Karur Vysya Bank Gold Loan Features – Apply Now

| Karur Vysya Bank Gold Loan Interest Rate | Starting 7.25% per annum |

| Karur Vysya Bank Gold Loan Rate Per Gram | Rate Per Gram Today is ₹ 4,621 |

| Karur Vysya Bank Gold Requirement | Minimum 18 Carat |

| Karur Vysya Bank Gold Loan Processing Fee | 1% of the Principal Loan Amount |

| Karur Vysya Bank Minimum Loan Amount | 90% LTV on Your Gold Market Price |

| Karur Vysya Bank Maximum Loan Amount | Up to Rs. 1 Crore (With Income Proof) |

| Karur Vysya Bank Prepayment Charges | 2%+GST (Within 3 Months), 0 (After 3 months) |

| Karur Vysya Bank Repayment Tenure | Up to 12 Months |

| Karur Vysya Bank Gold Loan Schemes | Bullet Payment Scheme, EMI Scheme |

Karur Vysya Bank issues a Gold Loan per gram rate of ₹ 2,506 to ₹ 4,621 in line with the current gold rate. The best Karur Vysya Bank Gold Loan Rate per gram is ₹ 4,621 for 22 Carat gold, measured at a maximum 75% loan to value, and the average gold price for the last one month for 22-carat is ₹ 4,621.

GOLD LOAN @ 0.75%*

APPLY NOW

Introduction to Karur Vyasa Bank Gold Loan

A Gold loan is one of the quickest and easiest ways of borrowing money and can be availed by any existing customer of the Karur Vyasa Bank as well as new borrowers. With Karur Vyasa Bank, you will not only be able to avail of the gold loan easily but it will also be at a competitive interest rate.

Karur Vysya Bank Gold Loan is one of the simplest ways to finance your needs. A jewellery loan is typically used for business and personal purposes such as working capital, office rental, wedding, medical emergency, farming, home repair, travel, education, etc. Swarnamitra in the form of overdrafts and other short-term loans for personal and non-agricultural purposes is one of Karur Vysya’s popular gold loan schemes. Non-residents can apply for a jewel loan at this bank as well.

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vyasa Bank Comparision With Other Banks

| Particulars | Karur Vyasa Bank | SBI | HDFC Bank |

| Interest Rate | 7.25% per annum | 7.25% per annum | 9.90% – 17.55% |

| Processing Fees | Up to 0.85% of the loan amount | 0.50% of the loan amount | 1.50% of the loan amount |

| Loan Tenure | 3 months to 60 months | 3 months to 36 months | 3 months to 24 months |

| Loan Amount | Up to Rs. 1 Crore | ₹ 20,000 to ₹ 20 Lakh | ₹ 25,000 to ₹ 50 Lakh |

| Foreclosure Charges | Up to 0.05% of the outstanding amount | Nil | Nil after 3 months |

| Repayment Options | Y | Y | Y |

| Lowest EMI Per Lakh | ₹ 2,801 to ₹ 3,424 | ₹ 3,111 per lakh | ₹ 4,610 per lakh |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vyasa Bank Gold Loan At Home

With the changing requirements of the times, Karur Vyasa Bank has devised a simple yet effective solution that will simplify your life. Just as you can get groceries, clothes, and other necessities delivered to your door, you can now acquire a gold loan from the comfort of your own home.

Karur Vyasa Bank Gold Loan At Home is a one-step option if you are in urgent need of finances, are too busy to visit a bank, or prefer social distancing. The procedure is simple to follow. To apply for a gold loan, you must first contact us by phone. Our executive from the nearest branch will pay you a visit as soon as possible.

