Syndicate Bank Gold Loan Key Features – Apply Now

| Syndicate Gold Loan Interest Rate | 7.25% per annum |

| Syndicate Gold Loan Rate Per Gram | ₹ 3,800 to ₹ 4,350 |

| Syndicate Gold Processing Fee | 1% or ₹1000 whichever is higher |

| Syndicate Gold Loan Amount | Up to Rs. 1 Crore (With Income Proof) |

| Syndicate Gold Prepayment Charges | 0-1% |

| Syndicate Gold Repayment Tenure | Up to 36 months |

| Syndicate Gold Repayment Scheme | Bullet Payment Scheme, Overdraft Scheme |

Syndicate Bank issues a Gold Loan per gram rate of ₹ 3,800 to ₹ 4,350 in line with the current gold rate. The best Syndicate Bank Gold Loan Rate per gram is ₹ 3,800 to ₹ 4,350 for 22 Carat gold, measured at a maximum 75% loan to value, and the average gold price for the last one month for 22-carat is ₹ 3,800 to ₹ 4,350.

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Explanation

Syndicate Bank Gold Loan can be fundamental to meet a critical requirement for money by vowing your gold redesigns or gold coins as assurance. Gold improvement is likely the speediest kind of getting and can be benefitted by existing clients of Syndicate Bank notwithstanding new borrowers. With Syndicate Bank, you won’t just profit by the gold credit sufficiently yet close at a veritable development cost. Here is all you require to consider Syndicate Bank gold improvement financing cost, residency, steadfast, and different terms and conditions.

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Comparison With Other Banks

| Particulars | Syndicate Bank | SBI | HDFC Bank |

| Interest Rate | 7.25% per annum | 7.25% per annum | 9.90% – 17.55% |

| Processing Fees | 1% or ₹1000 whichever is higher | 0.50% of the loan amount, minimum Rs. 500 | 1.50% of the loan amount |

| Loan Tenure | 3 months to 36 months | 3 months to 36 months | 3 months to 24 months |

| Loan Amount | ₹ 25,000 to ₹ 25 Lakh | ₹ 20,000 to ₹ 20 Lakh | ₹ 25,000 to ₹ 50 Lakh |

| Foreclosure Charges | Up to 0.50% of the principal amount | Nil | Nil after 3 months |

| Repayment Options | Y | Y | Y |

| Lowest EMI Per Lakh | ₹ 8,734 per lakh | ₹ 3,111 per lakh | ₹ 4,610 per lakh |

GOLD LOAN @ 0.75%*

APPLY NOW

Tips To Get Gold Loan From Syndicate Bank Fast

- Syndicate Bank sees both hallmarked and non-hallmarked beautifications for getting a gold new turn of events. In any case, you can get the most raised gold credit per gram for brand name embellishments, as it decreases the odds of under-valuation by the valuer. Two or three banks charge lower preparing costs on hallmarked gold pearls.

- Syndicate Bank changes the cost of 22-carat gold for the perfection of gold. Accordingly, constantly attempt to get against higher sensibility embellishments as it will present to you the most raised outright for the gold new development.

- Syndicate Bank will manage the net load of jewels to find the level of advance against the gold you can get. Firmly, try to pick embellishments that have the least pearls and stones. An enormous piece of the banks will diminish the significance of pearls and stones from an all-out pile of embellishments. Syndicate Bank will depend on the report of his gold valuer to learn the net weight.

- Higher the significance of pearls and stones in redesigns cut down the net weight and evaluation of diamonds which accomplishes the lower level of gem advance you can get Further, Syndicate Bank won’t see valuable stone important stones if the gold utilized is under 18-carat flawlessness. By a wide edge a large portion of the critical stone updates are made in 16 carats to 18-carat gold and from this time forward, will accomplish low gold movement per gram.

- Incessantly attempt to get the best LTV on the evaluation of gold. Syndicate Bank is permitted by RBI to charge a most bewildering LTV of up to 85% to manage the level of gold credit you are prepared for.

