About Bharatpur

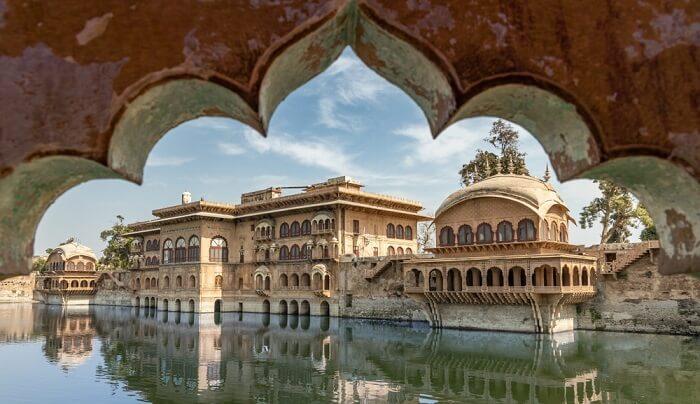

Bharatpur city is located in Rajasthan State which is also known as the “Eastern Gateway to Rajasthan”. Bharatpur has a population of over 254,846, majorly which uses Hindi and English language as their medium of communication. One of the very famous forts of Rajasthan Fort of Bharatpur also known as the “Lohagarh” is established in Bharatpur. Bharatpur is known for its flourishing wildlife and the history that is one of the remarks in the history. Bharatpur is known for the backpackers trip from around the nation. For this traveler’s city, the credit cards that provide great deals on hotel booking and other purchases are very beneficial. To know all about the Credit Card Bharatpur you’ve arrived at the right destination.

Bharatpur city is located in Rajasthan State which is also known as the “Eastern Gateway to Rajasthan”. Bharatpur has a population of over 254,846, majorly which uses Hindi and English language as their medium of communication. One of the very famous forts of Rajasthan Fort of Bharatpur also known as the “Lohagarh” is established in Bharatpur. Bharatpur is known for its flourishing wildlife and the history that is one of the remarks in the history. Bharatpur is known for the backpackers trip from around the nation. For this traveler’s city, the credit cards that provide great deals on hotel booking and other purchases are very beneficial. To know all about the Credit Card Bharatpur you’ve arrived at the right destination.

Top 5 Banks that offer Credit Card in Bharatpur

The following are the top banks that provide Credit Card in Bharatpur City:

Citi Bank

- Citibank Rewards Card: This card is designed for hardcore shoppers as this credit card comes with maximum reward points and cashback on every purchase. In addition to which the card comes with exclusive deals and offers on shopping trips.

- IndianOil Citi Platinum Credit Card: This card is a great convenience to the customers who frequently purchase fuel from the IndianOil outlet. The customers get reward points on every buy and the rewards are redeemable. So the users can redeem the points as cashback in IndianOil Outlets.

RBL Bank:

- RBL Maxima Credit Card: Upon the payment of the annual fee you get the Reward Points worth Rs. 8,000 within the first 30 days from the day of issuance of the credit card. Free movie tickets, free access to domestic air lounge, and much more are provided to the user of the credit card.

- RBL Icon Credit Card: This is the best-suited credit card for rewards and movies. It gets you free priority membership and 2 free domestic air lounge visits every quarter. Golf rounds, entertainment benefits, and many more benefits are added with the credit card.

Yes Bank:

- Yes First Preferred Credit Card: This is basically a reward card that gives the cardholder 10,000 points as a welcome benefit. It gets special priority memberships to the domestic lounge every quarter. Movie benefits on BookMyShow and rounds of Green Gold in India.

Standard Chartered Bank:

- Standard Chartered Platinum Reward Card: The card comes with many added benefits and rewards at the time of joining to the cardholder. This card is best suited for the shoppers and exclusive rewards make it customer-friendly.

- Standard Chartered Super Value Titanium Card: The credit card gets profits on dining, shopping, fuel purchase, and traveling at the cost of a basic joining fee. This card is best suited for strict budget customers.

Private Bank

- Private Bank Coral Contactless Card: With the Private Bank Coral Contactless Card the customers get exclusive access to airport lounges. The special feature of this card is that the user just has to wave the card over the card reader for payments as it is a contactless card.