Following are some of the benefits of Karur Vyasa Bank Gold Loan At Home:

- Faster processing

- Attractive interest rates

- Maximum value of gold

- Flexible repay tenures

- Easy payment options

- No additional charges

- 24*7 customer support

- Full security of the gold

- No hidden fees

- Service at your doorstep within 30 minutes

Tips To Get Gold Loan From Karur Vyasa Bank Fast

- Karur Vyasa perceives both hallmarked and non-hallmarked embellishments for getting a gold turn of events. In any case, you can get the most raised gold credit per gram for brand name designs, as it lessens the odds of under-valuation by the valuer. In, several banks charge lower arranging costs on hallmarked gold jewels.

- Karur Vyasa changes the cost of 22-carat gold for the flawlessness of gold. In this manner, dependably attempt to get against higher nobility enrichments as it will present to you the most raised aggregate for the gold turn of events.

- Karur Vyasa will enlist the net pile of pearls to find the extent of advance against the gold you can get. Continually, attempt to pick embellishments that have the least pearls and stones. A gigantic piece of the banks will decrease the generosity of pearls and stones from an all-out store of embellishments. Karur Vyasa Bank will depend upon the report of his gold valuer to calculate the net weight.

- Higher the generosity of pearls and stones in improvements, cut down the net weight and appraisal of jewels which accomplishes the lower extent of jewel advance you can get Further, Karur Vyasa won’t perceive diamond gems if the gold utilized is under 18-carat impeccability. By a long shot the vast majority of the significant stone beautifications are made in 16 carats to 18-carat gold and subsequently, will accomplish low gold advancement per gram.

- Steadily attempt to get the best LTV on the appraisal of gold. Karur Vyasa is permitted by RBI to charge a most unbelievable LTV of up to 75% to deal with the extent of gold credit you are prepared for.

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank Gold Loan Details

| Loan amount |

|

| Tenure of Repayment | Tenure of Repayment The overdraft facility is available for 12 months. You can get it renewed. However, it shall be possible only at the discretion of the banking authority. |

| Swarnamitra Interest Rate |

|

| Collateral | You have to pledge gold jewellery. The asset must be at least 22 Carats. |

| Guarantee Requirement | NA or optional |

| Processing Fee | 0.50% of the loan amount including the appraisal fee |

- The interest rate on a personal loan from Karur Vysya Bank starts at 12.00 per cent.

- The lowest EMI per lakh on a Personal Loan from Karur Vysya Bank is 3,321 at a low interest rate of 12.00 per cent and a loan term of 36 months.

- Both salaried and self-employed professionals are eligible for a loan.

- Borrowers between the ages of 25 and 60 years.

- A loan of at least 50,000 and up to ten lakh rupees is required.

- Loan terms range from 12 to 36 months.

- Fees for loan processing is 0.40%.

- Foreclosure charges: Prepayment of a Karur Vysya Bank personal loan is not permitted.

- Part-payment fees are not permitted.

- Other Fees: Some additional penalties and charges include – Late EMI payment fees, EMI bounce fees, and loan cancellation fees, which the bank discloses when you sign the loan agreement.

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits Of Karur Vysya Bank Gold Loan

- Loan Amount: A maximum amount of Rs.10,00,000 can be availed.

- EMI options: Hassle-free payment of EMIs.

- Instant liquidity: Enjoy liquidity of cash at any time. Generate instant cash in time of an urgent need.

- Security: The customer is assured that his/her gold is kept safe inside the bank vault.

- Interest Rates: Individuals can get the advantage of lower interest rates for this loan.

- A person can also apply for Gold Finance on Agricultural Land in their name and get a discount of 1% on the interest rate charged.

- Foreclosure – Karur Vysya Bank energizes a borrower to .50% on the key exceptional if there should be an occurrence of a Gold Loan Foreclosure.

GOLD LOAN @ 0.75%*

APPLY NOW

How Much Loans Can I Get From Karur Vyasa Bank Gold Loan?

