ARN number

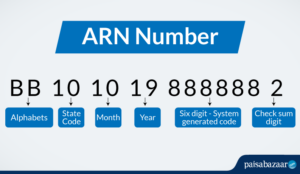

ARN stands for Application Reference Number. ARN is a unique number assigned to each transaction after it gets completed at the standard GST Portal. It can also be generated during the submission of the Enrollment Application electronically signed using DSC. However, It can also be used for future correspondence along with GSTIN. To know more about the ARN status, the applicant should check the below-mentioned points.

How to track GST application status?

After successfully submitting the GST registration application, an applicant will be provided with ARN, i.e. an Application Reference Number.

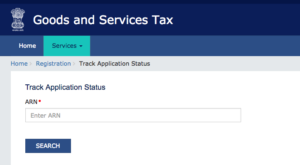

An applicant can easily track the status of their application by following this provided ARN. To view the quality of their ARN, they have to perform the following steps:

- Firstly an applicant should visit the website

- The applicant should enter the ARN in the ARN field provided when submitting the registration application.

- Fill in the Captcha and also enter the text of Captcha.

- Click on the SEARCH button.

- Here the Application status of an applicant will be shown.

Different ways to track the status of the Registration Application

An applicant can track the status of the registration application by following ways:

- Pre-Login: Track the status of an application related to registration, i.e. core amendment of enrollment, new registration/ cancellation etc., using ARN at the pre-login stage only after the application is submitted.

- Post-Login: At the post-login stage, Track the application status once an applicant submits a new registration application using an ARN or submission period.

- Using TRN: Only after submitting Part B’s new registration application on the GST Portal, an applicant can track the status of the application using TRN.

- Using SRN: Track the status of a new registration application by using SRN once the submission of the registration application is made on the MCA Portal.

Check your ARN status Instantly of GST Application.

An applicant can check the ARN status of the GST application instantly by following the below-mentioned criteria:

- To Search for the ARN status of the GST application numbers all over India, the applicant should type their ARN number and can check the application status of the UIN/GSTIN.

- After successfully submitting a GST registration application, an ARN number is generated on the GST Portal.

- After the GST ARN number is generated, an applicant can use it to track the GST registration application’s status.

- ARN, i.e. Application Reference Number, is of 15 digits.

Different status types for registration applications

Check below the different ARN status types: