Paschim Banga Gramin Bank Personal Loan Key Features Apr 19 2024

| Eligibility Criteria | Details |

| Age Criteria | 21-58 yrs(at loan maturity) |

| CIBIL Score | 700 |

| Paschim Banga Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Lowest EMI per lakh | NIL |

| Tenure | 12 to 60 months |

| Paschim Banga Gramin Bank Personal Loan Processing Fee | 1%-2% |

| Prepayment Charges | Up to 3% |

| Part Payment Charges | NIL |

| Minimum Loan Amount | 50,000 |

| Maximum Loan Amount | 20 lakh |

Paschim Banga Gramin Bank Personal Loan Eligibility Criteria

Personal Loan Eligibility Criteria:

| CIBIL score Criteria | 700 minimum |

| Age Criteria | 21-58 yrs |

| Min Income Criteria | Rs. 18,000 |

| Occupation Criteria | Salaried/Self-Employed |

Paschim Banga Gramin Bank Personal Loan Interest Rate and Charges

| Paschim Banga Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Paschim Banga Gramin Bank Personal Loan Processing Charges | 1%-2% |

| Prepayment Charges | Up to 3% |

| Stamp Duty | NIL |

| Cheque Bounce Charges | NIL |

| Penal Interest | NIL |

| Floating Rate of Interest | NIL |

Paschim Banga Gramin Bank Personal Loan Documents Required

| Form | Duly signed and filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Paschim Banga Gramin Bank Personal Loan EMI Calculator

Paschim Banga Gramin Bank Personal Loan Compared to Other Banks

| Particulars | Paschim Banga Gramin Bank | HDFC Bank | Bajaj Finserv | Axis Bank | Citibank | Private Bank |

| Interest Rate | 9.99% | 11.25% to 21.50% | Starting from 12.99% | 15.75% to 24% | Starting from 10.99% | 11.50% to 19.25% |

| Tenure | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Loan amount | NIL | Up to Rs. 40 lakh | Up to Rs. 25 lakh | Rs. 50,000 to Rs. 15 lakh | Up to Rs. 30 lakh | Up to Rs. 20 lakh |

| Processing Fee | 1%-2% | Up to 2.50% of the loan amount | Up to 3.99% of the loan amount | Up to 2% of the loan amount | Up to 3% of the loan amount | Up to 2.25% of the loan amount |

Other Loan Products from Paschim Banga Gramin Bank

Why should you apply for Paschim Banga Gramin Bank Personal Loan with Dialabank?

One of the leading and trustworthy providers in Dialabank. Dialabank provides the best and fast services for personal loans. You can apply for Paschim Banga Gramin Bank through Dialabank. It will get your loan approval at a faster rate.

Also, call 9878981166.

How to Calculate EMIs for Paschim Banga Gramin Bank Personal Loan

There is a need for the following information to calculate Paschim Banga Gramin Bank Personal Loan EMI:

- Tenure

- Rate of Interest

- Loan Amount

Put these values in the calculator below and find your monthly EMIs

Paschim Banga Gramin Bank Personal Loan Processing Time

Paschim Banga Gramin Bank personal loan, the processing time is 3 days. Fewer documents are required for this personal loan. It has time-saving processing. Your loan will get approved in 30 minutes.

Paschim Banga Gramin Bank Personal Loan Preclosure

Preclosure is the process in which you repay your loan amount before the due date. It helps to lower the interest rates.

Pre Calculated EMI for Personal Loan

Different Offers For Paschim Banga Gramin Bank Personal Loan

Paschim Banga Gramin Bank Home Loan

- Paschim Banga Gramin Bank offers home loan.

- It provides personal loans for repairing and construction of the home.

Paschim Banga Gramin Bank Personal Loan for Government Employees

- Paschim Banga Gramin Bank provides personal loans to the Govt. Employees.

- Based on the company name, the loan amount is provided.

Paschim Banga Gramin Bank Car Loan

- Paschim Banga Gramin Bank provides a personal loan for a car.