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank Gold Loan Per Gram

According to the latest prices of gold prices, KVB offers a gold loan per gram today of ₹ 3,800 to ₹ 4,350. The highest KVB gold loan rate per gram now is ₹ 3,800 to ₹ 4,350 for 22-carat jewellery calculated at a maximum LTV of 75% and average gold loan rates of the last 30 days in 2021 are ₹ 3,800 to ₹ 4,350 of 22 carats.

GOLD LOAN @ 0.75%*

APPLY NOW

KVB Gold Loan Rate Per Gram – Updated Apr 18 2024

Updated - Gold Loan Per Gram Rate w.e.f Apr 18 2024 |

||||

| Gold Weight | Gold Purity 24 Carat |

Gold Purity 22 Carat |

Gold Purity 20 Carat |

Gold Purity 18 Carat |

| 1 gram | 4621 | 4290 | 3900 | 3510 |

| 10 gram | 46210 | 42900 | 39000 | 35100 |

| 20 gram | 93600 | 85800 | 78000 | 70200 |

| 30 gram | 140400 | 128700 | 117000 | 105300 |

| 40 gram | 187200 | 171600 | 156000 | 140400 |

| 50 gram | 234000 | 214500 | 195000 | 175500 |

| 100 gram | 468000 | 429000 | 390000 | 351000 |

| 200 gram | 936000 | 858000 | 780000 | 702000 |

| 300 gram | 1404000 | 1287000 | 1170000 | 1053000 |

| 400 gram | 1872000 | 1716000 | 1560000 | 1404000 |

| 500 gram | 2340000 | 2145000 | 1950000 | 1755000 |

GOLD LOAN @ 0.75%*

APPLY NOW

About Karur Vysya Bank Gold Loan

Karur Vysya Bank began its operations in 1916 Karur. The bank provides many financial services and products to retail and institutional consumers. These include loans for personal needs. Many people need instant finance for certain expenses, and a Gold Loan is the best suited for such short term needs. It provides instant loans against gold. Gold Loan is taken to overcome the short term requirements of a person.

Karur Vysya has its gold loan scheme named Swarna Mitra which has many features.

Gold is one of the most precious and costly metals in India. Its value in our lives cannot be ignored because every person is attached to it emotionally. However, what is the point of keeping your gold in a closed drawer when it can help you in times of an emergency? Taking a Loan Against Gold can help you overcome any drastic situation. Gold Loan is the best way to get cash in a short span. Karur Vysya Bank Gold Loan Details can be found online.

GOLD LOAN @ 0.75%*

APPLY NOW

- KVB Gold Loan Interest Rate is 7.25% per annum

- KVB Gold Loan Per Gram Rate Today is ₹ 3,800 to ₹ 4,350

- KVB Gold Loan Tenure: Up to 24 months

- KVB Gold Loan Processing Fee is Up to 1% of the Loan Amount + GST

Karur Vysya Bank (KVB) Gold Loan Eligibility

Karur Vysya Bank Gold Loan is a fiscal scheme released by the bank to cater to your needs of short and long term funds. It is simple to avail of commercial service provided by Karur Vysya at low interest and also requires minimal documentation for the same. Karur Vysya Bank gives you the Loan amount within an hour of application as the valuation and approval process is quickly done, keeping in mind your urgency regarding the need for funds.

Primary Eligibility criteria for availing of the Karur Vysya Bank Gold Loan is:

| Age | 18-75 years |

| Requirements | Gold ornaments (18-22 carats) |

| CIBIL score | Above 500 |

| Nationality | Indian |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank (KVB) Gold Loan Documents Required

Gold Loan or Loan Against Gold is a loan product offered to the borrowers by the Karur Vysya Bank wherein funds are provided for fulfilling the financial needs of the applicant. The gold ornaments of the applicant are kept as security by the bank in exchange for the funds. The entire Karur Vysya Bank Gold Loan process is hassle-free and easy to get with minimal documentation. The bank ensures high protection of your gold ornaments till the loan is closed.

