Andhra Pradesh Grameena Vikas Bank Personal Loan Key Features Apr 18 2024

| Eligibility Criteria | Details |

| Age | 21 – 60 Years |

| CIBIL Score | 600 or above |

| Andhra Pradesh Grameena Vikas Bank Personal Loan Interest Rate | 9.99% per annum |

| Lowest EMI per lakh | Rs. 2149 |

| Tenure | 12 to 60 months |

| Andhra Pradesh Grameena Vikas Bank Personal Loan Processing Fee | 1% to 2% of Loan Amount |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | Rs. 50,000 |

| Maximum Loan Amount | Rs. 10 Lakh |

Andhra Pradesh Grameena Vikas Bank Personal Loan Eligibility Criteria

Personal Loan Eligibility criteria:

| CIBIL score Criteria | 600 or above |

| Age Criteria | 21 to 60 years |

| Min Income Criteria | Rs. 20,000 |

| Occupation Criteria | Salaried/Self-Employed |

Andhra Pradesh Grameena Vikas Bank Personal Loan Interest Rate and Charges

| Andhra Pradesh Grameena Vikas Bank Personal Loan Interest Rate | 9.99% per annum |

| Andhra Pradesh Grameena Vikas Bank Personal Loan Processing Charges | 1%-2% of the loan amount |

| Prepayment Charges | NIL |

| Stamp Duty | As per state law |

| Cheque Bounce Charges | Rs. 100 |

| Penal Interest | As per bank terms |

| Floating Rate of Interest | Not Applicable |

Andhra Pradesh Grameena Vikas Bank Personal Loan Documents Required

| Form | Duly filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Andhra Pradesh Grameena Vikas Bank Personal Loan EMI Calculator

Andhra Pradesh Grameena Vikas Bank Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Andhra Pradesh Grameena Vikas Bank | 9.99% | 12 to 60 months | Up to Rs. 10 lakh / 1% to 2% of Loan Amount |

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 15.75% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Upto Rs. 20 lakh / Up to 2.25% of the loan amount |

Other Loan Products from Andhra Pradesh Grameena Vikas Bank

Why should you apply for Andhra Pradesh Grameena Vikas Bank Personal Loan with Dialabank?

Dialabank helps you to choose the best option of banks by providing you with the updated market comparison of different banks so that you can make the right choice. Dialabank lets you compare offers from all the banks across the country. We at Dialabank have already helped thousands of people to get the loan they need without any issue, and we look forward to continuing in doing so. Apply with us today to get the offers and special deals on Andhra Pradesh Grameena Vikas Bank Personal Loan.

Call us at 9878981166 to avail of the Andhra Pradesh Grameena Vikas Bank Personal Loan.

How to Calculate EMIs for Andhra Pradesh Grameena Vikas Bank Personal Loan

You will need the following to calculate EMI:

- Loan Amount

- Rate of Interest

- Tenure

Andhra Pradesh Grameena Vikas Bank Personal Loan Processing Time

Your loan application takes about a week to process because there are many parameters that need to be verified and checked. But, if you are a customer of the bank, you get approval within 72 hours.

Andhra Pradesh Grameena Vikas Bank Personal Loan Preclosure Charges

You can easily close your personal loan with Andhra Pradesh Grameena Vikas Bank after the first EMI. Bank does not charge any foreclosure fee.

Andhra Pradesh Grameena Vikas Bank Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like manner reimburse the got out totally at whatever point the condition is ideal. From this time forward, it is possibly the most favoured credit choices that benefitted to meet changing individual supporting necessities unbounded.

Apply for an overdraft office as an Andhra Pradesh Grameena Vikas Bank for a startling new unforeseen development. The adaptable improvement office has all the goliath highlights of a slight overdraft credit.

Pre Calculated EMI for Personal Loan

Different Personal Loan offers by Andhra Pradesh Grameena Vikas Bank

Andhra Pradesh Grameena Vikas Bank Marriage Loan

Marriages can feel like a burden rather than happy occasions. Apply for a personal loan with Andhra Pradesh Grameena Vikas Bank and set your financial worries aside.

