About Karnataka Bank Gold Loan

Karnataka Bank Limited is a private sector bank in Mangalore, Karnataka. It is a scheduled commercial bank. The bank was founded in 1924, as Karnataka Bank Limited. The bank deal with major financial products like loans, credit cards, saving schemes, investments, and many more.

Karnataka Bank offers a Gold Loan to meet the financial requirements of customers who require immediate cash against their gold assets. Primarily catering to borrowers from the middle and lower-income groups, Karnataka Bank loan offers instant credit for multiple purposes.

Karnataka Bank loan provides an effective solution to meet your temporary monetary contingencies. The funds from the Karnataka Bank Gold loan can be used to meet the expenses for weddings, education, business expansion, or any other similar purpose. The bank offers the loan with minimal documentation and secure storage. The Karnataka Bank loan is a simple funding option to meet your financial needs.

- Karnataka Bank Gold Loan Interest Rate is 7.25% per annum.

- Karnataka Bank Gold Loan Rate Per Gram is ₹ 3,800 to ₹ 4,350.

- Karnataka Bank Gold Loan Tenure is up to 12 months.

- Karnataka Bank Gold Loan processing fee is 1% + GST.

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Gold Loan Key Features – Apply Now

| Karnataka Bank Gold Loan Collateral | Gold ornaments |

| Karnataka Bank Gold Loan Interest Rate | 7.25% per annum |

| Karnataka Bank Gold Loan Rate Per Gram | ₹ 3,800 to ₹ 4,350 |

| Karnataka Bank Gold Loan Age of Borrower | 18 – 70 years |

| Karnataka Bank Gold Loan Maximum Loan Amount | Up to Rs. 25 lakhs |

| Karnataka Bank Gold Loan Maximum Loan to Gold Value Ratio | Up to 70% |

| Karnataka Bank Gold Loan purity of Eligible gold | 18 carat to 22-carat gold |

| Karnataka Bank Gold Loan Maximum Loan Tenure | Up to 12 months |

GOLD LOAN @ 0.75%*

APPLY NOW

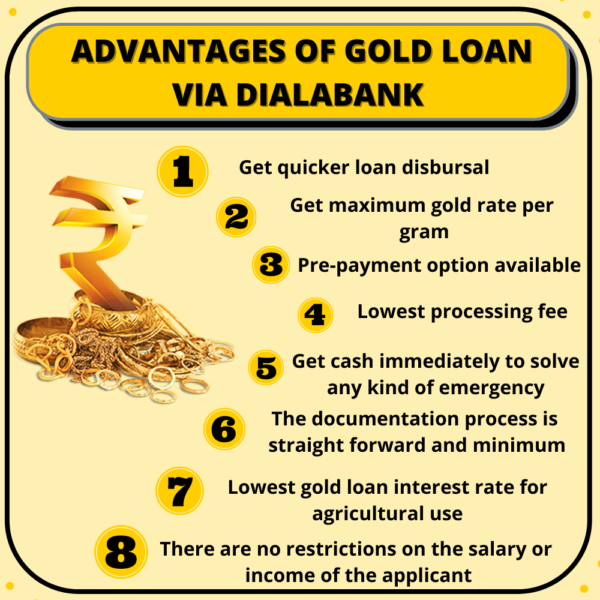

Advantages of Karnataka Bank Gold Loan

- Multipurpose – Karnataka Bank Gold loan can be used to fulfil any monetary need of the borrower. The funds receive can be used for personal expenditure such as a wedding, travel, etc. or for business expenses such as expansion, etc.

- Quick approval – Karnataka Bank Gold Loan can be availed easily without any hassle. The loan process involves minimal paperwork and requires basic documentation to get approval.

- High quantum – The loan amount is disbursed quickly and can be taken in cash or in any bank account. You get the option of choosing the denomination in case of the amount taken in cash.

- Competitive interest – Karnataka Bank Gold Loan is offered at a competitive rate of interest and a very low processing fee. The bank does not charge any documentation fee from the borrower.

- Prepayment – Karnataka Bank gives the borrowers the option of prepaying the Gold Loan without charging any additional charges. You just have to pay the due amount.

- Karnataka Bank gives funding of up to 70% of the total market price of your Gold keeping the remaining 30% as a security margin.

- Foreclosure: Bank charges a borrower up to .50% on the principal outstanding in case of a Gold Loan Foreclosure.

