Features and Benefits of Top 10 Yes Bank Credit Cards

YES Bank Credit Card |

Annual Fee |

Minimum Income |

Best Suited For |

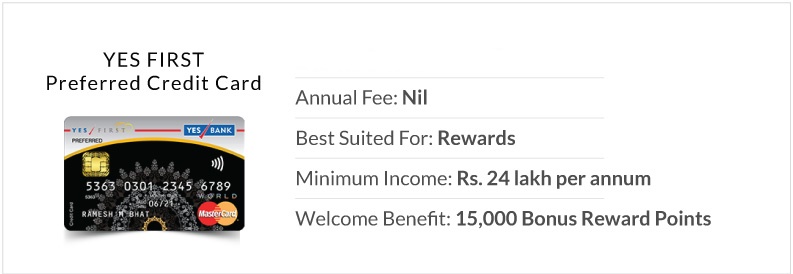

| YES FIRST Preferred | Nil | Rs. 24 lakh p.a. | Lifestyle and Rewards |

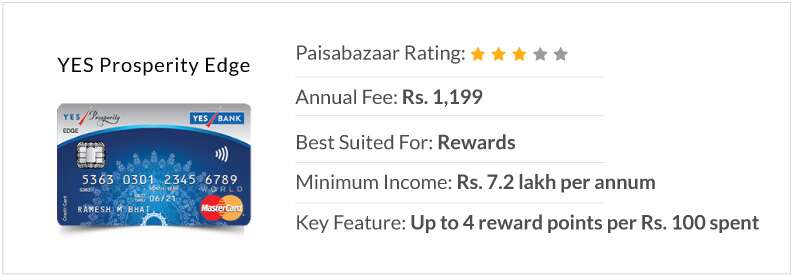

| YES Prosperity Edge | Rs.1,199 | Rs. 7.2 lakh p.a. | Rewards |

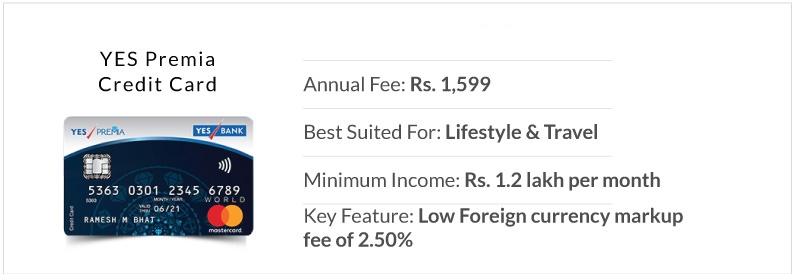

| YES Premia Credit Card | Rs. 1,599 | Rs. 1.2 lakh p.m. | Travel |

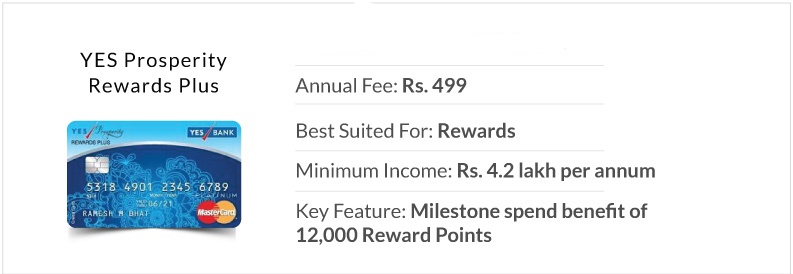

| YES Prosperity Rewards Plus | Rs. 499 | Rs. 4.2 lakh p.a. | Rewards |

| YES FIRST BUSINESS Card | Rs.4,999 | Rs. 9 lakh p.a. | Rewards |

| YES Prosperity BUSINESS Card | Rs.2,499 | Rs. 4.8 lakh p.a. | Rewards |

| YES Prosperity Rewards Credit Card | Rs. 299 | Rs. 25,000 p.m. | Rewards |

| YES Prosperity Cashback Credit Card | Rs. 999 | Rs. 25,000 p.m. | Cashback |

| YES Prosperity Cashback Plus Credit Card | Rs. 1,499 | Rs. 25,000 p.m. | Cashback |

| YES Private Credit Card | Rs. 10,000 | Check with Bank | Lifestyle |

| YES FIRST Exclusive Credit Card | Rs. 9,999 | Rs. 4 lakh p.m. | Travel |

Types of Credit Cards offered by Yes Bank

For everyone, the needs are plenty, and it could differ for each of us depending on the lifestyle. Clearly understanding the customer’s spending habits, Yes Bank offers varied credit cards in the following categories. The following are some of the Yes Bank Credit Cards Categories.