Andhra Pradesh Grameena Vikas Bank Personal Loan for Government Employees

Central and state government employees get added benefits and discounts when applying for a personal loan. It is because their jobs hold credibility, and it is easier for banks to cross-check their details.

Andhra Pradesh Grameena Vikas Bank Doctor Loan

If you are a doctor with more than 3 years of medical practice, you can apply for a personal loan for your all financial needs and get special rates and offers curated for you.

Andhra Pradesh Grameena Vikas Bank Personal Loan for Pensioners

Retired government employees who draw their pension from the bank account can get a personal loan against their pension to meet their post-retirement expenses.

Andhra Pradesh Grameena Vikas Bank Personal Loan Balance Transfer

Many borrowers feel that their personal loan is heavy on their pocket and that rate of interest is high. If you want lower rates of interest and better terms, you can apply for a personal loan balance transfer.

Andhra Pradesh Grameena Vikas Bank Personal Loan Top Up

Need more money even after taking a personal loan? A new expense has suddenly arrived? Worry not, apply for a top-up on your personal loan for additional funds.

Andhra Pradesh Grameena Vikas Bank Personal Loan Status

You can check the status of your personal loan with Andhra Pradesh Grameena Vikas Bank by visiting the branch in person and asking for the same.

Types of Andhra Pradesh Grameena Vikas Bank Personal Loan

Home renovation loan

Andhra Pradesh Grameena Vikas Bank provides individuals who plan to renovate their homes with a home improvement loan. This personal loan can fund critical repairs or allow the borrower to purchase new furniture, fixtures, and furniture for the house. Four of the Andhra Pradesh Grameena Vikas Bank Home Renovation Loan’s major features are:

- The Home Renovation Loan of Andhra Pradesh Grameena Vikas Bank’s interest rate starts at as low as 11.25%.

- Individuals will be liable to renew their homes with a loan of up to Rs. 20 Lakh.

- Andhra Pradesh Grameena Vikas Bank’s home improvement loan needs minimum paperwork to free up the whole credit process.

- Usually, within 72 hours after the bank accepts the applications, the loan balance will be credited to the account.

Holiday loan

The holiday loan from Andhra Pradesh Grameena Vikas Bank will help you budget for your dream vacation with limited difficulties. A number of holiday-related expenses will be funded by this personal loan from Andhra Pradesh Grameena Vikas Bank, including the booking of flight fares, hotel accommodation, guided tours, etc. The Andhra Pradesh Grameena Vikas Bank Holiday Loan’s key features are:

- Interest rates on holiday loans starting at 11.25 percent p.a.

- You should use up to Rs 20 Lakh easily so that a financial crunch would not spoil your perfect vacation

- Simplified and limited paperwork means fast and easy funding for your holiday.

- Quick processing of the loan directly credited to your account and disbursement

Fresher funding

Most unsecured personal loans are meant for individuals with a daily income, while the Fresher Funding of Andhra Pradesh Grameena Vikas Bank is distinct. The loan option provided by Andhra Pradesh Grameena Vikas Bank is intended to help refreshers, i.e. recent graduates searching for their first job. Few of Andhra Pradesh Grameena Vikas Bank Fresher Personal Loan Funding’s main features are as follows:

- Up to Rs 1.5 lakh loan

- A candidate must be 21 years of age or older.

- The personal loan interest rate for Fresher Funding depends on the applicant’s profile, credit history/score, applicant’s age, and place.

NRI Personal Loan

Knowing the wishes and desires of NRIs, Andhra Pradesh Grameena Vikas Bank provides NRIs directly with a personal loan. An Indian resident must be the main loan borrower, and a close relative must be the NRI co-applicant. The Personal Loan includes the following features for NRIs:

- Andhra Pradesh Grameena Vikas Bank offers NRIs with adjustable end-use personal loans of up to Rs. 10 lakh.

- NRI Personal Loan interest rates launch at 15.49 percent p.a.

- Up to 36 months is the term of the loan.