GOLD LOAN @ 0.75%*

APPLY NOW

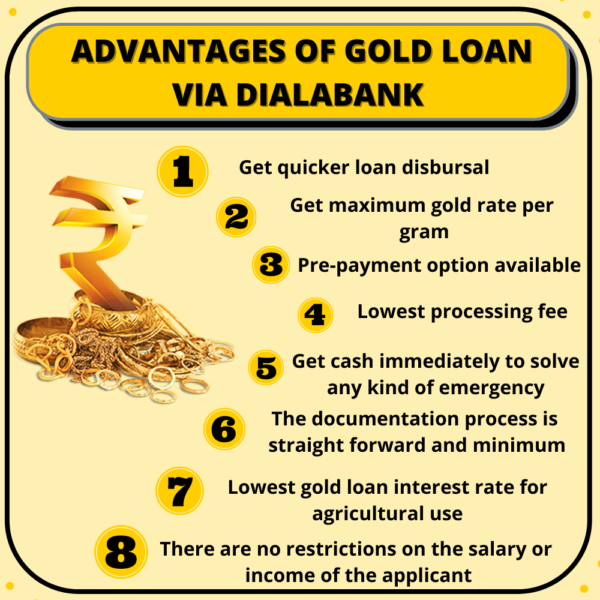

Advantages Of Syndicate Bank Gold Loan Scheme

- Syndicate Bank Gold Loan is very easy to apply. One can apply for the gold loan online within a few minutes through Dialabank.

- If a borrower is eligible, Syndicate Bank Gold Loan can be approved within 5 minutes.

- After the approval of a gold loan, the loan amount is disbursed quickly if the borrower has all the documents that are required.

- Responsibility of your Gold is entire of the bank. Borrower’s gold assets will be kept under very tight and fireproof security.

- The Gold Loan Interest Rates provided by the bank are quite affordable.

- The documentation process is very easy and straightforward.

- Bank will not ask the reason behind the gold loan. One can use the Syndicate Bank Gold Loan amount according to their needs.

- The bank charges a borrower up to .50% on the principal outstanding in case of a Gold Loan Foreclosure.

GOLD LOAN @ 0.75%*

APPLY NOW

How Much Gold Loan Can I Get Through Syndicate Bank Gold Loan?

The loan is granted against the security of gold ornaments or jewels at the rate of ₹ 3,800 to ₹ 4,350 per gram of 22 Karat Gold or 90% of the net market value of your gold, whichever is lower.

Syndicate Bank Gold Loan Rate Per Gram Today – Apr 19 2024

Updated - Gold Loan Per Gram Rate w.e.f Apr 19 2024

Gold Weight

Gold Purity

24 CaratGold Purity

22 CaratGold Purity

20 CaratGold Purity

18 Carat

1 gram

4621

4290

3900

3510

10 gram

46210

42900

39000

35100

20 gram

93600

85800

78000

70200

30 gram

140400

128700

117000

105300

40 gram

187200

171600

156000

140400

50 gram

234000

214500

195000

175500

100 gram

468000

429000

390000

351000

200 gram

936000

858000

780000

702000

300 gram

1404000

1287000

1170000

1053000

400 gram

1872000

1716000

1560000

1404000

500 gram

2340000

2145000

1950000

1755000

GOLD LOAN @ 0.75%*

APPLY NOW

About Syndicate Bank Gold Loan

Syndicate Bank offers loan against gold at very low-interest rates. They are one of the major Gold Loan providers who understand the need of the customers and disburse the loan amount in one hour. The Syndicate Bank Gold Loan rate today and all other charges are transparently announced to borrower upfront before sanctioning the loan amount. Also, The pledged gold is locked safely in the vault and the borrower does not have to worry about its safety.

- Syndicate Gold Loan Interest Rate is 7.25% per annum

- Syndicate Gold Loan Per Gram Rate is ₹ 3,800 to ₹ 4,350

- Syndicate Gold Loan Tenure: Up to 36 months

- Syndicate Gold Loan Processing Fee is Up to 1% of the Loan Amount + GST

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Eligibility Criteria

Gold Loan is a financial product provided by the Syndicate bank which caters to your needs of short term or long term funds. It is easy to avail financial service provided by banks at low rates of interest and also requires minimal documentation for the same. Syndicate bank gives you the Loan amount within an hour of application as the valuation and approval process is quickly done, keeping in mind your urgency regarding the need for funds.

Major Eligibility criteria for availing the Syndicate bank Gold Loan is:

| Age | 18-70 years of age |

| Nationality | Indian |

| Employment Status | Salaried, Self-Employed |

| Gold Quality | Minimum 18 Carats |

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan At Home

With the changing needs of the times, Syndicate Bank has come across a simple yet valuable solution that will make everything easy for you. Just like your necessary commodities such as groceries, clothes and much more, everything is provided at your doorstep, in the same way, now, you can quickly get a gold loan at the comfort of your home.

