Baroda UP Gramin Bank Personal Loan Key Features Apr 19 2024

| Eligibility Criteria | Details |

| Age | 21 – 60 Years |

| CIBIL | 675 or above |

| Baroda UP Gramin Bank Personal Loan Interest Rate | 9.99% per annum |

| Lowest EMI per lakh | N/A |

| Tenure | 12 to 60 months |

| Baroda UP Gramin Bank Personal Loan Processing Fee | 1% to 2% |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | According to the type of Loan |

| Maximum Loan Amount | Rs. 20 Lakhs |

Baroda UP Gramin Vikas Bank Personal Loan Eligibility Criteria

Eligibility criteria for a personal loan:

| CIBIL score | 675 or above |

| Age | 21 to 60 years |

| Min Income | Rs. 20,000 |

| Occupation | Salaried/Self-Employed/farmers |

Baroda UP Gramin Personal Loan Interest Rate and Charges

| Baroda UP Gramin Bank Personal Loan Interest Rate | 9.99% per annum |

| Baroda UP Gramin Bank Personal Loan Processing Charges | 1% to 2% |

| Prepayment Charges | NIL |

| Stamp Duty | As per state law |

| Cheque Bounce Charges | Rs. 100 |

| Penal Interest | As per bank terms |

| Floating Rate of Interest | Not Applicable |

Baroda UP Gramin Bank Personal Loan Documents Required

Documents required to Get Personal Loan

| Form | Duly filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Baroda UP Gramin Bank Personal Loan EMI Calculator

Personal Loan EMI Calculator online

Baroda UP Gramin Bank Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Baroda UP Gramin Bank | 9.99% | 12 to 60 months | Up to Rs. 20 lakh / – |

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 15.75% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Upto Rs. 20 lakh / Up to 2.25% of the loan amount |

Why should you apply for Baroda UP Gramin Bank Personal Loan with Dialabank?

- Best financial helpline in India

- One-click and know every offer regarding the loan

- Dialabank lets you compare offers from all the banks across the country

How to Calculate EMIs for Baroda UP Gramin Bank Personal Loan

You will need the following to calculate EMI:

- You need to provide a loan amount

- Rate of Interest

- Tenure of the loan

Baroda UP Gramin Bank Personal Loan Processing Time

Your loan application takes about a week to process because there are many parameters that need to be verified and checked. But, if you are a customer of the bank, you get approval within 48 to 72 hours.

Baroda UP Gramin Bank Personal Loan Preclosure Charges

If the fund is ready then you can apply for Preclosure for Baroda UP Gramin Personal Loan. No charges.

Baroda UP Gramin Bank Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can correspondingly repay the got out absolutely at whatever point the condition is ideal. In this way, it is maybe the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.

Apply for an overdraft as Baroda UP Gramin Bank Personal Loan. The flexible improvement office has all the enormous features of an unstable overdraft credit.

Pre Calculated EMI for Personal Loan

Types of Baroda UP Gramin Bank Personal Loan

Baroda UP Gramin Bank Marriage Loan

Feel free to apply for a Marriage Loan from Baroda UP Gramin Bank at a very affordable personal loan interest rate.

Baroda UP Gramin Bank Personal Loan for Government Employees

Central and state government employees get added benefits and discounts when applying for a personal loan. It is because their jobs hold credibility, and it is easier for banks to cross-check their details.

Baroda UP Gramin Bank Doctor Loan

If you are a doctor with more than 3 years of medical practice, you can apply for a personal loan for your all financial needs and get special rates and offers curated for you.

Baroda UP Gramin Bank Personal Loan for Pensioners

Retired government employees who draw their pension from the bank account can get a personal loan against their pension to meet their post-retirement expenses.

Baroda UP Gramin Bank Personal Loan Top Up

Need more money even after taking a personal loan? A new expense has arrived suddenly? No need to worry, apply for a top-up on your personal loan for additional funds.

Home Renovation Loan

Baroda UP Gramin Bank offers home update credit for individuals wishing to have their homes upgraded. This individual credit will back the fundamental fixes or grant the borrower to buy new home fittings, machines, and furniture. Some goliath highlights of the Baroda UP Gramin Bank Home Renovation Loan are:

- The financing cost of Baroda UP Gramin Bank Home Improvement Loan starts at as low as 11.25%.

- People will be at hazard for a progress extent of Rs. 20 Lakhh to have their home adjusted.

