Madhyanchal Gramin Bank Personal Loan Key Features Apr 23 2024

| Features | Details |

| Age | 21-54 (at loan maturity) |

| CIBIL Score | Minimum 700 or above |

| Madhyanchal Gramin Bank Personal Loan Interest Rate | 9.99% per annum |

| Lowest EMI per lakh | Rs 2363 |

| Tenure | Up to 60 months |

| Madhyanchal Gramin Bank Personal Loan Processing Fee | 1%-2% of Loan Amount |

| Prepayment Charges | N/A |

| Minimum Loan Amount | No Limit |

| Maximum Loan Amount | ₹2 Lakh |

Benefits of Madhyanchal Gramin Bank Personal Loan

- Easy Disbursal: Madhyanchal Gramin Bank comes with quick processing and easy disbursal of Loans to help you meet your urgent needs.

- No need for any guarantor: You do not need any guarantor, and neither has to submit any confidential papers. The personal Loan is a completely collateral-free loan.

- Simple Application Process: You only need a few basic documents, along with your two recently clicked passport-sized photographs.

Madhyanchal Gramin Bank Personal Loan Eligibility Criteria

The personal loan eligibility criteria for Personal Loan is as follows:

| CIBIL score Criteria | 700 and Above |

| Age Criteria | 21-54 years |

| Min Income Criteria | Rs 20000/month |

| Occupation Criteria | Salaried/Self-employed |

Madhyanchal Gramin Bank Personal Loan Interest Rate and Charges

The interest rate, fees, and other charges for a Personal Loan are:

| Madhyanchal Gramin Bank Personal Loan Interest Rate | 9.99% per annum |

| Madhyanchal Gramin Bank Personal Loan Processing Charges | 1%-2% of the Loan Amount + GST |

| Prepayment Charges | N/A |

| Stamp Duty | As per state laws |

Madhyanchal Gramin Bank Personal Loan Documents Required

Documents Required for Personal Loan are:

| Proof of Identity | Copy of: Passport, Driving License, Aadhar Card, Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | ITR: Last two Assessment years, Salary Slip: Last 6 months, Bank Statement: Last 3 months |

Madhyanchal Gramin Bank Personal Loan EMI Calculator

You can use the EMI Calculator here

Rate |

5 Yrs |

4 Yrs |

3 Yrs |

10.50% |

2149 |

2560 |

3250 |

11.00% |

2174 |

2584 |

3273 |

11.50% |

2199 |

2608 |

3297 |

12.00% |

2224 |

2633 |

3321 |

12.50% |

2249 |

2658 |

3345 |

13.00% |

2275 |

2682 |

3369 |

13.50% |

2300 |

2707 |

3393 |

14.00% |

2326 |

2732 |

3417 |

14.50% |

2352 |

2757 |

3442 |

15.00% |

2378 |

2783 |

3466 |

Madhyanchal Gramin Bank Personal Loan Overdraft Scheme

Madhyanchal Gramin Bank Personal Loan Offers an Overdraft Scheme. With this, you are provided with a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Personal Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Madhyanchal Gramin Bank Personal Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

Different Types of Personal Loan Offered by Madhyanchal Gramin Bank

Madhyanchal Gramin Bank Home Renovation Loan

Home Renovation Loan offered by Madhyanchal Gramin Bank helps you achieve the desired look of your house by providing help in covering the expenses of new furniture and tiling. Below are the highlights of the Home Renovation Loan.

- The home renovation loan schemes and policies include basic documentation and no-complexity.

- The Madhyanchal Gramin Bank Home loan is accessible to both new customers and existing ones.

- The minimal processing fee is charged with applicable Tax.

- This insecure loan is available at an interest rate starting from 8.00% p.a.

Holiday Loan

Travelling has become an integral part of individuals now, and a Holiday Loan is taken to check off your travelling bucket list. This credit will make the travel and holiday plans easy.

- The Madhyanchal Gramin Bank Holiday Loan is available at easy interest rates.

- A low processing fee is one such relief.

- Interest rates are applicable 11.25% p.a. onwards.

The Madhyanchal Gramin Bank Fresher Funding

The Madhyanchal Gramin Bank has launched a new category of fresher funding. This funding is basically for students who recently graduated from college and start-up business owners, looking for funds. Fresher funding helps these newbies to have the credit and flourish the small businesses.

- An encouraging amount of Loan is received under Fresher Funding.

- The age of the applicant should be more than 21.

- The applicant’s profile decides the loan amount.

NRI Personal Loan

When people move out of the country due to various reasons as education, job or medical contracts, then if any emergency fund requires and such emergencies are taken care of by the special loan category that is The Madhyanchal Gramin Bank NRI Personal Loan. The important features of the individual loan are as given below:

- This loan can be received without any collateral.

- Attractive interest rates are available.

- Proper documents of the co-applicant(Indian loan applicant) and NRI are required for this loan.

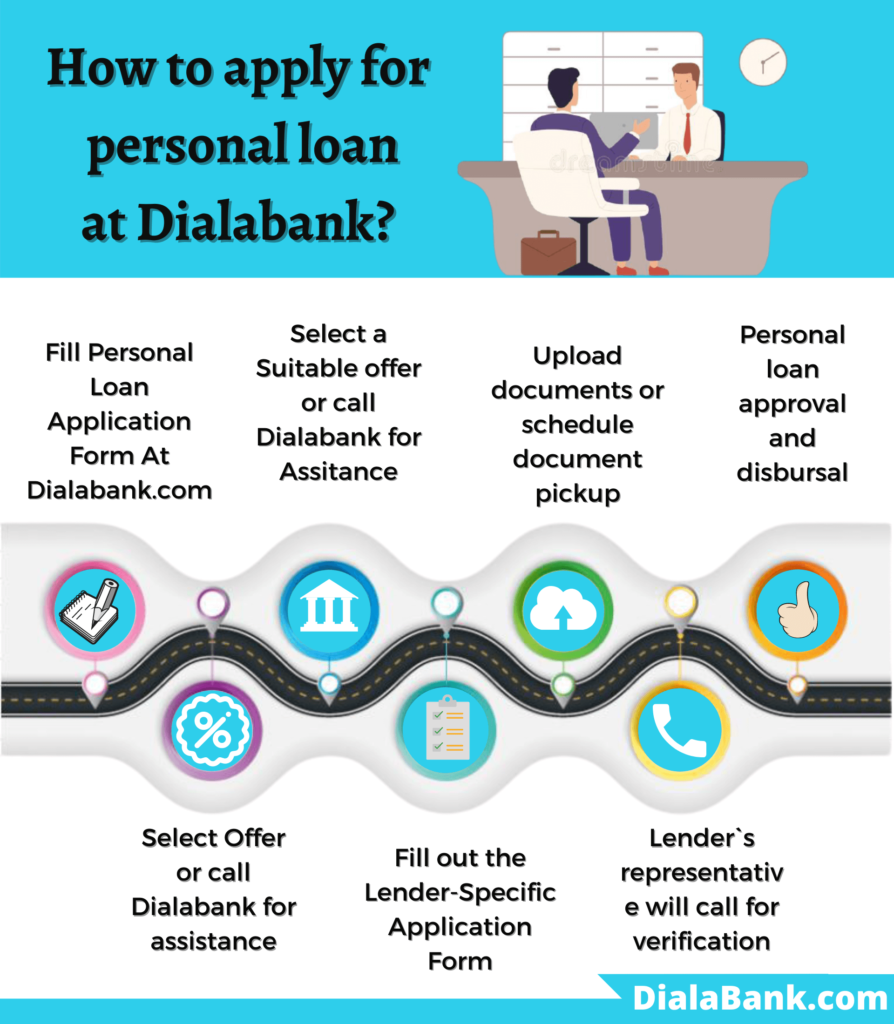

How to Apply Online for The Madhyanchal Gramin Bank Personal Loan with Dialabank?

You can apply for The Madhyanchal Gramin Bank’s Personal Loan online by visiting The Madhyanchal Gramin Bank’s online portal and filling the form for applying for a personal loan, or you can simply follow the given steps for applying for a The Madhyanchal Gramin Bank Personal Loan:

- Visit Dialabank

- Fill in your required details in the personal loan application form.

- you will get a call from our representative.

- Share your documents and get instant approval.

Personal Loan Verification Process

The Madhyanchal Gramin Bank follows the below-mentioned steps for loan verification:

- The bank receives the application from Dialabank and proceeds further.

- After verifying all the details from the application form, the bank gives a call to the customer.

- Once the customer confirms the details, the document picks up is scheduled by Bank.

- After receiving all the required documents bank decides the Final Loan amount, tenure and rate of interest to be paid.

- After the agreement of the customer, the loan is disbursed.

Check Your The Madhyanchal Gramin Bank Personal Loan Application Status

The Madhyanchal Gramin Bank Loan application can be tracked in simple easy steps as follows:

- By visiting the nearest Bank officials in person, as it calls offline mode.