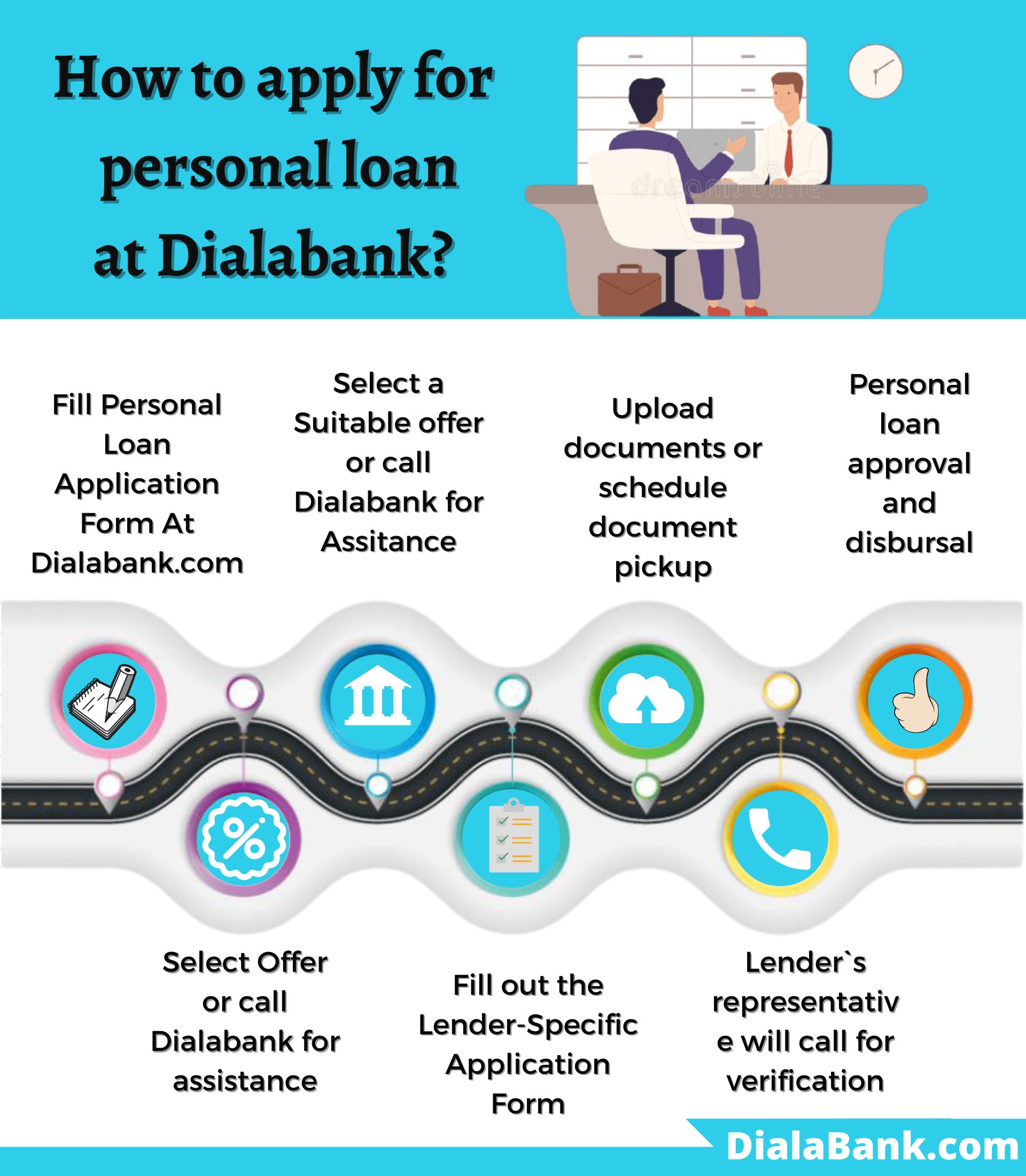

How to Apply for Andhra Pradesh Grameena Vikas Bank Personal Loan?

- Visit Dialabank

- Go to Andhra Pradesh Grameena Vikas Bank Personal Loan page.

- Fill the application form for the personal loan.

- Wait for our team to reach you.

- We will advise and assist you through the entire loan process.

Personal Loan verification process

Following the online submission of your loan application to Dialabank, the following are the principal stages of the personal loan authentication process.

