Bank of Maharashtra Personal Loan Key Features Jan 2021

| Eligibility Criteria | Details |

| Age | 21 – 60 Years |

| CIBIL | Minimum 750 or above |

| Bank of Maharashtra Personal Loan Interest Rate | 6.95% per annum |

| Lowest EMI per lakh | Rs. 1800 |

| Tenure | 12 to 84 months |

| Bank of Maharashtra Personal Loan Processing Fee | 1% |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | Rs. 3 lakh |

| Maximum Loan Amount | Rs. 20 Lakh |

Each Feature Explained in Detail Below

Bank of Maharashtra Personal Loan Eligibility Criteria

Eligibility criteria for a personal loan:

| CIBIL score | 750 and Above |

| Age | 21-60 years |

| Min Income | Rs 25000/month |

| Occupation | Salaried/Self-employed |

Bank of Maharashtra Personal Loan Interest Rates and Charges

| Bank of Maharashtra Personal Loan Interest Rate | 6.95% per annum |

| Bank of Maharashtra Personal Loan Processing Charges | 1% |

| Prepayment Charges | NIL |

| Stamp Duty | As per state laws |

| Cheque Bounce Charges | As per bank terms |

| Penal Interest | N/A |

| Floating Rate of Interest | Not Applicable |

Bank of Maharashtra Personal Loan Documents Required

| Form | Duly filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Bank of Maharashtra Personal Loan EMI Calculator

Bank of Maharashtra Personal Loan Compared to Other Banks

| Particulars | Bank of Maharashtra | HDFC Bank | Bajaj Finserv | Axis Bank | Citibank | Private Bank |

| Interest Rate | 6.95% | 10.50% to 21.50% | Starting from 12.99% | 7.35% to 24% | Starting from 10.50% | 10.50% to 19.25% |

| Tenure | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Loan amount | Up to Rs. 10 lakh | Up to Rs. 40 lakh | Up to Rs. 25 lakh | Rs. 50,000 to Rs. 15 lakh | Up to Rs. 30 lakh | Up to Rs. 20 lakh |

| Processing Fee | Up to 1% of the loan amount | Up to 2.50% of the loan amount | Up to 3.99% of the loan amount | Up to 2% of the loan amount | Up to 3% of the loan amount | Up to 2.25% of the loan amount |

Why should you apply for a Bank of Maharashtra Personal Loan with Dialabank?

- Dialabank is a team of professionals that will help you find the financial product according to your personal needs.

- We provide a wide range of products and have served many happy customers.

- With Dialabank, you get trust and convenience at your fingertips.

How to Calculate EMIs for Bank of Maharashtra Personal Loan

You need three parameters to calculate your EMIs

- Amount of the Loan

- Rate of Interest

- Tenure

Use these values in the calculator below to find your monthly EMIs

Bank of Maharashtra Personal Loan Processing Time

A Personal loan from the Bank of Maharashtra is processed within a week. Existing customers and pre-verified customers can get their loans approved within 48 hours.

Bank of Maharashtra Personal Loan Preclosure charges

- You get a foreclosure facility on your personal loan from the Bank of Maharashtra without any extra charges.

- If you have the required funds, you can apply for foreclosure and pay back your loan before the end of your tenure.

Bank of Maharashtra Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like way repay the got out absolutely at whatever point the condition is ideal. From this time forward, it is potentially the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.

Apply for an overdraft office as a Bank of Maharashtra solitary an unexpected new turn of events. The adaptable improvement office has all the gigantic features of a slight overdraft credit.

Pre Calculated EMI for Personal Loan

Different Personal Loan offers by Bank of Maharashtra

Bank of Maharashtra Marriage Loan

You can apply for a personal loan to meet all the expenses of a marriage, be it yours or that of family members. You will get a loan amount that will cover all your needs at affordable rates of interest.

Bank of Maharashtra Personal Loan for Government Employees

Government employees get extra benefits and a reduction in their personal loan interest rates for personal loans.

Bank of Maharashtra Doctor Loan

Medical professionals and doctors receive extra benefits and an extended period to repay their loans. They can use a personal loan for both their personal and professional needs.

Bank of Maharashtra Personal Loan for Pensioners

- Less Paperwork

- Affordable Interest Rate

You can apply for a Personal loan through Dialabank

Bank of Maharashtra Personal Loan Balance Transfer

If your current and existing personal loan is high interest, you can apply for a personal loan balance transfer to transfer your loan to another bank at lower rates and a better tenure period.

Bank of Maharashtra Personal Loan Top Up

If you feel the need for extra money, instead of applying for a fresh loan, you can get a loan top-up on your existing personal loan.

Bank of Maharashtra Personal Loan Status

Check the status of your personal loan by visiting the nearest Bank of Maharashtra branch and asking your banker.

