Top Standard Chartered Bank Credit Cards

Name |

Annual Fee |

Category |

Minimum Income |

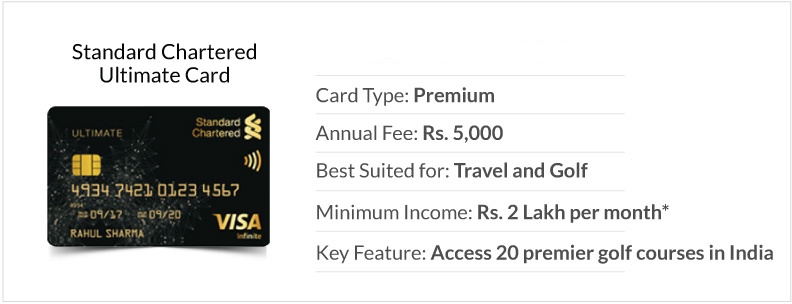

| Ultimate Credit Card | Rs.5000 | Travel | Rs.2 Lakhs p.m |

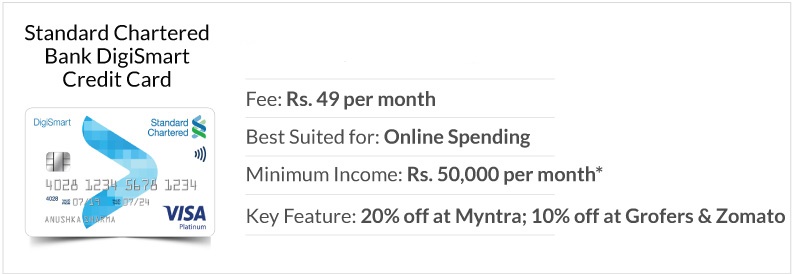

| DigiSmart Credit Card | Rs.588 | Shopping and Dining | Rs.50,000 p.m |

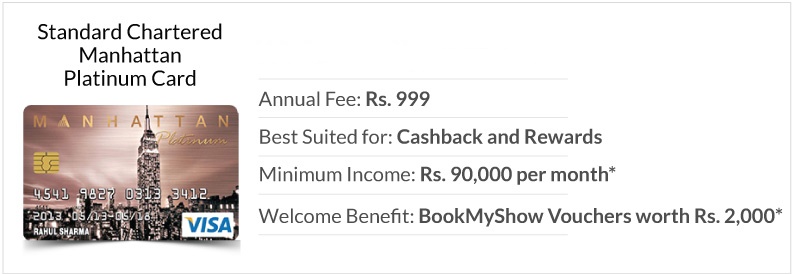

| Manhattan Credit Card | Rs.999 | Rewards | Rs.90,000 p.m |

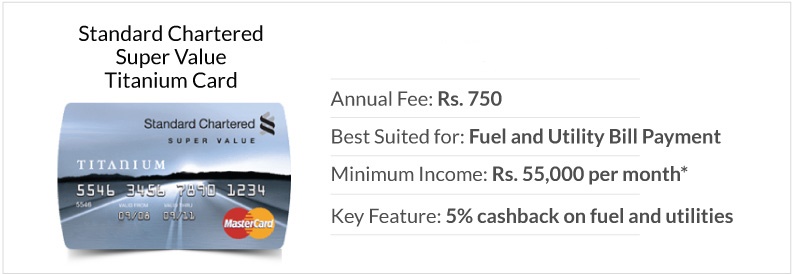

| Super Value Titanium Credit Card | Rs.750 | Fuel and Rewards | Rs.50,000 p.m |

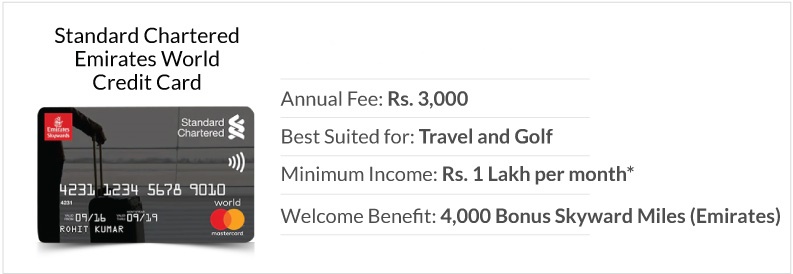

| Emirates World Credit Card | Rs. 3000 | Travel | Rs. 1 Lakhs p.m |

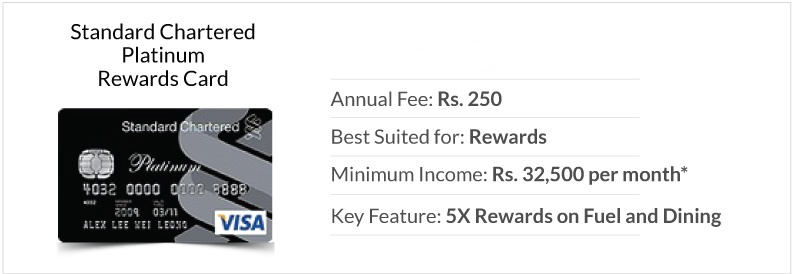

| Platinum Rewards Credit Card | Rs.250 | Rewards | Rs. 32,500 p.m |

Standard Chartered Bank Credit Cards Categories

Standard Chartered Bank provides various credit card categories to fulfill each and every requirement.

Lifestyle Credit Cards From Standard Chartered Bank

You can get access to the best lifestyle privileges by using this credit card

Apply for DigiSmart Credit Card

Travel Credit Cards From Union Bank Of India

With the help of this credit card, you can travel wherever you want without worrying about anything. Enjoy the best travel experience along with exciting rewards.

Apply For Emirates World Credit Card

Apply For Ultimate Credit Card

Rewards Credit Cards From Union Bank Of India

You will get exciting reward points on the purchase you make using the Standard Chartered Bank Credit Cards.

Apply For Manhattan Credit Card

Apply For Platinum Rewards Credit Card

Fuel Credit Cards From Union Bank Of India

You will get exciting offers and deals when you make a purchase at the fuel station by using Standard Chartered Bank Credit Cards.

Apply For Super Value Titanium Credit Card

Standard Chartered Bank Credit Cards Eligibility Criteria

There are some criteria set by Standard Chartered Bank for the credit card application. Check the required eligibility criteria below.

Eligibility criteria For Standard Chartered Bank Credit Cards |

|

| Minimum Age | 21 Years |

