Odisha Gramya Bank Personal Loan Key Features Apr 24 2024

| Eligibility Criteria | Details |

| Age | 21 – 58 (at loan maturity) |

| CIBIL Score | Minimum 750 or above |

| Odisha Gramya Bank Personal Loan Interest Rate | 9.99% per annum |

| Tenure | 2 to 5 yrs |

| Odisha Gramya Bank Personal Loan Processing Fee | 1%-2% |

| Prepayment Charges | Allowed after 18 EMIs |

| Maximum Loan Amount | Rs. 10 Lakh |

Benefits of Odisha Gramya Bank Personal Loan

- Quick Loan Approval: The Odisha Gramya bank offers quick loan approval for making the processing easy for its customers.

- Guarantor required is not: There is no need for a guarantor for this type of loan which makes it one of the easiest products to avail.

- Personal Documents: You only need to present the documents for this type of loan, so make sure that you present genuine and authentic documents.

- Offers Special Discounts: Odisha Gramya Bank provides special offers and schemes for its customers. You can avail of special offers and schemes through this bank.

- Attractive and Competetive Interest Rates: Odisha Gramya Bank provides attractive and competitive interest rates. This bank provides an interest rate of up to 10.70%.

Odisha Gramya Bank Personal Loan Eligibility Criteria

The personal loan eligibility criteria for a personal loan are as follows:

| CIBIL score Criteria | 750 and Above |

| Age Criteria | 21-58 years |

| Min Income Criteria | Rs 18,000 per month |

| Occupation Criteria | Salaried/Self-employed |

Odisha Gramya Bank Personal Loan Interest Rate, Fees & Other Charges

| Odisha Gramya Bank Personal Loan Interest Rate | 9.99% per annum |

| Odisha Gramya Bank Personal Loan Processing Charges | 1% to 2% of Loan Amount |

| Prepayment Charges | NIL |

| Stamp Duty | As per state laws |

| Cheque Bounce Charges | As per bank terms |

| Penal Interest | N/A |

| Floating Rate of Interest | Not Applicable |

Odisha Gramya Bank Personal Loan Documents Required

The requirement for the Salaried Applicants and the Self Employed Applicants are the following:

Documents Required for Salaried Applicants:

- Personal Loan application: Filled and signed.

- Bank Pass Book: Last 6 months entries.

- ID Proof: Aadhaar Card, Driving License, Voter Id, Pan Card, Government Department ID Card.

- Income Proof: Salary Certificate and Form Number 16, last salary slip also.

- Residence Proof: Bank Account statement, Last Electricity bill, Latest Credit Card Statement, Existing House Lease Agreement.

- Two passport-sized photographs

*NOTE: In the case of rented apartments, the rent agreement is to be attached.

Documents Required for Self-Employed Applicants:

- Personal Loan application: Filled and signed.

- Bank Pass Book: Last 6 months entries.

- ID Proof: Aadhaar Card, Driving License, Voter Id, Pan Card, Government Department ID Card.

- Income Proof: Income Tax Return of the last 2 financial years.

- Residence Proof: Bank Account statement, Last Electricity bill, Latest Credit Card Statement, Existing House Lease Agreement.

- Two passport-sized photographs

Personal Loan EMI Calculator for Odisha Gramya Bank

Calculate on personal loan EMI calculator

Odisha Gramya Bank Personal Loan Comparison with Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Odisha Gramya Bank | 9.99% | 24 to 60 months | Up to Rs. 10 lakh / Up to 3% of the loan amount |

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 15.75% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Upto Rs. 20 lakh / Up to 2.25% of the loan amount |