- The credit of Baroda UP Gramin Bank’s home replicates needs zero documentation, making the entire progress time span freed from trouble.

- As a rule, the improvement whole is credited to the record within 72 hours before the bank favours the solace.

Holiday Loan

The Baroda UP Gramin Bank’s Holiday Loan will help you with a minor issue while planning your dream move away. The fundamental highlights of the Baroda UP Holiday Loan are This individual Baroda UP Gramin advance will maintain a level of outing related costs, including booking travel tickets, standing workplaces, guided visits, and so on

- Financing costs for event drives start at 11.25 percent p.a.

- Without a lot of stretch supported position, you can do a level of up to Rs 20 Lakh.

- The quick and away from of your move away is guaranteed by made and immaterial work.

- Eager advancement blueprint and dispensing that is promptly credited to your record.

Fresher Funding

Baroda UP Gramin Bank’s Fresher Funding is essential for a general bit of insecure individual credits subject to individuals with a standard compensation. This alternative instead of Baroda UP Gramin credit is proposed to help freshers, for instance, continuing with graduated class, for example looking for their first work. Coming up next are some reasonable highlights of Baroda UP Gramin Fresher Funding’s individual credit:

- Credit extent of up to Rs 1.5 lakh

- Contenders must, at any rate, be 21 years old.

- The progression of interest for Fresher Funding depends on the up-and-comer’s profile, the financial record/score, age of the contender, and region.

NRI Personal Loan

For NRIs, Baroda UP Gramin outfits a person with advancement, understanding the necessities and dreams of NRIs. The essential progress picked one should be an Indian occupant, and the co-contender NRI must be a near family member. The Individual Loan for NRIs contains the going with highlights.

- Individual NRI advances of up to Rs. 10 lakh with versatile end-use pushes are surrendered by Baroda Gramin Bank.

- The cost of NRI Personal Loan financing starts at 15.49 percent p.a.

- The credit requires a residency of as long as three years.

