State Bank of Mysore Personal Loan Key Features Jan 2021

| Eligibility Criteria | Details |

| Age | 21 – 58 <76 (for pensioners) |

| CIBIL score | Minimum 700 or above |

| State Bank of Mysore Personal Loan Interest Rate | 9.99% per annum |

| Lowest EMI per lakh | Rs. 2105 |

| Tenure | 6 to 72 months |

| State Bank of Mysore Personal Loan Processing Fee | 1% to 2% |

| Prepayment Charges | 3% |

| Part Payment Charges | Not Applicable |

| Minimum Loan Amount | Rs. 24,000 |

| Maximum Loan Amount | Rs. 20 Lakh |

Each Feature Explained in Detail Below

State Bank of Mysore Personal Loan Eligibility Criteria

Eligibility criteria for a personal loan:

| CIBIL score | 700 and Above |

| Age | 21 – 58 Years <76 (for pensioners) |

| Min Income | Rs. 15000/month |

| Occupation | Salaried/Self-employed |

State Bank of Mysore Personal Loan Fees and Other Charges

| State Bank of Mysore Personal Loan Interest Rate | 9.99% per annum |

| State Bank of Mysore Personal Loan Processing Charges | 1% to 2% |

| Prepayment Charges | 3% |

| Stamp Duty | As per state laws |

| Cheque Bounce Charges | As per bank terms |

| Penal Interest | 2% |

| Floating Rate of Interest | Not Applicable |

State Bank of Mysore Personal Loan Documents Required

Documents required for a personal loan from State Bank of Mysore:

| Form | Duly filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

State Bank of Mysore Personal Loan EMI Calculator

State Bank of Mysore Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| State Bank of Mysore | 9.99% | 6 to 72 months | Up to Rs. 20 lakh / Up to 1.50% of the loan amount |

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 15.75% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh / Up to 2.25% of the loan amount |

Other Loan Products from State Bank of Mysore

| Gold Loan | Car Loan | Home Loan | Business Loan |

| TWL | LAP | Credit Card | Education Loan |

Why should you apply for a State Bank of Mysore Personal Loan with Dialabank?

- Dialabank helps you choose the best financial products for your needs.

- We provide convenient options for the hassle-free loan process.

- We make sure you get the lowest personal loan interest rates available in the market.

- With Dialabank, you have a trustworthy friend as your financial advisor.

How to Calculate EMIs for State Bank of Mysore Personal Loan

You can use the personal loan EMI calculator given below.

State Bank of Mysore Personal Loan Processing Time

The processing time for your personal loan application with the State Bank of Mysore can take anywhere between 7 to 14 days. You can apply with Dialabank, and we make sure to provide you with quick disbursing financial products.

State Bank of Mysore Personal Loan Preclosure Charges

You can pre-close a personal loan with the State Bank of Mysore. The bank charges you a foreclosure charge of 3% on your outstanding loan amount.

State Bank of Mysore Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like way repay the got out absolutely at whatever point the condition is ideal. From this time forward, it is maybe the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.

Apply for an overdraft office as a State Bank of Mysore Personal Loan. The versatile improvement office has all the huge features of a slight overdraft credit.

Pre Calculated EMI for Personal Loan

Types of State Bank of Mysore Personal Loan

-

State Bank of Mysore Marriage Loan

Marriages are a grand festival in Indian households, and the State Bank of Mysore helps you manage your wedding expenses through their personal loan schemes. You can get a loan amount of up to Rs. 20 lakhs at affordable interest rates.

-

State Bank of Mysore Personal Loan for Government Employees

Government employees are entitled to many benefits; easy and discounted personal loans are one of them. You can apply for a personal loan with the State Bank of Mysore to meet your financial needs.

-

State Bank of Mysore Doctor Loan

The State Bank of Mysore has special personal loan offers and packages for all the doctors and health professionals to help them meet their personal as well as professional needs.

-

State Bank of Mysore Personal Loan for Pensioners

Elderly citizens who have pension accounts with the State Bank of Mysore can take a personal loan and use it to meet their personal financial expenses.

-

State Bank of Mysore Personal Loan Balance Transfer

The personal loan balance transfer facility of the State Bank of Mysore allows you to transfer your high-interest loan from another lender to the bank. You can apply for a personal loan balance transfer with Dialabank.