Stage 1. Dialabank will forward to your chosen lender your loan application, and you will usually get a call from the representative of the lender within 48 hours.

Stage 2. The possible lender can arrange for your KYC documents, salaries, etc. to be collected or provide an opportunity to upload them online. To confirm your submission, these documents will be used.

Stage 3. You will get another call to confirm the loan bid and seek your permission for disbursement if the lender’s verification has been fulfilled and your loan has been approved.

Stage 4. The loan is normally disbursed within 48 hours of the loan’s acceptance and adequate verification.

Note: The timeframe for verification/disbursement of personal loans, as stated above, can vary on the basis of the internal criteria of the lender, as well as other parameters.

Check your Andhra Pradesh Grameena Vikas Bank Personal Loan Application Status

The process for checking your application’s status requires the following steps:

- Visit the official website of Andhra Pradesh Grameena Vikas Bank, click on ‘Products’, and select ‘Personal Loans.’

- Click ‘More and choose’ Review Loan Application Status.’ on the next tab that opens below.

- Firstly, by submitting details such as your contact number, date of birth, and either entering the OTP you get on your mobile number or using your application number, you can check your application status.

How to login to the Andhra Pradesh Grameena Vikas Bank Portal

- Visit the Official Website of Andhra Pradesh Grameena Vikas Bank.

- In the upper right corner of the screen, press the ‘Login’ button.

- Using your user ID and password or your registered cell phone number to log in.

How to Check Your Loan Statement

By taking the following steps, customers can download the bank’s loan statement:

- Visit the official website of the bank.

- Tap ‘Get in touch’ and click ‘Requests for help’ from the drop-down column.

- On the next page that opens, pick ‘Personal Loan Related’ under the ‘Loans’ menu.

- Next, press the ‘Loan Account Statement Order’ button.

- To make use of the bank’s loan statement, log in using your user ID and password or using your registered cell phone number and OTP.

Andhra Pradesh Grameena Vikas Bank Personal Loan Restructuring (COVID-19)

Many borrowers have been adversely affected by the national lockout due to the COVID-19 pandemic, and a six-month moratorium on various term loans has been declared to some degree to minimize its impact. Andhra Pradesh Grameena Vikas Bank announced an RBI-mandated one-time gain from the Andhra Pradesh Grameena Vikas Bank loan restructuring after the six-month moratorium was terminated. This mechanism aims at providing continued relief to borrowers who are still unable to repay their daily EMI due to the ongoing financial distress of the pandemic.

In order to minimize the monthly EMI payments, the loan settlement scheme implemented by Andhra Pradesh Grameena Vikas Bank provides for an extended moratorium of up to 2 years or an extension of the current period of maturity. It is necessary to bear in mind, of course, that the restructuring of the loan by Bajaj Finance employees would result in additional interest rates exceeding those applicable to the initial loan. Using this relief method only as a last resort is also necessary so that the unpaid loan does not end up defaulting.

Andhra Pradesh Grameena Vikas Bank Customer Care

Customers can approach Andhra Pradesh Grameena Vikas Bank’s Customer Support via any of the following means:

By phone: You can call Andhra Pradesh Grameena Vikas Bank on 1800-121-0354 (toll-free)

Callback order: You can also make a return call by accessing the bank’s website.

Online Chatbot: You can even have an apple Chatbot online to answer your questions.

Visit Branch: To obtain your requests, visit the nearest Andhra Pradesh Grameena Vikas Bank branch.

Benefits of Applying for Personal Loan on Dialabank

On the Dialabank website, there are many drawbacks to applying for a personal loan. Below, some of these are given:

- 24 x 7 Accessibility: You can reach the Dialabank website anywhere, wherever and even apply at any time for a personal loan from the comfort of your home or office.

- Multiple lenders on a single platform: Dialabank helps you to view personal loan offers on a single platform from multiple prospective lenders, avoiding the need to visit multiple bank websites or branches.

- Know EMI instantly: On the Dialabank website, use the personal loan EMI calculator, and you can check the EMIs that you are going to pay for on a personal loan right before applying for one. It can allow you to borrow the amount you need, which you will repay easily and have a stable payment schedule.