If you are in urgent need of funds or too busy to visit a bank or prefer social distancing, Syndicate Gold Loan At home is a one-step solution. The process is straightforward. You need to give us a call to put in your request for a gold loan. Our executive from the nearest branch will visit your home at the earliest. Everything will be done at your home in your presence, from the evaluation of the loan documentation to the transfer of the loan amount. Furthermore, there are many benefits of Syndicate Bank Gold Loan at Home:

- Fast loan approval

- Lower interest rates

- Maximum value of gold

- Flexible repay tenures

- Easy payment options

- No additional charges

- 24*7 customer support

- Full security of the gold

- No hidden fees

- Service at your doorstep within 30 minutes

Syndicate Bank Gold Loan Documents Required

Gold Loan or Loan Against Gold is a loan product offered to the borrowers by the Syndicate bank wherein funds are provided for fulfilling the financial needs of the applicant. The gold ornaments of the applicant are kept as security by the bank in exchange for the funds. The entire Syndicate bank Gold Loan process is hassle-free and easy to get with minimal documentation. The bank ensures the high security of your gold ornaments till the loan is closed.

Documents required for Applying for Syndicate bank Gold Loan are :

A duly filled and signed Gold Loan application form shall be submitted along with the following documents:

| Photographs | 2 Passport Size |

| Identity Proof | Aadhar Card, Passport, PAN Card, etc. (Only 1 is required) |

| Residence Proof | Aadhar Card, Driving License, Ration Card, etc. In the case of Rented House then the rent agreement or water/electricity bills for the last three months can be considered. (Only 1 is required) |

| Agricultural Land Proof | Required only if the Loan is taken for Agricultural Purpose |

**Any other documents as requested by the bank shall be duly submitted.**

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Interest Rate, Fees and Charges

Syndicate bank Gold Loan can fulfill all your urgent short term and long term monetary requirements. The rate of interest that you will be charged with depends on the total loan amount as well as the quality/purity of the gold you are to keep as security with the bank. Gold Loan interest rates offered by the Syndicate bank are lower in comparison to other loans because it is a fully secured loan.

Syndicate bank also charges some additional fees along with the rate of interest in some cases, which are :

| Syndicate Gold Loan Interest Rate | 7.25% per annum |

|

Processing Fee

|

1% of the Principal Loan Amount

|

|

Prepayment/Foreclosure Charges

|

1%+GST (Within 3 Months), 0 (After 3 months)

|

| Valuation Fee |

Rs 250 for a loan up to Rs 1.5 lacs and Rs 500 for a loan over and above Rs 1.5 lacs

|

|

Late Repayment Charges

|

2% p.a. + Applicable rate of interest.

|

|

Renewal Processing Fees

|

Rs 350 + GST |

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Apply Online

Applying for the Syndicate bank Gold Loan service is a simple and hassle-free process that can be done from the comfort of your home. You can do it online by visiting the bank’s official website and submitting a form with necessary information regarding yourself and the Gold Loan you wish to avail. You will then need to visit the branch with the required documents and your gold.

You can also apply with Dialabank by following the below-mentioned steps to get a Gold Loan as per your need.

- Visit Dialabank’s digital platform, where you will have just to fill a form without any registration.

- Our Relationship Manager will contact you and assist you throughout the Gold Loan process and guide you in fulfilling your financial needs.

- You will get personalized service, giving you the option of comparing and taking the best deal according to your needs without any extra charges.

- With Dialabank, you can compare the different offers and schemes from various banks based on funding provided and the rate of interest charged for choosing the best loan deal for yourself.

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan EMI Calculator

| Rate of Interest | 6 months | 1 Yr | 2 Yrs | 3 Yrs |

| 7.00% | 17008 | 8652 | 4477 | 3088 |

| 8.00% | 17058 | 8699 | 4523 | 3134 |

| 8.50% | 17082 | 8722 | 4546 | 3157 |

| 9.00% | 17107 | 8745 | 4568 | 3180 |

| 9.50% | 17131 | 8678 | 4591 | 3203 |

| 10.00% | 17156 | 8791 | 4614 | 3227 |

| 10.50% | 17181 | 8815 | 4637 | 3250 |

| 11.00% | 17205 | 8838 | 4661 | 3274 |

| 11.50% | 17230 | 8861 | 4684 | 3298 |

| 12.00% | 17254 | 8885 | 4707 | 3321 |

| 12.50% | 17279 | 8908 | 4731 | 3345 |

| 13.00% | 17304 | 8932 | 4754 | 3369 |

| 13.50% | 17329 | 8955 | 4778 | 3393 |

| 14.00% | 17354 | 8979 | 4801 | 3418 |

| 14.50% | 17378 | 9002 | 4825 | 3442 |

| 15.00% | 17403 | 9026 | 4845 | 3466 |

GOLD LOAN @ 0.75%*

APPLY NOW

How To Pay Your Syndicate Bank Gold Loan EMI?