| Maximum Age | 65 Years |

| Income | Applicant must have a stable income |

| Location | The applicant should belong to the credit card sourcing locations of the bank. |

Standard Chartered Bank Credit Cards Documents Required

Address Proof |

Identity Proof |

Income Proof |

|

|

|

How to Apply For Standard Chartered Bank Credit Cards

You can easily apply for a credit card through Dialabank. The following steps will guide you in the credit card application process.

- First, visit the Dialabank website.

- Fill the application form. Fill in all your basic details like monthly income, residential address, contact no., etc. correctly.

- Find your preferred Standard Chartered Bank Credit card.

- Check your eligibility and if you are eligible then you can complete the online application.

Types of Credit Cards offered by Standard Chartered Bank

Some of the Standard Chartered Bank Credit cards are:

- Standard Chartered Manhattan Platinum Card

- Standard Chartered Platinum Rewards Card

- Standard Chartered Super Value Titanium Card

- Standard Chartered Ultimate Bank

- Standard Chartered Emirates World Credit Card

- Standard Chartered Digi Smart Credit card

Standard Chartered Bank Credit Card Fees and Charges

| Fee | Charges |

| Annual Fee | NIL |

| Late Fee Charges | 1.30% |

| Late payment charges | 2.50% |

| Enhanced fee | 100 |

| PIN Fee | 150 |

Standard Chartered Bank Credit Card Rewards Programme

Standard Chartered Bank has different types of credit card rewards programmes. In these reward programmes, you can get various rewards and cashback. These banks offer various benefits and these benefits include things like points. By using these rewards you can know all about the rewards programme.

Why choose Standard Chartered Bank Credit Cards?

You can choose a standard chartered bank for availing of credit cards. Because standard chartered bank avails best benefits to the people who want to avail credit cards. So use this standard chartered bank for availing credit cards and these credit cards are useful for cashback and a lot more things.

