Langpi Dehangi Rural Bank Car Loan Key Features – Apr 16 2024

| Eligibility Criteria | Details |

| Age | 21 – 60 Years |

| CIBIL Score | 600 or above |

| Langpi Dehangi Rural Bank Personal Loan Interest Rate | 9.99% per annum |

| Lowest EMI per lakh | Rs. 2214 |

| Tenure | 12 to 60 months |

| Langpi Dehangi Rural Bank Personal Loan Processing Fee | 1% to 2% of Loan Amount |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | No Limit |

| Maximum Loan Amount | Rs. 5 Lakhs |

Each Feature Explained in Detail Below

Langpi Dehangi Rural Bank Personal Loan Eligibility Criteria

Eligibility criteria for a personal loan:

| CIBIL score Criteria | 600 or above |

| Age Criteria | 21 to 60 years |

| Min Income Criteria | Rs. 20,000 |

| Occupation Criteria | Salaried/Self-Employed |

Langpi Dehangi Rural Bank Personal Loan Interest Rate and Charges

Some of the samples of personal loan interest rates are-

| Langpi Dehangi Rural Bank Personal Loan Interest Rate | 9.99% per annum |

| Langpi Dehangi Rural Bank Personal Loan Processing Charges | 1% to 2% of Loan Amount |

| Prepayment Charges | NIL |

| Stamp Duty | As per state law |

| Cheque Bounce Charges | Rs. 100 |

| Penal Interest | As per bank terms |

| Floating Rate of Interest | Not Applicable |

Langpi Dehangi Rural Bank Personal Loan Documents Required

| Form | Duly filled application form |

| Proof of Identity | Copy of: -Passport -Driving License -Aadhar Card -Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | -ITR: Last two Assessment years -Salary Slip: Last 6 months -Bank Statement: Last 3 months |

Documents required to Get Personal Loan

Langpi Dehangi Rural Bank Personal Loan EMI Calculator

Personal Loan EMI Calculator online

Langpi Dehangi Rural Bank Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Langpi Dehangi Rural Bank | 9.99% | 12 to 60 months | Up to Rs. 5 lakh / 1% to 2% of Loan Amount |

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 15.75% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh / Up to 2.25% of the loan amount |

Other Loan Products from Langpi Dehangi Rural

Why should you apply for Langpi Dehangi Rural Bank Personal Loan with Dialabank?

Dialabank is India’s first financial helpline, and we work diligently to bring the best financial products to you. Our team makes sure that your information is safe and that you leave satisfied with our service. A personal loan EMI calculator will help you to have your estimation to a great extent.

We at Dialabank have already helped thousands of people to get the loan they need without any issue, and we look forward to continuing in doing so. So apply with us today to get the offers and special deals on Langpi Dehangi Rural Bank Personal Loan.

Call us at 9878981166 to avail of the Langpi Dehangi Rural Bank Personal Loan.

How to Calculate EMIs for Langpi Dehangi Rural Bank Personal Loan

You can calculate your EMIs using our EMI calculator.

Langpi Dehangi Rural Bank Personal Loan Processing Time

Langpi Dehangi Rural Bank has a general processing time of 48 to 72 hours for your loan application. So one needs to check the personal loan eligibility also

Langpi Dehangi Rural Bank Personal Loan Preclosure Charges

Langpi Dehangi Rural Bank allows you to pre-close your personal loan without any foreclosure fee.

Langpi Dehangi Rural Bank Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can, in like manner, reimburse the got out totally at whatever point the condition is ideal. From this time forward, it is possibly the most favoured credit choices that benefitted from meeting changing individual supporting necessities unbounded.

Apply for an overdraft office as a Bank for a startling new unforeseen development. The adaptable improvement office has all the goliath highlights of a slight overdraft credit.

Pre Calculated EMI for Personal Loan

Different Personal Loan offers Langpi Dehangi Rural Bank

Langpi Dehangi Rural Bank Marriage Loan

Weddings are the costliest events of Indian households, and a personal loan can help you manage your marriage budget and requirements in a better way.

Personal Loan for Government Employees

Government employees can avail of special offers and discounts for their personal loan needs from Langpi Dehangi Rural Bank.

Langpi Dehangi Rural Bank Doctor Loan

Doctors who have been practising for more than 4 years can apply for personal loan offers that are customized to meet their personal and professional needs.

Langpi Dehangi Rural Bank Personal Loan for Pensioners

Retired employees of central and state governments who draw their pension from the bank account of Langpi Dehangi Rural Bank can get a personal loan for all their post-retirement expenses.

Langpi Dehangi Rural Bank Personal Loan Balance Transfer

You can transfer your personal loan with costly EMIs from an existing bank to Langpi Dehangi Rural Bank for better rates and offers.

Langpi Dehangi Rural Bank Personal Loan Top Up

Apply for a Langpi Dehangi Rural Bank personal loan top-up if you require extra money rather than applying for a fresh loan.

Personal Loan Status

To check the status of your Langpi Dehangi Rural Bank personal loan, you will have to visit the bank branch in person.