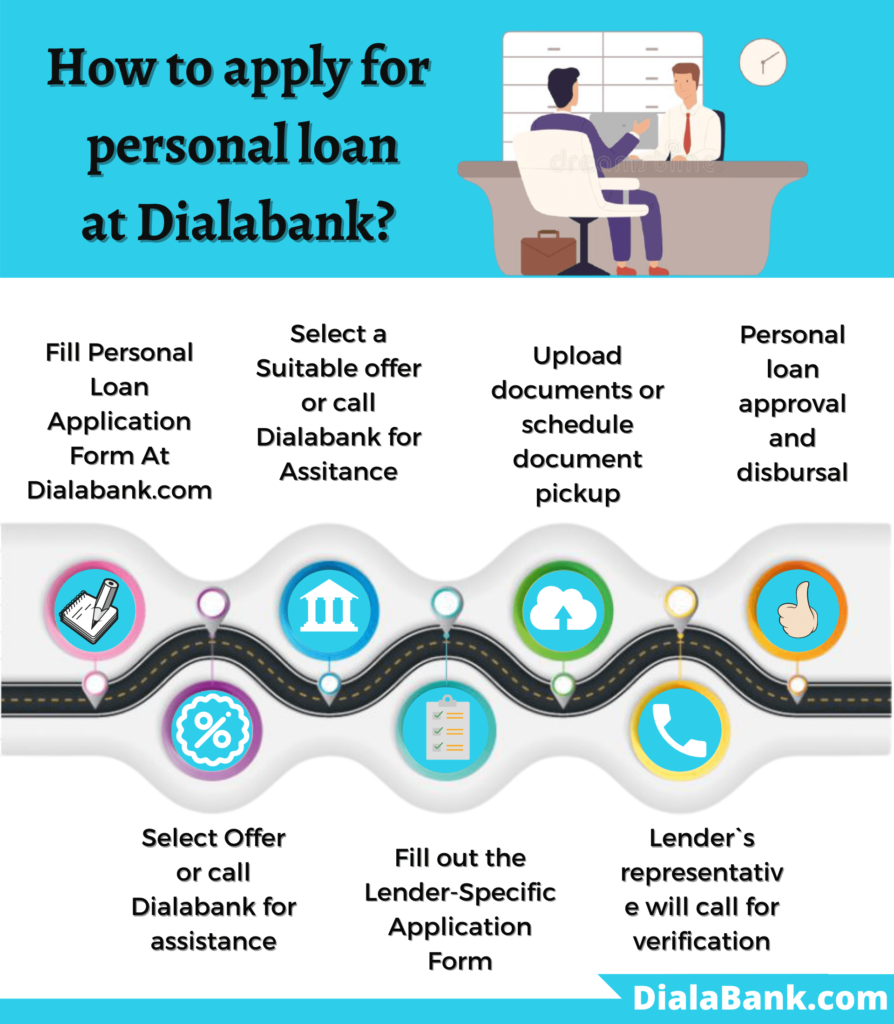

How to apply for Odisha Gramya Bank Personal Loan?

There are two ways for Odisha Gramya Bank Personal Loan application are the following:

Apply Online

- Visit our bank website.

- Check your loan eligibility.

- Fill an application form.

Apply Offline

- Visit your nearby personal loan branch.

- Fill the application form with general information.

- Then, get your loan approval.

Why should you apply for Odisha Gramya Bank Personal Loan with Dialabank?

Dialabank helps you to choose the right option by providing a comparison among different banks. Dialabank helps so many people who need funds for many purposes. Apply and get special deals on the Odisha Gramya Bank Personal Loan.

Call us at 9878981166 to avail of the Odisha Gramya Bank Personal Loan.

How to Calculate EMIs for Odisha Gramya Bank Personal Loan

You can easily calculate the EMIs on your personal loan, you just require the basic information regarding the loan –

- Amount of the Loan

- Rate of Interest

- Tenure

Just put these values in the calculator below to find the exact amount payable each month.

Odisha Gramya Bank Personal Loan Processing Time

Every bank has its criteria for the processing time for the personal loan. Odisha Gramya Bank decides the processing of personal loan applications from time to time.

Odisha Gramya Bank Personal Loan Preclosure Charges

Odisha Gramya Bank gives the pre-closing as per bank discretion. Odisha Gramya Bank charges a Prepayment or Pre-closure charge, if you wish to do so we have listed the charges below:

| Time | Pre-closure Charge |

| 13 to 24 months | NIL |

| 25 to 36 months | NIL |

| more than 36 months | NIL |

Pre Calculated EMI for Odisha Gramya Bank Personal Loan

| Loan Amount @ Rate of Interest | Tenure Of Loan | ||||

| 1 year | 2 years | 3 years | 4 years | 5 years | |

| 6.5 lakh @ 11.25% | NIL | NIL | NIL | NIL | NIL |

| 5 lakh @ 12% | NIL | NIL | NIL | NIL | NIL |

| 10 lakh @ 12.5% | NIL | NIL | NIL | NIL | NIL |

| 8 lakh @ 13% | NIL | NIL | NIL | NIL | NIL |

Different Offers for Odisha Gramya Bank Personal Loan

- Odisha Gramya Bank has a wide range of Personal Loan.