Lifestyle Credit Cards from Yes Bank

Yes Bank provides credit cards that offer the best lifestyle privileges to their customers. Yes Bank Credit Cards take care of each need of their customers.

Apply for YES FIRST Preferred Credit Card

Travel Credit Cards from Yes Bank

Yes Bank Credit Cards comes with various travel benefits. You will get exciting offers on airline tickets and other travel expenses.

Apply for YES Premia Credit Card

Rewards Credit Cards from Yes Bank

Yes Bank Credit Cards offers various rewards on the purchases you make by using the credit card.

Apply for YES Prosperity Edge Credit Card

Apply for YES Prosperity Rewards Plus Credit Card

Business Credit Cards from Yes Bank

Yes Bank provides business credit cards as well. These credit cards offer exclusive rewards and many other benefits to the cardholder.

Apply for YES FIRST BUSINESS Credit Card

Apply for YES Prosperity BUSINESS Credit Card

Yes Bank Credit Cards Eligibility Criteria

Different credit cards from Yas Bank’s range of credit cards have their specific criteria; however, to apply for a Yes Bank credit card, the following eligibility requirements are applicable across all variants:

- Minimum of 21 years of age and a maximum of 60 years.

- Salaried or self-employed individuals with a consistent source of income.

- Minimum monthly income of INR 40 thousand (can be more for YES Prosperity Edge Credit Cards).

Yes Banks Credit Cards Documents Required

- Address proof – Passport/ Driving Licence/ Voters ID etc.

- Identity proof – Bank Statement/ Voter Id/ Driving Licence/ Pension Book etc.

- Income Proof – Bank Statement/ Pay Slip/ Income Tax return.

- Pan Card.

- Passport size photo.

How to apply for Yes Bank Credit Cards

You can easily apply for a credit card through Dialabank. Follow the following steps and get your credit card easily.

- First, visit the Dialabank website.

- Fill the application form. Fill in all your basic details like monthly income, residential address, contact no., etc., correctly.

- Find your preferred Yes Bank Credit card.

- Check your eligibility, and if you are eligible, then you can complete the online application.

How to Check Yes Bank Credit Card Status?

Following your credit card application, you can receive a message from the bank confirming your credit card application and including the reference number and application number.

The Yes Bank has launched a quick mechanism to monitor your credit card application status online to make the banking process easier. To search the Yes Bank credit card application online, follow the steps below.

You should go to the bank’s official website. You should go to the bank’s credit card site. You will check the status of your credit card application by entering your application reference number, application form number, telephone number, or date of birth.

Why choose Yes Bank Credit Cards?

Yes, Bank credit cards offered a number of advantages that make them a good competitor in the credit card market. The main advantages offered to the customers are:

-

- Shopping, eating, movie rentals, and travel are also included with exclusive packages.

- As welcoming presents, you’ll get bonus loyalty points and coupons.

- Domestic airport lounge service is complimentary at major airports around the country.

- Surcharge on petrol purchases is waived.

- There will be an exclusive concierge service available.

- Free access to some of the best golf courses in the world.

- Spending on both sales earns you reward points.

- The ability to convert credit card charges to EMI and pay in simple instalments.

- A contactless transaction option is open.

- Mastercard Secure Code can be used to protect online purchases.

- Instant cash advances up to the available credit limit are available at a low interest rate. This cash advance is a Personal Loan that has no end-use restrictions and can be charged in convenient instalments.

