Why are the loans for which I am the guarantor showing up on my account?

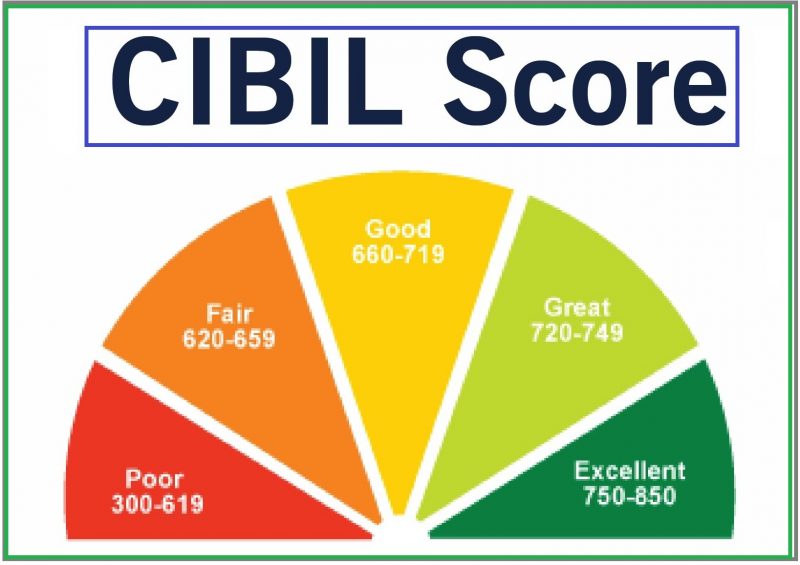

The unhealthy credit history and the low CIBIL score will be going to put you in trouble financially. When you are going to avail of the loan, the lender will check your credit history. However, when you just have to work on the credit history and repayment of the loan.

But sometimes, things will turn out to be different. You will be unable to pay the loan, and when you go for another one, that will be the problematic condition for the lender to avail you of the loan. They ask you to put a bystander or the guarantor for your loan. The guarantor’s meaning is that when you cannot pay the loan, the second person has to pay the bank amount.

But sometimes, things will turn out to be different. You will be unable to pay the loan, and when you go for another one, that will be the problematic condition for the lender to avail you of the loan. They ask you to put a bystander or the guarantor for your loan. The guarantor’s meaning is that when you cannot pay the loan, the second person has to pay the bank amount.

The low credit score person generally tries to borrow the money at a lower credit score. The guarantor’s interest rate will be too high, up to 35-50%, especially the unsecured loan. The situation will only help you when you repay the loan on time.

Usually, the guarantor might be a friend or a relative.

The Role of Guarantor For The Loan

The guarantor is someone who is the family member of the person who availed the loan. Due to the low cibil score and the risk of inquiry, the person asks the close people to stay as a guarantor. When the person does not pay the loan on time, the lender will chase the guarantor.

The guarantor will be the person who used to pay while there is no payment by the loan first person. The lender will be totally tension-free when they give a loan to the guarantor-based loan due to the low credit score and unable to apply for the loan somewhere else. The lender will find the other family member as a guarantor. The lender will only be going to approve the loan when the guarantor has an appropriate credit score.

So, there is a crucial role of the guarantor when the person will avail of the loan. If you are more than 21 years old, you can be a guarantor, and that person must have been financially sound. One of the biggest nightmares for the borrower is they have to repay the borrower’s massive loan. You must have to trust the borrower because if they cannot pay the loan, this will affect the guarantor’s credit score. A bad credit score because of being the guarantor will put you in trouble for your loan.

Consequences For Not Paying

The terms when both the borrower and the guarantor will be unable to pay the loan will create chaos. The upstanding payment will be a troublesome experience as the lender may take legal action against you. There might be the repossession of the asset you are having, and the credit score turns out to be less. The next time when you will apply, the lenders will not be going to sanction the loan.