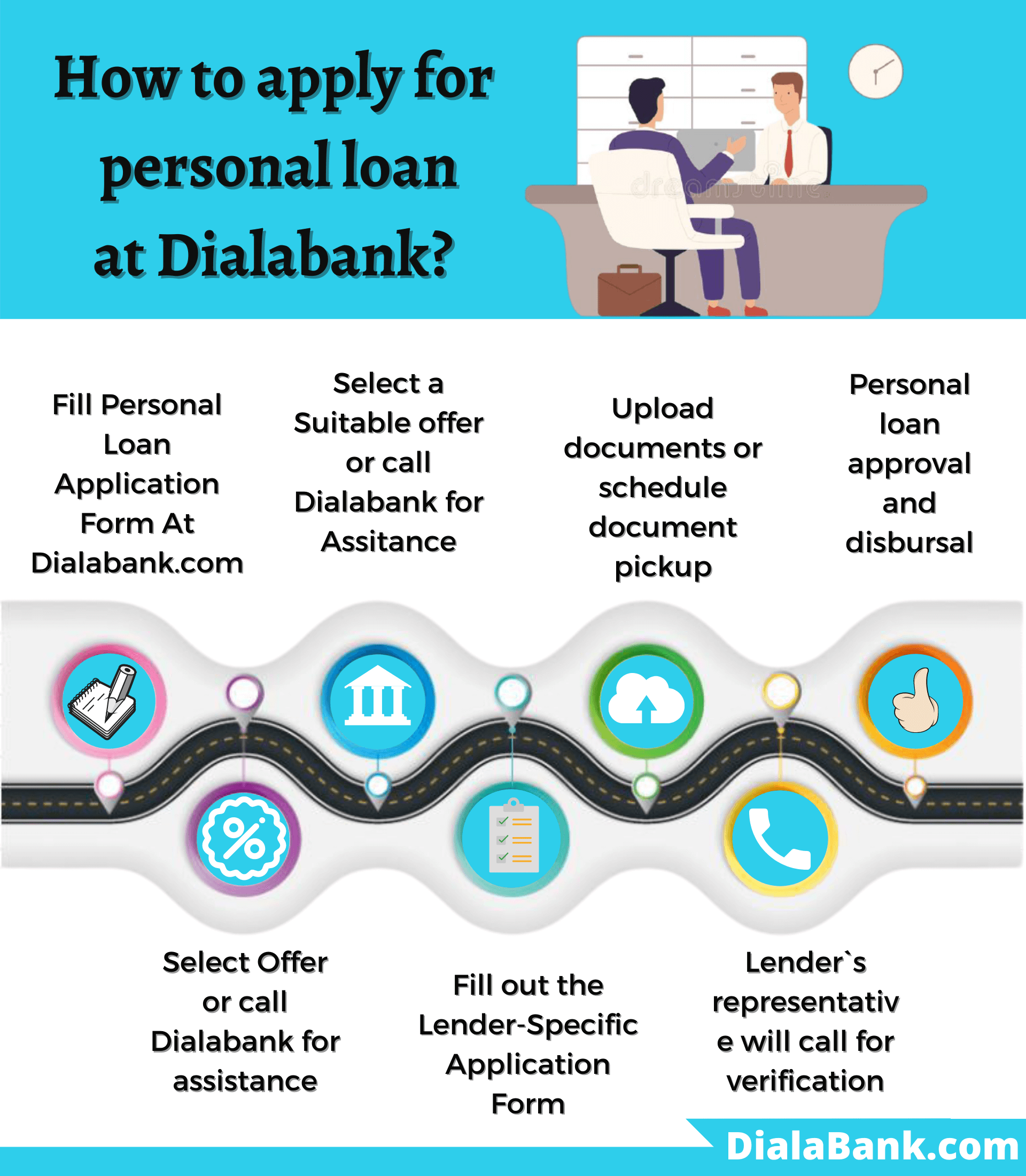

How to Apply Online for Baroda UP Gramin Bank Personal Loan?

For Personal Loan, Baroda UP Gramin Bank Personal Loan is considered to be an ideal choice whether you are applying online or offline. You can either visit the branch physically or visit Dialabank to acquire a personal loan.

- Visit the website of Dialabank.

- You can directly go to Baroda UP Gramin Bank Personal Loanon the webpage of Dialabank.

- After analyzing the best choice for you, choose the personal loan.

- Fill in your personal and employment details.

- Wait for our team to reach you.

- We will advise and assist you through the entire loan process.

- Your loan will get approved in no time.

- For more info, connect 9878981166.

Personal Loan Verification Process

The Baroda UP Gramin Bank follows the below-mentioned steps for loan verification:

Step 1 The Bank experiences Dialabank Application and push ahead.

Step 2 First step of confirmation is finished by calling the candidate.

Step 3 Post the discussion with the client, bank gathers the archives.

Step 4 Documents helps in choosing the Loan residency, financing costs and sum.

Step 5 After the arrangement of the client, the advance is dispensed.

Baroda UP Gramin Bank Personal Loan Status

- Visit the site of this bank.

- Check the personal loan eligibility.

- Fill the form with your information.

- Our managers will contact you.

How to login to the Baroda UP Gramin Bank Portal

- Check the official website of Baroda UP Gramin Bank.

- Click on ‘Login’ in the upper right corner of the screen.

- Using your User ID and Password or reported mobile number to log in

How to Check Your Loan Statement

Clients can download the bank’s very own credit proclamation by following the means given below:

- Visit the official site of the bank.

- Select ‘Connect’ and from the drop-down list, choose ‘Administration Requests’.

- On the following page that opens, under the ‘Advances’ menu, click’ Individual Loan Related.’

- Tap on ‘Request for Loan Account Statement’ first.

- Log in using your User ID and the secret word or using your enlisted versatile number and OTP to benefit from the bank’s very own credit clarification.

Baroda UP Gramin Bank Personal Loan Restructuring (COVID-19)

All through nation lockdown unreasonably affected a couple of borrowers due to the COVID-19 pandemic, and a multi-month renouncing on different term drives was expressed to control its effect on a specific degree. Baroda UP Gramin Bank articulated the RBI-guided one-time advantage by the individual credit increment of Baroda UP Gramin Bank after the half-year blacklist had wrapped up. This instrument is expected to offer assistance to those borrowers who, considering the pushing money related difficulties of the pandemic, are not yet set up to begin repayment of their standard EMI.

The credit target plan of Baroda UP Gramin Bank proposes an additional blacklist of as long as two years or headway of the current reimbursement term to decrease EMI disengages from month to month. As a significant concern, it is essential that the recuperation of your individual headway from Baroda UP Gramin Bank will achieve extra stunning charges far past those of the standard improvement. Accordingly, if whatever else misfires with the hankering for not ending up defaulting on your extraordinary credit, you can basically use this assistance instrument.