- Free of charge: In addition, when applying for a personal loan on Dialabank, you are not required to incur any fees.

Important Aspects

Below are some important items you need to note when applying to Andhra Pradesh Grameena Vikas Bank for a personal loan:

- It is still a smart thing to review your credit report before applying for a personal loan. A decent credit score increases the chances of accepting the loan and will make it possible for you to use a personal loan on conditions that are more desirable.

- It is advisable to compare the expense of a personal loan (interest rates and all associated fees and charges) issued by various lenders on Dialabank before finalizing on a particular lender.

- As per your wishes and ability to repay, borrow. Avoid borrowing only because you have the right to borrow a bigger amount. It will just add to the interest rate and will have no long-term advantages.

- Avoid applying for individual loans concurrently with many lenders. It reveals that you are credit-hungry and therefore increases the amount of demanding credit report requests that can negatively impact your credit score.

FAQs About Andhra Pradesh Grameena Vikas Bank Personal Loan

✅ How to apply for Andhra Pradesh Grameena Vikas Bank Personal Loan?

Apply for a personal loan with Andhra Pradesh Grameena Vikas Bank by visiting the nearby branch of Andhra Pradesh Grameena Vikas Bank or you can fill a simple form and submit it with Dialabank. With Dialabank, you can get your loan approval faster and get the accessibility to apply from anywhere.

✅ What is the Interest Rate for Andhra Pradesh Grameena Vikas Bank Personal Loan?

The interest rate for Andhra Pradesh Grameena Bank Personal Loan is 9.99% per annum for their personal loan products. This rate keeps on varying with time.

✅ What is the minimum age for getting a Personal Loan from Andhra Pradesh Grameena Vikas Bank?

The minimum age to apply for a personal loan with Andhra Pradesh Grameena Vikas Bank is 21 years.

✅ What is the maximum age for getting a Personal Loan from Andhra Pradesh Grameena Vikas Bank?

The maximum age for availing of a personal loan from Andhra Pradesh Grameena Vikas Bank is 60 years.

✅ What is the minimum loan amount for Andhra Pradesh Grameena Vikas Bank Personal Loan?

The minimum loan amount for Andhra Pradesh Grameena Bank Personal Loan is Rs 50000.

✅ What is the maximum loan amount for Andhra Pradesh Grameena Vikas Bank Personal Loan?

You can avail of a maximum loan amount of Rs. 10 lakh from Andhra Pradesh Grameena Bank Personal Loan.

✅ What are the documents required for Andhra Pradesh Grameena Vikas Bank Personal Loan?

The documents required for Andhra Pradesh Grameena Vikas Bank are Aadhaar card/Voter ID, PAN card, salary slips/ITR, and two recently clicked photographs.

✅ What is the Processing Fee for Andhra Pradesh Grameena Vikas Bank Personal Loan?

Andhra Pradesh Grameena Vikas Bank charges 1% to 2% of the Loan Amount as a processing fee of the loan amount for the personal loan.

✅ How to get Andhra Pradesh Grameena Vikas Bank Personal Loan for Self Employed?

Andhra Pradesh Grameena Vikas Bank offers personal loans to Self-Employed for their financial needs. You must have the ITR files of the last two financial years for income proof.

✅ What is the Maximum Loan Tenure for Andhra Pradesh Grameena Vikas Bank Personal Loan?

The maximum loan tenure for Andhra Pradesh Grameena Vikas Bank Personal Loan is 60 months.

✅ What should be the CIBIL Score for Andhra Pradesh Grameena Vikas Bank Personal Loan?

For Andhra Pradesh Grameena Vikas Bank Personal Loan, you must have a CIBIL score 600 and above.

✅ Do I have a preapproved offer for Andhra Pradesh Grameena Vikas Bank Personal Loan?

You can avail of a preapproved offered for Andhra Pradesh Grameena Vikas Bank Personal Loan through Dialabank. For this, you fill a simple form and choose the best offer for your personal loan.

✅ How to calculate EMI for Andhra Pradesh Grameena Vikas Bank Personal Loan?

