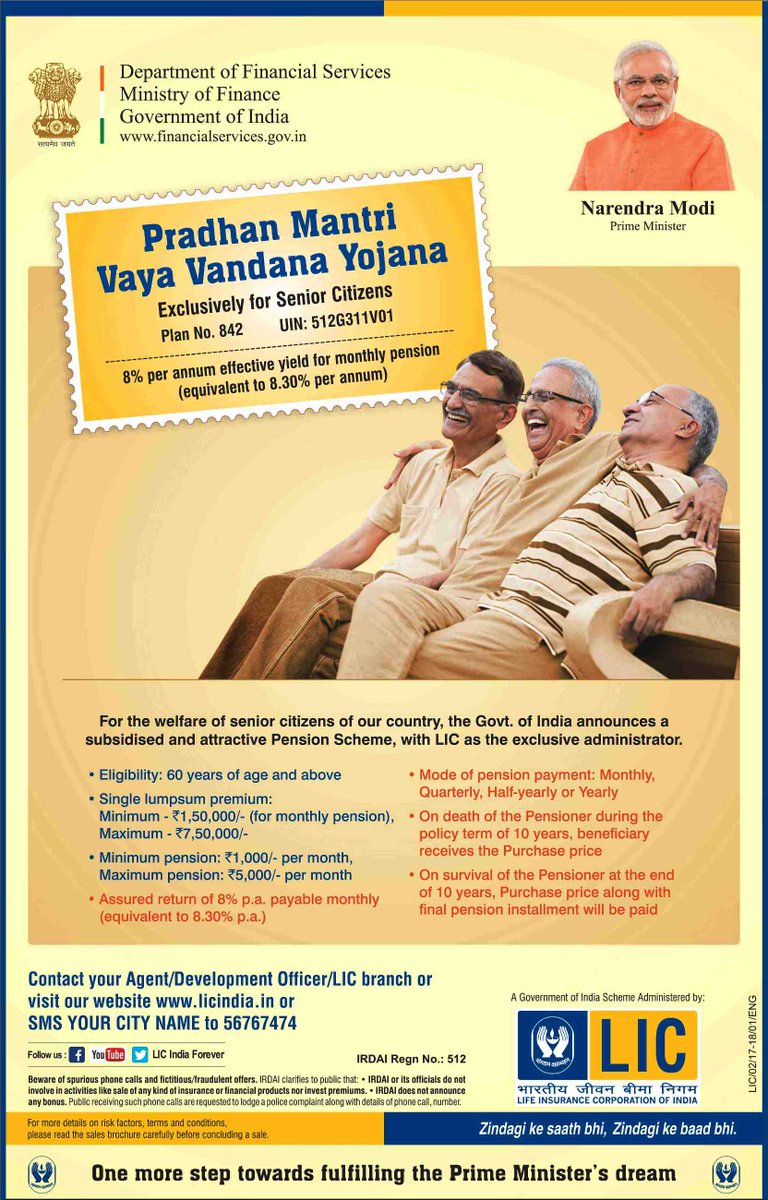

Pradhan Mantri Vaya Vandana Yojana- PMVVY

The Government of India has launched a new pension scheme for the benefit of the pensioners and it was launched on 4th May 2017 and the benefit could be taken till 31st March 2020. In the Budget Speech of 2018-2019, the Indian Government increased the maximum limit to an amount of Rs. 15 lakh under this scheme. Also, this scheme can be bought either online or offline from the Life Insurance Corporation (LIC) of India. The main focus of this scheme is to provide the senior citizens of the country with a regular pension during the time when there is a fall in the interest rates.

Eligibility Criteria For Pradhan Mantri Vaya Vandana Yojana

The eligibility criteria that a person has to fulfil if he wants to apply for this scheme is summed up in the following points:

- The age of the applicant should be at least 60 years (completed) while he is opting for the scheme.

- The minimum age is 60 years and there is no limit on the maximum age.

- The applicant must be a citizen of India.

- The minimum term of the policy is 10 years.