Baroda UP Gramin Bank Customer Care

Customers can contact Baroda UP Gramin Bank customer care via any of the following means:

- By Phone: You can call Baroda UP Gramin Bank on 9878981166 (toll-free)

- Callback Request: You can also request a call back by visiting the bank’s website

- Online Chatbot: You can also get your queries answered by the iPal chatbot online

- Branch Visit: You can visit the nearby Baroda UP Gramin Bank branch to get your queries.

Benefits of Applying for Personal Loan on Dialabank

There are several points of concern when applying for a personal advance on the Dialabank website. Underneath some of them are provided:

- 24 x 7 Availability: At whatever point and anyplace you can get to the site of Dialabank, and thusly, when your home or office is agreeable, apply for individual development.

- Numerous moneylenders: Dialabank engages you to get singular credit offers from different planned advance experts on a single stage and along these lines wipes out the need to visit distinctive bank locales or branches.

- Know EMI: On a personal loan EMI calculator, you can check the EMIs you would be paying on an individual credit even before you apply for one. It will help you with getting the reasonable total that you can without a very remarkable stretch repay and have a supportive repayment plan.

- Liberated from cost: Additionally, you are not supposed to pay any charges when you apply for an individual advance on Dialabank.

Important Aspects

Below are some critical points you ought to consider while applying for an individual Baroda UP Gramin Bank credit:

- It is ideal to check your money related assessment in any condition while applying for an individual new turn of events. The chances of your credit keep up are worked by a strong credit evaluation and can allow you to benefit by an individual movement on better harmony.

- Before picking a specific bank, it is shrewd to think about the cost of an individual credit (premium expense and each and every sensible expense and charge) offered by different moneylenders on Dialabank.

- Secure as shown by the need and reimbursement limit. Make the significant steps not to win since you’re set up to get a higher whole. It just adds to the expense of your supported position and has a sensible couple of focal spotlights over the long haul.

- Make the principal steps not to apply all the while with various moneylenders for solitary advances. This shows that you are prepared for credit and widens the proportion of complex credit report rules, which can ridiculously affect your FICO score.

FAQs About Baroda UP Gramin Bank Personal Loan

✅ How to apply for Baroda UP Gramin Bank Personal Loan?

You can apply for a personal loan with Baroda UP Gramin Bank either by visiting the nearby Baroda UP Gramin Bank branch or through a simple form submission with Dialabank. With Dialabank, you get the satisfaction to apply from anywhere and get quick online approval.

✅ What is the Interest Rate for Baroda UP Gramin Bank Personal Loan?

Baroda UP Gramin Bank charges an interest rate that starts at 9.99% per annum for their personal loan products.

✅ What is the minimum age for getting a Personal Loan from Baroda UP Gramin Bank?

You should be 21 years old to apply for a personal loan with Baroda UP Gramin Bank.

✅ What is the maximum age for getting a Personal Loan from Baroda UP Gramin Bank?

The maximum age for availing of a personal loan from Baroda UP Gramin Bank is 60 years.

✅ What is the minimum loan amount for Baroda UP Gramin Bank Personal Loan?

The minimum loan amount for Baroda UP Gramin Bank Personal Loan depends on the type of loan.

✅ What is the maximum loan amount for Baroda UP Gramin Bank Personal Loan?

Baroda UP Gramin Bank lets you take a maximum loan amount of Rs. 20 lakhs under the personal loan scheme.

✅ What are the documents required for Baroda UP Gramin Bank Personal Loan?

You will require an Aadhaar card/Voter ID, PAN card, salary slips/ITR, and two recently clicked photographs that are required for a personal loan from Baroda UP Gramin Bank.

✅ What is the Processing Fee for Baroda UP Gramin Bank Personal Loan?

The processing fee for Baroda UP Gramin Bank is 1% to 2%.

✅ How to get Baroda UP Gramin Bank Personal Loan for Self Employed?

Baroda UP Gramin Bank has special offers for self-employed borrowers to help them monetarily. You will have to present the ITR files of the last two years as your income proof.

✅ What is the Maximum Loan Tenure for Baroda UP Gramin Bank Personal Loan?

The maximum tenure period for a personal loan from Baroda UP Gramin Bank is 60 months.

