Top Corporation Bank Credit Cards

Name |

Annual Fee |

Minimum Income Required |

| Corp Platinum Credit Card | Rs.230 | 2.50 lakhs to 3.00 lakhs per year |

| Corp Gold Credit Card | NIL | 1.80 Lakhs to 2.00 lakhs per year |

| Corp Signature Credit Card | Rs.900 | 10.50 lakhs per year |

Types of Credit Cards offered by Corporation Bank

Corporation Bank offers different types of credit cards. Thus the customers can choose the best credit card for them according to their needs. Corporation bank has Corp Platinum Credit Card, Corp Platinum Credit Card, Corp Signature Credit Card.

Lifestyle Credit Cards from Corporation Bank

Corporation Bank provides credit cards to its customers. This credit card provides the best lifestyle facilities.

Apply for a Corporation Bank Platinum Credit Card

Shopping Credit Cards from Corporation Bank

Shopping credit cards will provide you with a better shopping experience. Corporation Bank provides the signature credit card which is best suitable for shopping.

Apply For a Corporation Bank Signature Credit Card

Corporation Bank Credit Cards Eligibility Criteria

Given below are the eligibility criteria for Corporation Bank Credit Cards.

- The applicant must be an Indian Citizen or a person of Indian Origin.

- The applicant must have a PAN Card issued by the Income Tax department.

- The applicant must be a Corporation bank account holder.

- The applicant must have a valid contact number.

- The minimum age of the applicant should be 18 years.

- The maximum age of the applicant should be 70 years.

Name |

Minimum Annual Income |

|

| Salaried Individual | Self-Employed Individual | |

| Corp Platinum Credit Card | 1.80 Lakhs per year | 2.00 lakhs per year |

| Corp Gold Credit Card | 2.50 Lakhs | 3.00 Lakhs per year |

| Corp Signature Credit Card | 10.50 lakhs per year | 10.50 lakhs per year |

Corporation Bank Credit Cards Documents Required

While applying for a credit card applicants need to submit some documents. The list of required documents is given below.

Address Proof |

Identity Proof |

Income Proof |

|

|

|

Corporation Bank Credit Cards – How to apply

The application process becomes easy with Dialabank. What you have to do is,

- Visit Dialabank website

- There is a form provided. Fill in information like name, contact number, etc in it.

- Click on request a quote.

- Within less time, our relationship manager will contact you. You will get more information from our representatives.

- you can choose the best option.

Corporation Bank Credit Card Rewards Programme

Name of the Card |

Rewards Points Offer on the Card |

| Corp Platinum Credit Card |

|

| Corp Gold Credit Card |

|

| Corp Signature Credit Card |

|

Features and Benefits of Top 3 Corporation Bank Credit Cards

Corporation Platinum Credit Card

| Corp Platinum Credit Card | |

| Key Highlights | 1 point for every Rs.125/- spent. |

| Joining Fee | Free |

| Renewal Fee | 230 Rupees |

| Joining Bonus | NIL |

| Suitable for | Shopping, fuel, online payments, bookings, etc. |

| Features and benefit |

|

| Rewards redemption option |

1 point=Rs.1 on attaining a minimum of 750 |

Corporation Gold Credit Card

| Corp Gold Credit Card | |

| Key Highlights | I Point for every Rs.150/- spent. |

| Joining Fee | NIL |

| Renewal Fee | NIL |

| Joining Bonus | NIL |

| Suitable for | Shopping, fuel, online payments, bookings, etc. |

| Features and benefit |

|

| Rewards redemption option | 1 point=Rs.1 on attaining a minimum of 500 reward points |

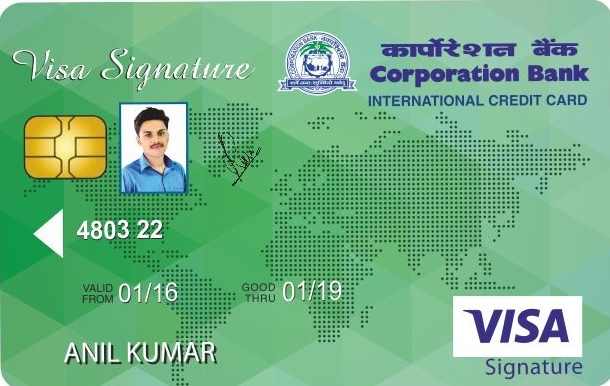

Corporation Signature Credit Card

| Corp Signature Credit Card | |

| Key Highlights |

1 point for every Rs.125/- spent. |

| Joining Fee | Free |

| Renewal Fee | 900 Rupees |

| Joining Bonus | nil |

| Suitable for | Shopping, fuel, online payments, bookings, other privileges, etc. |

| Features and benefit |

|

| Rewards redemption option | 1 point=Rs.1 on attaining a minimum of 1000 reward points |

Why choose Corporation Bank Credit Cards?

LIC Corporation Bank Credit Cards are only available to LIC agents, policyholders (Salaried, Self-employed, and HNC segments), and other LIC workers. By purchasing up to three add-on cards, the primary cardholder can extend these benefits and share the credit available on his or her card with family members. LIC Corporation Bank’s credit cards come with enticing features including the ability to gain more loyalty points by paying LIC policy premiums with the card, a lower rate of interest, credit shield, personal injury insurance, purchase security, and so on.

How to check Corporation Bank Credit Card Status?

The Corporation Bank has launched a simple process to monitor your credit card application status online to make the banking process easier. To search the Corporation Bank credit card application online, follow the steps below.