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Gold Loan Interest Rate

Karnataka Bank Gold Loan can fulfil all your urgent short term and long term monetary requirements. The rate of interest that you will be charged depends on the total loan amount as well as the quality/purity of the gold you are to keep as security with the bank. Gold Loan interest rates offered by the Karnataka Bank are lower in comparison to other loans because it is a fully secured loan.

| Karnataka Bank Gold Loan Interest Rate | 7.25% per annum |

| Repayment Scheme | Bullet Repayment Scheme, Overdraft Scheme |

| Minimum Gold | 10 grams |

| Service Charges | Under Rs 5 lakh- Rupees 500. Loans between Rs 5 and 10 lakh- Rupees 1,000. Loans exceeding Rs 10 lakh- 0.2% of Loan subject to a maximum of Rs 5,000. |

| Processing Fee | 1% + GST or ₹1000 whichever is higher |

| Prepayment Charges | Nil |

You may also be charged some gold valuation and documentation charges.

GOLD LOAN @ 0.75%*

APPLY NOW

Who can get a Karnataka Bank Gold Loan?

- Any salaried individual.

- Any self-employed.

- Housewives/homemakers.

- Students (age should be more than 18 years).

- A farmer.

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Gold Loan Eligibility

Gold Loan is a financial product provided by Karnataka Bank which caters to your needs of short term or long term funds. It is easy to avail of financial services provided by banks at low rates of interest and also requires minimal documentation for the same. Karnataka Bank gives you the Loan amount within an hour of application as the valuation and approval process is quickly done keeping in mind your urgency regarding the need for funds.

Major Eligibility criteria for availing of the Karnataka Bank Gold Loan is:

| Age | 18-70 years of age |

| Nationality | Indian |

| Employment Status | Salaried, Self-Employed |

| Gold Quality | Minimum 18 Carats |

| Requirements | Gold ornaments (18-22 carats) |

| CIBIL score | Above 500 |

A good Credit or CIBIL score is not required to apply for the Gold Loan as it is a fully secured financial service against your Gold as collateral security.

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Gold Loan At Home

Gold Loan at House is a doorstep loan service that allows you to borrow money from the convenience of your own home. The service is rapid, flexible, and cost-effective because interest rates are low. You can use the gold loan calculator to assess the value of your gold or the loan amount before completing a loan request. Obtaining a Gold Loan at home is an easy and quick process that can be done in a matter of minutes.

Within 30 minutes, one of our employees will contact you and arrive at your home. When all e-documentation and gold identification are completed at your residence, the appropriate gold loan amount will be sent directly to your bank account.

Furthermore, there are many benefits of Karnataka Bank Gold Loan at Home:

- Fast loan approval

- Lower interest rates

- Maximum value of gold

- Flexible repay tenures

- Easy payment options

- No additional charges

- 24*7 customer support

- Full security of the gold

- No hidden fees

- Service at your doorstep within 30 minutes

Karnataka Bank Gold Loan Documents Required

Gold Loan or Loan Against Gold is a loan product offered to the borrowers by the Karnataka Bank wherein funds are provided for fulfilling the financial needs of the applicant. The gold ornaments of the applicant are kept as security by the bank in exchange for the funds. The entire Karnataka Bank Gold Loan process is hassle-free and easy to get with minimal documentation. The bank ensures the high security of your gold ornaments till the Loan is closed.

Documents required for Applying for Karnataka Bank Gold Loan are :

A duly filled and signed Gold Loan application form shall be submitted along with the following documents:

| Photographs | 2 Passport-Sized photos, clear, without spectacles |

| Identity Proof | Aadhar Card, Passport, PAN Card, etc. (Only 1 is required) |

| Residence Proof | Aadhar Card, Driving License, Ration Card, etc. In the case of Rented House then the rent agreement or water/electricity bills for the last three months can be considered. (Only 1 is required) |

| Agricultural Land Proof | Required only if the Loan is taken for Agricultural Purpose |

**Any other documents as requested by the bank shall be duly submitted.**

GOLD LOAN @ 0.75%*

APPLY NOW

How Much Can I Get Through Karnataka Bank Gold Loan

Karnataka Bank Gold Loan Per Gram

Updated - Gold Loan Per Gram Rate w.e.f Apr 18 2024 |

||||

| Gold Weight | Gold Purity 24 Carat |

Gold Purity 22 Carat |

Gold Purity 20 Carat |

Gold Purity 18 Carat |

| 1 gram | 4621 | 4290 | 3900 | 3510 |

| 10 gram | 46210 | 42900 | 39000 | 35100 |

| 20 gram | 93600 | 85800 | 78000 | 70200 |

| 30 gram | 140400 | 128700 | 117000 | 105300 |

| 40 gram | 187200 | 171600 | 156000 | 140400 |

| 50 gram | 234000 | 214500 | 195000 | 175500 |

| 100 gram | 468000 | 429000 | 390000 | 351000 |

| 200 gram | 936000 | 858000 | 780000 | 702000 |

| 300 gram | 1404000 | 1287000 | 1170000 | 1053000 |

| 400 gram | 1872000 | 1716000 | 1560000 | 1404000 |

| 500 gram | 2340000 | 2145000 | 1950000 | 1755000 |

GOLD LOAN @ 0.75%*

APPLY NOW

Use of Karnataka Bank Gold Loan

Instead of keeping your gold idle in your bank lockers, you can use it to avail of a gold loan instead for many purposes such as:

