Himachal Pradesh Gramin Bank Personal Loan Key Features Apr 20 2024

| Eligibility Criteria | Details |

| Age | 21 to 58 yrs(at loan maturity) |

| CIBIL Score | 750 |

| Himachal Pradesh Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Lowest EMI per lakh | NIL |

| Tenure | 12 to 60 Months |

| Himachal Pradesh Gramin Bank Personal Loan Processing Fee | 1% to 2% of Loan Amount |

| Prepayment Charges | Decided by bank |

| Part Payment Charges | Decided by bank |

| Minimum Loan Amount | Rs. 5000 |

| Maximum Loan Amount | Rs. 20 Lakhs |

Himachal Pradesh Gramin Bank Personal Loan Eligibility Criteria

Personal Loan Eligibility Criteria:

| CIBIL score Criteria | 750 or above |

| Age Criteria | 21 to 58 yrs |

| Min Income Criteria | Rs. 15,000 to Rs 25,000 |

| Occupation Criteria | Salaried/Self-Employed/Pensioner |

Himachal Pradesh Gramin Bank Personal Loan Interest Rate and Charges

| Himachal Pradesh Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Himachal Pradesh Gramin Bank Personal Loan Processing Charges | 1% to 2% of Loan Amount |

| Prepayment Charges | NIL |

| Stamp Duty | NIL |

| Cheque Bounce Charges | NIL |

| Penal Interest | NIL |

| Floating Rate of Interest | NIL |

Himachal Pradesh Gramin Bank Personal Loan Documents Required

| Form | Duly filled and signed the application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhaar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Proof of permanent residence Ration card, Bank Account Statement, Latest Credit Card Statement |

| Proof of Income | ITR: Last two financial years( For self-employed)

> Salary Slip: Last 6 months (Salaried Employee) > Bank Statement: Last 3 months |

Himachal Pradesh Gramin Bank Personal Loan EMI Calculator

Himachal Pradesh Gramin Bank Personal Loan Compared to Other Banks

| Particulars | Himachal Pradesh Gramin Bank | HDFC Bank | Bajaj Finserv | Axis Bank | Citibank | Private Bank |

| Interest Rate | 9.99% | 11.25% to 21.50% | Starting from 12.99% | 15.75% to 24% | Starting from 10.99% | 11.50% to 19.25% |

| Tenure | 12 to 60 Months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Loan amount | Up to Rs. 20 Lakh | Up to Rs. 40 lakh | Up to Rs. 25 lakh | Rs. 50,000 to Rs. 15 lakh | Up to Rs. 30 lakh | Up to Rs. 20 lakh |

| Processing Fee | 1% to 2% of Loan Amount | Up to 2.50% of the loan amount | Up to 3.99% of the loan amount | Up to 2% of the loan amount | Up to 3% of the loan amount | Up to 2.25% of the loan amount |

Other Loan Products from Himachal Pradesh Gramin Bank

Why should you apply for Himachal Pradesh Gramin Bank Personal Loan with Dialabank?

- Dialabank is one of the leading financial helplines in India.

- Less Documentation is required

- Fast Approval is provided to our customer

You can call at 9878981166 for any query.

How to Calculate EMIs for Himachal Pradesh Gramin Bank Personal Loan

There is a requirement of the following information to calculate Himachal Pradesh Gramin Bank’s Personal Loan:

EMI:

- Loan of the Amount

- The Interest Rate of the loan

- Tenure of the loan

Substitute the values in the calculator below and find your monthly EMIs

Himachal Pradesh Gramin Bank Personal Loan Processing Time

- Fast processing

- Need less documentation

- Processing fee up may vary and can be asked by the bank

Himachal Pradesh Gramin Bank Personal Loan Preclosure Charges

Is your fund ready? Then you can apply for Pre-closure. For more details make a call or visit the branch.

Different Offers For Himachal Pradesh Gramin Bank Personal Loan

Himachal Pradesh Gramin Bank Home Loan

Himachal Pradesh Gramin Bank offers personal loans for a home:

- The minimum age is 21 yrs

- The maximum Age should be 60 yrs

- Regular Income applicants are a must for the Home Loan

- Earn more than the required monthly income.