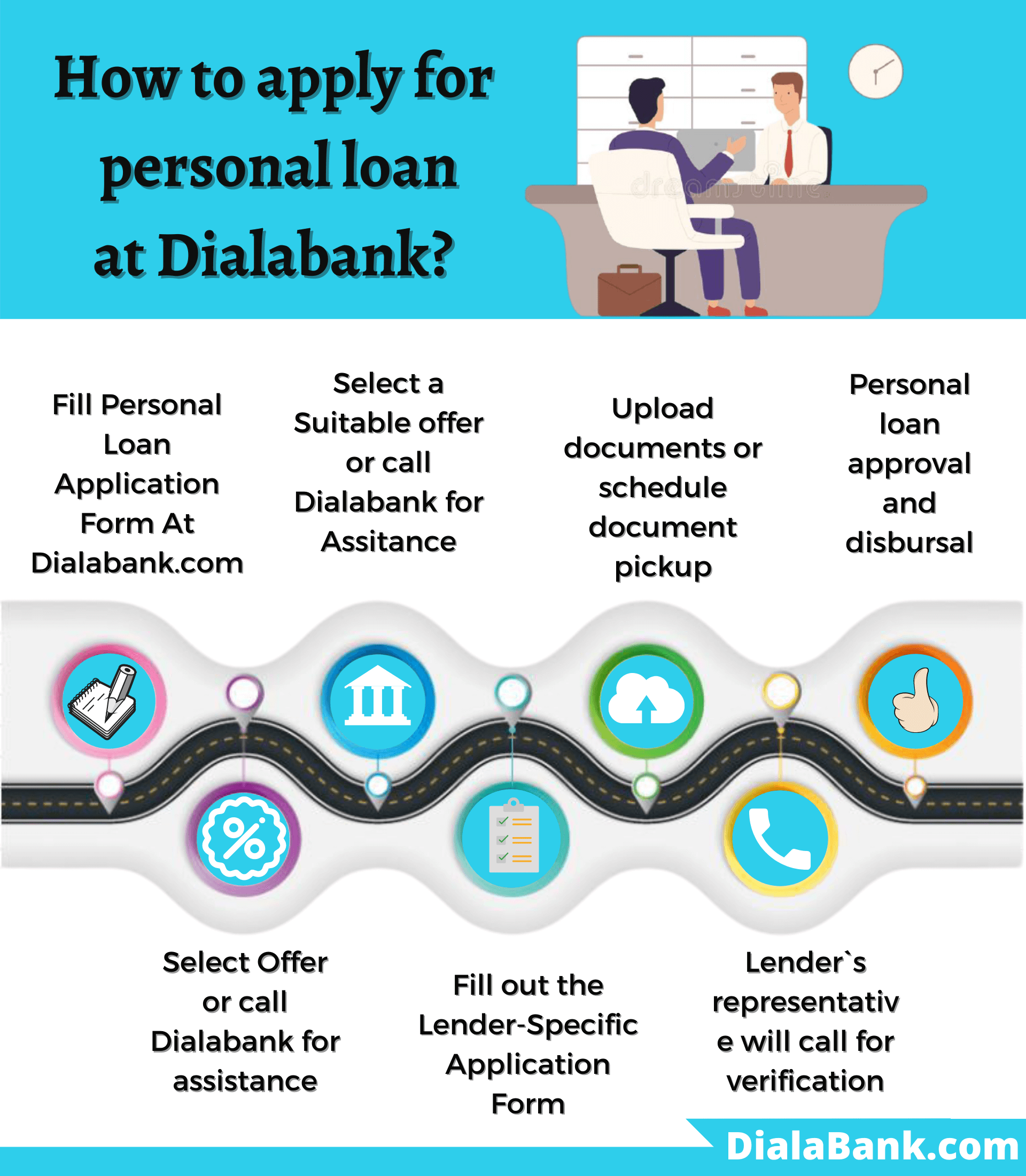

How to Apply for Bank of Maharashtra Personal Loan?

- Visit Dialabank.

- Fill the online application for Personal Loan.

- Don’t forget to enter the contact number in the application form.

- Further, you can check the personal loan eligibility criteria and interest rates online.

- The whole process is very easy and simple.

FAQs About Bank of Maharashtra Personal Loan

✅ How to apply for a Bank of Maharashtra Personal Loan?

You can apply for a personal loan with the Bank of Maharashtra either:

- Visiting the nearest branch of the Bank of Maharashtra with your documents.

- Through a simple form submission with Dialabank.

Dialabank gives you a convenient and quick online option to apply from anywhere and anytime.

✅ What is the Interest Rate for the Bank of Maharashtra Personal Loan?

Bank of Maharashtra charges an interest rate for a personal loan starting from 10.95% per annum.

✅ What is the minimum age for getting a Personal Loan from the Bank of Maharashtra?

Your age should be a minimum of 21 years to apply for a personal loan with the Bank of Maharashtra.

✅ What is the maximum age for getting a Personal Loan from the Bank of Maharashtra?

The maximum age for getting a personal loan from the Bank of Maharashtra is 60 years at the time of loan maturity.

✅ What is the minimum loan amount for the Bank of Maharashtra Personal Loan?

The minimum loan amount for a personal loan from the Bank of Maharashtra is Rs. 3 lakh.

