Do you need a CIBIL score for a personal loan?

A personal loan is an unsecure d loan that will not ask for collateral. There is no requirement to deposit anything. The loan will depend on the CIBIL score you are having considered as the factor. The harmful impact of the CIBIL score will affect the loan if you are a defaulter in the loan amount.

d loan that will not ask for collateral. There is no requirement to deposit anything. The loan will depend on the CIBIL score you are having considered as the factor. The harmful impact of the CIBIL score will affect the loan if you are a defaulter in the loan amount.

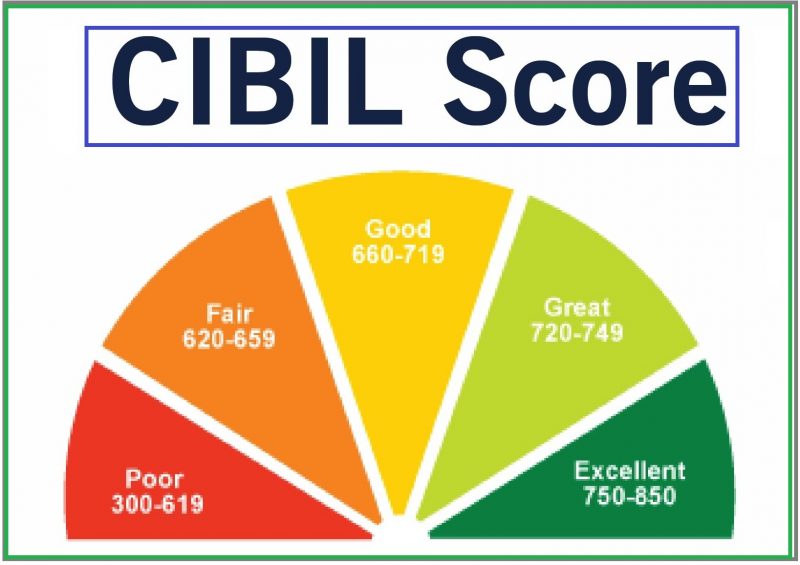

The loan you can avail of via CIBIL will disrupt due to the earlier credit history. The CIBIL will be directly involved in the personal loan, unlike the gold loan, where the score is not mandatory. But when it comes to the CIBIL score in the personal loan, it will be around 700-750 in most banks, whether public or private.

How does CIBIL help with the personal loan?

The personal loan is not like the other loans, which will go a long way. The tenure will be less, and you have to repay the amount in a specific period. You can switch to the EMI option, where you can pay the loan every month. The loan you can repay on time.

The CIBIL score is the factor for creditworthiness. If you are good at a credit score that is 700-750, there are 100% chances that you will get the loan as soon as possible. The lender will consider you as giving the money based on a genuine credit score.

The personal loan will not be asking for any kind of collateral. The main point for the loan will be the credit score. When you fill the loan application initially, lenders can reject if you have a less CIBIL score because that will eventually. When you get the loan, make sure you will repay the amount at the exact time; otherwise, this will lead to a big problem.

There are other loans like car loan house loan; they all ask for the collateral, and if you are unable to repay the amount, they will sell out the things. Eventually, that will be the most significant loss for the borrower.

How payment history will effect

The credit payment history will be going to struggle you if you haven’t paid the amount earlier. If you ever juggled paying the money you borrow from the lender will ultimately make the credit score unhealthy. The longer the history of your credit, this will be fully taking the credit score low. The effect of this will be seen on the credit score when you will perceive the loan. They will reject the application, or the amount will be less than 60%, and the interest rate will be more. The planning of the payment is playing a vital role here. If you tend to pay the amount at the right time and in short tenure, it will maximize the CIBIL score and the case of the other loans. There should not be any hard inquiry in the account which will also minimize the CIBIL score. The lender will check the authentication, and then after the maximum inquiry, the CIBIL score will dropdown.