Major Personal Loan Providers in Allahabad

Feature

HDFC Bank

Private Bank

Bajaj Finance

Interest Rate

10.75% - 17%

11.25% - 18.5%

0.12

Min Loan Amt

Metro : 75000 & Non Metro: 50000

50000

100000

Max Loan Amt

50 Lacs

50 Lacs

1 Cr

Loan Tenure

1 - 5 Years

1 - 5 Years

1 - 5 Years

Processing Fee

0.25% - 2% of the Loan Amt

1% - 2.5% of the Loan Amt

Preclosure Charges

2%, Nil foreclosure charges after 12 months

2%, Nil foreclosure charges after 24 months

Nil

Overdraft Facility

No

No

Yes

Personal Loan Allahabad Features

We all have dreams and desires which we want to full-fill at any cost. Whether its somebody wanting to start his restaurant or someone thinking about an exotic vacation to Hawaii. With a personal loan every dream can be achieved. As the name suggests, you can use the loan amount in any way you want to, unlike the other loans, without having to worry about the restrictions. You can even use the loan amount to pay your medical expenses, or you can use the loan amount to fund your child’s wedding as per your requirements.

We all have dreams and desires which we want to full-fill at any cost. Whether its somebody wanting to start his restaurant or someone thinking about an exotic vacation to Hawaii. With a personal loan every dream can be achieved. As the name suggests, you can use the loan amount in any way you want to, unlike the other loans, without having to worry about the restrictions. You can even use the loan amount to pay your medical expenses, or you can use the loan amount to fund your child’s wedding as per your requirements.

- A Guarantor is not needed in personal Loan.

- The bank/NBFC won’t ask you for any kind of security submission.

- The amount of Loan depends upon the income of the applicant and his capabilities.

Personal Loan Allahabad Interest Rates

To check Personal Loan Interest Rate for all major banks you can visit: Personal Loan Interest Rates

Bank

Processing Fee

HDFC Bank Personal Loan

0.25% to 1.50%

Axis Bank Personal Loan

0.50% to 1.50%

Nil

Private Bank Personal Loan

0.25% to 1.50%

SBI Personal Loan

500/- to 0.50%

Nil

Kotak Personal Loan

1% to 2%

IIFL Personal Loan

Nil

Nil

Muthoot Personal Loan

Nil

Nil

Manappauram Personal Loan

Nil

Nil

PNB Personal Loan

0.70% to 1%

Nil

Canara Bank Personal Loan

0.01

Nil

Andhra Bank Personal Loan

Nil

Nil

Documents for Personal Loan Allahabad

For salaried customers:

Salaried Customers:

- PAN Card

- Residence Proof (Owned/Rented/Company provided whatsoever applicable)

- Passport-sized photographs – 2

- Identity proof (Aadhar card/driving license)

- Salary slips of last three months

- Bank statements for the last 6 months

Self-Employed Customers:

- Books of records of the company

- PAN Card

- Aadhar Card

- Residence Proof

- Two passport-sized photographs

PERSONAL LOAN

Interest Rate 9.99%

Eligibility Criteria for Personal Loan Allahabad

The Personal loan eligibility criteria differ as per requirements accordingly:

Salaried Applicants

- An applicant applying for the Personal Loan should have a good CIBIL score.

- Age requirements are 21 to 60 years.

- The applicant is required to submit his bank statement for the last three months and salary slips of the last 6 months.

- Should have worked for at least 3 years.

- An applicant living in the metropolitan city should have a minimum income of Rs 18,000. And for a person living in the non-metropolitan city, the minimum salary should be Rs 12,000.

Self-Employed Applicants

- The applicant should not be below 25 years of age.

- 700+ credit scores will be approved loan.

- The minimum amount should be Rs 2.5 lakhs per annum at least.

- Operational business from 3years is essential.

- The whole documentation process is simple and easy; the applicant has to submit his financial records and his bank statement for the last three months.

Why Apply for Personal Loan Allahabad?

- A Personal Loan does not require any co-applicant or nominee.

- There is no need to deposit any sort of mortgage or collateral security to the bank/NBFC.

- A personal loan is a multi-purpose offer loan.

- The amount of personal loan completely depends upon the repayment capacity of individual income.

How to apply for Personal Loan Allahabad?

- Visit www.dialabank.com.

- Fill in the personal required details like name, location, etc.

- Choose a personal loan option from the box.

- Click on Request a quote.

- Wait for the relationship manager to soon get in touch with you.

- For more information and free guidance on personal loans in Allahabad, you may call on 9878981166.

PERSONAL LOAN

Interest Rate 9.99%

Processing Fee / Prepayment Charges on Personal Loan Allahabad

Banks and NBFC charges a fee for processing your Personal Loan application in Allahabad. These charges are 1% of the sanctioned loan amount according to every banks own policies.

For closing your loan before the end of tenure period 2% to 4% may be charged.

Personal Loan Allahabad EMI Calculator

Equated Monthly Installments also know as EMI are the monthly fixed charges that the applicant has to pay to the bank as monthly repayment for the loan amount borrowed. Your EMI is calculated on the basis of personal loan Interest Rate you are charged by the bank which is required to be paid by a specific date every month. You can also determine your EMI for free using the Personal loan EMI Calculator.

CIBIL Score required for Personal Loan Allahabad

Every lending institution has its own minimum criteria required for the minimum CIBIL score required for processing a Personal Loan application in Allahabad. Most financial institutions require a minimum score of 750 to process your personal loan application in Allahabad while others might look into other factors like income and job stability to process the application of loans.

PERSONAL LOAN

Interest Rate 9.99%

Personal Loan Allahabad Agents

Dialabank assists you in comparing various banks and NBFCs interest rates so that you can avail the best offers available according to your need. DialaBank is your best agent available for free for personal loan in Allahabad.