How to check Standard Chartered Bank Credit Card Status?

You can check the Standard Chartered bank credit card status both online and offline. For availing of credit cards, you need to visit the bank for offline modes. For online you need to go to the website and then fill in all your details for credit cards. Then you can avail the respective credit cards.

Standard Chartered Bank Credit Card Customer Care

you can contact the standard chartered bank customer care by using the following number 011-66014444. Then you can solve all your questions related to credit cards and these credit cards are based on cashback and points and rewards. Rewards are also important for credit cards. You can contact Dialabank for availing credit cards.

Dialabank: 9878981166

Standard Chartered Bank Credit Card Offers

You can avail best discounts from Standard Chartered Bank. Standard Chartered Bank has various offers and these offers include various benefits and standard chartered bank offers various cashback and rewards. These rewards are based on some rewards programme. So in this way you can use these Credit card offers.

Rewards Points offer on Standard Chartered Bank Credit Cards

Name Of the Card |

Rewards Points Offer on Card |

| Manhattan Credit Card |

|

| Platinum Rewards Credit Card |

|

| Super Value Titanium Credit Card |

|

| Ultimate Credit Card |

|

Features and Benefits of Top 10 Union Bank of India Credit Cards

Ultimate Credit Card |

|

| Key Highlights | Best for Dining, Attractive rewards |

| Joining Fee | N/A |

| Suitable For | Dining |

| Features and Benefits |

|

DigiSmart Credit Card |

|

| Key Highlights | Best for shopping, Attractive rewards |

| Joining Fee | N/A |

| Renewal Fee | N/A |

| Joining Bonus | N/A |

| Suitable For | Shopping |

| Features and Benefits |

|

Manhattan Credit Card |

|

| Key Highlights | Best for shopping, Attractive rewards, Exclusive offers |

| Joining Fee | N/A |

| Renewal Fee | N/A |

| Joining Bonus | N/A |

| Suitable For | Shopping |

| Features and Benefits |

|

Super Value Titanium Credit Card |

|

| Key Highlights | cashback on purchases, convenient to use |

| Joining Fee/Annual Fee | N/A |

| Renewal Fee | N/A |

| Joining Bonus | N/A |

| Suitable For | Shopping |

| Features and Benefits |

|

In the features and benefits of the Standard Chartered Bank, you can avail of no processing fee. The processing fee is low for these banks and many banks charge a processing fee. This withdrawal facility is also available in many banks and banks offers various credit card types and these are used for cashback.

FAQs

✅ What is the processing fee for Standard Chartered Bank?

The processing fee for these Standard Chartered Bank is nil.

✅ What is the customer care number for Standard Chartered Bank?

The customer care number for Standard Chartered Bank is 011-66014444.

✅ Which is higher Platinum or Titanium Credit Cards?

Titanium Credit Cards is higher than Platinum Credit Cards.

✅ Which bank credit cards are best?

Standard Chartered Bank Credit cards are useful.

✅ What is the minimum balance of Standard Chartered Bank?

The minimum balance of Standard Chartered Bank is 25000.

News

Standard Chartered Bank Credit cards

Standard Chartered Bank is offering credit cards with high offers and discounts. These discounts include various cashback offers and rewards. These credit cards are useful for various benefits. These credit cards are useful for various online transactions and online purchases.

Credit cards Reward points expiry

Credit cards are used for rewards points and these rewards points are used for expiry and in credit cards, there are many cashback offers and rewards. And by using these credit cards there are many benefits and these benefits are useful in credit cards. You can use it online for credit cards.

How to choose the right credit cards

Credit cards are used for various purposes. Most credit cards are used for online transactions and online purchases. So using these credit cards are used for banks. Banks offer varieties of credit cards and by using these credit cards you can avail a lot of benefits in the banks for credit cards.

The credit card offers in Standard Chartered Bank

There are many uses of credit cards in Standard Chartered Bank. These banks offer various offers and discounts for credit cards and by using these credit cards you can do various online and offline purchases. These credit cards are useful for the standards chartered bank purchases.