Credit scoring options

An individual UN agency freshly initiated with the multifarious options of the credit and loan monetary system will currently additionally get loans by forwarding their credit access ability even within the case of a low credit score information mirrored on standard platforms.

The emergence of different credit marking pathways has a light-emitting diode to the creation of a broad-based credit marking technique.

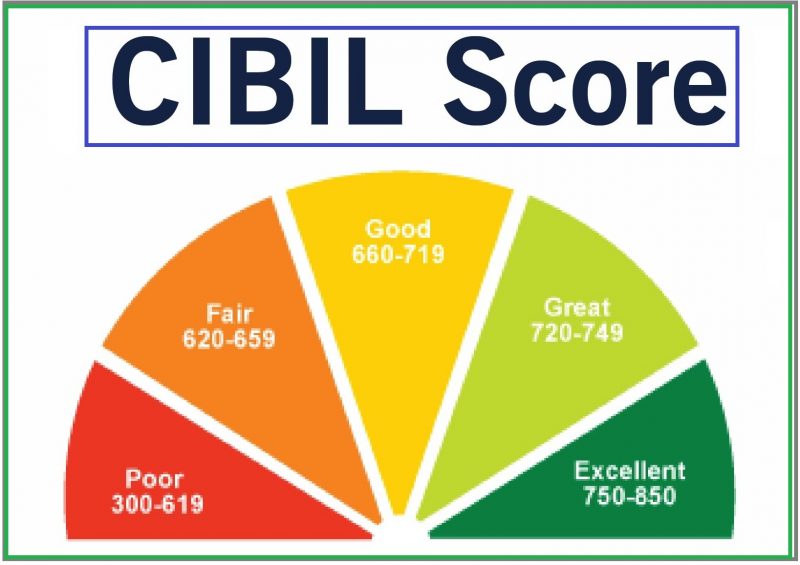

Business specialists say this new model is capable of going on the far side of standard constraints obligatory by monetary regulation entities like CIBIL.

Rohit Garg, Co-Founder and business executive, Smartcoin, says, “Intriguingly, the new-age customer’s UN agency has simply been introduced to the intricacies of the credit and loaning visual image currently stand an opportunity to reap substantial profit by leveraging various credit marking channels.”

Nowadays, out of the box, various credit marking enterprises are quick to optimize such tangible techniques assessing a doable consumer’s digital impressions to see their trustworthiness. specialists say this technique renders mutual advantages to each of the concerned parties.

For instance, a non-public UN agency freshly initiated with the multifarious options of the credit and loan monetary system will currently additionally get loans by forwarding their credit access ability even within the case of a low credit score information mirrored on standard platforms.

Similarly, Garg says, “lenders, too, will reap advantage as they are going to currently use various credit marking pathways to heighten their credit reach in extent unventured and virgin terrains like remote and rural areas, while at the same time reducing risk levels and monetary embezzlements.”

Here is however it works; Alternate marking techniques are also a monetary approach that optimizes various technologies like cubic centimetre, AI-based models to live numerous tangents just like the loan applicant’s payment history, overall bank balance, e-commerce transactions, travel vary, and expenditure blueprint.

Garg says, “Alternate marking is based on the synergic assimilation of next-gen technologies aboard the assessment of digital characteristics of a recipient which can be generated through one’s social media and email and net use to verify if a doable recipient is eligible for the loan.”