EMI : Budget Your Income

EMI: Budget Your Income

A long-term loan as a home loan is a debt that is part of your budget every month. If you invest a lot in it, you may not have sufficient funds to adjust a huge list of other expenses that tend to accumulate over time. For an example, it is necessary to consider future expenses such as educational expenses of children, emergency funds for job loss or loss of income in a situation where two people have taken a loan together.

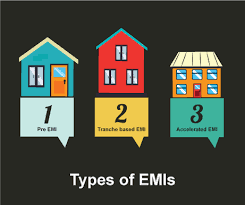

Have you ever wondered why the EMI is usually restricted to 30% or 40% of your monthly income? Here it is why. Salary details, qualifications, employer / business, years of experience, growth prospects and the prospects for alternative employment and sources of income if any are all aspects that determine the amount of home loan you eligible.

INSURANCE PREMIUMS

Most people make the mistake of mixing insurance with investment. So, instead of opting for low-cost pure life protection, they pack their portfolios with traditional plans, which yield low returns of 5-6% and come with a huge premium. Add to these other insurance plans like health, critical illness, car and home cover, and the premium outgo swells up considerably.

The pure life cover, or term plan, should be about 8-10 times your annual income, and should take into account all dependants and loans. If you also have traditional plans and Ulips, the premium should not exceed 6-7% of your total income.

The answer to a disciplined financial life is financial planning. Financial planning requires budgeting and adhering to the expenditure budget and envisaging some savings for the future contingencies like children’s education, marriage, sickness, buying / constructing a home, vehicle repairs, retirement planning etc. First of all list out all your liabilities and assets and find out what is your net worth. If it is negative then it is a sign of looming bankruptcy!

In the case of debt, your future income is also committed towards debt and it is all the more imperative that you start planning your finances. However if the debt is contracted for creating an asset (e.g., housing loan), the value of the asset may be more than the debt and thus balances out the debt to owned assets. If the debt is purely for consumption then you have a problem there. Debt to income ratio will give an indication of whether your debt is within your means. This is calculated by dividing your monthly debt repayment obligations by your monthly net income multiplied by 100. Consumption loans repayment should not exceed 10% and housing loan another 40%.

Hence a debt to income ratio of 50% made up as above is considered as within tolerance limit. Beyond this, you are stretching it beyond your immediate means. However, this is only a thumb rule. In case you have many dependants, then debt-to-income ratio needs to be less than 50%. Or you may need to postpone the idea of buying a house till you have a better income flow.

In general, the schedule of payments is compiled in a way that allows no more than 40% of your gross monthly income to be paid as EMI. It is limited to 30% or 40%, ensuring the following:

- 10% of their income is spent on other loans, if you have or availability in the future.

- 25% of their income is deducted by way of statutory deductions and for investment purposes.

- 25% of its revenues are generally spent to cover your monthly expenses.

- This leaves behind 40%, which takes as its ability to repay this loan.

For self-employed applicants, the benefit is the benchmark that determines the value of the loan. The longer term to repay the loan the lower the EMI and this also mean that you can opt for a larger loan. The loan amount is eligible to receive also depends on other factors as the company that used the location of your residence and your credit history.

A long-term loan as a home loan is a debt that is part of your budget every month. If you invest too much into it, may not have sufficient funds to manage a huge list of other expenses that tend to accumulate over time. For example, it is necessary to consider future expenses such as educational expenses of children, emergency funds for job loss or loss of income in a situation where two people have taken a loan together.

May be spikes in interest rates. In this general scenario, banks will increase the loan tenure to not put the borrower in a difficult situation by increasing the EMI. In this scenario, if you have sufficient funds on hand can be paid in advance, at intervals, allowing scope for closing your loan early.

|

Leading Home Loan Providers (Click to Apply) |

||||

| REMINDER SERVICES | CURRENT HOME LOAN INTEREST RATES | EMI CALCULATOR |

Read Other Related Articles

| Budget 2014-15 Key Highlights | |

| Bank Accounts For All | |

| Aadhar Card | |

| Terms and Conditions of Gold Loan |