Bank of Maharashtra Key Features – Apply Now

| Bank of Maharashtra Gold Loan Interest Rate | 7.25% per annum |

| Bank of Maharashtra Gold Loan Rate Per gram | ₹ 3,800 to ₹ 4,350 |

| Bank of Maharashtra Processing Fee | 1% of the Principal Loan Amount or Rs. 1000 (Whichever Is Higher) |

| Bank of Maharashtra Loan Amount | Rs. 20000 to Rs. 50 Lakh |

| Bank of Maharashtra Prepayment Charges | Nil |

| Bank of Maharashtra Repayment Tenure | Maximum 12 Months |

| Bank of Maharashtra Repayment Scheme | Bullet Payment Scheme |

You can call on 9878981144 to avail of the Best Deals and Offers on the Bank of Maharashtra Gold Loan.

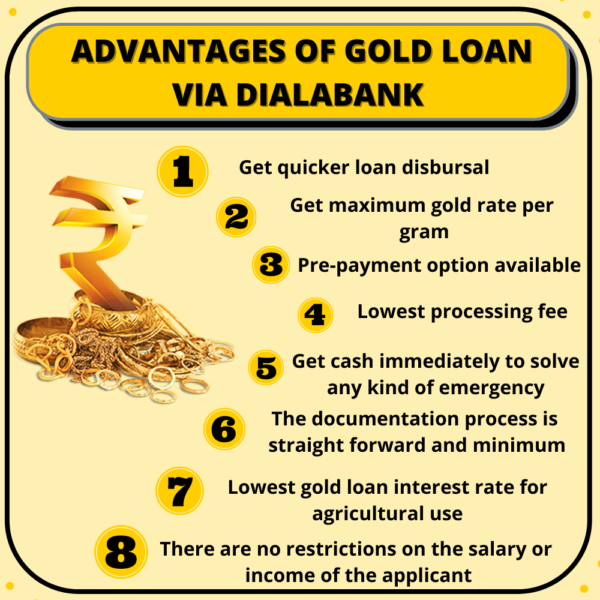

Advantages of Bank of Maharashtra (BOM) Gold Loan

- Fast Process: BOM Gold Loan is approved and disbursed very quickly and easily. The loan gets passed in an hour.

- Fewer Documents: The documentation process is very easy and less. Very basic documents are required for the Bank of Maharashtra (BOM) gold loan.

- Transparent System: The bank provides full transparency to the customer; that is, there are no hidden charges.

- Amount of Loan: A minimum of Rs. 50000 loan is provided by The Bank of Maharashtra (BOM) but for the customers from Rural areas, it can go even below Rs. 50000.

- Safety of Jewelry: One important thing to note is that the bank is liable entirely for the security of your Gold. Thus, the Gold is kept in fireproof security.

- Loan Tenure: The tenure of the loan can be from 1 year to 4 years. Hence, You can choose according to your comforts.

- No Debt Burden: There can be situations in which an applicant is not able to repay the loan amount, and in such a case the applicant will not be under debt as the bank will only confiscate the ornaments.

- No Income conditions for availing of the loan: There are no restrictions on the salary or income of the applicant; hence, anyone with any income range can avail of a gold loan.

- Foreclosure: Bank charges a borrower up to 0.50% on the principal outstanding in case of a Gold Loan per gram Foreclosure.

How much loan can I get from the Bank of Maharashtra (BOM)

According to the newest Gold prices, the Bank of Maharashtra (BOM) Gold Loan Per Gram Rate is ₹ 3,800 to ₹ 4,350. The per gram loan price changes as per the average of gold prices for the past few days and the current price. The purity of gold also impacts the Bank of Maharashtra (BOM) Gold Loan Per Gram price.