Personal Loan for Government Employees

- Himachal Pradesh Gramin Bank offers personal loans to all the Govt. employees

- The loan amount depends on the Company in which you are working with

Himachal Pradesh Gramin Bank Education Loan

- Himachal Pradesh Gramin Bank offers Education loans up to Rs 10 lac in India and Rs 20 lac to study Abroad

- The loan limit should be above Rs 4.00 lac

- Max Loan to study in India is Rs 10 lac

- Max Loan to Study in India is Rs 20 lac

Personal Loan for Pensioners

- A processing charge can be asked from the bank.

- Very Affordable Interest Rate

Himachal Pradesh Gramin Bank Personal Loan Balance Transfer

- Personal Loan balance transfer means the borrower transfer the sum to other institutions.

- Low-interest rates.

- Long repayment tenure.

Himachal Pradesh Gramin Bank Personal Loan Top Up

Himachal Pradesh Gramin bank’s personal loan provides top-up that means an additional amount on the existing loan.

Himachal Pradesh Gramin Bank Personal Loan Overdraft Scheme

Himachal Pradesh Gramin Bank Personal Loan Offers an Overdraft Scheme. With this, you are provided with a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Personal Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Himachal Pradesh Gramin Bank, Personal Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

Himachal Pradesh Gramin Bank Home Renovation Loan

Home update now bests the need list for by far most of the borrowers anyway funds become an obstacle at the same time. Himachal Pradesh Gramin Bank Home Renovation Loan is familiar with get your home reestablished whether it is repainting or tiling Himachal Pradesh Gramin Bank advance covers it all. The imperative highlights of the Himachal Pradesh Gramin Bank home rebuild acknowledge are according to the accompanying:

- The home upgrade credit plans and courses of action fuse fundamental documentation and no-eccentrics.

- Himachal Pradesh Gramin Bank Home credit is open for both existing and new customers.

- This individual flimsy credit is open on any occasion a financing cost of 8.00% p.a.

- The planning cost for the credit is charged at a decent movement of 0.50% close by added charge.

Himachal Pradesh Gramin Bank Holiday Loan

An event advance is just a credit taken against your journeying expenses and lodging organizations expected to add on to your move away. You can check the brand name features of the event credit to simply avow store for your fascinating dream journey:

- Himachal Pradesh Gramin Bank ensures the second disbursal of the credit advance for your excursion fun.

- The getting ready cost is charged at an inconsequential rate.

- The financing cost material to the Holiday Loan is 11.25%, and so on

Himachal Pradesh Gramin Bank Fresher Funding

Himachal Pradesh Gramin Bank has revived in the domain of credit which as of now has introduced another order of advance that is Himachal Pradesh Gramin Bank Freshers Funding. This remarkable kind of advance is available to those applicants who are graduates and as of late printed capable delegates who are searching for resources to develop a consistent future. Coming up next are the key features that the Himachal Pradesh Gramin Bank Freshers Funding show:

- A decent credit sum is given to the competitors.

- The up-and-comer must be 21 years of age or more.

- The financing cost charges are dependent upon the up-and-comer’s profile.

Himachal Pradesh Gramin Bank NRI Personal Loan

There are genuine reasons people will, as a rule, move out which routinely consolidate guidance, clinical office, work, etc For such contenders financial costs become an obstacle, such emergency singular expenses are dealt with by the unprecedented credit characterization that is Himachal Pradesh Gramin Bank NRI Personal Loan. The huge features of the individual development are as given underneath:

- Particularly genuine rates and versatile repayment residencies for the applicant.

- No assurance or security is mentioned or the advancement instalment.

- The record affirmation is should have been joined for both the Indian occupant (fundamental borrower) and the NRI up-and-comer (co-applicant).