- It offers to the Salaried Individuals and Self Employed Individuals.

- It offers education, home, business, car loans, etc.

Odisha Gramya Bank Personal Loan for Salaried Employees

- Odisha Gramya Bank provides personal loans for Salaried Employees: Attractive Interest Rates.

- There is a requirement for a Company ID Card for the personal loan.

- It offers a loan tenure of 24 to 60 months.

Odisha Gramya Bank Personal Loan for Self Employed Individuals

- Odisha Gramya Bank provides personal loans who are self-employed and who need funds.

- Provides attractive interest rates.

- Self- Employed have to present the ITR of the last 2 financial years.

- The maximum loan amount will be Rs. 10 lakh.

Odisha Gramya Bank Education Loan

- Odisha Gramya Bank provides Education loans for studies in India as well as for Abroad.

- Avail loan for Studie sin India: Rs. 10 lac.

- Avail loan for Studies Abroad: Rs. 20 lac.

Odisha Gramya Bank Home Loan

- Odisha Gramya Bank offers personal loans for homes.

- For the construction of the home, avail loan up to Rs. 100 lacs.

- For repair, you can avail Loan of up to Rs. 10 lacs.

Odisha Gramya Bank Personal Loan for Government Employees

- Government Employees are offered Personal Loans at low interest rates which start at about 10.70%.

- Loan tenure: 24 to 60 months.

- Visiting the nearest Odisha Gramya Bank Loan Branch.

- You can contact us at 9878981166 and avail of Odisha Gramya Bank Personal Loan.

Odisha Gramya Bank Personal Loan Balance Transfer

Personal Loan Balance Transfer refers to a process where you shift your personal loan from one lending foundation to another. In this, the new bank pays off your previous loan and gives you the loan. You get many benefits if you do this but you may have to pay the foreclosure charges associated with that loan along with the Processing fee on your new loan. Some of the benefits are listed below –

- Lower Interest Rate

- Extended Tenure for the Repayment

- You may also get additional features associated with your Loan such as no processing fee, etc. based on your CIBIL score.

Odisha Gramya Bank Personal Loan Top Up

- The top-up facility is the supplementary amount that you borrow from the bank on your current loan.

- Provision of this facility if you have paid 18 EMIs without any holiday period.

- Minimum top-up is given according to the bank.

Odisha Gramya Bank Personal Loan Overdraft Scheme

Odisha Gramya Bank Personal Loan Offers an Overdraft Scheme. With this, you are provided with a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Personal Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Odisha Gramya Bank Personal Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

Different Types of Personal Loan Offered by Odisha Gramya Bank

Home Renovation Loan

Home Renovation Loan provided by Odisha Gramya Bank helps you to change the appearance of your house by helping in covering the expenses of new furniture and tiling. Below are the highlights of the Home Renovation Loan.

- The home renovation loan schemes and policies include basic documentation and no-complexity.

- The Odisha Gramya Bank Home loan is accessible to both new customers and existing ones.

- The minimal processing fee is charged with applicable Tax.

- This insecure loan is available at the interest rate starting from 8.00% p.a.

Holiday Loan

A holiday loan is taken to cover the expenses of travelling during the international or countrywide trips. This credit will make the travel and holiday plans smooth.

- The Odisha Gramya Bank Holiday Loan is available at easy interest rates.

- Low processing fee.

- Interest rates are applicable 11.25% p.a. onwards.

Fresher Funding

The Odisha Gramya Bank have launched a new category of fresher funding. This funding is for students who recently graduated from college and start-up business owners, looking for funds. Fresher funding helps these entrepreneurs to have the loan amount and grow the business.

- The loan amount sums up to 1.5 lacs.

- The age of the applicant should be 21 or more.

- The applicant’s profile decides the loan amount.

NRI Personal Loan

When people residing in different countries due to various reasons as education, job or medical contracts, then if any emergency fund requires and such emergencies are taken care by the special loan category that is The Odisha Gramya Bank NRI Personal Loan. The important features of the individual loan are as given below:

- This loan can be received with no security.