Bank of Maharashtra (BOM) Gold Loan Per Gram

| Bank of Maharashtra Gold Loan Rates/ Gram | ||||

| Weight | Loan on 18Cr Gold | Loan on 20Cr Gold | Loan on 22Cr Gold | Loan on 24Cr Gold |

| 1 gm | 2450 | 2732 | 3015 | 3297 |

| 10 gms | 24500 | 27320 | 30150 | 32970 |

| 20 gms | 49000 | 54640 | 60300 | 65940 |

| 30 gms | 73500 | 81960 | 90450 | 98910 |

| 50 gms | 122500 | 136600 | 150750 | 164850 |

| 100 gms | 245000 | 273200 | 301500 | 329700 |

| 200 gms | 490000 | 546400 | 603000 | 659400 |

| 300 gms | 735000 | 819600 | 904500 | 989100 |

| 500 gms | 1225000 | 1366000 | 1507500 | 1648500 |

GOLD LOAN @ 0.75%*

APPLY NOW

About Bank of Maharashtra (BOM) Gold Loan

Bank of Maharashtra (BOM) is a residential bank of the Indian state Maharashtra, registered in September 1935 claiming an authorized capital of 1 Million. The bank begins its business on 8th February 1936. Headquartered in Pune. Bank has the largest branch network in Maharashtra by any public sector bank.

Gold Loan in the Bank of Maharashtra (BOM) comes with a lot of benefits and special offers. The bank is one of the most reputed and known for its financial services. Moreover, Gold Loan is among the safest and fastest loan services with minimal documentation. No reason to wait anymore, apply for the Bank of Maharashtra Gold Loan today.

- Bank of Maharashtra (BOM) Gold Loan Interest Rate is 7.25% per annum.

- Bank of Maharashtra (BOM) Gold Loan Rate Per Gram is 7.25% per annum.

- Bank of Maharashtra (BOM) Gold Loan Tenure is 12 Months.

- Bank of Maharashtra (BOM) Gold Loan processing fee is 1% or Rs.1000(The higher amount).

Bank of Maharashtra (BOM) Gold Loan Eligibility

Bank of Maharashtra (BOM) provides the Gold Loan as one of its financial products to satisfy short-term as well as long-term needs of funds. Bank of Maharashtra (BOM) ensures to provide you with the loan amount in less than an hour of the application after the approval process is quickly completed. Also, it requires very less paperwork throughout the process.

Major Eligibility criteria for availing of the Bank of Maharashtra Gold Loan is:

| Age | 18-70 years of age |

| Nationality | Indian |

| Employment Status | Salaried, Self-Employed |

| Gold Quality | Minimum 22 Carats (10 grams) |

Bank of Maharashtra (BOM) Gold Loan at Home

Gold Loan at Home is a doorstep loan service that allows you to borrow money without leaving your home. The service is quick, flexible, and cost-effective, with low-interest rates. Before submitting a loan request, you may use the gold loan calculator to determine the worth of your gold or the loan amount. Getting a Gold Loan at home is a simple and quick process that takes only a few minutes.

One of our employees will contact you and visit your home within 30 minutes. The necessary gold loan amount will be delivered immediately to your bank account after all e-documentation and gold identification are completed at your home.

The benefits of getting a gold loan at your doorsteps are:

- Access To Your Loan Account 24 X 7

- Diverse Range of Gold Loan Schemes

- You can get free insurance for your Gold

- There are no hidden fees.

- You will get the maximum value of your Gold

- You can avail your Gold Loan in just 1 visit

- Service at Your Door in 30 Minutes

- Pre & Part Payment Facility

- Your Gold will just be released the same day.

Bank of Maharashtra (BOM) Gold Loan Documents Required

Bank of Maharashtra (BOM) provides a Loan against Gold or commonly known as Gold Loan as a product to its customer to keep their financial needs satisfied. It also provides extreme security to the ornaments of gold provided by the applicant against the loan and continues it till the end of the loan tenure.