- It provides a personal loan for the new car and a used car.

Paschim Banga Gramin Bank Personal Loan for Pensioners

- Paschim Banga Gramin Bank provides personal loans to pensioners.

- It provides a personal loan with a minimum service of 10 yrs.

Paschim Banga Gramin Bank Personal Loan Balance Transfer

- Paschim Banga Gramin Bank allows you to transfer your balance from one foundation the another.

- It helps in lowering interest rates.

Paschim Banga Gramin Bank Personal Loan Top Up

Loan top-up is the additional amount provided by the bank for the loan. Home loans, home renovation customers can apply for a loan top-up.

Paschim Banga Gramin Bank Personal Loan Overdraft Scheme

Paschim Banga Gramin Bank Personal Loan Offers an Overdraft Scheme. With this, you are provided with a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Personal Loan Amount as you want anytime, anywhere. The overall loan amount will have a Credit/Loan Limit. The bank charges interest only on the amount you withdraw/utilize in the Paschim Banga Gramin Personal Loan Overdraft facility.

Paschim Banga Gramin Bank Personal Loan Status

- Visit our bank website.

- At the top, fill your city or district.

- Then, check your loan status.

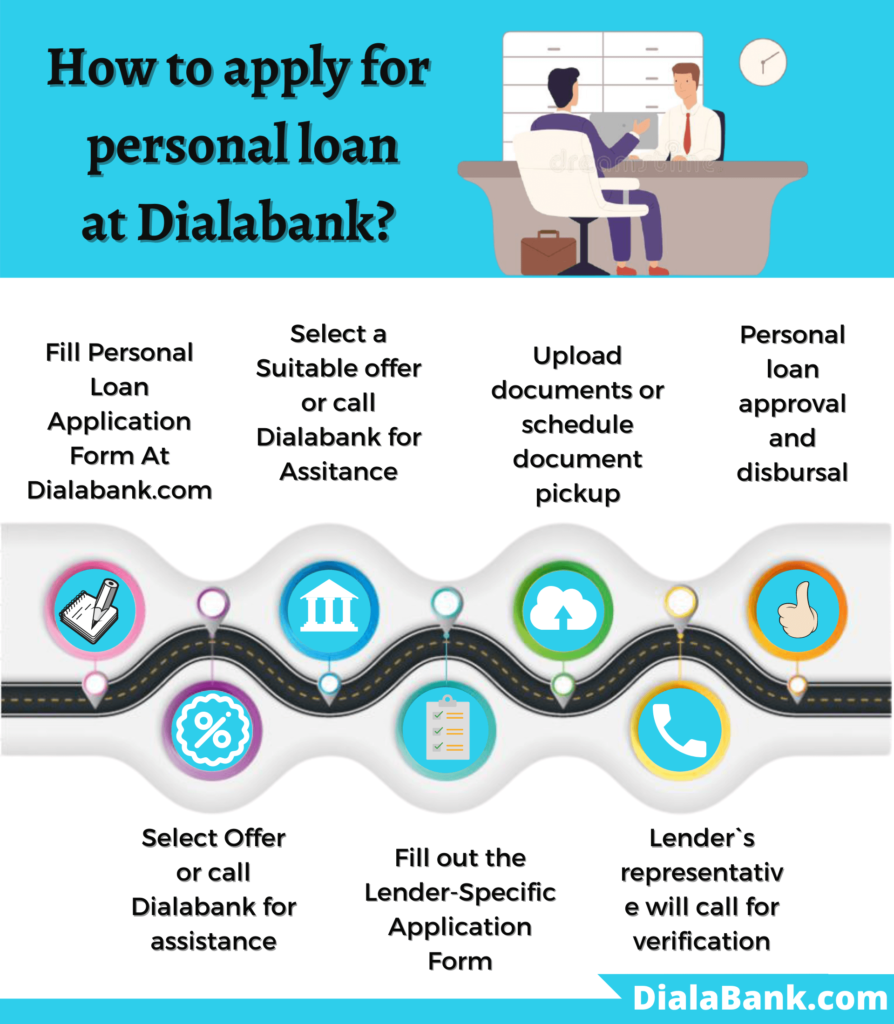

How to Apply for Paschim Banga Gramin Bank Personal Loan?

