Factors used for Calculating CIBIL Score

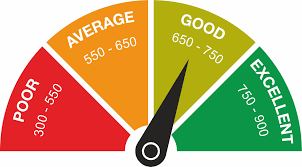

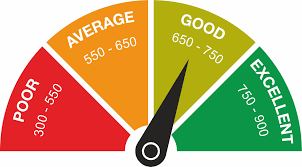

Having a good credit score is the most significant demand for availing any Loan today. It’s the key to easy and quick availing of finances from leading banks and NBFC’s. Talking about the maintenance of the credit score, it has much to do with the Loan availing policies and criteria.

Many of the customers at times fail to avail loan due to lack of good CIBIL score. There can be many factors that are involved in the calculation of the CIBIL score. The score has to be dully maintained by the customer with tracking his credit record, having a check on his repayment strategies and working on other aspects as well.

We have certain factors that are taken into consideration in order to calculate to CIBIL score. However, these factors can vary from person to person. Some of them are stated below.

Loan Repayment History details:

The most important factor that would affect your CIBIL is the repayment history details. This detail is to be updated and maintained properly and should be free from defaults. This includes your repayment of credit card bills, loan instalments and other EMI’s on time. The compensation of loan amount within the given tenure also matters a lot.

If you are found to be a defaulter concerning your payments, your credit score would be gradually affected negatively.

On the other hand, if you pay the credit card bills and other EMI’s on time, you would be rewarded with a better and good credit score.

Utilisation of existing credit limit:

The credit utilization limit matters a lot. A high credit limit over and over can embark a negative impression to the credit bureau which would gradually place your credit report onto the negative side. So always use your credit cards without violating the utilization limits, as this would keep your credit score maintained.

Multiple Loan Applications

If you are someone who is too much into the Loan world, that is if you have availed different kinds of loans such as a loan against a car, a personal loan, etc., from multiple banks and organizations, the bureau can have a check onto your credit details.

The company can run an inquiry against your CIBIL report. Availability of much credit history details can hold a negative impact on your credit score. You could even be considered more of a credit hungry person with a fluctuating repayment history. Multiple loan applications that you possess can take you to a level in which you could be seen as an unstable person in terms of credit availability. This eventually would drop down your credit score.

Loan servicing duration:

If you are someone who has a long term loan servicing period, this could positively influence your CIBIL score. Till the time you are repaying the amount in a responsible, planned and disciplined manner you have chances of up-gradation in your CIBIL score.

A number of unsecured loans:

If you have availed more of unsecured loans for a long time. This could be another biggest factor which would embrace a negative impact on your CIBIL score.

A high percentage of unsecured loans, such as a personal loan or credit card expenses can negatively affect your CIBIL score.

Increase in credit limit:

Requesting a higher credit limit can affect your credit score negatively. In the processing, the banks ask CIBIL for your reports. This hard inquiry can affect your CIBIL score drastically. Thus, request for higher limits only when you really in need for them.

Guaranteeing Loan:

If you are acting as a guarantor for someone’s loan this might not affect your credit score but if the person for whom you are guaranteeing is found to be guilty of his repayment or involved in false practices violating bank’s or an organization’s rules then surely your credit score would be impacted in a negative manner.

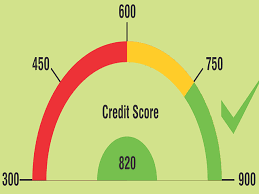

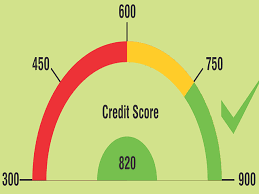

All the above-mentioned factors carry a huge significance in calculating your CIBIL score and influencing it accordingly. Keeping a check on your credit report mistakes would eventually influence the score positively. Always keep a firm check on your credit report mistakes and rectify the errors within every six months, so that the CIBIL bureau calculates your score without any errors and enhance your capabilities of availing loans or any kind of financial help from the banks. If you work judiciously on these factors you would eventually develop a good CIBIL score.