Documents required for applying for the Bank of Maharashtra Gold Loan are :

Submit your application appropriately filled and signed with the listed documents:

| Photographs | 2 Passport Size |

| Identity Proof | Aadhar Card, Passport, PAN Card, etc. (Only 1 is required) |

| Residence Proof | Aadhar Card, Driving License, Ration Card, etc. In the case of Rented House then the rent agreement or water/electricity bills for the last three months can be considered. (Only 1 is required) |

| Agricultural Land Proof | Agricultural Land Proof and Income Statement of the applicant have required in the case the applicant wants the Gold Loan for Agricultural purposes. |

**Any other documents as requested by the bank shall be duly submitted.**

GOLD LOAN @ 0.75%*

APPLY NOW

Bank of Maharashtra (BOM) Gold Loan Interest Rate, Fees and Charges

Gold Loan is meant to pace you up with all of the short-term and long-term requirements. The amount of the loan and the purity/quality of the gold you provide to the bank is directly responsible for the gold loan rate of interest. It provides loans comparatively at a low Gold Loan Interest Rate.

You can call on 9878981144 to avail of the Best Deals and Offers on the Bank of Maharashtra Gold Loan.

| Bank of Maharashtra (BOM) Interest Rate | 7.25% per annum |

| Processing Fee | 1% of the loan amount or ₹1000 whichever is higher |

| Prepayment/Foreclosure Charges | Nil |

Bank of Maharashtra (BOM) Gold Loan Apply Online

Bank of Maharashtra (BOM) provides an easy and most reliable process of gold loan and applicants begin it from their home itself with full comfort ensured.

Apply for Gold Loan by directly visiting the bank’s authentic website and submitting a form requesting some specific details and the type of gold loan you wish for. Later, reach the nearest branch with the documents required and the gold you want to provide for the loan.

You can also apply with Dialabank by following the below-mentioned steps to get a Gold Loan as per your need.

- Go to the official web address of Dialabank and fill in the mentioned details over there.

- Our Relationship Manager will contact you at the soonest and help you go through the Gold Loan process.

- Dialabank provides services like compared and detailed information leading to the best Gold loan per gram for you.

Bank of Maharashtra Gold Loan EMI Calculator

(depends on the sum of the loan

Benefits of Bank of Maharashtra Agricultural Jewel Loan Scheme

- No processing fee is required for up to ₹ 25,000.

- 0.30% of the total loan amount, ₹ 300 down payment applies to amounts ranging from ₹ 25,000.

- 0.28% of total debt, subject to at least Rs.1500 applies to more than Rs.5 lakh yet less than Rs.1 crore.

Bank of Maharashtra Gold Loan Overdraft Scheme

Bank of Maharashtra offers an Overdraft Scheme. With this, the loan amount is provided as an overdraft facility. It functions as a Credit Card, where you can spend your Gold Loan Amount as per your wishes, anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Bank of Maharashtra Gold Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

FAQs About Bank of Maharashtra Gold Loan

✅ What is the Bank of Maharashtra Gold Loan?

Mahabank Gold Loan Scheme is a prominent loan product of the Bank of Maharashtra (BOM) to cater to your personal urgent financial needs. You can avail instant funds of up to ₹ five lakhs by submitting your Gold as security with the bank. The rate of interest for gold loans too is competitive and is at 7.0% per annum for a tenure of up to 12 months.

✅ How can I get Gold Loan from the Bank of Maharashtra?

Get a Gold Loan from the Bank of Maharashtra (BOM) by visiting the nearest branch with your Gold ornaments. Your Gold will undergo a valuation process and once verified the amount will be disbursed into your account within hours.

✅ How much Gold Loan can I get per gram in the Bank of Maharashtra?

Under the Maha Gold Loan Scheme of the Bank of Maharashtra (BOM), you can get a maximum of ₹ 3,800 to ₹ 4,350 per gram of 22-carat gold ornament or 75% of the market value of the net weight of the Gold ornaments excluding stones attached to ornaments/jewellery to be pledged, whichever is less.

✅ How does the Bank of Maharashtra Gold Loan work?

Taking Gold Loan from the Bank of Maharashtra (BOM) is a hassle-free and straightforward process and requires only 90 minutes for the disbursal of the loan. Just visit the branch with your Gold and documents to avail of a quick Gold Loan for all your urgent financial needs.

✅ What is the Gold Loan Interest Rate in the Bank of Maharashtra?

The rate of interest under the Gold Loan Scheme is at7.25% per annum and varies according to your loan amount and is floating in nature.

