Home Credit Personal Loan Key Features Apr 20 2024

| Eligibility Criteria | Details |

| Age | 18 – 69 Years |

| CIBIL score | Minimum 600 or above |

| Home Credit Personal Loan Interest Rate | 9.99% per annum |

| Lowest EMI per lakh | Rs 3260 |

| Tenure | 12 to 48 months |

| Home Credit Personal Loan Processing Fee | 1% to 2% |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | Rs. 10,000 |

| Maximum Loan Amount | Rs. 2.4 Lakh |

Home Credit Personal Loan Eligibility Criteria

Eligibility criteria for a personal loan to get maximum benefits:

| CIBIL score | 600 and Above |

| Age | 18-69 years |

| Min Income | Rs. 25000/month |

| Occupation | Salaried/Self-employed |

Home Credit Personal Loan Fees and Other Charges

| Home Credit Personal Loan Interest Rate | 9.99% per annum |

| Home Credit Personal Loan Processing Charges | 1% to 2% |

| Prepayment Charges | NIL |

| Stamp Duty | As per state laws |

| Cheque Bounce Charges | As per bank terms |

| Penal Interest | As per terms of the loan |

| Floating Rate of Interest | Not Applicable |

Home Credit Personal Loan Documents Required

| Form | Duly filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Home Credit Personal Loan EMI Calculator

Home Credit Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Home Credit | 9.99% | 12 to 48 months | Up to Rs. 2.4 lakh / Up to 3% of the loan amount |

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 15.75% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Upto Rs. 20 lakh / Up to 2.25% of the loan amount |

Other Loan Products

| Gold Loan | Car Loan | Home Loan | Business Loan |

| TWL | LAP | Credit Card | Education Loan |

Why should you apply for Home Credit Personal Loan with Dialabank?

Dialabank provides convenient options and great deals for all your financial needs. We are professionals who thrive to fulfil your monetary needs and help you overcome all your financial problems. Our team will make sure you are completely satisfied.

How to Calculate EMIs for Home Credit Personal Loan

You can use your loan amount, rate of interest and tenure to calculate your personal loan EMI using the personal loan EMI calculator given below.

Home Credit Personal Loan Processing Time

You can easily get your personal loan application approved within a few hours through the online submission of documents. Home Credit mobile app can be used to get instant anytime loans.

Home Credit Personal Loan Preclosure Charges

Home Credit allows you the flexibility to prepay your loan any time after the first EMI. You will not be charged with any foreclosure fees or charges.

Pre Calculated EMI for Personal Loan

Types of Home Credit Personal Loans

Personal Loan for Government Employees

Personal Loan schemes that are tailored made for employees of government provide benefits such as low-interest rates, flexible tenure, and discounts on various fees and charges.

Personal Loan for Doctors

Medical professionals and doctors who have been in practice for at least four years can enjoy the personal loan benefits specifically curated to their personal and professional needs.

Personal Loan for Pensioners

Elders who draw pension and do not have any other source of income can apply for a personal loan and get their financial needs fulfilled. Banks provide special offers and loan terms to pensioners.

Personal Loan for Marriage

A personal loan helps you meet all your financial needs, marriage and wedding are some of the most celebrated events in India and thus can be heavy on pocket. Apply for a personal loan and do away with your financial worries.

Home Credit Personal Loan Balance Transfer

Balance Transfer is a type of personal loan scheme offered by banks under which you can transfer your existing high-interest loan to another bank that might be offering you lower rates and better terms.

Home Credit Personal Loan Top Up

You might feel the need for additional money even after getting a personal loan, in such a scenario, you can go for a personal loan top-up instead of applying for a fresh loan.

Home Credit Personal Loan Overdraft Scheme

Home Credit Personal Loan Offers an Overdraft Scheme. With this, you are provided with a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Personal Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In Home Credit Personal Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

Home Credit Personal Loan Status

You can check the status of your personal loan by;