- In Online mode, Mobile banking apps are useful.

- Bank’s official website has a feature for checking the application status.

How to Login to The Madhyanchal Gramin Bank Portal

- Google and land on The Madhyanchal Gramin Bank Website.

- Log in with your Madhyanchal Gramin Bank login ID and Password.

- Tap on the login key and get access to the bank portal easily.

The Madhyanchal Gramin Bank Personal Loan Statement

- Visit the official website of The Madhyanchal Gramin Bank.

- Find and click on the “Register New Loan”.

- Provide the required details and submit

- After entering the OTP it will redirect you to the Loan Statement page.

The Madhyanchal Gramin Bank Personal Loan Restructuring (COVID-19)

In the middle of the pandemic and lockdown, The Madhyanchal Gramin Bank showed a drive to decrease the weight on its borrowers. The bank commanded the RBI ban that finished in the period of September. Therefore, all the borrowers were foreseen to continue back to the past EMI plans. In any case, the borrowers were as yet in pandemonium concerning how to reimburse the extraordinary with progressing monetary crunches. Considering the antagonistic circumstance The Madhyanchal Gramin Bank presented another structure that bolsters the reason for its borrowers allowable by the RBI.

The alleviation structure is pointed toward destressing the borrowers by plunging monetary pressure. This new structure gives the borrower freedom to stretch out the reimbursement residency as long as 2 years at specific outcomes. The all-encompassing unwinding will invite an additional financing cost on the extraordinary sum and along these lines, the advance will be named as “Rebuilt” in the credit report of the recipient. Bringing about a comment on the borrower’s FICO rating, hence, the borrowers are encouraged to settle on the instrument in most ominous conditions in any case the reimbursement plans must get the strings as in the past.

Bank Customer Care

- Visiting the Bank: The applicant can visit the bank branch for any information on loan approval.

- Calling Customer Care: The customers get in touch with the bank via call on 9878981166.

- ChatBox On Website: The chatbox is open for any suggestion or query on the official site.

- Asking for a Call Back: A callback request can be dropped while visiting the Bank branch.

Benefits of Applying for Personal Loan on Dialabank

- Availability: When an applicant requests the loan through Dialabank, they can get in touch with customer care 24 hours a day of the week.

- Minimum Paperwork: Dialabank makes sure that there is less paperwork and an easy documentation process.

- Unlimited Options: Dialabank provides the functionality of comparing multiple banks at once and choose the best all in one place.

- EMI Calculator: You can easily know the applicable EMI on your Personal Loan with Dialabank’s customer-friendly EMI Calculator that gives accurate EMI Payable on your Personal loan based on the interest rate.

Important Aspects

The mentioned below are a few points that should be taken into consideration before you apply for a Personal Loan:

- The FICO rating chooses whether the applicant is equipped for the given credit, so it is recommended to examine the Credit Score preceding pitching a Loan application. In most circumstances, the weak monetary appraisal just prompts a straight excusal of the application.

- It is judicious to keep the development total as least as could be normal in light of the current situation. Since the repayment of a lesser entirety is basic and brief. The repayment furthest reaches of the competitor is of most extraordinary hugeness while applying for a Personal Loan so the credit total should be benefitted by the need as opposed to profiting higher development entirety due to its basic openness.

- Go for the bank or foundation offering the top-level organization and financing cost for the development whole you require. Consider and analyze preceding consenting to one bank. In the Credit World, the banks are offering genuine financing expenses and residencies for the development entirety so second research the banks will simply benefit you.

FAQs About Madhyanchal Gramin Bank Personal Loan

✅ What is Madhyanchal Gramin Bank Personal Loan?

A Personal Loan is a loaning scheme that can be availed to meet your urgent financial needs without the need to submit security with the bank. You can easily apply for a Madhyanchal Gramin Bank’s Personal Loan to finance your expenses.

✅ What is the Personal Loan rate of interest in Madhyanchal Gramin Bank?

Madhyanchal Gramin Bank Personal Loan rate is 9.99% per annum. The rate of interest depends on the borrower’s profile. If you have a good CIBIL Score you can expect a lower rate of interest.

✅ How can I get Madhyanchal Gramin Bank Personal Loan?

You can get a Personal Loan from Madhyanchal Gramin Bank by visiting the nearest branch with your documents and duly signed application form. You can also visit Dialabank’s digital platform to compare offers of different banks and financial companies.

✅ How to apply for a Personal Loan in Madhyanchal Gramin Bank?