- Interest rates available starting from 11.25%.

- Proper documents of the co-applicant(Indian loan applicant) and NRI are required for this loan.

How to Apply Online for The Odisha Gramya Bank Personal Loan with Dialabank?

You can apply for Odisha Gramya Bank Personal Loan online by visiting the Odisha Gramya Banks online portal and filling the form for applying for a personal loan or you can simply follow the given steps for applying for an Odisha Gramya Bank Personal Loan –

- Visit Dialabank.

- Fill the Application form and submit it.

- Wait for a call from one of our Relationship Managers who are experts in this field.

- Get personalized service for availing Personal Loan by comparing the features of various banks and selecting the one which is most suitable according to your needs.

Personal Loan Verification Process

The Odisha Gramya Bank follows the below-mentioned steps for loan verification:

Step 1 The Bank goes through Dialabank Application and move forward.

Step 2 First step of verification is completed by calling the applicant.

Step 3 Post the conversation with customer, bank collects the documents.

Step 4 Documents helps in deciding the Loan tenure, interest rates and amount.

Step 5 After the agreement of the customer, the loan is disbursed.

Check Your Odisha Gramya Bank Personal Loan Application Status

You can check the status of your Odisha Gramya Bank Personal Loan by the following methods –

- You can also visit your loan branch and ask the bank officials for the same.

- Log In to the Odisha Gramya Bank Net banking Portal, Click on loans from the top ribbon and click on Enquire to check the status of your loan.

- Search for ‘personal loan status’ on Google, open the first link which will take you to the Loan Status Tracker webpage of Odisha Gramya Bank, and fill the required information to check the status of your loan.

How to Login to The Odisha Gramya Bank Portal

- Google and land on The Odisha Gramya Bank Website.

- Log in with your The Odisha Gramya Bank log in ID and Password.

- Tap on the login key and get access to the bank portal easily.

The Odisha Gramya Bank Personal Loan Statement

- Visit the official website of The Odisha Gramya Bank.

- Find ‘More’ and click on the “Register New Loan”.

- Provide the required details and submit

- After entering the OTP it will redirect you to the Loan Statement page.

The Odisha Gramya Bank Personal Loan Restructuring (COVID-19)

In the pandemic and lockdown, Odisha Gramya chose to stand firm to alleviate the pressure of, Therefore, all the borrowers were anticipated to proceed back to the past EMI plans. Regardless, the borrowers were so far in commotion concerning how to repay the uncommon with advancing financial crunches. Considering the hostile situation The Odisha Gramya Bank introduced another structure that reinforces the explanation behind its borrowers reasonable by the RBI.

The mitigation structure is highlighted destressing the borrowers by plunging money related weight. This new structure gives the borrower opportunity to loosen up the repayment residency up to 2 years at explicit results. The sweeping loosening up will welcome an extra financing cost on the remarkable whole and thusly, the development will be named as “Reconstructed” in the credit report of the beneficiary. Achieving a remark on the borrower’s FICO rating, thus, the borrowers are urged to choose the instrument in many unpropitious conditions regardless of the repayment plans must get the strings as before.

Odisha Gramya Bank Customer Care

- Visiting the Bank: The applicant can visit the bank branch for any information on loan approval.

- Calling to the Customer Care: The customers get in touch with the bank via call on 9878981166

- Chat Box On Website: The chatbox is available for any suggestion or query on the official site.

- Asking for a Call Back : A call back request can be dropped while visiting the Bank branch.

Benefits of Applying for Personal Loan on Dialabank

- Availability: When an applicant request for the loan through Dialabank, they can get in touch with customer care 24 hours on any day of the week.

- Minimum Paperwork: Dialabank makes the documentation process less complicated.

- Unlimited Options: Dialabank provides the functionality of comparing multiple banks at once and choose the best all at one place.

- EMI Calculator: You can easily know the applicable EMI on your Personal Loan with Dialabank’s customer-friendly EMI Calculator that gives accurate EMI Payable on your Personal loan based on the interest rate.

Important Aspects

The mentioned below are a few points that should be taken into consideration before you apply for a Personal Loan:

- Checking on your Credit score saves you from further troubles and waste of time and energy. The credit score determines the eligibility of the Loan applicant hence it’s advisable to check your credit score before applying for the Loan.

