Best Banks for Car Loan in Hunsur

Car Loan Hunsur Features

Click here to apply for an instant car loan

Are you searching for a car loan? If yes, then your wait is over as we at Dialabank brings you amazing offers for a car loan in Hunsur. We provide the lowest rate of interest for car loans Hunsur, which you won’t find anywhere else.

We offer Car loans for both Self-employed and salaried people. We offer car loans on new as well as used cars.

A car loan is a financial help offered by banks and NBFC’s to fulfill your dream of having your own car. They provide necessary funding for buying a car which can be on Ex-Showroom Price or On-Road Price of the car. A car loan is a secured loan with easy refund options. The loan amount is provided on Interest Rates which differs from bank to bank. One can pay for the vehicle in easy installments.

Car Loan Hunsur Interest Rates

Car Loan Hunsur Documents Required

For Salaried Individuals:

- Proof of Identification: Passport copy, PAN Card, Voters ID card, Driving License

- Income Proof: Latest 3-month salary slip with form 16

- Residence Proof: Ration card / Driving license / Voters card / Passport Copy / Telephone Bill / Electricity Bill / Life Insurance Policy /PAN Card

- Bank Statement: Last 6 months.

For Self Employed Individuals:

- Identification Proof: Passport copy, PAN Card, Voters ID card, Driving License

- Income Proof: Latest ITR

- Address Proof(anyone): Ration card/ Driving license / Voters card / Passport Copy / Telephone Bill / Electricity Bill / Life Insurance Policy /PAN Card

- Bank Statement: Last 6 months.

Car Loan Hunsur Eligibility Criteria

For Salaried Applicants

- Minimum age: 21 years

- Maximum age at loan maturity: 65 years

- Minimum employment: 1 year in current employment and a minimum of 2 years of employment

- Minimum Annual Income: Rs.100000 net annual income

For Self-Employed Applicants

- Minimum age: 21 years

- Maximum age at loan maturity: 65 years

- Minimum employment: At least 3 years in business

- Minimum Annual Income: Net profit Rs. 60000 per annum for standard cars and Rs.100000 per annum for mid-sized and premium cars

Car Loan for Major Car Manufacturers in Hunsur

TABLE WILL APPEAR

Processing Fees/ Prepayment Charges on Car Loan in Hunsur

Category

Details

Processing Charges

Prepayment

Preclosure

Stamp Duty

Cheque Bounce Chgs

Floating Rate of Interest

Not Applicable

Overdue EMI Interest

Amortisation Schedule Chgs

Rs 200 + GST

CIBIL Score Required for Car Loan Hunsur

A CIBIL score of 750 and above is considered to be very good and it attracts a lower interest rate for car loans in Hunsur. However, a CIBIL score between 650 to 750 could be considered if you have a good income but a slightly higher rate of interest will be offered in that case. If you have defaulted in your CIBIL score is very low, then your car loan application might be refused.

Most institutions prefer to give loans only with a minimum CIBIL score of 750. The institutions don’t just look at the overall score but also check the detailed behavior on the previous loans taken. This includes details on the type of loan taken and the amount of loan you have borrowed. Any late payments for previous loans can create a barrier to your availing a fresh loan.

Check your CIBIL score in your credit report for more information on the score.

Car Loan Hunsur Contact Number

Call us at 9878981166 to get on car loans in Hunsur and exclusive offers on car loans.

Pre Calculated EMI Table for Car Loan Hunsur

Rate

5 Yrs

4 Yrs

3 Yrs

10.50%

2149

2560

3250

11.00%

2174

2584

3273

11.50%

2199

2608

3297

12.00%

2224

2633

3321

12.50%

2249

2658

3345

13.00%

2275

2682

3369

13.50%

2300

2707

3393

14.00%

2326

2732

3417

14.50%

2352

2757

3442

15.00%

2378

2783

3466

Car Loan EMI Calculator Hunsur

About Hunsur

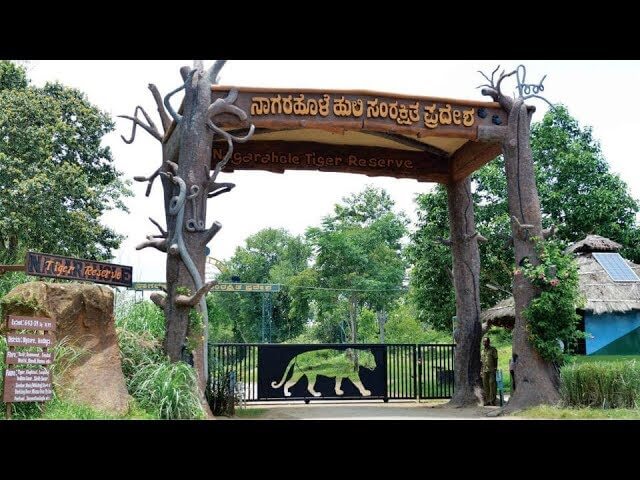

Hunsur is a city in the Mysore district in Karnataka, India. It is sustained by the Hunsur City Municipal Council and has 31 wards. Hunsur is known for the timber trade, especially teak. A plywood manufacturing company named Hunsply is located in Hunsur.

Other Cities For Car Loan In Karnataka

| Car Loan Doddaballapur | Car Loan Bijapur |

| Car Loan Dharwad | Car Loan Bidar |

| Car Loan Davanagere | Car Loan Bidadi |

| Car Loan Chikmagalur | Car Loan Bellary |