You should go to the bank’s official website. You can go to the bank’s credit card site. You can check the status of your credit card application by entering your application reference number, application form number, telephone number, or date of birth.

Using Your Mobile Number to Check the Status of Your Corporation Bank Credit Card Application

You can also monitor the status of your credit card application by using the mobile number you provided during the application.

You must go to Corporation Bank’s official website and look under the credit cards section. You must enter the mobile number that you used to apply for a credit card. An OTP is usually used to verify a mobile number. You can check the status of your credit card application after it has been checked.

Inquiry into the Status of a Corporation Bank Credit Cards

Many who are unfamiliar with the internet or who are unable to access the internet can seek assistance from Corporation Bank credit card customer service to monitor the status of their credit card application. For all credit card-related inquiries, dial Corporation Bank’s toll-free number 1800226606. The response time is short, and the services are available 24 hours a day, seven days a week.

Checking the status of a Corporation Bank credit card application over the phone

If you don’t have access to the internet, you can still check the status of your credit card application offline. With your e-reference number, application form number, and date of birth, you can call the Corporation Bank credit card customer service line 24 hours a day, 7 days a week. The bank’s executives will immediately assist you in tracking the status of your credit card application.

Corporation Bank Credit Card Customer Care

Corporation Bank Credit Card Customer Care Toll-Free Number: 1800 22 6606.

Contact Dialabank at 9878981166 for an easier application process.

Corporation Bank Credit Card Fees and Charges

| Type of Charge | LIC Corporation Bank Platinum EMV Credit Card | Corporation Bank International Credit Card |

| Joining Fee | Nil | Nil |

| Annual Fee | Nil | Nil |

| Renewal Fee | Nil | Nil |

| Add-on Cards | 3 add-on cards. First, the add-on card free and the next cards will be charged Rs. 200 each. | 3 add-on cards. |

| Interest in Revolving Credit | 3% per month and 36% annually. | 2.25% per month for a gold credit card. 2.50% per month for a classic credit card. |

| Cash Advance Limit | 30% of Credit Limit | Not Available |

| Over Limit Charges | 2% of the over-limit amount or a minimum of Rs. 250, whichever is the highest. | 2.5% of the over-limit amount or a minimum of Rs. 100, whichever is the highest. |

| Standing Instruction Failure/ Cheque Return Penalty | Rs. 250 for each failed transaction. | Rs. 250 for each failed transaction |

Corporation Bank Credit Cards Offers

Credit cards have been ingrained in our culture. In the market for various forms of credit cards, we are spoiled for options. With so many credit card deals available, it has become a popular method of financial transaction payment. One can take advantage of a variety of credit card benefits. It is quickly becoming a valuable financial asset in our lives.

The majority of major credit card companies have partnerships with luxury brands, merchandise partners, exclusive dining, travel & hotel privileges, movie tickets, and cashback. Credit cards extend credit and thereby assist us in managing our financial needs in the interim.

FAQs for Corporation Bank Credit Card

✅ Is Corporation Bank credit card available only for salaried individuals?

No, both salaried, as well as self-employed individuals, can apply for Corporation Bank Credit Cards.

✅ What are the different credit cards offered by Corporation Bank?

Corporation Bank offers the following credit cards:

- Corporation Bank Gold Credit Card

- Corporation Bank Platinum Credit Card

- Corporation Bank Signature Credit Card

✅ What are the determining factors to get a credit card from a Corporation bank?

Corporation bank looks into your credit history, income, age, employment type and current relationship with the bank, to determine your credit card eligibility.

✅ Where do I apply for Corporation Bank Credit Card?

You can apply for a Corporation Bank Credit Card at your nearest branch.

✅ Is there an income criterion to apply for a Corporation Bank Credit Card?

Yes, the minimum income requirement is Rs. 1.2 lakhs per annum.

✅ What are the documents I need to submit to apply for Corporation Bank Credit Cards?

The essential documents required to be submitted are:

- Address Proof

- Identity Proof

- Income Proof

- PAN Card

✅ Can I get my family members an additional Corporation Bank credit card?

Yes, you can get additional cards for your spouse, children and parents.

✅ Do I need to be an existing customer of Corporation Bank to apply for their credit card?

Yes, one has to be an existing customer of the bank to apply for their credit card.

✅ Can I apply for a credit card if I don’t have a job?

The primary requirement to get a credit card is income. As long as you can prove to the bank that you have a stable income, your credit card application shall be approved.

News for Credit Cards

Corporation Bank introduces RuPay credit cards

Corporation Bank has launched two variants of RuPay credit cards viz. RuPay Platinum and RuPay Select Credit Card, in collaboration with NPCI. The cards will be accepted at RuPay-enabled PoS terminals and e-commerce merchants in the country. It also provides personal accident insurance of Rs. 1m on select credit card and Rs. 200,000 on the Platinum card.

Credit Card Debts keep falling, banks are on the edge

Large card issuers that cater to borrowers ranging from the affluent to the subprime say that overall card balances—and thus the firms’ interest income—are falling. To make up for it, issuers are spending more on marketing and loosening their underwriting standards

The Brex credit cards just launched the first-ever cryptocurrency rewards for business owners, offering up to 8x in Bitcoin and Ethereum

With Tesla’s $1.5 billion Bitcoin acquisition and Square’s $50 million investment in crypto’s most well-known brand, some of the world’s wealthiest business people are helping to fuel the discussion around digital currencies. Brex is now allowing anybody — not just those who can host Saturday Night Live or sell tweets as NFTs — to experiment with blockchain-based finance without having to purchase it.