- Funding your child’s education

- Down payment for a vehicle purchase

- Business expansion

- A vacation with your family

- Any situation where you need money urgently

- Funding your agricultural business

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Agricultural Jewel Loan Scheme

| Scheme | Karnataka Bank Agricultural Jewel Loan Scheme |

| Interest Rate | Starting from 7.25% per annum (depends on the sum of the loan |

| Least amount of Loan | Depends on the value of the jewel which is being kept as security |

| Loan period | Adjustment of advance sum inside 2 months from the date of reap of yields |

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits of Karnataka Bank Agricultural Jewel Loan Scheme

- No processing fee is required for up to ₹ 25,000.

- 0.30% of the total loan amount, ₹ 300 down payment applies to amounts ranging from ₹ 25,000.

- 0.28% of total debt, subject to at least Rs.1500 applies to more than Rs.5 lakh yet less than Rs.1 crore.

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Gold Loan Overdraft Scheme

Karnataka Bank offers an Overdraft Scheme. With this, the loan amount is provided as an overdraft facility. It functions as a Credit Card, where you can spend your Gold Loan Amount as per your wishes, anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Karnataka Bank Gold Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Gold Loan EMI Calculator

| Rate of Interest | 6 months | 1 Yr | 2 Yrs | 3 Yrs |

| 7.00% | 17008 | 8652 | 4477 | 3088 |

| 8.00% | 17058 | 8699 | 4523 | 3134 |

| 8.50% | 17082 | 8722 | 4546 | 3157 |

| 9.00% | 17107 | 8745 | 4568 | 3180 |

| 9.50% | 17131 | 8678 | 4591 | 3203 |

| 10.00% | 17156 | 8791 | 4614 | 3227 |

| 10.50% | 17181 | 8815 | 4637 | 3250 |

| 11.00% | 17205 | 8838 | 4661 | 3274 |

| 11.50% | 17230 | 8861 | 4684 | 3298 |

| 12.00% | 17254 | 8885 | 4707 | 3321 |

| 12.50% | 17279 | 8908 | 4731 | 3345 |

| 13.00% | 17304 | 8932 | 4754 | 3369 |

| 13.50% | 17329 | 8955 | 4778 | 3393 |

| 14.00% | 17354 | 8979 | 4801 | 3418 |

| 14.50% | 17378 | 9002 | 4825 | 3442 |

| 15.00% | 17403 | 9026 | 4845 | 3466 |

GOLD LOAN @ 0.75%*

APPLY NOW

Karnataka Bank Gold Loan Rate per Gram

The amount of Gold Loan that you get per gram of your gold is directly dependent on the purity of your gold and the current prevailing rates of that purity of Gold in the market. The rate of gold changes daily in the market and therefore, the Karnataka Bank Gold Loan per Gram rate also varies every day. The amount that you will receive for a gram of Gold varies depending on its purity and the market price for your Karnataka Bank Gold Loan.

*Keep in mind that gold biscuits and bars are not accepted. Only jewellery and in some cases gold coins are accepted by banks.*

**Keep in mind that only the weight of gold is considered and not the weight of stones on your jewellery.**

GOLD LOAN @ 0.75%*

APPLY NOW

Gold Loan Apply Online

You can also apply with Dialabank by following the below-mentioned steps to get a Gold Loan as per your need.

- Visit Dialabank over the network on Dialabank and fill the application form available on the web address.

- One of our Relationship Managers will get you in touch as the soonest and guide you.

- Enjoy free service of guidance and support till the approval of your loan with no hidden charges at all.

- Shake hands with Dialabank and know more about various options available in the market depending on their Rate of Interest and tenure of the Loan and select the best option for you.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs About Karnataka Bank Gold Loan

✅ What is Karnataka Bank Gold Loan?

Karnataka Bank Gold Loan is a loaning product whose purpose is to meet the immediate finance requirements for agricultural purposes, business & personal needs by the pledge of gold ornaments. You can avail of maximum funding of ₹25 lacs in 5 accounts of ₹5 lacs each for a tenure of up to 12 months. The bank provides quick disbursal with easy repayment and prepayment options.