Your Syndicate Bank gold advance can be reimbursed in the following three different ways.

- Standing Instruction (SI): If you are a current record holder with Syndicate Bank, Standing Instruction is the best method of repayment. Your EMI sum will be charged automatically toward the finish of the month to month cycle from the Syndicate Bank account you indicate.

- Electronic Clearing Service (ECS): This mode can be utilized if you have a non-Syndicate Bank account and might want your EMIs to be charged consequently toward the finish of the month to month cycle from this record.

- Post-Dated Checks (PDC): You can submit post-dated EMI checks from a non-Syndicate Bank account at your closest Syndicate Bank Loan Branch. A new arrangement of PDCs should be submitted on time. It will be ideal if you note Post Dated Checks will be gathered non-ECS areas as it were.

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Contact Number

Syndicate Bank offers loan against gold at the lowest Interest rate. Being one of the significant gold loan suppliers, Syndicate Bank understands the necessities of the clients and disburses the loan amount in 60 minutes. The gold promised is securely secured in the bank locker, and you don’t need to stress over its safety.

You just need to give a call on 9878981144 for any Syndicate Bank Gold Loan details.

GOLD LOAN @ 0.75%*

APPLY NOW

Gold Ornaments Accepted By Syndicate Bank

- Any jewellery of 18 karats to 22 karats is acceptable to avail the loan.

- Gold coins weighing less than 50 grams in total.

- Bank does not accept minted/forged gold coins.

- Gold Bars and bricks are not acceptable.

- Raw gold in any form is not acceptable.

GOLD LOAN @ 0.75%*

APPLY NOW

Uses Of Syndicate Bank Gold Loan

The funds acquired by availing the Syndicate bank Gold Loan service can be used for several purposes such as:

- To finance any personal expenses such as a wedding, travel, payment of higher education fees, etc.

- For all your business needs, such as buying raw material, expansion of business, etc.

- You can also avail a Gold Loan for agricultural purposes. The bank offers lower rates of interest for Gold Loans that are used for agriculture or allied activities.

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Agricultural Gold Loan Scheme

| Scheme | Syndicate Bank Agricultural Gold Loan Scheme |

| Interest Rate | Starting from 7.25% per annum (depends on the sum of the loan |

| Least amount of Loan | Depends on the value of jewel which is being kept as security |

| Loan period | Adjustment of advance sum inside 2 months from the date of reap of yields |

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits Of Syndicate Bank Agricultural Jewel Loan Scheme

- There is no processing fee is applicable up to ₹ 25,000

- 0.30% of the loan amount, Minimum of ₹ 300 charge is applicable to the amount ranging from above ₹ 25,000 – less than ₹ 5 lakh

- 0.28% of the credit sum, subject to at least Rs.1,500 is applicable to the amount more than Rs.5 lakh however under Rs.1 crore

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Overdraft Scheme

Syndicate Bank Offers an Overdraft Scheme. With this, you are provided a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Gold Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Syndicate Bank Gold Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

GOLD LOAN @ 0.75%*

APPLY NOW

Syndicate Bank Gold Loan Key Highlights

| Age | 18-75 years |

| Minimum Loan Amount | Rs. 25,001 |

| Maximum Loan Amount | Rs. 25 Lakh |

| Syndicate Bank Gold Loan Interest Rate | 7.25% per annum onwards |

| Loan Tenure | From 3 months to 36 months |

| Gold Items accepted | Jewelry and gold coins sold by banks |

| Syndicate Bank Gold Loan Processing Charges | 1% of the loan amount |

GOLD LOAN @ 0.75%*

APPLY NOW

How Does Syndicate Bank Gold Loan Work, Here’s An Example

The improvement of far and away cutoff is settled dependent on the perfection of gold, LTV, and the weight of gold. Envision Mr A and his two associates Mr. B and Mr. C own different degrees of gold with moving faultlessness. Mr. A has 50 grams of gold of 22 carats. Mr. B has 60 grams of gold with uprightness of 20 carats and Mr. C has 70 grams of gold with goodness or 22 carats. They approach the Syndicate Bank to benefit from a gold new development. The worth applied to acquire capacity with their gold credit absolute cutoff reliant on the most over the top LTV of 85% will vary by the significance of gold and thusly, will achieve moving gold improvement limit.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs About Syndicate Bank Gold Loan

✅ What is Syndicate Bank Gold Loan?