Looking for Bank Branches where you can get information on Credit Card in Bharatpur

Bank |

Address |

| Corporation Bank | Bharatpur, Subhas Nagar, Rajasthan |

| IDBI Bank | Bharatpur, SH-1, Bharatpur Road, Bharatpur, Rajasthan |

| Corporation Bank | Tara Mahendra Colony, Bharatpur, Rajasthan 321001 |

Why Apply Online or Choose Dialabank for Credit Cards in Bharatpur

With Dialabank, you can pick any credit card from Bharatpur City.

- You can easily extract the online eligibility for the Credit Card of your choice.

- The entire process is very easy.

- You can easily get the application online.

- The application is instantly submitted and you get a quick update.

How you can get credit cards with Dialabank in Bharatpur in just three easy steps:

All you have to do is follow the simple steps for Credit Card Bharatpur:

- Visit the Dialabank page and compare the eligibility for the bank credit card that you want.

- Complete the online application.

- The customer gets an instant update after the application submission.

Which are the credit cards available in Bharatpur for Customers?

- Travel credit cards

- Fuel Credit Cards

- Entertainment Credit Cards

- Shopping Credit Cards

- Regular Credit Cards

- Premium Credit Cards

- Charge Credit Cards

- Reward Credit Cards

How you can pay for credit card payments or payment options?

The following are the options that are provided by Bharatpur banks for credit card payment:

- Net Banking from any bank account

- Via Cheque at dropbox

- NEFT/RTGS

- Autopay

Eligibility Criteria for Credit Card Bharatpur:

Following are the important points that need to be kept in mind for Credit Card Bharatpur:

- Occupation: The applicant must be Either Self-employed or Salaried-employee

- Minimum Age: A minimum of 21 years

- Maximum Age: A maximum of 65 years

- Minimum Income: Rs.15,000 per month for Credit Card Bharatpur

- Cibil Score: Good CBIL score is required

Required Income Criteria for Credit Cards in Bharatpur:

- In Bharatpur, the criteria for the minimum income of the applicant is Rs.15,000 a month. Although, the criteria for income varies depending upon the different bank and the credit card some of the premium credit cards require a higher salary than the regular. Cibil score is another important factor that needs to be kept in mind as it impacts credit card approval.

FAQs for Credit Card Bharatpur

✅ What should be the least income of an applicant from Bharatpur for a Credit Card approval?

The applicant should earn a minimum of Rs. 15,000 a month although it may vary on the basis of the credit card you are applying for.

✅ Is a good cibil score required for Credit Card Bharatpur?

Yes, cibil score is one of the important criteria for the availing of credit cards as it is a data analysis of your credit history and repayment dues. In case of a faulty cibil score, your application might get rejected.

✅ How does the Credit Card Bharatpur benefit the Cardholders?

These credit cards provide an ample number of benefits to its users from shopping to traveling along with reward points on every purchase. Hence, shopping becomes more delightful with these credit cards.

✅ How can I get the credit card of my choice approved?

- Visit the Dialabank page and compare the eligibility for the bank credit card that you want.

- Complete the online application.

- The customer gets an instant update after the application submission.

✅ What kinds of credit cards are available in Bharatpur City?

You can apply for any credit card such as; travel card, entertainment card, reward card, regular card, premium card, fuel card, etc.

✅ What are the modes of payment available in Bharatpur?

- Via Cheque at dropbox

- Net Banking from any bank account

- NEFT/RTGS

- Autopay

✅ How much should a customer earn to get a Credit Card Bharatpur?

The applicant should be a minimum of 21 years of age while applying for a credit card in Bharatpur city.

✅ Who should the cardholder approach in case of any query?

All the problems of the customers are addressed by the customer-relationship manager who engages in a dialogue with the customers. The services are provided 24*7 to the customers if any doubt or query.

| Credit Card Baranagar | Credit Card Bardhaman |

| Credit Card Bettiah | Credit Cards Belgaum |

| Credit Card Berhampore | Credit Card Bellary |

| Credit Card Berhampur | Credit Card Bhatinda |