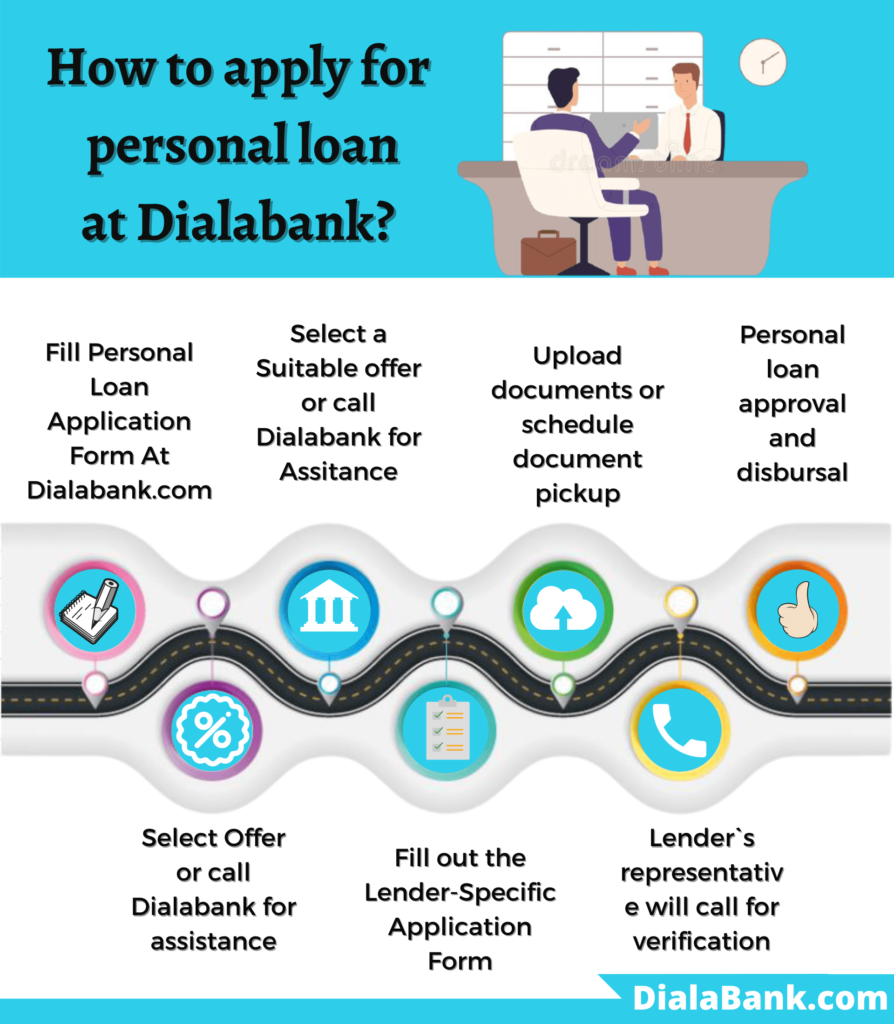

How to Apply Online for Himachal Pradesh Gramin Bank Personal Loan with Dialabank?

You can apply for Himachal Pradesh Gramin Bank online by visiting the Himachal Pradesh Gramin Bank’s online portal and filling the form for applying for a personal loan or you can simply follow the given steps for applying for a Himachal Pradesh Gramin Personal Loan –

- Visit Dialabank.

- Fill the Application form and submit it.

- After that, our experts will contact you for more discussion.

- After comparing various offers with multiple banks, get a feasible loan as per your requirements.

Personal Loan Verification Process

The following steps are a must after you apply for a Personal Loan in Himachal Pradesh Gramin Bank which is as mentioned below:

- After the completion of the application form through Dialabank, the bank further proceeds with the application.

- The bank person will give a call after the verification of the application.

- Bank books an appointment for the collection of the papers after telephone verification.

- The further procedure of verifying documents takes place.

- After the second verification, the loan amount, tenure and rate of interest is decided.

- Once the affirmation of customer the bank grants the loan.

Check your Himachal Pradesh Gramin Bank Personal Loan Application Status

You can check the status of your Himachal Pradesh Gramin Bank Personal Loan by the following methods –

- You can likewise hit your loan department and ask the manager for the corresponding.

- Log In to the Himachal Pradesh Gramin Bank Net banking Portal, Bang on loans from the top ribbon, and click on Enquire to monitor the situation of your investment.

- Explore for ‘personal loan status’ on Google, initiate the first link which will take you to the Loan Status Tracker webpage of Himachal Pradesh Gramin Bank, and fill in the necessary data to check the status of your loan.

How to Login to Himachal Pradesh Gramin Bank Portal

- Navigate through the Himachal Pradesh Gramin Bank Website.

- Log in with your Himachal Pradesh Gramin Bank login ID and Password.

- Hit the login key and get access to the bank portal easily.

Himachal Pradesh Gramin Bank Personal Loan Statement

- Visit the official website of Himachal Pradesh Gramin Bank and navigate through the page and click on the “Register New Loan”.

- Fill in all the required details.

- Now click on the submit key.

- After which you will receive an OPT that will direct you to register for Loan Statement.