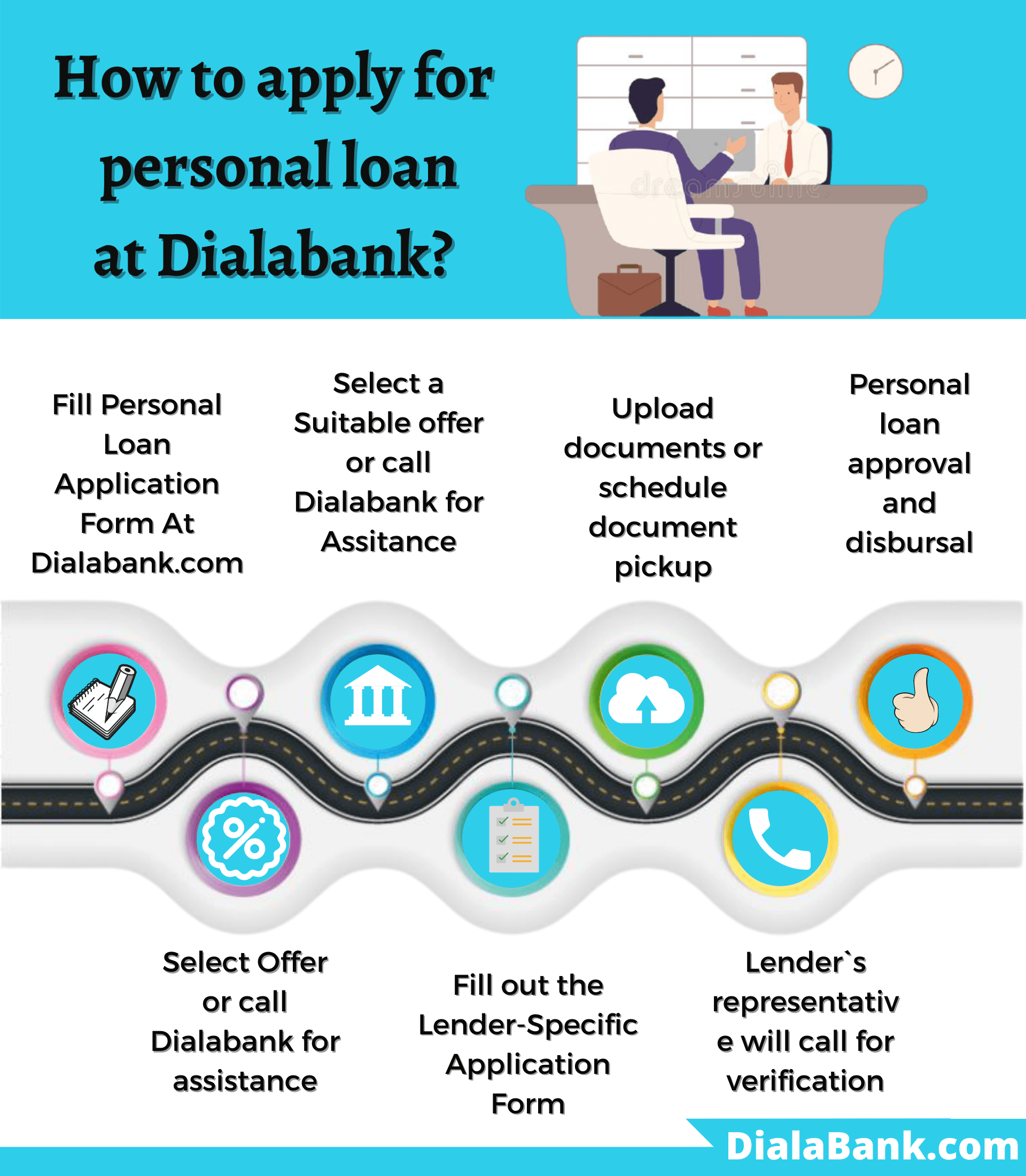

How to Apply for Langpi Dehangi Rural Bank Personal Loan?

- Visit Dialabank

- Go to the Langpi Dehangi Rural Bank page.

- Fill in your details in the personal loan application form.

- Wait for our team to contact you and help you get the best offers.

FAQs About FAQs About Langpi Dehangi Rural Bank Personal Loan

✅ How to apply for Langpi Dehangi Rural BankPersonal Loan?

You can apply for a personal loan at Langpi Dehangi Rural Bank by visiting the nearest branch or by applying through the official website. You also have a better option, i.e. Dialabank, in which all your worries will be ours.

✅ What is the Interest Rate for Langpi Dehangi Rural BankPersonal Loan?

Langpi Dehangi Rural Bank charges an interest rate of 9.99% per annum on all personal loan products.

✅ What is the minimum age for getting a Personal Loan from Langpi Dehangi Rural Bank?

The minimum age criteria set by Langpi Dehangi Rural Bank for personal loan applicants is 21 years.

✅ What is the maximum age for getting a Personal Loan from Langpi Dehangi Rural Bank?

The maximum age you must apply for the personal loan at Langpi Dehangi Rural Bank is 60 years.

✅ What is the minimum loan amount for Langpi Dehangi Rural Bank Personal Loan?