You can apply for a Personal Loan with Madhyanchal Gramin Bank by contacting your nearest branch in person or through Dialabank’s online portal for better convenience and to get the best deals and offers.

✅ Why apply for a Personal Loan?

Personal Loans can be used to finance all your small and big expenses. The long tenures and attractive interest rates make it easy to repay the loan in burden-free EMIs. You can use your Madhyanchal Gramin Bank Personal Loan for all your personal financial needs without having to submit any security.

✅ How much EMI on Personal Loan?

Your Personal Loan EMI depends on your loan amount, loan tenure, and rate of interest. You can visit Dialabank and use our EMI Calculator to calculate your Madhyanchal Gramin Bank Personal Loan EMIs.

✅ How much CIBIL score is required for a Personal Loan?

You will need a CIBIL score above 750 for your Personal Loan with Madhyanchal Gramin Bank. Banks require a high CIBIL score for unsecured Personal Loans because it helps calculate the risk of default.

✅ Minimum credit score needed for Personal Loan?

A minimum credit score of 750 is needed for Madhyanchal Gramin Bank’s Personal Loans. A healthy credit score is a necessity to avail of unsecured loans.

✅ How to calculate Personal Loan EMI?

You can calculate your Madhyanchal Gramin Bank’s Personal Loan EMI using the formula, E = P x R x [((1+R)^N)/((1+R)^N)-1]. Here, P is your principal loan amount, R is your rate of interest, and N is the loan tenure. You can also use Dialabank’s EMI calculator.

✅ What can I use Madhyanchal Gramin Bank Personal Loan for?

Your Madhyanchal Gramin Bank’s Personal Loan can be used to fulfil all your financial needs and meet all your personal expenses. A wedding, an event, travel and vacation, buying of consumer goods, payment of bills, etc.

✅ Can I prepay Madhyanchal Gramin Bank Personal Loan?

Yes, you can prepay your Madhyanchal Gramin Bank’s Personal Loan by contacting your loan branch in person. In some cases, you may be required to pay a small foreclosure charge.

✅ How to prepay Madhyanchal Gramin Bank Personal Loan?

Visit your Madhyanchal Gramin Bank loan branch and apply for a foreclosure on your Personal Loan account. You will need to pay all the pending amounts and upon verification of your payments, your loan will be closed.

✅ How to repay Madhyanchal Gramin Bank Personal Loan?

You can repay your Madhyanchal Gramin Bank Personal Loan in easy monthly EMIs that consist of both your principal amount and interest. You can either give a standing instruction or an ECS on your bank account for the monthly deduction of EMIs.

✅ What documents are needed for Madhyanchal Gramin Bank Personal Loan?

You will need your basic KYC documents along with proof of your income to apply for a Personal Loan from Madhyanchal Gramin Bank. These documents are to be submitted along with a duly signed application form with the bank.

✅ How to check Madhyanchal Gramin Bank Personal Loan status?

You can check your Personal Loan status by contacting your Madhyanchal Gramin Bank branch in person or through a customer care number.

✅ What is the Madhyanchal Gramin Bank Personal Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Madhyanchal Gramin Bank Personal loan account.

- Pay the pre-closure charges as per Madhyanchal Gramin Bank Personal Loan.

✅ What are Madhyanchal Gramin Bank Personal Loan preclosure charges?

Madhyanchal Gramin Bank Personal Loan preclosure charges are Nil.

✅ What is the Madhyanchal Gramin Bank Personal Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at Madhyanchal Gramin Bank Personal Loan is provided, it gives you an online way to get your own overdraft, also known as Smartdraft – Overdraft Against Salary. You do not need to visit bank branches and go through a boring process. Just log in to the Madhyanchal Gramin Bank online banking portal and from there you can fill out a simple form and get an overdraft under your name.

✅ What is Madhyanchal Gramin Bank Personal Loan maximum tenure?

Madhyanchal Gramin Bank Personal loan maximum tenure is 60 months.

✅ What is Madhyanchal Gramin Bank Personal Loan minimum tenure?

Madhyanchal Gramin Bank Personal Loan minimum tenure is 12 months.

✅ What is the Madhyanchal Gramin Bank Personal Loan customer care number?

The customers get in touch with the bank via call on 9878981166.

Other Banks For Personal Loan

| Prathama Bank Personal Loan | |

| Pragathi Krishna Gramin Bank Personal Loan | |

| Puduvai Bharathiar Grama Bank Personal Loan scheme | |

| Puduvai Bharathiar Grama Bank Personal Loan |