Himachal Pradesh Gramin Bank Personal Loan Restructuring (COVID-19)

In the midst of the heaviness of COVID-impelled lockdown, The Himachal Pradesh Gramin Bank demonstrated a drive to decrease the weight on its borrowers. The bank mentioned the RBI blacklist that finished in the critical length of September. Moreover, all the borrowers were foreseen to continue back to the past EMI plans. Regardless, the borrowers were as of not long ago in confusion concerning how to reimburse the earth-shattering with interminable monetary crunches. Considering the antagonistic circumstance Himachal Pradesh Gramin Bank presented another structure that fortifies the reason behind its borrowers acceptable by the RBI.

The helping structure is featured destressing the borrowers by plunging cash related weight. This new structure gives the borrower occasion to relax up the reimbursement residency as long as 2 years at unequivocal outcomes. The thorough extricating up will invite an additional financing cost on the exceptional entire and in this way, the advancement will be named as “Adjusted” in the credit report of the recipient. Accomplishing a comment on the borrower’s FICO rating, moreover, the borrowers are encouraged to pick the system in numerous troubling conditions notwithstanding the reimbursement plans must get the strings as in the past.

Himachal Pradesh Gramin Bank Customer Care

- Via Phone: The customers get in touch with the bank via call on 9878981166

- Via Chatbox: The chatbox is open for any suggestion or query on the official site.

- Branch Visit: The applicant can visit the bank branch for any information on loan approval.

Benefits of Applying for Personal Loan on Dialabank

Easy Access: When the up-and-comer applies for an individual advancement with Dialabank. The client can without an entirely striking stretch interface with the bank and have 24*7 openness.

Helpful EMI Calculator: You can undoubtedly know the pertinent EMI on your Personal Loan with Dialabank’s client benevolent EMI Calculator that gives exact EMI Payable on your Personal advance dependent on the financing cost.

Less Documentation: While applying for a Personal Loan with Dialabank the candidate experiences an immediate framework near to the advantages of essential documentation.

Numerous Banks at One spot: The up-and-comer is prescribed not to restrict their choices as Dialabank offers you the chance to pick and look at changed monetary affiliations immediately.

Important Aspects

The alluded to underneath are a few habitats that should be an idea about before you apply for a Personal Loan:

It is sensible to keep the improvement total as least as could be ordinary considering the current circumstance. Since the reimbursement of a lesser complete is direct and brief. The reimbursement uttermost spans of the candidate are of most over the top significance while applying for a Personal Loan so the improvement total should be profited by the need instead of benefitting higher advancement entire because of its fundamental accessibility.

The FICO rating picks whether the contender is prepared for the given credit, so it is supported to investigate the Credit Score before pitching a Loan application. By a long shot the greater part of the conditions, the weak FICO examination just prompts a straight dismissal of the application.

Go for the bank or establishment offering the high-level association and financing cost for the improvement sum you require. Consider and take a gander at before consenting to one bank. In the Credit World, the banks are offering real financing costs and residencies for the improvement total so a second exploration the banks will just profit you.

FAQs About Himachal Pradesh Gramin Bank Personal Loan

✅ How to apply for Himachal Pradesh Gramin Bank Personal Loan?

You can for a personal loan at the website of Himachal Pradesh Gramin Bank.

✅ What is the Interest Rate for Himachal Pradesh Gramin Bank Personal Loan?

Interest Rate for Himachal Pradesh Gramin Bank’s Personal Loan is 9.99% p.a.

✅ What is the minimum age for getting a Personal Loan from Himachal Pradesh Gramin Bank?

The Minimum Age to apply for Himachal Pradesh Gramin Bank’s Personal Loan is 21 years.

✅ What is the maximum age for getting a Personal Loan from Himachal Pradesh Gramin Bank?

The maximum age you need for applying for Himachal Pradesh Gramin Bank’s Personal Loan is 60 years

✅ What is the minimum loan amount for Himachal Pradesh Gramin Bank Personal Loan?

The minimum loan amount Himachal Pradesh Gramin Bank’s Personal Loan can be asked from the bank by calling them or by visiting personally.

✅ What is the maximum loan amount for Himachal Pradesh Gramin Bank Personal Loan?

The maximum loan amount for Himachal Pradesh Gramin Bank’s Personal Loan is Rs. 20 Lakh, but it may vary.

✅ What are the documents required for Himachal Pradesh Gramin Bank Personal Loan?

You need Proof of Identity, Proof of income, and address proof to apply for Himachal Pradesh Gramin Bank’s Personal Loan.