-

State Bank of Mysore Personal Loan Top Up

Personal loan top-up allows the existing personal loan borrowers to avail of additional funds based on their repayment and Personal loan eligibility. You can apply for a top-up by filling a simple form with Dialabank.

State Bank of Mysore Personal Loan Status

You can check your loan status by;

- Visiting the branch in person.

- Using the State Bank of Mysore’s online platform.

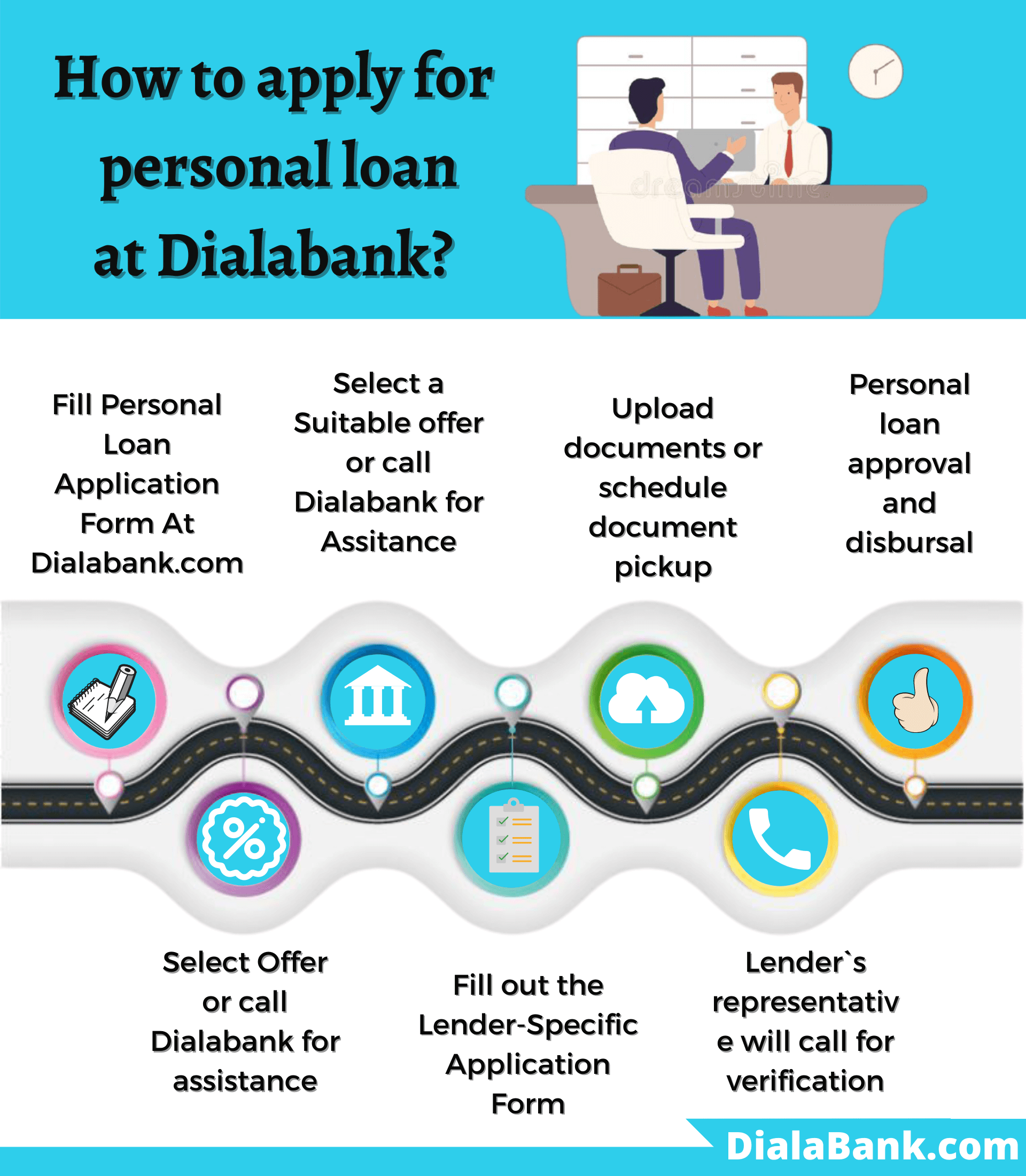

How to Apply for a Personal Loan from the State Bank of Mysore?

For State Bank of Mysore Personal Loan through Internet, given below are the steps you need to follow:

- Visit Dialabank.