✅ How to check Gold Loan status in Bank of Maharashtra?

You can easily track your Gold Loan by contacting the bank branch either in person or through their customer care number.

✅ How to calculate Gold Loan Interest in the Bank of Maharashtra?

Dialabank’s EMI Calculator helps you to calculate the amount of interest to be charged from you for the loan you acquired. Providing the basic details like loan figures will lead you to get the exact interest amount that is to be charged against your loan.

✅ What is the maximum loan amount I can avail myself on a Gold Loan from the Bank of Maharashtra?

You can avail of a maximum of Rs 50 lakh when borrowing from the Bank of Maharashtra (BOM) against your Gold. The amount that you get is dependent on the quality and the weight of the jewellery to be pledged.

✅ What is the loan tenure of the Bank of Maharashtra Gold Loan?

You can avail of the Gold Loan from the Bank of Maharashtra (BOM) for a maximum period of 12 months and is the choice of the borrower completely to decide upon the tenure within 12 months.

✅ How much Processing Fee is applicable on the Bank of Maharashtra Gold Loan?

The processing fee charged by the bank on the gold loan is minimal and is usually just 1% of the principal loan amount or Rs.1000 whichever is higher amongst the two.

✅ What are the charges for renewal in the Bank of Maharashtra Gold Loan?

No charges for the renewal of the existing Gold Loan for another term. But yes, Valuation fees for the evaluation of your gold at the time of renewal might be charged.

✅ What are the charges for Prepayment in the Bank of Maharashtra Gold Loan?

Prepayment charges are Bank of Maharashtra (BOM) are minimal and are usually 15 of the amount to be prepaid which is also waived off in some cases.

✅ How to renew Bank of Maharashtra Gold Loan Online?

For the renewal of the Bank of Maharashtra (BOM) Gold Loan, the applicant has to visit the branch with all loan-related documents. There, the Gold will be revalued at the latest prices and new terms for the loan will be decided upon after which renewal will be done. In some cases, some renewal processing fees may also be charged.

✅ How to Pay Bank of Maharashtra Gold Loan Interest Online?

You can repay the Bank of Maharashtra (BOM) Gold Loan using various services and methods provided by the bank. For more information on this, you need to visit the nearest bank branch.

✅ What if I can’t pay the interest on the Bank of Maharashtra Gold Loan for 3 months?

The bank has the right to auction the gold ornaments provided by you for the loan in case of a Failed payment at the end of time. A Penal fess on the amount due can also be charged by the bank.

✅ How can I apply for the EMI Moratorium on the Bank of Maharashtra Gold Loan?

You can apply for the EMI Moratorium by visiting the nearest bank branch and checking your eligibility for this service as it is available only to a certain set of loans.

✅ How to pay Bank of Maharashtra Gold Loan through Credit Card?

Bank of Maharashtra (BOM) does not give you the option of repaying your Gold Loan through a Credit Card.

✅ What is the Overdraft Scheme for the Bank of Maharashtra Gold Loan?

Bank of Maharashtra does provide an Overdraft Scheme and the overall loan amount will have a Credit/Loan Limit. In the Bank of Maharashtra Gold Loan Overdraft facility, the bank charges interest only on the amount that you will withdraw/utilize.

✅ What is the Bank of Maharashtra Gold Loan closure procedure?

Once the loan is paid, the bank will close your gold loan immediately.

✅ What is the Bank of Maharashtra customer care number?

The customer care number for the Bank of Maharashtra is 9878981144.

✅ What is the Bank of Maharashtra Gold Loan Preclosure charges?

There are no preclosure charges for the gold loan provided by the Bank of Maharashtra.

✅ What is the maximum gold loan tenure?

The maximum gold loan tenure for the Bank of Maharashtra is up to 12 months.

✅ What is the minimum gold loan tenure?

The minimum gold loan tenure is 3 months.

✅ What is the foreclosure charge of the Bank of Maharashtra Bank gold loan?

Bank of Maharashtra charges an interested borrower up to .50% on the principal amount in case of a Gold Loan Foreclosure.