Advantages of a High CIBIL Score for Personal Loan

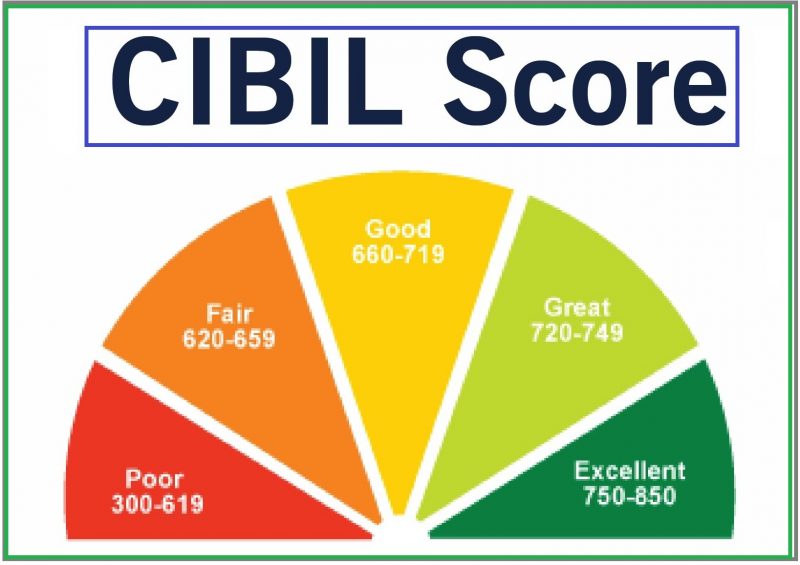

The two concepts which we hold in the discussion here are Personal Loans and CIBIL Score. Firstly in personal loans, you avail loans from banking institutions. When you require funds, you approach banking institutions. Banks scrutinize your documents thoroughly. After thoroughly analyzing the documents, they determine whether you are suitable for accepting the loan application. When they find that you can pay the required loan amount, they grant you the loan. This entire facility is known as Personal Loans. On the other hand, the CIBIL score or credit score refers to the score attached with your loan repayment. Following are the impacts and effects of a personal loan on a high CIBIL Score.

Helps in Development of Credit Basket

The facility of personal loans can help in improving your credit mix. As you take different varieties of loans, your opinion about the changes. With every passing opportunity, you get the idea of how to deal with personal loans. Development of loan mix and loan basket is significant. Thus your variety of loans would help you reduce your financial dependence on one loan altogether.

Generation of Payment Environment

It helps in developing a payment environment. When you take loans and repay them, a transaction takes place. With more and more transactions, your credit rating develops. As a transaction and payment history is created, your trustworthiness in the market improves. Therefore establishing a payment history is very important to impact personal loans on credit score. Better payment history means that you have had many monetary transactions. More monetary transactions mean that you have repaid all your loans in time. Thus, it will positively impact your high CIBIL Score, thereby improving it multiple times.

Insurmountable Debt Burden

Taking a loan to meet your financial needs is good. It is also a necessary practice. But it should not become a habit. When it becomes a habit, you cannot restrict yourself from taking credit. For example- At one point in time, you will find that all your expenses are being covered through a debt basket. You are paying off all the necessary expenses through debt. It should not thus become a habit. Thus when you fall into a heap of debt, you cannot get out of it and recover your lost position in the market.

Additional expenditure associated with the loan

The more loans you take from the commercial banking institutions, the more expenses you have to incur. The expenses refer to the ones which are important to clear off the necessary loan process. Banking institutions charge the expenses. Expenses like Noting Charges for the bank transfer are considered in this regard. The additional fees and expenses differ from one banking institution to another. Therefore it has a big negative impact on high CIBIL Score. When you are unable to pay off additional fees, your high CIBIL score is impacted. Thus the score reduces, and the opportunity to take more loans in the future also reduces.

Conclusion

Thus the aforementioned points are important to understand the impact of personal loans on a high CIBIL Score.