Syndicate Bank gives you Loan Against Gold for personal and professional use for a maximum loan amount of ₹20 lacs for a maximum period of 36 months. The Gold Loan comes with quick approval and minimal paperwork to fulfil your urgent monetary requirements.

✅ How much Gold Loan Can I get per gram from Syndicate Bank?

The loan is granted against the security of gold ornaments or jewels at the rate of ₹ 3,800 to ₹ 4,350 per gram of 22 Karat Gold or 90% of the net market value of your gold, whichever is lower.

✅ How Does Syndicate Bank Gold Loan work?

The Syndicate Gold Loan is provided by the Banks /NBFC by providing you with funds against your gold ornament. The loan amount depends upon the gold weight and its quality.

✅ What is Syndicate Bank Gold Loan Interest Rate?

The Syndicate Gold Loan interest rate online is 7.25% per annum.

✅ How to check gold loan status in Syndicate Bank?

To check your Syndicate Bank Gold Loan status online just visit the portal from your web browser and fill in the details of your Gold Loan application.

✅ How to calculate Syndicate Bank gold loan interest?

The gold loan interest rate in Syndicate Bank can be calculated by simply subtracting the principal amount from the total amount to be paid.

✅ What is the maximum gold loan amount I can avail on gold loan from Syndicate Bank?

You can avail a maximum of up to 75% of your pledged gold jewellery’s market value from Syndicate Bank.

✅ What is the loan tenure of Syndicate Bank gold loan?

The loan tenure of your Syndicate gold loan is up to 36 months.

✅ How much processing fee is applicable on Syndicate Bank Gold loan?

A processing fee of up to 1% of the loan amount is applicable on Syndicate gold loan.

✅ What are the charges for pre-payment in Syndicate gold loan?

The charges of pre-payment in Syndicate loan vary from 0-1% of the outstanding loan amount.

✅ How to renew Syndicate Gold Loan online?

To renew your Syndicate Gold loan online just log in to the portal with your personal credentials and fill a form of renewal of the loan.

✅ How to pay Syndicate Gold loan interest online?

You can pay the Syndicate Gold loan interest online using any of the following options:

- net banking

- debit cards

- i-mobile app

✅ What if I can’t pay the interest on Syndicate Gold Loan for 3 months?

If you fail to pay your interest on Syndicate Bank gold loan for 3 months then the bank will warn you against further defaults. In case the defaults continue, the bank may consider selling off your gold ornaments kept as a security.

✅ How can I apply for EMI moratorium on Syndicate Gold Loan?

You can apply for EMI Moratorium on Syndicate Gold loan online by logging in with your unique ID and password or can also visit the bank personally and apply for the same.

✅ How to pay Syndicate Bank Gold Loan through credit card?

You cannot pay Syndicate Bank Gold Loan through credit card as per RBI’s guidelines.

✅ What is the Syndicate Bank Gold Loan customer care number?

For contacting the Syndicate Bank Gold loan customer care just dial 9878981144. You can also call this number for any other Syndicate Bank Gold Loan details.

✅ What is the Syndicate Bank Gold Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Syndicate Bank Gold loan account.

- Pay the pre-closure charges as per Syndicate Bank Gold Loan.

✅ What is the Syndicate Gold Loan preclosure charge?

Up to 2% preclosure charge before 3 months, after that 0.50%.

✅ What is the Syndicate Bank Gold Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at Syndicate bank is provided. You do not need to visit bank branches and go through the process. Just log in to the Syndicate Bank online banking portal and from there you can fill out a simple form and get an overdraft under your name.

✅ What is the Syndicate Gold Loan maximum tenure?

The maximum tenure of the Syndicate Gold loan is 60 months.

✅ What is the minimum gold loan tenure of the Syndicate Bank gold loan?

The minimum tenure of the Syndicate Bank gold loan is 6 months.

✅ What is the Syndicate Bank Gold Loan Rate Per Gram?

The Syndicate Bank Gold Loan today is Rs. ₹ 3,800 to ₹ 4,350.

✅ What are the foreclosure charges of the Syndicate Bank Gold Loan?

Syndicate Bank charges a borrower up to .50% on the principal amount in case of a Gold Loan Foreclosure.