- Logging into the online portal of Home Credit, or

- Through the Home Credit mobile app

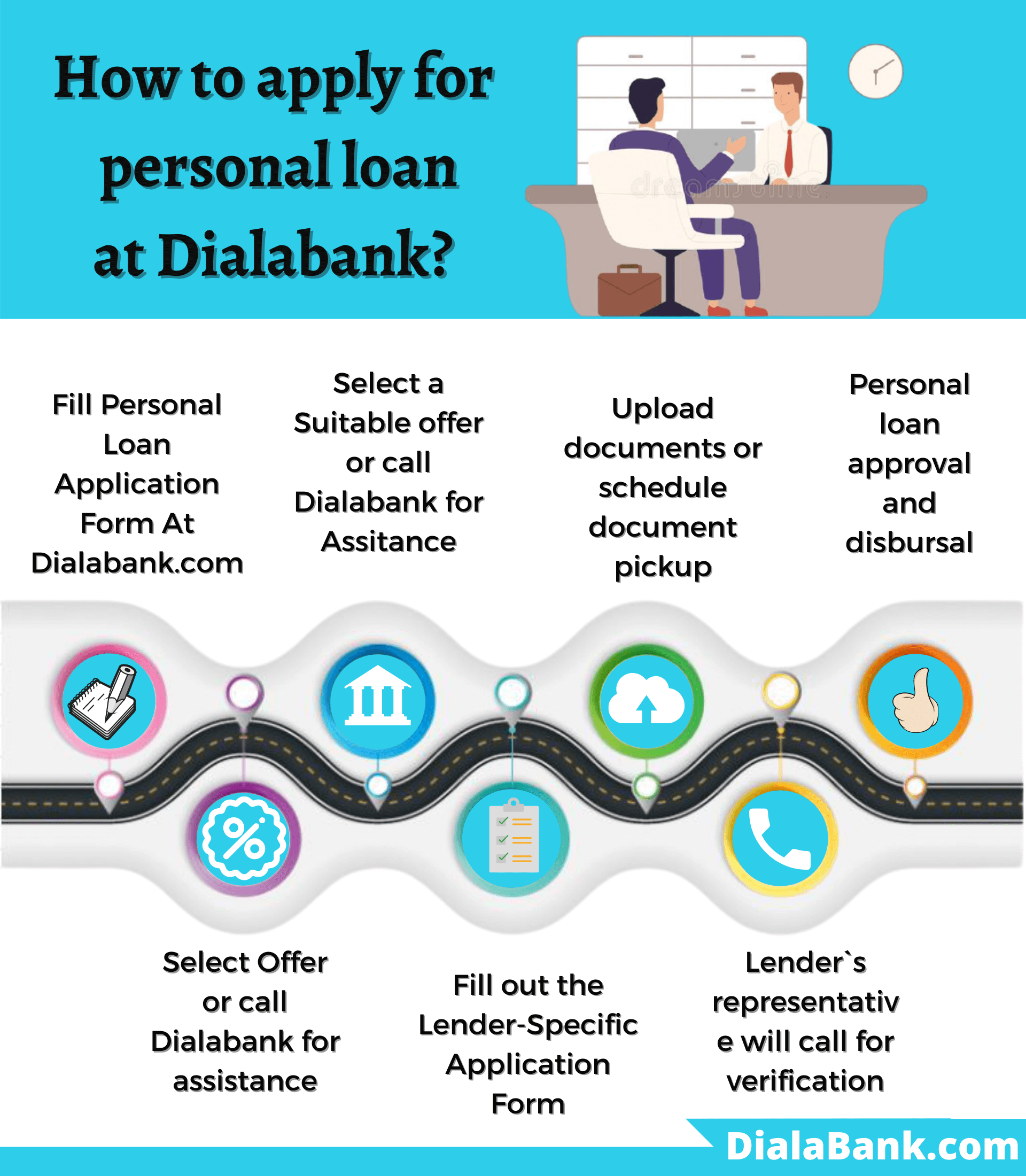

How to Apply for Home Credit Personal Loan?

Availing a personal loan online is comparatively easier than offline. With the help of technology, you can avail yourself of a Home Credit Personal Loan in no time. Given below are the instructions to follow:

- To avail of Home Credit Personal Loan online, you have to visit Dialabank online.

- Also, you can visit Home Credit Personal Loan on Dialabank.

- Then, you can fill a simple online form with your specifications.

- Once you submit the form, you will be called telephonically by our representatives.

- The representatives will assist you in the whole process.

- Your Home Credit Personal Loan will get approved in no time.

FAQs About Personal Loan

✅ What is a personal loan?

Personal Loans can be classified as unsecured loans that do not require you to submit any collateral security in exchange for money.

✅ How does a personal loan work?

You need to first apply and fill a form, after which the lender will verify your details and explain to you the terms. Once the documents and eligibility are approved, you get the loan amount.

✅ What is an EMI?

Equal Monthly Installment or EMI is the per month instalment that you will have to pay for your loan. EMIs make it easy to repay the loan with less burden.

✅ What is a credit score? Why is it important?

A credit score or CIBIL score is a three-digit number that describes your past repayment history. It helps your lender determine the risk involved with lending you the money.

✅ What is a prepayment of a personal loan?

Sometimes you may find yourself financially sound and would want to pay your loan before the end of its tenure. The banks and NBFCs allow you to prepay your loan and charge you a small foreclosure fee.

✅ Is the PAN card mandatory to apply for a personal loan in India?

Yes, a PAN card is a necessary document when applying for a personal loan.

✅ Can I offer collateral and get a Personal loan even if I have bad credit?

Yes, certain banks and finance companies allow you to take a personal loan in exchange for collateral.

✅ Am I eligible to get a loan if applied with a co-applicant, if I have a bad credit score?

Yes, in the case where your credit history is bad, you can apply with a co-applicant with a good credit score to get your loan approved.

✅ What relaxation scheme and moratorium Home credit Bank provides in relation to Personal Loan due to COVID 19?

A 6 months moratorium can be availed from Home credit bank.

✅ What is the Home Credit Personal Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Home Credit Personal loan account.

- Pay the pre-closure charges as per Home Credit Personal Loan.

✅ What are Home Credit Personal Loan preclosure charges?

Home Credit Personal Loan preclosure charges are Nil.

✅ What is the Home Credit Personal Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at Home Credit Personal Loan is provided, it gives you an online way to get your own overdraft, also known as Smartdraft – Overdraft Against Salary. You do not need to visit bank branches and go through a boring process. Just log in to the Home Credit online banking portal and from there you can fill out a simple form and get an overdraft under your name.

✅ What is the Home Credit Personal Loan maximum tenure?

The Home Credit Personal loan maximum tenure is 48 months.

✅ What is the Home Credit Personal Loan minimum tenure?

The Home Credit Personal Loan minimum tenure is 12 months.

✅ What is the Home Credit Personal Loan customer care number?

The customers get in touch with the bank via call on 9878981166.