NIRVIK Scheme (Niryat Rin Vikas Yojana)

The NIRVIK Scheme (Niryat Rin Vikas Yojana) is a special scheme that was implemented under the Export Credit Guarantee Corporation of India (ECGC) with a view to ease the lending of loans. It also helps to enhance the credit availability to the small scale exporters.

The scheme was announced by the Finance Minister of India during the Union Budget on 2020-21 and it was mentioned that this scheme will boost the export segment of the economy of the country.

What Is The Aim of the NIRVIK Scheme (Niryat Rin Vikas Yojana)?

The main aim of the scheme is to provide high insurance coverage for the exporters and also to reduce the premiums on small scale exporters. It is also believed that such a step would lead to a higher export credit disbursement.

This scheme was announced at a time when 10 out of the 30 exporting sectors experienced a sharp decline with respect to outbound shipment in the year 2019. The exports of India in the month of December 2019 fell abruptly for the fifth time in a row which was really disturbing, which resulted in a trade deficit of USD 118.10 billion.

Also, the development of the scheme was significant as the exporters were concerned about the availability of credit.

What Are The Features Of NIRVIK Scheme (Niryat Rin Vikas Yojana)?

There are a lot of features of this scheme and some of the important features of the scheme are mentioned below:

- The coverage of Insurance will be up to 90% of the principal amount and the rate of interest.

- The extended coverage will ensure that the foreign export credit interest rates are not above 4%. Also, the rupee export credit rates of interest will be limited to only 8%.

- Both the pre and post-shipment credit will be covered under the new scheme.

- The borrowers from the jewellery, gems and diamond with a limit of over Rs. 80 crore will have a premium rate as compared to those from other sectors. This is because the loss ratio is high.

- Those accounts that are having limits below Rs. 80 crore, their premium rates will be moderated to 0.60 p.a.

- For the accounts whose limits are not above Rs. 80 crore, the rates will be 0.72 p.a.

- If there will be losses exceeding Rs. 10 crores, the exporter will be subjected to inspection by the banks.

What Are The Benefits Of the NIRVIK Scheme (Niryat Rin Vikas Yojana)?

The benefits of the scheme are mentioned below:

- The scheme will play a crucial role in improving affordability and accessibility of credit for the exporters making Indian exports more competitive.

- The scheme will also dispense with the usual red-tape and the other procedural hurdles in order to become exporter friendly.

- The extended insurance cover is also likely to bring down the cost of credit with factors like better liquidity, capital relief and quick settlement of claims in the play.

- The Micro, Small and Medium Enterprises ( MSME’s) will stand to benefit as well due to improvement in the ease of doing business and making the procedures of ECG much simpler.

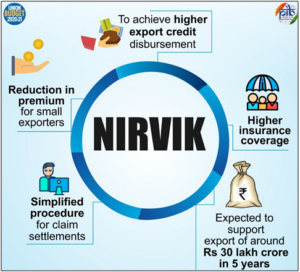

What Are The Key Highlights of The NIRVIK Scheme (Niryat Rin Vikas Yojana)?

The key highlights of the scheme are mentioned below:

- It currently provides a credit guarantee of up to 60% loss.

- To achieve higher export credit disbursement

- Offers higher insurance coverage

- Reduction in premium for small exporters

- Simplified procedure for claim settlements

- Expected to support the export of around Rs. 30 lakh crore in 5 years.

NIRVIK Scheme (Niryat Rin Vikas Yojana) FAQs

✅ What is NIRVIK?

Niryat Rin Vikas Yojana is the scheme that provides enhanced insurance cover and reduces the premium for small exporters.

✅ What is the aim of this scheme?

The main aim of the scheme is to ease lending of the loans and enhancing the credit availability to the small scale exporters

✅ What is the full form of ECGC?

The full form of ECGC is the Export Credit Guarantee Corporation of India.

✅ What is its main objective?

The main objective of the scheme is to reach out to the potential exporters and to get them into International trade and also to boost exports from the country.