- The less loan amount takes less time to repay hence keeping the loan amount in reach will save you from complicating various future plans.

- Go for the bank or establishment offering the high-level association and financing cost for the advancement entire you require. Consider and investigate going before consenting to one bank. In the Credit World, the banks are offering certified financing costs and residencies for the improvement sum so a second examination the banks will just profit you.

FAQs About Odisha Gramya Bank Personal Loan

✅ What is Odisha Gramya Bank Personal Loan?

Personal loans with minimal documentation become unproblematic as no mortgage is required. Odisha Gramya Bank provides personal loans to its pre-approved customers.

The interest rate starts from 9.99% per annum and the loan amount can be used by the borrower for any personal financial requirements ranging from higher studies or a vacation to using the amount for day to day expenses.

✅ How does Odisha Gramya Bank Personal Loan work?

- The first step: Check the eligibility criteria for the Odisha Gramya Bank personal loan.

- You can check eligibility online.

- Avail loan up to Rs. 10 lac with the lowest interest rate based on the credit history of the customer.

✅ What is the Personal Loan rate of interest in Odisha Gramya Bank?

The personal loan rate of interest in Odisha Gramya bank is 9.99% per annum.

For the latest interest rates, visit Dialabank’s digital platform and compare them.

✅ What is the procedure of a Personal Loan in Odisha Gramya Bank?

The procedure to avail a personal loan with Odisha Gramya Bank is unproblematic.. You can apply for an Odisha Gramya Bank personal loan by visiting the nearest branch with your documents, through an Odisha Gramya Bank ATM, or using Odisha Gramya Bank’s Loan Assist App. You can also contact and apply with Dialabank for easy processing and personalized assistance. The basic steps include:

- Calculation of loan amount required: as per your need

- Checking your loan eligibility: online or by visiting the branch

- Approaching the bank via your preferred method: online or offline

- Submitting the required documents with the banker.

- The expense of the loan amount once your application and documents have been verified and approved.

✅ How can I get Odisha Gramya Bank Personal Loan?

Getting a Personal Loan from Odisha Gramya Bank is a simple process as minimal documentation ensures a quick disbursement time. You can check your eligibility status and contact the bank either online or by visiting the nearest branch. After submission and verification of the required documents, the loan amount will be credited to your bank account.

✅ How to apply for a Personal Loan in Odisha Gramya Bank?

A personal loan is a security free loaning option to meet all your financial needs. You can apply for a personal loan with Odisha Gramya Bank with the requirement of minimum documents and get a quick loan amount disbursal by visiting the nearest branch with your documents or filling an application online at Odisha Gramya Bank’s official website.

You can also apply with Dialabank to avail of personalized assistance and get the best deals and offers.

✅ Why apply for Odisha Gramya Bank personal loan?

Odisha Gramya Bank has one of the leading and trusting operators of personal loans in India, it offers the best loan options that come with unique attributes. They provide personal loans at low interest rates with minimum documents for an easy and smooth process. Repayment of the loan can be done through EMIs or via online payment options as preferred. Repayment tenure ranges between 2 to 5 years.

✅ How much EMI on Odisha Gramya Bank Personal Loan?

EMI (Equated Monthly Installment) is the amount payable to the bank every month as repayment of your personal loan. The EMI on Odisha Gramya Bank personal loan depends on the loan amount, interest rate, and the tenure of the loan. It can easily be calculated using the EMI calculator on Dialabank’s website.

✅ How much CIBIL score is required for Odisha Gramya Bank personal loan?

For a personal loan, the CIBIL score is the major factor in deciding eligibility. You should have a minimum of 750 CIBIL scores. By making timely payments of your EMIs and credit cards, you can increase your CIBIL score.

✅ Minimum credit score needed for Odisha Gramya Bank personal loan?

Odisha Gramya Bank requires you to have a minimum credit score of 750 to become eligible for a personal loan.

✅ How to calculate Odisha Gramya Bank personal loan EMI?

EMI on personal loan can be calculated using the formula, E = P x R x [(1+R)^N] / [(1+R)^N-1] where,

P= Principal or your loan amount,

R= Rate of interest, and

N= Loan Tenure.

You can easily calculate your EMI online at Dialabank’s website for free and compare offers from different banks and finance companies.

✅ What can I use Odisha Gramya Bank personal loan for?