- The minimum pension for a month, quarter, half-yearly and yearly are Rs. 10,000, Rs. 30,000, Rs. 60,000 and Rs. 1,20,000 respectively.

- The maximum pension that can be earned by an applicant for a month, quarter, half-yearly and yearly is Rs. 10,000, Rs. 30,000, Rs. 60,000 and Rs. 1,20,000 respectively.

The whole family is considered when the maximum pension ceiling of the applicant is decided. The family under the scheme consists of the pensioner, his/her dependents and spouse.

Purchase Price Payment of Pradhan Mantri Vaya Vandana Yojana

The applicants can buy the scheme by paying a lump sum price. The pensioner can either choose the price of the purchase amount or the price he will be receiving. Under various modes, the minimum price and the maximum price are mentioned in the table below:

| Pension Mode | Minimum Purchase Price (Rs.) | Maximum Purchase Price (Rs.) |

| Monthly | 1,50,000/- | 15,00,000/- |

| Quarterly | 1,49,0698/- | 14,90,683/- |

| Half-Yearly | 1,47,601/- | 14,76,015/- |

| Yearly | 1,44,578/- | 14,45,783/- |

How To Apply For Pradhan Mantri Vaya Vandana Yojana?

A person can follow the steps mentioned below if he wants to get enrolled and obtain maximum benefits from this scheme: –

Online Process

- Visit the website of LIC.

- Click on ‘Products’

- Look for ‘Pension Plans’ and proceed further

- Fill in the application form under ‘Buy Policies’

- Submit the form and upload the necessary documents.

Offline Process

- Visit the nearest branch of LIC.

- The application form will be available in LIC.

- Fill in the application form

- Submit the documents.

Benefits Of Pradhan Mantri Vaya Vandana Yojana

The scheme was made for the benefit of the people living in the country. The main advantages of this scheme which are being provided to the applicants are mentioned below:

- This scheme focuses to furnish the pensioners with 8.00% returns per annum payable for a time period of 10 years.

- The taxes like GST or service tax are also exempted from this scheme.

- Throughout the time period of 10 years of the policy, the pension is payable in the arrears at the end of each period.

- The payments can be made monthly/ quarterly/ half-yearly/ yearly, whichever is suitable for the pensioner.

- The whole amount, including the purchase price and the final pension instalment, is payable at the end of the term of the policy, which is 10 years when the pensioner survives.

- In an emergency, a loan up to 75% of the Principal price is allowed to be sanctioned if the term of 3 years of the policy is completed. Also, the interest on the loan is recovered from the pension instalments whereas the amount of the loan is recovered from the claim proceeds.

- 98% of the purchase price is refunded for the treatment if there is any medical emergency, critical illness of either the person or his/her spouse. This is known as the Premature Exit.

- If the pensioner who has enrolled dies due to any circumstances, the purchase price will be paid to the nominee.

- The rate of interest is affordable as it is 10% per annum and is payable half-yearly throughout the term of the policy.

- The applicant can surrender the policy within 15 days if he is not happy with the terms of the policy. However, the free look period of the policy is 30 days if the policy is bought online. The purchase price of the policy after the deduction of the stamp charges will also be refunded to the policyholder.

Documents Required For Pradhan Mantri Vaya Vandana Yojana

The necessary documents that a person has to submit when he is enrolling on this scheme are mentioned below:

- Aadhaar Card

- Age Proof

- Residential Proof

- Passport size photographs of the applicant

- Declaration to show the retired status of the applicant.

Pradhan Mantri Vaya Vandana Yojana FAQs

✅ What are the documents required to apply for Pradhan Mantri Vaya Vandana Yojana?

The documents required are:

- PAN Card

- Address Proof such as Passport or Aadhar Card

- Copy of the cheque leaf or the first page of the bank passbook.

✅ What is the procedure to apply for this scheme?

A person has to submit the application form with the relevant documents. He can also apply for the scheme online by uploading the documents and filling the application form.

✅ Are there any tax benefits offered in this scheme?

No tax benefits are available for investments in this scheme.