GOLD LOAN @ 0.75%*

APPLY NOW

Documents Required For Applying For Karur Vysya Bank Gold Loan Are :

| Identity Proof | Aadhar Card/Pan Card/ Passport/ Voter ID (Anyone) |

| Residence Proof | Aadhar Card /Pan Card/ Ration Card/ Utility Bills on the name of the applicant/ Rental Agreement of applicant/ Voter ID card (Anyone) |

| Agriculture Proof ( if applicable) | Agriculture Land Ownership Proof |

| Photographs | 2 Passport sized coloured |

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank (KVB) Gold Loan Interest Rates, Fees & Charges

Karur Vysya Bank Gold Loan can fulfil all your urgent short term and long term monetary requirements. The rate of interest that you will be charged depends on the total loan amount as well as the quality/purity of the gold you are to keep as security with the bank. Gold Loan interest rates offered by the Karur Vysya Bank are lower in comparison to other loans because it is a fully secured loan.

The Gold Loan interest rates in the bank start at 7.0% per annum.

| Swarnamitra | 7.25% per annum Interest Rate per annum |

| Primary security | Pledge of Gold Jewellery with Minimum purity of 22 Carats and Gold Ingots sold by banks. |

| Collateral security | Nil (Optional) |

| Guarantee | Nil (Optional) |

| Processing charges | 0.50 Per Loan of Rs.100.00 (inclusive of Appraisal charges) |

| Minimum Loan Amount | Rs.1.00 Lakhs |

| Repayment Tenor | 12 Months (Overdraft Facility). The Limit can be renewed for a further period of 12 months, subject to the discretion of sanctioning authority. |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank (KVB) Gold Loan Schemes

| S.No | Jewel Loan Products | Per Gram Rate (Rs.) | Rate Of Interest (%) With Effect From 24.02.2016 | Maximum Limit |

| JEWEL LOAN (AGRI) | ||||

| 1 | JEWEL LOAN (AGRI)-12 MONTH | 1950 | 10.4 | Any amount |

| (Long term) | (Base rate) | (Based on extend of land and cultivation) | ||

| 2 | KVB QUICK JEWEL LOAN (AGRI)-6 MONTH | 2000 | 10.4 | Rs.25 lacs |

| (Short term) | (Base rate) | |||

| JEWEL LOAN – OTHERS (NON-AGRI) | ||||

| 3 | JEWEL LOAN (OTHERS)-12 MONTH | 1625 | 12 | Rs.40 lacs |

| (Base rate+1.60) | ||||

| 3 | JEWEL LOAN (TRADE)-12 MONTH | 1625 | 11.75 | Rs.40 lacs |

| (Base rate+1.35) | ||||

| 4 | KVB QUICK JEWEL LOAN (TRADE) – 6 MONTH | 1725 | 12.15 | Rs.25 lacs |

| (Base rate+1.75) | ||||

| 5 | KVB QUICK JEWEL LOAN (PERSONAL) – 6 MONTH | 1725 | 12.15 | Rs.25 lacs |

| (Base rate+1.75) | ||||

| 6 | KVB-SWARNA MITHRA SCHEME | 1900 | 12 | Rs.75 lacs |

| OVERDRAFT (OD) PRODUCT | (Base rate+1.60) | |||

GOLD LOAN @ 0.75%*

APPLY NOW

KVB Gold Loan Apply Online

You can also apply with Dialabank by following the below-mentioned steps to get a Gold Loan as per your need.

- Minister Dialabank’s digital platform, where you will have only to fill a form without any registration.

- Our Contact Director will talk to you and help you during the Gold Loan rule and lead you to fulfil your business necessities.

- You will get personalized help, giving you a choice to compare and choose the most desirable deal according to your demands without any extra charges.

- With Dialabank, you can connect the various offers and schemes from multiple banks based on the funding given and the rate of interest charged for choosing the most suitable loan deal for yourself.