- You can apply online for a State Bank of Mysore Personal Loan through Dialabank.

- On the loan page, you can analyze the loan schemes, interest rates, eligibility, and documents required.

- After analysis, you can select your loan and submit a form with your details.

- After submission, you will be reverted by our representatives.

- Our representatives will help you with the whole loan approval process.

- You can know more by calling on 9878981166.

FAQs About State Bank of Mysore Personal Loan

✅ How to apply for a State Bank of Mysore Personal Loan?

To apply for a State Bank of Mysore personal loan you can visit your nearest State Bank of Mysore branch with the required documents- Aadhar card, Voter ID card, driving license, etc. Or you could contact us at Daialabank for further assistance.

✅ What is the Interest Rate for the State Bank of Mysore Personal Loan?

The interest rate for the State bank of Mysore’s personal loan is 9.99% per annum.

✅ What is the minimum age for getting a Personal Loan from the State Bank of Mysore?

The minimum age for getting a Personal loan from the State Bank of Mysore is 21 years.

✅ What is the maximum age for getting a Personal Loan from the State Bank of Mysore?

The maximum age for getting a personal loan from the State Bank of Mysore is 58 years.

✅ What is the minimum loan amount for the State Bank of Mysore Personal Loan?

The minimum loan amount that can be availed from the State Bank of Mysore is Rs.24,000/-

✅ What is the maximum loan amount for the State Bank of Mysore Personal Loan?

The maximum loan amount that can be availed from the State Bank of Mysore is Rs.20 lakhs.

✅ What are the documents required for the State Bank of Mysore Personal Loan?

The documents required are a copy of your Aadhar card, voter ID card, driving license, bank’s statement of the last 3 months, salary slip of the last 6 months, income tax return of the last two assessment years along with rental agreement ( with minimum 1 year of stay), utility bills, passport copy (to show permanent residence address) and ration card.

✅ What is the Processing Fee for State Bank of Mysore Personal Loan?

The processing fee for the State Bank of Mysore is from 1% to 2% of the loan amount.

✅ What is the Maximum Loan Tenure for State Bank of Mysore Personal Loan?

The maximum loan tenure for the State Bank of Mysore is 72 months that is 6 years.

✅ What should be the CIBIL Score for State Bank of Mysore Personal Loan?

You should have a CIBIL score of 700 and above.

✅ How to calculate EMI for State Bank of Mysore Personal Loan?

EMI on personal loan can be calculated using the formula, E = P x R x [(1+R)^N] / [(1+R)^N-1] where,

P= Principal or your loan amount,

R= Rate of interest, and

N= Loan Tenure.

You can easily calculate your EMI online at Dialabank’s website for free and compare offers from different banks and finance companies.

✅ How to check the State Bank of Mysore Personal Loan Status?

You have several options to check the status of your Bank of India Personal Loan:

- Log In to the State Bank of Mysore Netbanking Portal, Click on loans from the top ribbon and click on Enquire to check the status of your loan.

- Search for ‘personal loan status’ on Google, open the first link which will take you to the Loan Status Tracker webpage of State Bank of Mysore Bank, and fill in the required information to check the status of your loan.

- You can also visit your loan branch and ask the banker for the same.

✅ How to Top Up Personal Loan in State Bank of Mysore?

Top up is the additional loan amount that can be taken from the existing bank of your running loan or at the time of balance transfer from your new bank. You can get a top-up of a minimum of ₹50,000 and a maximum of your already sanctioned loan amount. You can check the online portal of the Bank of India for more offers or contact Dialabank for any financial help.

✅ What happens if I don’t pay my State Bank of Mysore Personal Loan EMIs?

There will be a penal interest charged as applicable and would even face legal actions if defaulting continues.

✅ How to find the State Bank of Mysore Personal Loan account number?

To get your personal loan account number you can contact the loan officer at the bank branch or by contacting the customer care number of State Bank of Mysore.

✅What is the State Bank of Mysore personal loan customer care number?

Contact 9878981166 for any queries.

✅What are the State Bank of Mysore Personal Loan pre-closure charges?

You can pre-close a personal loan with the State Bank of Mysore. The bank charges you a foreclosure charge of 3% on your outstanding loan amount.

✅What is the State Bank of Mysore personal loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgement of the balance amount you have paid.

✅What is the State Bank of Mysore Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like way repay the got out absolutely at whatever point the condition is ideal. From this time forward, it is maybe the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.