The minimum loan amount for the personal loan at Langpi Dehangi Rural Bank has no limits.

✅ What is the maximum loan amount for Langpi Dehangi Rural Bank Personal Loan?

Langpi Dehangi Rural Bank allows you to take the maximum amount of Rs. 5 lakh.

✅ What are the documents required for Langpi Dehangi Rural Bank Personal Loan?

You need to show your Aadhaar card or Voter ID, PAN card, salary slips, or ITR, and two recently clicked photographs to avail yourself of the personal loan from Langpi Dehangi Rural Bank.

✅ What is the Processing Fee for Langpi Dehangi Rural Bank Personal Loan?

Langpi Dehangi Rural Bank charges 1% to 2% of the Loan Amount as a processing fee.

✅ How to get Langpi Dehangi Rural Bank Personal Loan for Self Employed?

Langpi Dehangi Rural Bank provides special offers to Self Employed applicants. All you need to show is ITR files of the last three years as your income proof.

✅ What is the Maximum Loan Tenure for Langpi Dehangi Rural Bank Personal Loan?

The maximum loan tenure for a Personal Loan from Langpi Dehangi Rural Bank is 60 months.

✅ What should be the CIBIL Score for Langpi Dehangi Rural Bank Personal Loan?

It would help if you had a CIBIL score of at least 750 or above to avoid the risk of rejection in the personal loan application at Langpi Dehangi Rural Bank.

✅ Do I have a preapproved offer for Langpi Dehangi Rural Bank Personal Loan?

To know the preapproved offer for the personal loan from Langpi Dehangi Rural Bank, you can contact Dialabank to see every detail.

✅ How to calculate EMI for Langpi Dehangi Rural Bank Personal Loan?

You can use the EMI calculator to calculate the EMI of Langpi Dehangi Rural Bank. It is available on the website of Dialabank.

✅ How to pay Langpi Dehangi Rural Bank Personal Loan EMI?

Your EMI’s for the personal loan will get automatically deducted from your Bank account monthly. You can also use net banking.

✅ How to close Langpi Dehangi Rural Bank Personal Loan?

If your funds are ready, you can apply for Preclosure, or after all the EMI’s are paid, your loan will get closed.

✅ How to check Langpi Dehangi Rural Bank Personal Loan Status?

To know the status of a Personal Loan, you need to call the bank or check on the official website, i.e. provided by the bank.

✅ How to close Langpi Dehangi Rural Bank Personal Loan Online?

Dialabank is the best option for applying for a Personal Loan with less paperwork and ease or visit the official site of the bank to apply for the loan.

✅ How to pay Langpi Dehangi Rural Bank Personal Loan EMI Online?

Your loan EMIs can be paid using the online and mobile banking services of Langpi Dehangi Rural Bank.

✅ How to check Personal Loan Balance in Langpi Dehangi Rural Bank?

To check the personal loan balance in Langpi Dehangi Rural Bank, you will need to contact the customer care number of Langpi Dehangi Rural Bank. If you are looking for low-interest personal loans, you can visit Dialabank and fill a simple form for Personal Loan Balance Transfer, and we will do the hard work for you.

✅ How to download Langpi Dehangi Rural Bank Personal Loan Statement?

From the official website of the Langpi Dehangi Rural Bank, you can also download the statement from the Dialabank account.

✅ How to Top Up Personal Loan in Langpi Dehangi Rural Bank?

Langpi Dehangi Rural Bank allows you to do the top-up of the existing loan rather than opening the new one. You can also contact Dialabank for this facility.

✅ What happens if I don’t pay my Langpi Dehangi Rural Bank Personal Loan EMIs?

Langpi Dehangi Rural Bank charges penal interest on your outstanding loan amount if the EMI amount is not paid. Penal interest depends upon the bank norms.

✅ What relaxation scheme and moratorium Langpi Dehangi Rural Bank provides about Personal Loan due to Covid 19?

A period of 6 months can be offered to eligible applicants by Langpi Dehangi Rural Bank.

✅ How to find the Langpi Dehangi Rural Bank Personal Loan account number?

After your application gets approved, you will be provided with your account number for your Personal Loan.

✅ What is the Langpi Dehangi Rural Bank personal loan customer care number?

Contact 9878981166 for any queries.

✅ What are the Langpi Dehangi Rural Bank Personal Loan pre-closure charges?

Langpi Dehangi Rural Bank allows you to pre-close your personal loan without any foreclosure fee.

✅ What is the State Bank of Hyderabad personal loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgement of the balance amount you have paid.

✅ What is the Langpi Dehangi Rural Bank Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can, in like manner, reimburse the got out totally at whatever point the condition is ideal. From this time forward, it is possibly the most favoured credit choices that benefitted from meeting changing individual supporting necessities unbounded.

Other Banks For Personal Loan

| Prathama Bank Personal Loan | |

| Pragathi Krishna Gramin Bank Personal Loan | |

| Puduvai Bharathiar Grama Bank Personal Loan scheme | |

| Puduvai Bharathiar Grama Bank Personal Loan |