✅ What is the Processing Fee for Himachal Pradesh Gramin Bank Personal Loan?

The processing fee for Himachal Pradesh Gramin Bank’s Personal Loan is 1% to 2% of the Loan Amount.

✅ How to get Himachal Pradesh Gramin Bank Personal Loan for Self Employed?

You must have a good and rigid source of income and your credit history should be good to avoid rejection.

✅ What is the Maximum Loan Tenure for Himachal Pradesh Gramin Bank Personal Loan?

Maximum Loan tenure for Himachal Pradesh Gramin Bank’s Personal Loan is 60 months

✅ What should be the CIBIL Score for Himachal Pradesh Gramin Bank Personal Loan?

A good CIBIL Score less chance of Rejection. For Himachal Pradesh Gramin Bank’s Personal Loan you must have a 750 or above CIBIL Score.

✅ Do I have a preapproved offer for Himachal Pradesh Gramin Bank Bank Personal Loan?

N/A

✅ How to calculate EMI for Himachal Pradesh Gramin Bank Personal Loan?

You can calculate your EMI at any EMI calculator just you have to put the loan amount, Interest rate, and Tenure of the loan.

✅ How to pay Himachal Pradesh Gramin Bank Personal Loan EMI?

All the procedures will be explained once you applied for a personal loan and your application will get approved.

✅ How to close Himachal Pradesh Gramin Bank Personal Loan?

If your funds are ready then you can apply for Preclosure or after all the EMI’s are paid your loan will get closed.

✅ How to check Himachal Pradesh Gramin Bank Personal Loan Status?

To know the status just call the bank or check on the website i.e provided by the bank.

✅ How to close Himachal Pradesh Gramin Bank Personal Loan Online?

Dialabank is the best option for applying for Himachal Pradesh Gramin Bank’s Personal Loan with less paperwork and ease or visit the official site of the bank apply for the loan

✅ How to pay Himachal Pradesh Gramin Bank Personal Loan EMI Online?

Through Netbanking you can pay EMI for Himachal Pradesh Gramin Bank’s Personal Loan.

✅ How to check Personal Loan Balance in Himachal Pradesh Gramin Bank?

You can call the bank customer care or a timely message will be sent on your registered no.

✅ How to download Himachal Pradesh Gramin Bank Personal Loan Statement?

From the official website of the Himachal Pradesh Gramin Bank, you can download the statement.

✅ How to Top Up Personal Loan in Himachal Pradesh Gramin Bank?

You can Top up the Personal Loan in Himachal Pradesh Gramin Bank by filling the simple form or by visiting the nearest branch.

✅ What happens if I don’t pay my Himachal Pradesh Gramin Bank Personal Loan EMIs?

You may face action against you and also your CIBIL score will get affected.

✅ How to find Himachal Pradesh Gramin Bank Personal Loan account number?

After your application gets approved you will be provided with your account number for Himachal Pradesh Gramin Bank’s Personal Loan.

✅What is the Himachal Pradesh Gramin Bank Personal Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Himachal Pradesh Gramin Bank Personal loan account.

- Pay the pre-closure charges as per Himachal Pradesh Gramin Bank Personal Loan.

✅ What are Himachal Pradesh Gramin Bank Personal Loan preclosure charges?

Himachal Pradesh Gramin Bank Personal Loan preclosure charges are Nil.

✅ What is the Himachal Pradesh Gramin Bank Personal Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at Himachal Pradesh Gramin Bank Personal Loan is provided, it gives you an online way to get your own overdraft, also known as Smartdraft – Overdraft Against Salary. You do not need to visit bank branches and go through a boring process. Just log in to the Himachal Pradesh Gramin online banking portal and from there you can fill out a simple form and get an overdraft under your name.

✅ What is Himachal Pradesh Bank Personal Loan maximum tenure?

Himachal Pradesh Bank Personal loan maximum tenure is 60 months.

✅ What is Himachal Pradesh Bank Personal Loan minimum tenure?

Himachal Pradesh Bank Personal Loan minimum tenure is 12 months.

✅ What is the Himachal PradeshBank Personal Loan customer care number?

The customers get in touch with the bank via call on 9878981166.

Other Banks For Personal Loan

| Karnataka Vikas Grameena Bank Personal Loan | |

| Jharkhand Gramin Bank Personal Loan | |

| Kashi Gomti Samyut Gramin Bank Personal Loan | |

| Jana Small Finance Bank Personal Loan |