For the calculation of EMI for Andhra Pradesh Grameena Vikas Bank Personal Loan, using the EMI calculator available at Dialabank’s website.

✅ How to pay Andhra Pradesh Grameena Vikas Bank Personal Loan EMI?

Your Andhra Pradesh Grameena Vikas Bank personal loan EMIs are deducted automatically from your bank account every month. You can use the internet banking facility for paying the EMIs.

✅ How to close Andhra Pradesh Grameena Vikas Bank Personal Loan?

When you receive no dues certificate from Andhra Pradesh Grameena Vikas Bank Personal Loan, after paying all the outstanding loan amount.

✅ How to check Andhra Pradesh Grameena Vikas Bank Personal Loan Status?

You will require to visit the Andhra Pradesh Grameena Vikas Bank branch to know about your personal loan status. On the other hand, visit Dialabank and fill the form.

✅ How to close Andhra Pradesh Grameena Vikas Bank Personal Loan Online?

The following steps are to be followed for the closing of personal loan from Andhra Pradesh Grameena Vikas Bank:

- Visit the internet-banking page of Andhra Pradesh Grameena Vikas Bank.

- Login by filling your details.

- Pay for your personal loan and save the transaction receipt.

✅ How to pay Andhra Pradesh Grameena Vikas Bank Personal Loan EMI Online?

You can pay EMI through the net-banking services of Andhra Pradesh Grameena Vikas Bank. Dialabank helps you in comparing the offers and schemes of different banks so that you can choose the best. You just have to fill a simple form and the rest will do by the bank.

✅ How to check Personal Loan Balance in Andhra Pradesh Grameena Vikas Bank?

You will contact the customer care number of Andhra Pradesh Grameena Vikas Bank and check your personal loan balance. If you are searching for low-interest personal loans, visit Dialabank and fill a form for Personal Loan Balance transfer, and we will do the best for you.

✅ How to download Andhra Pradesh Grameena Vikas Bank Personal Loan Statement?

You can download your Andhra Pradesh Grameena Vikas Bank’s Personal Loan Statement from the Andhra Pradesh Grameena Vikas Bank mobile banking app. You also visit the Dialabank online platform and know the offers for your personal loan.

✅ How to Top Up Personal Loan in Andhra Pradesh Grameena Vikas Bank?

You will need to visit the bank branch and come in contact with the loan officer if you need a top-up on your personal loan from Andhra Pradesh Grameena Vikas Bank. Also, you can fill a form with Dialabank at Personal Loan Top Up and the rest will do by us.

✅ What happens if I don’t pay my Andhra Pradesh Grameena Vikas Bank Personal Loan EMIs?

If you are unable to pay your personal loan EMIs, Andhra Pradesh Grameena Vikas Bank will charge a penal interest. You can apply for a balance transfer through Dialabank and get low-interest personal loans.

✅ What relaxation scheme and moratorium Andhra Pradesh Grameena Vikas Bank provides in relation to Personal Loan due to Covid 19?

A six-month moratorium on various term loans has been declared to some degree to minimize its impact. Andhra Pradesh Grameena Vikas Bank announced an RBI-mandated one-time gain from the Andhra Pradesh Grameena Vikas Bank loan restructuring after the six-month moratorium was terminated.

✅ How to find the Andhra Pradesh Grameena Vikas Bank Personal Loan account number?

You will require to contact your Andhra Pradesh Grameena Vikas Bank branch Personal Loan to know your account number. You can also fill the form which is available at Dialabank and we will do the best work for you.

✅ What is the Andhra Pradesh Grameena Vikas personal loan customer care number?

Contact 9878981166 for any queries.

✅ What are the Andhra Pradesh Grameena Vikas Personal Loan pre-closure charges?

You can easily close your personal loan with Andhra Pradesh Grameena Vikas Bank after the first EMI. Bank does not charge any foreclosure fee.

✅ What is the Andhra Pradesh Grameena Vikas personal loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgment of the balance amount you have paid.

✅ What is the Andhra Pradesh Grameena Vikas Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like manner reimburse the got out totally at whatever point the condition is ideal. From this time forward, it is possibly the most favored credit choices that benefitted to meet changing individual supporting necessities unbounded.