- You should set up recurring payments on YesPayNow to ensure that your utility bills are paid on time.

Yes Bank Credit Card Customer Care

Yes Bank is a market-leading financial institution; they are known for their good customer relations and additional loan term benefit for their customers. To enhance this further, Yes Bank has a special credit card customer care helpline:

The number of banks providing credit cards in India is large and is ever-increasing. This makes it difficult for you to find a new customer care number every time, hence save yourself from all that hassle and just call us for all your financial needs:

Dialabank: 9878981166

Reward Points offered on Yes Bank Credit Cards

Name of the Card |

Rewards Points Offer on the Card |

| YES FIRST Preferred |

|

| YES Prosperity Edge |

|

| YES Premia Credit Card |

|

|

YES Prosperity Rewards Plus |

|

|

YES FIRST BUSINESS Credit Card

|

|

|

YES Prosperity BUSINESS Credit Card

|

|

Yes Bank Credit Cards Offers

YES FIRST Preferred

- YES FIRST Preferred Credit Card is a premium credit card well-suited for shopping and travel. An excellent rewards program and complimentary access to international airport lounges are among its major highlights.

- The welcome privilege of 15000 Reward Points on the first transaction

- Enjoy a 25% discount on movie bookings at BookMyShow

- Avail of great offers across travel, dining, shopping, wellness and more, in select cities

rewards - ₹100 = 8 Reward Points (On Travel Agencies & Tour Operators, Domestic Airlines and Dining)

- ₹100 = 4 Reward Points (On others)

- Save up to ₹12918 on an Annual Spend of ₹4 Lakh

YES Prosperity Edge

- YES Prosperity Edge Credit Card rewards its user on all their transactions. Bonus reward points are earned on grocery, department, dining, and supermarket transactions.

- Annual Fee: ₹1199

- Joining Fee: ₹1199

- 500 Reward Points on each YES PayNow registration

- 4 Reward Points per ₹100 on Grocery Stores & Supermarkets, Department Stores and Dining spends

- Avail of great offers across travel, dining, shopping, wellness and more, in select cities

rewards - ₹100 = 4 Reward Points (On Grocery Stores & Supermarkets, Department Stores and Dining spends)

- ₹100 = 2 Reward Points (On others)

- Save up to ₹3432 on an Annual Spend of ₹4 Lakh

YES PREMIA Credit Card

- YES Premia Credit Card by YES Bank is a premium card that offers luxury and convenience to the user. Customers get lounge access, golf offers, accelerated reward points, and much more. The card is best suited for international travellers who would like to enjoy luxury privileges.

- Annual Fee: ₹1599

- Joining Fee: ₹1599

- 750 Reward Points on each YES PayNow registration

- Avail of 25% discount on movie tickets booked on BookMyShow Website or Mobile App

- Avail of great offers across travel, dining, shopping, wellness and more, in select cities

rewards - ₹100 = 4 Reward Points (On Grocery Stores & Supermarkets, Department Stores and Dining spends)

- ₹100 = 3 Reward Points (On others)

- Save up to ₹7104 on an Annual Spend of ₹4 Lakh

YES Prosperity Rewards Plus

- YES Prosperity Rewards Plus Credit Card is best suited for everyday spends. Users earn bonus reward points on grocery and supermarket transactions.

- Annual Fee: ₹499

- Joining Fee: ₹499

- Earn 12,000 Bonus Reward Points on achieving spends of ₹3.6 Lakhs or more in each anniversary year

- 500 Reward Points on each YES PayNow registration

- Avail of great offers across travel, dining, shopping, wellness and more, in select cities

rewards - ₹100 = 3 Reward Points (On Grocery Stores & Supermarkets)

- ₹100 = 2 Reward Points (On others)

- Save up to ₹5904 on an Annual Spend of ₹4 Lakh

YES FIRST BUSINESS Credit Card

- YES FIRST Business Credit Card makes travel cheaper for the businesspersons and rewards them for all their spending. The card also offers complimentary lounge access at domestic and international airports.