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank Gold Loan EMI Calculator

| Rate | 6 months | 1 Yr | 2 Yrs | 3 Yrs |

| 7.00% | 17008 | 8652 | 4477 | 3088 |

| 8.00% | 17058 | 8699 | 4523 | 3134 |

| 8.50% | 17082 | 8722 | 4546 | 3157 |

| 9.00% | 17107 | 8745 | 4568 | 3180 |

| 9.50% | 17131 | 8678 | 4591 | 3203 |

| 10.00% | 17156 | 8791 | 4614 | 3227 |

| 10.50% | 17181 | 8815 | 4637 | 3250 |

| 11.00% | 17205 | 8838 | 4661 | 3274 |

| 11.50% | 17230 | 8861 | 4684 | 3298 |

| 12.00% | 17254 | 8885 | 4707 | 3321 |

| 12.50% | 17279 | 8908 | 4731 | 3345 |

| 13.00% | 17304 | 8932 | 4754 | 3369 |

| 13.50% | 17329 | 8955 | 4778 | 3393 |

| 14.00% | 17354 | 8979 | 4801 | 3418 |

| 14.50% | 17378 | 9002 | 4825 | 3442 |

| 15.00% | 17403 | 9026 | 4845 | 3466 |

- These are some of the factors that influence the gold loan EMI for a Karur Vysya Bank Gold Loan:

- Loan Amount: The amount of the loan affects the interest rate. Sometimes, banks are willing to apply a higher loan amount at a lower rate and vice versa.

- Relation with the Bank: You can receive discounted interest rates on jewel loans when you share a good relationship with the Bank and are an existing customer.

- Tenure of the loan: The tenure of the loan affects the payment of interest on loans. Shorten the term, increase the EMI but reduce the amount of interest to be paid. The greater the term, the lower the EMI burden, but the higher the interest payments.

- Gold Weight and Purity: The greater the purity and weight of gold, the greater the loan amount and the lower the interest rate, and vice versa. For example, you may receive a lower rate on 22-carat gold than on 18-carat gold.

- Repayment Capacity: If you have decent repayment potential, the interest rate is negotiable, and you may be able to get the best rate offer.

GOLD LOAN @ 0.75%*

APPLY NOW

How To Pay Your Karur Vysya Bank Gold Loan EMI?

Your Karur Vysya Bank gold advance can be reimbursed in the following three different ways.

- Standing Instruction (SI): If a person is a current account owner with Karur Vysya Bank, Standing Instruction is the most reliable mode of repayment. Your EMI amount will be charged automatically toward the finish of the month to month cycle from the Karur Vysya Bank account you indicate.

- Electronic Clearing Service (ECS): This method can be employed if you have a non-Karur Vysya Bank account and might need your EMIs to be required consequently near the finish of the month to month cycle from this account.

- Post-Dated Checks (PDC): A person can present post-dated EMI checks from a non-Karur Vysya Bank account at your closest Karur Vysya Bank Loan Center. A new version of PDCs should be given on time. It will be comprehensive if you see Post Dated Checks will be collected in non-ECS areas as it were.

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank (KVB) Gold Loan Contact Number

For any assistance regarding a gold loan in Karur Vysya Bank, you can contact on the number 9878981144.

GOLD LOAN @ 0.75%*

APPLY NOW

What type of Gold can be used to secure a Karur Vysya Bank Gold Loan?

- The Karur Vysya bank accepts only Gold jewellery of 18 carats to 22 carats.

- Minted gold coins are not accepted.

- The applicant should pledge at least 10 grams of gold to get a gold loan.

- Digital gold is also accepted in case you are applying for an online Gold Loan.

GOLD LOAN @ 0.75%*

APPLY NOW

Use Of Karur Vysya Bank (KVB) Gold Loan

The funds acquired by availing the Karur Vysya Bank Gold Loan service can be used for several purposes such as:

- To bankroll any special payments such as a trip, wedding, payment of higher education fees, etc.

- For all your market needs, such as the expansion of business, buying raw material, etc.

