 per month. So, the net payable interest will be Rs.2,30,394.67, while the total payable amount is Rs. 12,30,394.67.

Interest Calculation Methods

The interest charged on a Personal Loan can be determined in two ways:

- Flate Rate

- Reducing Balance Method

1. Flat rate: In this method, the total interest charged upon the loan amount is calculated by the entire loan amount borrowed initially over the entire tenure of the loan.

2. Reducing Balance Method: The parts of your loan amount and the interest component gets paid off with the payment of monthly EMIs. therefore, the Principal Loan Interest keeps on depleting over time. So, this method utilizes the decreasing loan amount to calculate the interest rate instead of the total loan amount borrowed initially.

Interest Rates for Different Applicant Types:

Among many factors that decide the interest rate for the borrower the applicant type is also important. The lender decides the interest rate based on the type of borrower. Hence, interest rates tend to vary so given below are the brief points on the mentioned criteria:

- Salaried or Self-employed applicant: The interest in Personal Loan is impacted whether salaried or self-employed applicant. As for salaried individuals with a consistent income source in a reputed firm the interest rates are normally lower as compared to the self-employed applicants. Because the employees with consistent income sources and stable jobs have financial and job security which makes them capable of repaying the outstanding amount. Whereas the self-employed applicants with a regular and stable source of income can also avail of Personal loans from different banks at competitive interest rates.

- Pensioners: A special category of Personal Loan has been introduced for Pensioners which they can avail themselves of at relatively lower interest rates. The applicants can get such loans done from SBI, PNB, etc. Although, the privilege is only accessible when the borrower’s bank account is held with the selected lending institution.

- Women: Some of the selected banks and NBFCs provide Personal Loans to the women candidate at favourable interest rates such as; Bajaj Finserv and Fullerton India. This move is aimed at encouraging women employment along with entrepreneurship among women to make them financially independent.

Note: Apart from the applicant type criteria some norms exist for the applicants who possess a regular and stable source of income with a clean profile, they get a Personal Loan at a favourable interest rate. The Applicant’s profile is also an important factor to consider for Interest Rate.

What is CIBIL Score?

Look at the following table that will give you an idea about how banks decide your loan application procedure.

| CIBIL Score | Ranking |

| 650 or below | Bad |

| 650 – 700 | Delay in money |

| 700 – 750 | Normal |

| 750 – 850 | Good |

| 850 – 900 | Excellent |

Influence of CIBIL Score on your loan:

What is an EMI?

How Personal Loan Works here’s an example

| Maximum Annual Percentage Rate (APR) | 10.98% to 24.58% |

| A representative example of the total cost of the loan, including all applicable fees | Here is an illustration of the total cost of the loan: |

| Total amount borrowed: ₹ 1,00,000 | |

| Time period: 6 Months to 72 Months | |

| Personal Loan Interest Rate: 10.40% to 24.00% | |

| Processing Fee payable to Upto ₹ 3,500 | |

| Fee payable: NIL | |

| Total Monthly Cost – From ₹ 1,873 for 72 Months ₹ 1,00,000 loan at 10.40% (lowest rate, longest time period) to ₹ 17,853 for 6 Months ₹ 1,00,000 loan at 24.00% (highest rate, shortest time period). This is inclusive of principal repayment. | |

| Annual Percentage Rate (APR) of charge including all applicable fees: 10.98% to 24.58% | |

| Total cost payable over loan tenure: ₹ 6,555 for 6 Months loan to ₹ 38,343 for 72 Months loan |

Personal Loan Interest Rate Calculator

Why Dialabank?

Personal Loan Customer Care Number

You can call the lender’s customer service line to find out about the status of your loan and other information. Take a peek at the customer service numbers for various lenders listed below.

| Lenders | Customer Care Number |

| SBI | 1800112211, 18004253800 |

| HDFC Bank | 18004254332, 1800224060, 1800221006 |

| Private Bank | 18001024242 |

| IndusInd Bank | 186050050

04, 02244066666 |

| Fullerton India | 18001036001 |

| YES Bank | 18001031212 |

| IDFC First Bank | 18605009900 |

| Axis Bank | 18604195555, 18605005555 |

FAQs about Personal Loan Interest Rates

✅ Which bank has the best and low rate of interest?

✅ Who can apply for a Personal Loan?

✅ Does only a bank provide a Personal Loan?

✅ How can I apply for a Personal Loan?

✅ For how long does a Personal Loan last?

✅ Are there any other charges included for a Personal Loan?

✅ How do I avoid rejection of my loan?

✅ What if I’m not able to repay the loan amount?

✅ Can I return the money to the bank all at once?

✅ Can I take more than one Personal Loan at a time?

✅ How important is it to maintain your CIBIL score?

✅ If my CIBIL score is not up to the mark, then can I get a rejection for my Personal Loan?

✅ What are the processing charges for a Personal Loan?

✅ What are the things that are covered in your gross salary?

- Base/Basic Salary

- HRA (House Rent Allowance)

- TDS (Tax Deduction at Source)

- PF (Provident Fund)