Dialabank provides the best services all over the country. Dialabank has relationship managers who will guide you and give all the information about your personal loan.

Availing a personal loan is very simple; all you have to do is to:

- Visit Dialabank and fill the application form.

- Then, you will get a call from us.

- Our experts will guide you through the entire process and tell you the loan details.

FAQs About Paschim Banga Gramin Bank Personal Loan

✅ What is Paschim Banga Gramin Bank personal loan?

The Paschim Banga Gramin Bank provides a personal loan with a 9.99% p.a. interest rate.

✅ How does Paschim Banga Gramin Bank personal loan work?

There is no security issue, and there is no need for any collateral. The essential documents are required to be submitted here. It is a simple process. Visit the branch along with the application form and documents. After approval, the loan amount will be credited to your bank account. Then, use your money for financial needs. Repay money in easy monthly instalments.

✅ What is the personal loan rate of interest in Paschim Banga Gramin Bank?

In Paschim Banga Gramin bank, the interest rate for a personal loan is up to 9.99% p.a.

✅ How to apply for a personal loan in Paschim Banga Gramin Bank?

Apply Online

- Visit our bank website.

- Check your eligibility.

- Fill in general information in the application form.

- Then, submit it.

- Our representative will call you back.

Apply Offline

- Visit the nearest branch of a bank.

- Fill the form there.

- Then, get your loan approval.

✅ How much EMI on Paschim Banga Gramin Bank personal loan?

EMI is an Equated Monthly Installments. You can clear your loan amount by paying monthly payments from your salary. 12 Lowest EMIs are allowed.

✅ How much is the CIBIL score required for a personal loan from Paschim Banga Gramin Bank?

For Paschim Banga Gramin Bank, the minimum CIBIL score for a personal loan is 700 and above.

✅ What can I use Paschim Banga Gramin Bank personal loan for?

Paschim Banga Gramin bank provides loans for multipurpose personal loans. This bank offers personal loans for homes, cars, businesses, and education. There are endless opportunities.

✅ How to prepay Paschim Banga Gramin Bank personal loan?

You are settling your loan amount before the due date refers to the Prepayment. It will help lower your interest rates.

✅ What documents are needed for Paschmin Banga Gramin Bank personal loan?

There is a requirement of an Aadhaar Card, Driving License, Voter ID Card, Salary Certificate, ITR for the last two financial yrs.

✅ What is the Paschim Banga Gramin Bank Personal Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for the Paschim Banga Gramin Bank Personal loan account pre-closure.

- Pay the pre-closure charges as per Paschim Banga Gramin Bank Personal Loan.

✅ What are Paschim Banga Gramin Bank Personal Loan preclosure charges?

Paschim Banga Gramin Bank Personal Loan preclosure charges are Nil.

✅ What is the Paschim Banga Gramin Bank Personal Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at Paschim Banga Gramin Bank, Personal Loan is provided. It gives you an online way to get your overdraft, also known as Smartdraft – Overdraft Against Salary. You do not need to visit bank branches and go through a tiresome process. Just log in to the Paschim Banga Gramin online banking portal, and from there, you can fill out a simple form and get an overdraft under your name.

✅ What is Paschim Banga Gramin Bank Personal Loan maximum tenure?

Paschim Banga Gramin Bank Personal loan maximum tenure is 60 months.

✅ What is Paschim Banga Gramin Bank Personal Loan minimum tenure?

Paschim Banga Gramin Bank Personal Loan minimum tenure is 12 months.

✅ What is Paschim Banga Gramin Bank Personal Loan customer care number?

The customers get in touch with the bank via call on 9878981166.