- You can also avail of a Gold Loan for farming ideas. The bank advances more moderate rates of interest for Gold Loans that are used for agriculture or related activities.

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank Agricultural Jewel Loan Scheme

| Scheme | Agricultural Jewel Loan Scheme |

| Interest Rate | Starting at 7.25% per annum |

| Least amount of Loan | Depends on the value of the jewel |

| Loan period | Adjustment of advance sum inside 2 months from the date of reap of yields |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits Of Karur Vysya Bank Agricultural Jewel Loan Scheme

- No preparing expense is appropriate up to ₹ 25,000

- 0.30% of the credit sum, Minimum of ₹ 300 charge is material to the sum going from above ₹ 25,000 – not exactly ₹ 5 lakh

- 0.28% of the credit aggregate, subject to at any rate Rs.1,500 is pertinent to the sum more than Rs.5 lakh anyway under Rs.1 crore

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank Gold Loan Overdraft Scheme

Karur Vysya Bank Offers an Overdraft Scheme. With this, you are given an advance sum as an overdraft office. It works like a Credit Card, where you can spend your Gold Loan Amount as you need whenever anyplace. The general advance sum will have a Credit/Loan Limit. In the Karur Vysya Bank Gold Loan Overdraft office, the bank charges revenue just on the sum you pull out/use.