✅ What is the maximum loan amount for the Bank of Maharashtra Personal Loan?

Bank of Maharashtra allows you to borrow a maximum loan amount of Rs. 20 lakhs under their personal loan scheme.

✅ What are the documents required for the Bank of Maharashtra Personal Loan?

You will require your identity proof (Aadhaar card/Voter ID), PAN card, income proof (salary slips/ITRs), and two recent photographs for a personal loan with the Bank of Maharashtra.

✅ What is the Processing Fee for the Bank of Maharashtra Personal Loan?

Bank of Maharashtra charges a processing fee of up to 1% of the loan amount personal loan.

✅ How to get a Bank of Maharashtra Personal Loan for Self Employed?

Bank of Maharashtra provides special offers for self-employed borrowers that have been filing their ITRs for the last two years. You can use this personal loan to meet all your needs.

✅ What is the Maximum Loan Tenure for Bank of Maharashtra Personal Loan?

The maximum tenure period for a personal loan from the Bank of Maharashtra is 84 months.

✅ What should be the CIBIL Score for the Bank of Maharashtra Personal Loan?

You need to have a minimum CIBIL score of 750 or above for availing of a personal loan from the Bank of Maharashtra.

✅ Do I have a preapproved offer for the Bank of Maharashtra Personal Loan?

You can check out your Bank of Maharashtra preapproved personal loan offers through Dialabank. All you need to do is fill a form. We will check the offers for you and contact you to help choose the best one.

✅ How to calculate EMI for Bank of Maharashtra Personal Loan?

You may use the EMI calculator available at Dialabank’s website for the calculation of your Bank of Maharashtra personal loan EMIs.

✅ How to pay Bank of Maharashtra Personal Loan EMI?

Your personal loan EMIs from the Bank of Maharashtra is deducted from your bank account every month. You can also use net-banking and the online payment facility of the Bank of Maharashtra.

✅ How to close Bank of Maharashtra Personal Loan?

To close a personal loan from the Bank of Maharashtra, you will need to pay all the outstanding loan amount along with any charges as applicable. Once that is done, you should collect your payment receipt and no dues certificate for future reference.

✅ How to check Bank of Maharashtra Personal Loan Status?

You will need the visit the Bank of Maharashtra branch in person to know the status of your personal loan. You can also simply fill a form by visiting Dialabank and let us do the hard work part.

✅ How to close Bank of Maharashtra Personal Loan Online?

To close a personal loan from the Bank of Maharashtra online follow these steps:

- Visit the net-banking page of the Bank of Maharashtra.

- Log in using your credentials.

- Make all the due payments for your personal loan and save the transaction receipt.

- Take a no dues certificate from the bank.

✅ How to pay Bank of Maharashtra Personal Loan EMI Online?

Your personal loan EMIs can be paid using online banking services. Dialabank helps you compare offers and deals from different banks to choose the best and lowest EMI personal loan available. Fill the form and let us do the work for you.

✅ How to check Personal Loan Balance in the Bank of Maharashtra?

To check the personal loan balance in Bank of Maharashtra, you will the customer care number of Bank of Maharashtra. If you are seeking personal loans with lower interest rates, all you have to do is visit Dialabank and fill a simple form for Personal Loan Balance Transfer, and we will do the rest for you.

✅ How to download the Bank of Maharashtra Personal Loan Statement?

The personal loan statement of the Bank of Maharashtra can be downloaded using the mobile banking app of the Bank of Maharashtra. You can also visit Dialabank and fill a simple form to compare all the offers and deals that we have for you.

✅ How to Top Up Personal Loan in Bank of Maharashtra?

To get a top-up on your personal loan from the Bank of Maharashtra, you will be required to contact the bank. You may also simply fill a form with Dialabank at Personal Loan Top Up and leave the hard work to us.

✅ What happens if I don’t pay my Bank of Maharashtra Personal Loan EMIs?

Bank of Maharashtra will charge a penal interest on your loan amount if you don’t pay your personal loan EMIs. You can apply for a personal loan balance transfer with Dialabank to get low-interest and easy EMI personal loans.

✅ What relaxation scheme and moratorium Bank of Maharashtra provides about Personal Loan due to Covid 19?

A Moratorium period of 6 (3+3) months of the personal loan.

✅ How to find the Bank of Maharashtra Personal Loan account number?

You will need to contact your Bank of Maharashtra loan branch to find your personal loan account number. You may also fill out the form available at Dialabank and we will do all the work for you.

✅What is the Bank of Maharashtra personal loan customer care number?

Contact 9878981166 for any queries.

✅What are the Bank of Maharashtra Personal Loan pre-closure charges?

- You get a foreclosure facility on your personal loan from the Bank of Maharashtra without any extra charges.

- If you have the required funds, you can apply for foreclosure and pay back your loan before the end of your tenure.

✅What is the Bank of Maharashtra personal loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgment of the balance amount you have paid.

✅What is the Bank of Maharashtra Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like way repay the got out absolutely at whatever point the condition is ideal. From this time forward, it is potentially the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.