You can use your Odisha Gramya Bank personal loan for a number of reasons ranging from small bill payments and daily expenses to a medical emergency and bigger expenses such as debt consolidation, wedding, education, business loan, and etc.

Fulfil all your financial needs with a personal loan by applying online at Dialabank’s digital platform.

✅ Can I prepay Odisha Gramya Bank personal loan?

When a borrower pays off their loan entirely or in part before the agreed due date, it is termed as prepayment or preclosure. Odisha Gramya Bank gives you the option to prepay your personal loan provided that you have at least paid 18 month’s EMIs. You will be charged up to a 3% foreclosure fee of your outstanding loan amount depending on the number of EMIs left to pay.

✅ How to prepay Odisha Gramya Bank personal loan?

Steps to prepay your Odisha Gramya Bank personal loan:

- Collect the required documents.

- Visit your loan branch and ask for the balance and any pre-closure charges or penalties.

- You will be prompted to fill a form requesting the prepayment of the loan.

- Pay the prepayment amount.

- Your loan will be closed as soon as the bank receives the fund.

✅ How to repay Odisha Gramya Bank personal loan?

You have the option of repaying your Odisha Gramya Bank personal loan either by a standing instruction on your bank account to pay the EMI, online payment through different modes or through post-dated cheques given to the loan branch.

✅ How to repay Odisha Gramya Bank personal loan online?

You can pay your personal loan EMI online in just 5 steps:

- Visit the payments page on Odisha Gramya Bank’s website.

- Click on ‘PAY ONLINE’ and enter your required information.

- Click on PAY.

- You will be securely redirected to the bank payment interface of your chosen net banking option.

- Complete the payment and you will receive an online transaction confirmation. You can also pay your Odisha Gramya Bank personal loan on Paytm.

✅ What documents are needed for Odisha Gramya Bank personal loan?

- Odisha Gramya Bank provides comfortable personal loans with minimum documentation.

- You need PAN Card, Aadhaar Card, the Last 6 months Bank Statements, the latest ITR file.

- For more assistance, contact Dialabank’s financial helpline number that is 9878981166.

✅ How to check Odisha Gramya Bank personal loan status?

You have a number of options to check the status of your Odisha Gramya Bank personal loan:

- Log In to the Odisha Gramya Bank Netbanking Portal, Click on loans from the top ribbon and click on Enquire to check the status of your loan.

- Search for ‘personal loan status’ on Google, open the first link which will take you to the Loan Status Tracker webpage of Odisha Gramya Bank, and fill in the required information to check the status of your loan.

- You can also visit your loan branch and ask the banker for the same.

✅ How to get Odisha Gramya Bank personal loan top up?

Top up is the additional loan amount that can be taken from the existing bank of your running loan or at the time of balance transfer from your new bank. Odisha Gramya Bank lets you avail of this facility if you have paid at least 18 EMIs without any cheque bounces. You can check the online portal of Odisha Gramya Bank for more offers or contact Dialabank for any financial help.

✅ What is the Odisha Gramya Bank Personal Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Odisha Gramya Bank Personal loan account.

- Pay the pre-closure charges as per Odisha Gramya Bank Personal Loan.

✅ What are Odisha Gramya Bank Personal Loan preclosure charges?

Odisha Gramya Bank Personal Loan preclosure charges are Nil.

✅ What is the Odisha Gramya Bank Personal Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at Odisha Gramya Bank Personal Loan is provided, it gives you an online way to get your own overdraft, also known as Smartdraft – Overdraft Against Salary. You do not need to visit bank branches and go through a boring process. Just log in to the Odisha Gramaya online banking portal and from there you can fill out a simple form and get an overdraft under your name.

✅ What is Odisha Gramya Bank Personal Loan maximum tenure?

Odisha Gramya Bank Personal loan maximum tenure is 60 months.

✅ What is Odisha Gramya Bank Personal Loan minimum tenure?

Odisha Gramya Bank Personal Loan minimum tenure is 12 months.

✅ What is the Odisha Gramya Bank Personal Loan customer care number?

The customers get in touch with the bank via call on 9878981166

Other Banks For Personal Loan

| Telangana Bank Personal Loan | |

| Telangana Grameena Bank Personal Loan | |

| Suryoday Small Finance Bank Personal Loan | |

| State Bank of Hyderabad Personal Loan |