GOLD LOAN @ 0.75%*

APPLY NOW

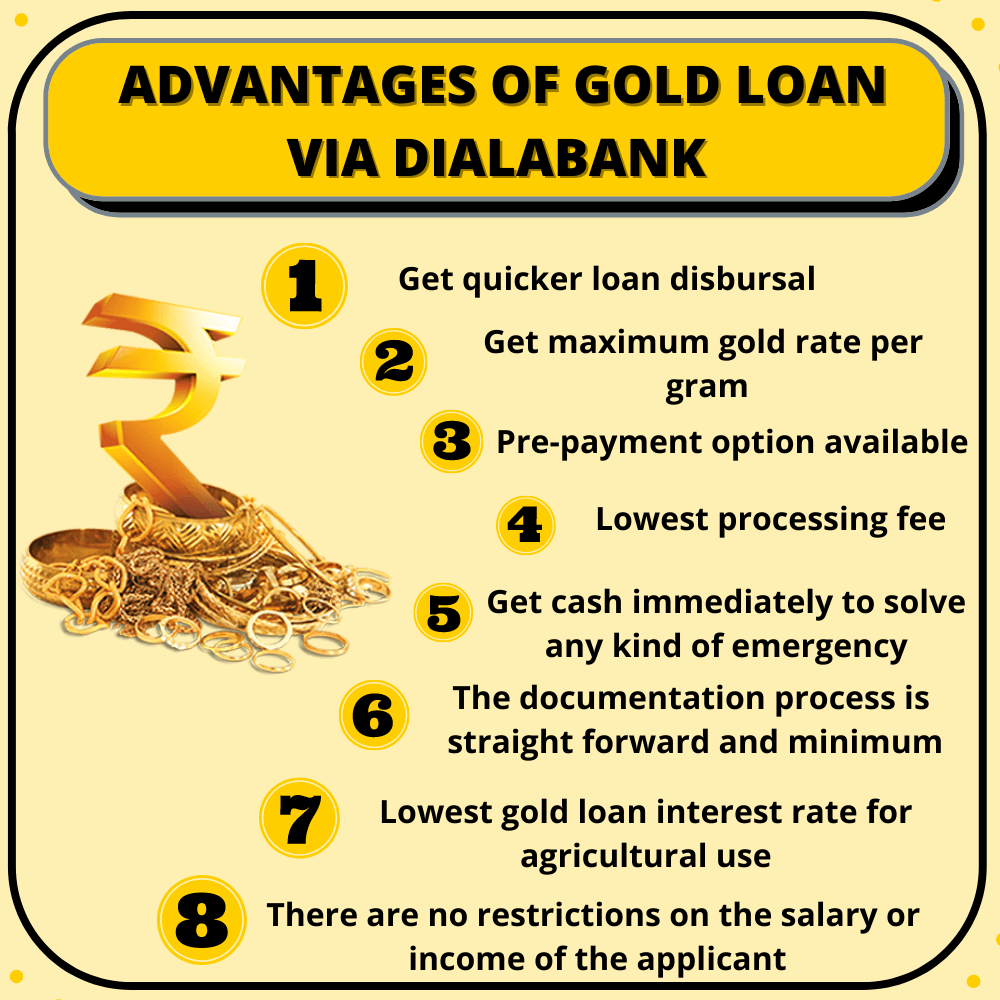

Applying through Dialabank’s website

- Possibility of obtaining the highest gold rate per gram.

- Take advantage of special features such as loan prepayment, easy and quick disbursement, low processing fees, etc.

- In an emergency, you can get the money you need within hours.

- Documentation is required in a simple and straightforward manner.

- There are no restraints on the nature of the job or proof of earnings.

- On-call assistance is available 24 hours a day, seven days a week.

- Interest rates on agricultural jewel loans are the lowest.

GOLD LOAN @ 0.75%*

APPLY NOW

Karur Vysya Bank Gold Loan Highlights

| Age | 18 – 70 years |

| Minimum Loan Amount | Rs. 1000 |

| Maximum Loan Amount | Rs. 1 Crore |

| Karur Vyasa Bank Gold Loan Interest Rate | 7.25% per annum onwards |

| Loan Tenure | From 3 months to 60 months |

| Gold Items accepted | Jewelry and gold coins sold by banks |

| Karur Vyasa Bank Gold Loan Processing Charges | 0.85% of the loan amount |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

How Does Karur Vysya Bank Work, Here’s An Example

The suitability of the loan is determined based on the purity of gold, LTV, and weight of gold. Suppose Mr A and his two friends Mr B and Mr C have different gold values for different purity. Mr A has 50 grams of gold per 22-carat purity. Mr B has 60 grams of gold in 20 carats of purity and Mr C has 70 grams of gold in purity or 22 carats. They approached the Vijaya Bank to get a gold loan. The price used to calculate the suitability of their gold loan according to the high 85% LTV will vary with the purity of the gold and therefore, will lead to the validity of the gold loan.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs About Karur Vysya Bank Gold Loan

✅ What is Karur Vysya Bank Gold Loan?

Gold Loan by Karur Vysya Bank is an easy to avail financial service for the fulfilment of your business needs at attractive rates of interest and a maximum tenure of 12 months. The bank requires minimal documentation and has convenient modes of repayment.

✅ How to get a Gold Loan?

You can take a Gold Loan in quick and easy steps:

- Visit Dialabank and submit a duly filled application form along with your documents.

- You will be contacted by Dialabank’s Relationship Manager to assist you further.

- We will suggest to you the best deals and offers on gold loans.

- Submit your gold to the assigned bank and get your money in your bank account within an hour.

✅ How much is the Karur Vysya Bank Gold Loan rate per gram?

You can get your Karur Vysya Gold Loan per gram of your gold starting from ₹ 3,800 to ₹ 4,350 depending on the quality of the gold.

✅ How does Karur Vysya Bank Gold Loan work?

The Karur Vysya Bank Gold loan is a secure credit availing service available for those who have urgent cash requirements and can pledge gold ornaments as collateral security. Once the gold pledged with the bank is valued, the bank processes the loan amount in your indicated account immediately. Various repayment options are available for repaying the loan.

✅ What is the Karur Vysya Bank Gold loan interest rate?

The rate of interest for Karur Vysya Bank Gold Loan starts at 7.25% per annum. These rates depend on the amount of Gold Loan sanctioned and the purpose of use.

✅ How to check Karur Vysya Bank Gold Loan status?