Personal Loan Allahabad Contact Number

Call 9878981166 and get quick help and assistance for approval of Instant Personal Loan in Allahabad.

Pre Calculated EMI Table for Personal Loan Allahabad

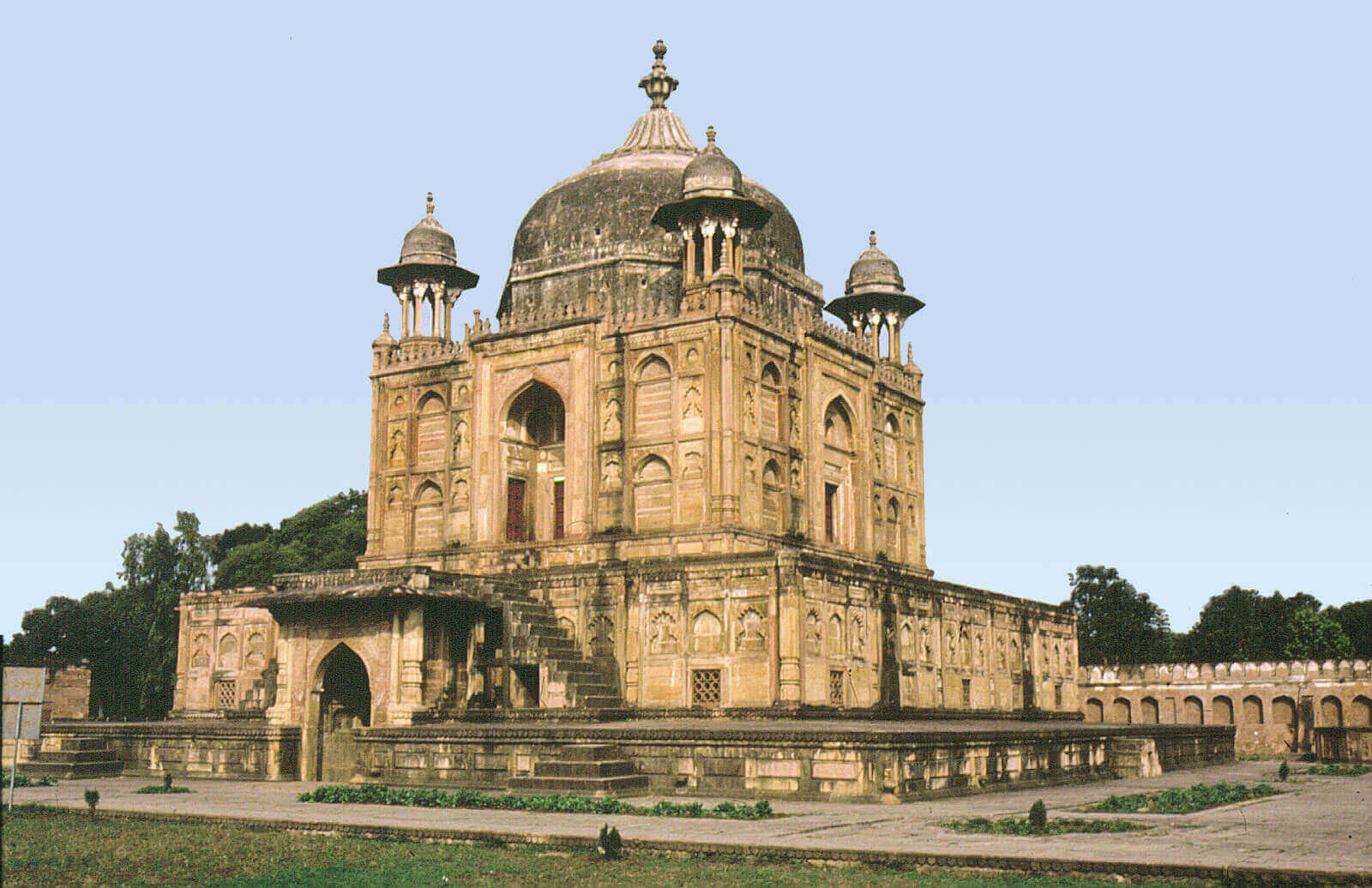

About Allahabad

Allahabad is a city situated in the Uttar Pradesh state, India. The city’s original name was Prayaga. It is the 7th most populous city of Uttar Pradesh.

FAQs About Personal Loan Allahabad

✅ Who can apply for a Personal Loan in Allahabad?

People who have an urgent need for money and do not want to keep a security and have a regular source of income (from employment or business) can apply for a Personal Loan in Allahabad.

✅ What is the tenure of Personal Loan in Allahabad?

Most of the Banks and NBFCs provide a Personal Loan in Allahabad for a min period of 1 Yr and a Max period of 5 Years. Some Banks are there which may extend the maximum period to 7 Years also. The repayment has to be done in form of equal monthly installments.

✅ Are there any other charges involved in Personal Loan Allahabad?

Yes, there are 2 types of charges that one needs to pay in order to avail a personal loan in Allahabad accordingly:

Processing Fee: that ranges from 1% for processing your loan.

Pre-closure Charges: that only exists in case you want to foreclose the loan before tenure ends.

✅ Can my application for Personal Loan Allahabad get rejected due to my CIBIL score?

Since Personal Loan in Allahabad is an unsecured loan, it is an important decision criterion for getting your Personal Loan application approved is your CIBIL Score. High CIBIL would ensure you get easy accessibility to the loan.

Other Cities For Personal Loan

| Personal Loan Chandauli | Personal Loan Bharthana |

| Personal Loan Bulandshahr | Personal Loan Bhadohi |

| Personal Loan Bulandshahar | Personal Loan Basti |

| Personal Loan Bijnor | Personal Loan Bareilly |