- Annual Fee: ₹4999

- Joining Fee: ₹4999

- Earn 20,000 Reward Points on your first transaction done within 30 days of the Card set-up date or upgrade date

- 15,000 Reward Points on each renewal

rewards - ₹100 = 8 Reward Points (On Travel Agencies & Tour Operators, Domestic Airlines and Dining)

- ₹100 = 4 Reward Points (On others)

- Save up to ₹12168 on an Annual Spend of ₹4 Lakh

YES Prosperity BUSINESS Credit Card

- YES Bank has brought out YES Prosperity Business Credit Card for businesspersons. The card offers multiple benefits such as lounge access, golfing offers, and so on.

- Annual Fee: ₹2499

- Joining Fee: ₹2499

- 10,000 Reward Points on the first transaction within 30 days of card set update or upgrade date*

- 500 Reward Points on each YES PayNow registration

rewards - ₹100 = 4 Reward Points (On Travel Agencies & Tour Operators, Domestic Airlines and Dining)

- ₹100 = 2 Reward Points (On others)

- Save up to ₹6432 on an Annual Spend of ₹4 Lakh

FAQs for Yes Bank Credit Card

✅ Suppose I want to apply for a credit card from YES Bank. The one is the most appropriate for me?

Yes Bank provides a range of credit cards for daily travellers, shoppers, and other types of customers. We recommend that you first determine your spending style. If you travel regularly, a travel card could be the best option for you. If you enjoy shopping, though, a card that offers loyalty points or cashback would be the right choice.

✅ On YES Bank credit cards, how do I gain incentive points?

You can collect loyalty points in almost any category with a Yes Bank credit card, depending on the card. Accelerated bonus points will be awarded on such orders. However, the majority of Yes Bank cards do not offer rewards for petrol purchases. Yes PayNow registration and Yes Bank’s standing coaching service will also win you incentive points.

✅ What does the credit card E-welcome Kit include?

The contents of the kit can differ depending on the card you apply for. If you apply for a consumer pass, for example, you will receive:

- A user’s manual

- The most crucial terms and conditions (MITC)

- Cardholders’ pact

- Customers’ Commitment Code is a document that outlines a bank’s commitment to its customers.

- Your credit card and ATM PIN will also be issued.

✅ What do I do if my Yes Bank credit card shows an illegal transaction?

You can call the Yes Bank credit card customer service department right away to get the card barred. This will prevent the card from being misused in the future.

News for Yes Bank Credit Card

2021-01-04:

YES BANK introduced a premium credit card for HNIs on January 4, 2021. Yes Private Prime Credit Card for High-Net-Worth Individuals was launched by YES BANK (HNIs). The Mastercard World Elite portal is where the credit card is available. According to the lender, it will provide global benefits and experiences in travel, leisure, lodging, dining, culture, and health.

2020-12-14:

Yes Bank plans to double its credit card user base by 2020-12-14.In the next two years, Yes Bank wants to more than double its credit card client base. In the next two years, the bank intends to increase the credit card by at least fourfold.

2019-02-26:

By using various credit cards, be careful about overleveraging: Yes, there is a bank. Yes Bank, a private sector lender, has urged credit card borrowers to be careful when using several credit cards to avoid falling into debt. Since using multiple credit cards gives you access to more credit, you can find yourself over-leveraged when paying for your regular expenses. As a result, setting a credit cap is important for using several credit cards.

2019-01-02:

Vivo announces a 10% instant discount on Yes Bank credit cards. Vivo has announced a special deal on its most recent smartphone release. Users who buy the newly launched NEX mobile phone on Amazon using their yes Bank credit cards will get a 10% instant discount as part of this deal. Both EMI and non-EMI orders are eligible for the bid.

2017-09-26:

Yes Bank introduces a new credit card for UHNIs Yes Bank, a private sector lender has introduced a new credit card for Ultra High Networth Individuals. The MasterCard World Elite programme has been used to introduce the card. This card has a membership fee of Rs. 50,000 and a renewal fee of Rs. 10,000, and it comes with a slew of perks. Just 2,500 millionaire consumers would be eligible for the newly introduced card.