You can quickly check the status of your Gold Loan by visiting your loan branch and asking your banker in person. You can also contact the customer care number of the bank to stay updated with all your loan details.

✅ How to calculate Gold Loan Interest in Karur Vysya Bank?

You can easily calculate the gold loan interest rate in Karur Vysya Bank by subtracting the principal amount from the total sum to be paid.

✅ What is the maximum loan amount I can avail myself of on Gold Loan from Karur Vysya Bank?

You can get a maximum amount of Rs 1 crore on a Karur Vysya Bank Gold Loan as the bank offers around 75% of the gold ornaments’ market value.

✅ What is the loan tenure of Karur Vysya Bank Gold Loan?

The maximum tenure of your Karur Vysya Bank Gold Loan is up to 36 months. However, kindly renew your loan plan after a year.

✅ How much Processing Fee is applicable on Karur Vysya Bank Gold Loan?

A processing fee of 1% of the loan amount is charged.

✅ How to renew Karur Vysya Bank Gold Loan?

Once you reach the end of your Gold Loan tenure, you can renew it by visiting your loan branch and submitting a renewal form. For more information, you can contact your loan officer.

✅ How to renew Karur Vysya Bank Gold Loan online?

You can renew your Gold Loan with Karur Vysya Bank by applying for renewal with your loan branch. Your gold will be released and valued again at the latest market prices, and upon agreement of terms, your loan will be renewed.

✅ What are the charges for renewal in Karur Vysya Bank Gold Loan?

Bank charges approximately Rs. 250- Rs. 500 for renewal of the gold loan.

✅ What are the charges for Pre-payment in Karur Vysya Bank Gold Loan?

Karur Vysya Bank charges 1% for the pre-payment of the gold loan.

✅ How to pay Karur Vysya Bank Gold Loan Interest online?

You can pay for your Karur Vysya Bank Gold Loan online through the net-banking facility of the bank. You can also give a Standing Instruction or use ECS to pay your EMIs directly from your bank.

✅ What if I cannot pay the interest on Karur Vysya Bank Gold Loan for three months?

If someone defaults on the payments of Karur Vysya Bank Gold Loan interest for three months, a penalty fee is charged on the total amount due, and in case of repeated defaults, the bank will have the authority to auction your gold ornaments to recover the amount publicly.

✅ How can I apply for EMI Moratorium on Karur Vysya Bank Gold Loan?

You can apply for the Karur Vysya Bank Gold loan moratorium online by logging in with your credentials or by personally visiting the main branch. The moratorium request has to be submitted at least five working days before the due date of your EMI.

✅ How to pay Karur Vysya Bank Gold loan through a credit card?

As per RBI Guidelines, the Karur Vysya Bank Gold loan cannot be repaid via credit cards. Other payment modes such as net banking, debit cards, cheques, DDs can be used for loan repayment.

✅ What is an overdraft scheme on Karur Vysya Bank Gold Loan?

Karur Vysya Bank Offers an Overdraft Scheme. In the Karur Vysya Bank Gold Loan Overdraft office, the bank charges revenue just on the sum you pull out/use.

✅ What is Karur Vysya Bank Gold Loan foreclosure charges?

Karur Vysya Bank energizes a borrower to .50% on the key extraordinary if there should arise an occurrence of a Gold Loan Foreclosure.

✅ What is the Karur Vysya Bank Gold Loan customer care number?

Call 9878981144 for any query.

✅ What is the Karur Vyasa Bank Gold Loan closure procedure?

The Gold loan period will end after the payment is done in full.

✅ What are Karur Vyasa Bank Gold Loan Preclosure charges?

The Bank preclosure charges are 1%+GST on the principal amount

✅ What is the maximum gold loan tenure?

The maximum gold loan tenure is 12 months.

✅ What is the minimum gold loan tenure?

The minimum gold loan tenure is 6 months.

Other Major Gold Loan Providers