Factors That Affect Credit Score

CIBIL Score is one of the most crucial codes that ensures a person’s full credit report in terms of his financial gains and loss. The score carries huge importance in the banking scenario. It plays a key role in maintaining the track record of an individual’s financial activities.

The data regarding an individual is collected by the CIBIL bureau through banks or firms, and the credit score is set accordingly. However many people neglect the due importance of this score and experience a decrease in their CIBIL score.

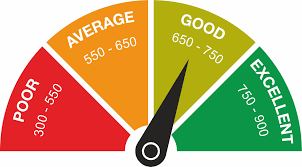

The bureau works on a number of parameters before giving the final score to the customer. The score basically ranges from 300-900. A CIBIL score above 750 is considered to be a good one and helps the customer in getting due benefits from banks. If you hold a CIBIL greater than 750 you are 100% eligible for availing any financial help from the bank.

Some of the common Factors That Affect Credit Score

Delaying your Credit Card Payments

Delaying the repayment of your credit card bills at times can lower down your CIBIL to an extent.

Making Frequent Loan Enquiries

Whenever you are in an urgent need for funds, you generally opt to inquire from many of the leading banks and firms about their loan policies and the disbursal process. It is one of the major factors that affect credit score.

According to you, this can be an intelligent step to grab the best loan deal, but this can impart an adverse effect on your credit report. The lender might see you as a credit hungry person and deny dealing with you.

It would drastically lower your credit score.

Lack of Cash in your Account

There can be a phase when you might suffer dents in your credit reports with a lack of balance in the account.

The account through which you are paying your monthly instalments should always have the cash to ensure time to time payments of the loan instalments. Missing or delaying the payments would affect credit score.

Having Multiple Credit Cards

Having more number of credit cards may boost your status in society and maybe a good source of availing funds. But in actual practice, they don’t give a hike to your credit score.

You might drain out of stress in holding track of your credit cards and miss the payment of your bills. This would eventually lower your credit score.

The concept of multiple credit cards works till the time you’re using them judiciously; otherwise, they become an issue of serious concern and unwanted stress.

Availing Too Many Unsecured Loans

Lastly, it’s the number of Unsecured Loans that are being traced out in your CIBIL report which can be a big reason to worry about. There could be many Personal Loans attached to your name, namely loans for education, business, medical emergencies, etc. This list could damage your CIBIL report to an extent.

These mistakes of yours are the factors that affect credit score. A sound check on them would provide you with a better score and financial benefits as well.

Read More Articles at Dialabank. Contact us for the best financial advice.