✅ How Can I Get Gold Loan?

You can fill an inquiry form at Dialabank and compare offers from different banks and financial companies. In case you have any confusion, you may contact us on the number 9878981144.

✅How much Gold Loan Can I get per gram from Karnataka Bank?

The per gram rate varies according to the quality of the gold to be pledged. The better quality gold gets you more funding under your Karnataka Bank Gold Loan scheme. Karnataka Bank Gold Loan Rate Per Gram is ₹ 3,800 to ₹ 4,350.

✅ How Does Karnataka Bank Gold Loan work?

You can take a Gold Loan from Karnataka Bank if you are above the age of 18 years with possession of gold. Your gold will undergo a valuation process and upon verification, the amount will be disbursed to your bank account.

✅ What is the Gold Loan interest rate in Karnataka Bank?

Karnataka Bank Gold Loan Interest Rate is 7.25% per annum. The Gold Loan interest rates vary in accordance with these rates.

✅ How to check gold loan status in Karnataka Bank?

Check your Gold Loan status by contacting your loan officer. You can stay updated with your loan details anytime by contacting the customer care number of the bank or through the online portal.

✅ How to calculate gold loan interest in the Karnataka Bank?

To calculate the gold loan interest rate, calculate the difference between the amount and principal. The EMIs can be calculated through the given EMI calculator.

✅ What is the maximum gold loan amount I can avail of on a gold loan from Karnataka Bank?

Karnataka Bank allows you to avail of maximum funding of ₹25 lacs in 5 accounts of ₹5 lacs each. This amount depends on the value of the gold you gave to the bank as collateral.

✅ What is the loan tenure of the Karnataka Bank gold loan?

The loan tenure for a gold loan in the Karnataka Bank extends up to 12 months. However, you can also renew your Loan after a year for a total period of 10 years.

✅ How much processing fee is applicable to the Karnataka Bank Gold loan?

The processing fee applicable in Karnataka Bank is Rs. 1000 or 1% of the loan amount, whichever is higher. The bank also charges a merger service fee which varies from Rs. 500 to Rs. 5000, on the basis of your loan amount.

✅ What are the charges for pre-payment in the Karnataka Bank gold loan?

The prepayment fee for a gold loan in Karnataka Bank is nil. Prepayment makes loan repayment a lot more convenient.

✅ How to renew Karnataka Bank Gold Loan online?

The renewal process of a Gold Loan is fairly simple. You only have to visit the branch with all your loan-related documents and get your gold kept as security released and revalued at the current market prices. New terms for the Loan are decided and after reaching an agreement the Loan is renewed.

✅ How to pay Karnataka Bank Gold loan interest online?

Your Gold Loan with Karnataka Bank can be repaid in monthly EMIs that are automatically deducted from your bank account.

✅ What if I can’t pay the interest on the Karnataka Bank Gold loan for 3 months?

If someone defaults with repayment of the Gold Loan, the bank charges a penalty fee and has the right to even sell your gold to recover the money. This also ruins the defaulter’s credit history.

✅ How can I apply for the EMI moratorium on the Karnataka Bank Gold loan?

You can apply for a gold loan moratorium very easily with Karnataka Bank. All you have to do is give the bank your application details in person by visiting the bank or online on its app. The bank will only approve of a moratorium minimum of 5 days before the EMI due date.

✅ How to pay the Karnataka Bank Gold loan through a credit card?

This option isn’t available to customers. They can instead pay through debit cards. Options to repay through cash, cheques, demand drafts, PayTM, net banking are also available.

✅ What is the Overdraft Scheme for Karnataka Bank Gold Loan?

Karnataka Bank does provide an Overdraft Scheme and the overall loan amount will have a Credit/Loan Limit. In the Karnataka Bank Gold Loan Overdraft facility, the bank charges interest only on the amount that you will withdraw/utilize.

✅ What is the Karnataka Bank Gold Loan closure procedure?

Once the loan is paid, the bank will close your gold loan immediately.

✅ What is the Karnataka Bank customer care number?

The customer care number is 9878981144.

✅ What are Karnataka Bank Gold Loan Preclosure charges?

There are no preclosure charges.

✅ What is the maximum gold loan tenure?

The maximum gold loan tenure is up to 36 months.

✅ What is the minimum gold loan tenure?

The minimum gold loan tenure is 12 months.

✅ What is the foreclosure charge of the Karnataka Bank gold loan?

Karnataka Bank charges an interested borrower up to .50% on the principal amount in case of a Gold Loan Foreclosure.