✅ What should be the CIBIL Score for Baroda UP Gramin Bank Personal Loan?

You should have a CIBIL score of at least 675 or above for availing of a personal loan from Baroda UP Gramin Bank.

✅ Do I have a preapproved offer for Baroda UP Gramin Bank Personal Loan?

You can examine your preapproved personal loan offers from Baroda UP Gramin Bank through Dialabank. All you have to do is fill the form, and we will check all the offers for you and get back to you to help you choose the best one.

✅ How to calculate EMI for Baroda UP Gramin Bank Personal Loan?

You can use the EMI calculator available at Dialabank’s website to calculate your personal loan EMIs from Baroda UP Gramin Bank.

✅ How to pay Baroda UP Gramin Bank Personal Loan EMI?

Your personal loan EMIs from Baroda UP Gramin Bank are automatically take away from your bank account on a monthly basis. You can also use the net-banking services of Baroda UP Gramin Bank to pay for your personal loan.

✅ How to close Baroda UP Gramin Bank Personal Loan?

You will have to first pay all the outstanding personal loan amount and then contact the branch of Baroda UP Gramin Bank to receive your no dues certificate.

✅ How to check Baroda UP Gramin Bank Personal Loan Status?

You will need the visit the branch of Baroda UP Gramin Bank to know the status of your personal loan. Alternatively, you can visit Dialabank and fill a simple form to let us do the hard work for you.

✅ How to close Baroda UP Gramin Bank Personal Loan Online?

Closing of a personal loan from Baroda UP Gramin Bank requires the following steps:

- Visit the net-banking page of Baroda UP Gramin Bank.

- Login using your details.

- Pay for your personal loan and save the transaction receipt.

✅ How to pay Baroda UP Gramin Bank Personal Loan EMI Online?

Your personal loan EMI can be paid using the net-banking facility of Baroda UP Gramin Bank. Dialabank allows you to compare offers and deals from different banks to choose the best, low-EMI personal loan. All you have to do is fill a simple form, and we will do the rest for you.

✅ How to check Personal Loan Balance in Baroda UP Gramin Bank?

To check the personal loan balance in Baroda UP Gramin Bank, you will contact the customer care number of Baroda UP Gramin Bank. If you are searching for low-interest personal loans, you can visit Dialabank and fill a simple form for Personal Loan Balance Transfer, and we will do the hard work for you.

✅ How to download Baroda UP Gramin Bank Personal Loan Statement?

The personal loan statement of Baroda UP Gramin Bank can be downloaded through the Baroda UP Gramin Bank mobile banking app. You can visit the online platform of Dialabank and fill a simple form to compare and know about all the offers that we have for you.

✅ How to Top Up Personal Loan in Baroda UP Gramin Bank?

If you require a top-up on your personal loan from Baroda UP Gramin Bank, you will have to visit the bank branch and contact the loan officer. You can also fill a simple form with Dialabank at Personal Loan Top Up and leave the rest to us.

✅ What happens if I don’t pay my Baroda UP Gramin Bank Personal Loan EMIs?

Baroda UP Gramin Bank will charge you with penal interest if you are unable to pay your personal loan EMIs. You can apply for a balance transfer using Dialabank to avail yourself of low-interest personal loans.

✅ How to find the Baroda UP Gramin Bank Personal Loan account number?

You will need to contact your Baroda UP Gramin Bank loan branch to find your personal loan account number. You may also fill out the form accessible at Dialabank and let us do all the work for you.

✅ What is the Baroda UP Gramin bank personal loan customer care number?

9878981166 is the Baroda UP Gramin bank personal loan contact number.

✅ What are the Baroda UP Gramin bank Personal Loan pre-closure charges?

If the fund is ready then you can apply for Preclosure for Baroda UP Gramin Personal Loan. No charges.

✅ What is the Baroda UP Gramin bank Personal Loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgement of the balance amount you have paid.

✅ What is the Baroda UP Gramin Bank Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can correspondingly repay the got out absolutely at whatever point the condition is ideal. In this way, it is maybe the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.

Personal Loan In Other Banks

| Fincare Small Finance Bank Personal Loan | |

| Chaitanya Godavari Grameena Bank Personal Loan | |

| Himachal Pradesh Gramin Bank Personal Loan | |

| Dena Gujarat Gramin Bank Personal Loan |