Credit Report is a report which is created and maintained by the CIBIL bureau which involves the details of an individual’s credit-related activities, the individual’s credit history details, and other information regarding his financial whereabouts.

The CIBIL Bureau is a company that is operating in India. It is responsible for maintaining the credit files of around 600 million individuals and over 32 million credit reports of businesses that are being run throughout the country.

Trans Union is one of the four Credit Bureaus that are functioning within India and is part of the Trans Union, which an American Multinational Group.

Since the CIBIL bureau firmly maintains the credit report of an individual, certain key terms are taken into consideration while creating the Credit Report of an individual. Let’s have a look at these terms:

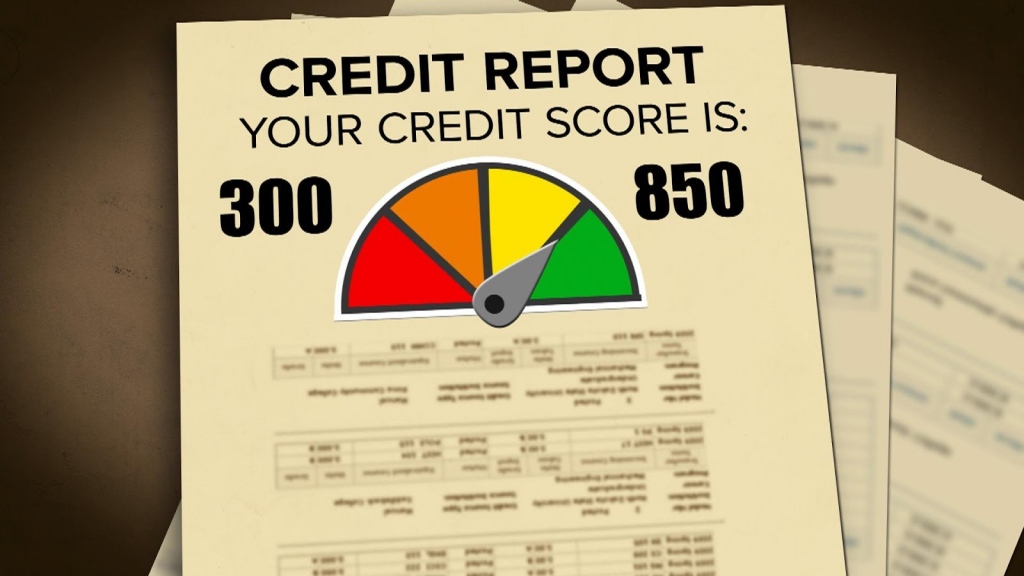

Credit Score:

A Credit Score is a top-most prioritized key term that has huge importance in an individual’s credit report. The score is a mandatory score ranging between 300-900 that decides your personal loan eligibility for availing any kind of loans or credits from the banks or any other NBFCs. The bureau acquires the individual’s data from the banks by whom he or she is related to and firmly studies his credit-related activities and assigns the score accordingly. The credit score should always be more than 700 for a person who wants his loans to be approved by the lenders. A high credit score of a person gives the legal proof of his financial stability in the banking or the financial sector.

APR:

The APR stands for Annual Percentage Rate, which is the charge applicable to credit card balances that are carried over a monthly basis. Notably, APR is the way credit is compiled.

Insolvency:

Insolvency or bankruptcy is another important key term which taken into action while designing the credit report of an individual. A court proceeding where a consumer might be excused of all his debts. There are various topics related to insolvency, and all of them impact negatively on the consumer’s credit score for several years, usually ranging from 7 to 10.

Credit history:

Is one of the essential requirements while making an individual’s Credit Report. It is defined as a consumer’s record of their financial history, such as repayment of their debts as agreed in the past.

Collection:

A collection is a negative term in context to a credit report that influences the credit score negatively, an account goes to collections when it goes past due, and a creditor wants to collect the debt that is owed.

Co-signer:

A co-signer is the person who signs with a primary individual on a line of credit. If the individual were to default on the loan, the co-signer is then responsible for it. Co-signers may be necessary when the primary signee doesn’t have good enough credit to get approved for a loan.

Creditor:

If you take out a line of credit, this is who you’re paying back.

Debtor:

A debtor is primarily a consumer who has an open line of credit and owes money to a creditor. You’re likely a debtor.

Negligent:

If in case you fail to make the minimum payment on a line of credit by the due date, then it will be marked as a careless move. The ones who act as lenders, often have monthly payment cycles and will mark accounts up to 120 days negligent. Negligent payments can at times be referred to as payments that are being made lately.

Debt-to-Credit Ratio:

Also known as the Credit Utilization Ratio, it is the total amount of debt that a consumer has to emanate to their total credit that is being allotted to him. For the sake of example, if a consumer posses just a single credit card with a limit of $10,000 and they’ve have been charging $3,000, then their debt-to-credit ratio is calculated to be 30 %.

Installment Debt:

Some of the Good examples of installment debts include mortgage loans and auto loans, as they have the debt to be paid – often in monthly payments – at specific time slots within the year.

Over-the-Limit Fee:

If your credit limit is exceeded, you’ll be charged with this fee. Bottom line: Don’t exceed your maximum credit limit on credit cards.

The Third-party collections:

These are typically agencies that work with creditors to collect debts.

Special Note: An individual must examine the whole EMI amount payable to the lender with the Personal loan EMI calculator.