Best Banks for Two Wheeler Loan in Guwahati

Two Wheeler Loan Guwahati Features

Thinking of purchasing a new bike? But do not have the required finances for it? Do not worry! A Two Wheeler Loan is available for you. A Two Wheeler Loan is a means of funding or financial help offered by banks and NBFCs to individuals at a reasonable rate of interest.

A Two-Wheeler Loan Guwahati helps you in buying a bike or scooter with your choice. Two Wheeler Loan in Guwahati is available for both the salaried as well as for the self-employed individuals.

Some of the main features of a Two Wheeler Loan in Guwahati are:

- Easy and simple processing

- Loan amount disbursed quickly

- Two Wheeler Loans are available at a reasonable interest rate

- Easy repayment options are available for you

- Fulfil your desire for buying a new two-wheeler

- Two Wheeler Loans are easily available through Dialabank

Two Wheeler Loan Guwahati Interest Rates

Two Wheeler Loan Guwahati Documents Required

For Salaried:-

- Self Proof: PAN Card, Voters ID card, Passport copy, Driving License

- Earning Proof: Latest 3-month salary slip with form 16

- House Proof: Driving license / Voters card / Passport Copy / Telephone Bill / Ration card / Electricity Bill / Life Insurance Policy

- Compulsory Document: PAN Card

- Bank Statement: Last 3 months.

For Self Employed:-

- Identification Proof: PAN Card, Voters ID card, Passport copy, Driving License

- Residence Proof(any 1): Voters card / Passport Copy / Ration card / Telephone Bill / Driving license / Electricity Bill / Life Insurance Policy /PAN Card

- Compulsory Document: PAN Card

- Bank Statement: Last 3 months.

Two Wheeler Loan Guwahati Eligibility Criteria

For Salaried:-

- Minimum age: 21 years

- Maximum age at loan maturity: 65 years

- Minimum employment: 1 year in job employment and a minimum of 2 years of job

- Minimum Monthly Income: Rs. 7,000

- High CIBIL Score: Get the loan easily

For Self-Employed:-

- Minimum age: 21 years

- Maximum age at loan maturity: 65 years

- Minimum employment: at shortest 3 years in sales

- Minimum Monthly Income: Rs. 6,000

Two Wheeler Loan for Top Selling Bikes in Guwahati

Processing Fees / Prepayment Charges on Two Wheeler Loan in Guwahati

The processing fee is the fee taken by the bank for the processing of a two-wheeler loan. This varies from bank to bank. It depends on the loan amount. The processing fee charges for a two-wheeler loan in Guwahati is up to 3% of the loan amount (maximum).

Prepayment charges are the charges you will pay to the bank if you want to pay the loan amount before the time for lowering your interest burden. Prepayment charges vary from 3% to 10% of the outstanding principal for getting a two-wheeler loan from Guwahati.

Two Wheeler Loan Guwahati Contact Number

Dialabank is the most trustworthy agent who will serve you in the entire processing of a two-wheeler loan. You can apply online with Dialabank and get the best offers on a two-wheeler loan with instant approval or you can contact this number for any queries about the two-wheeler loan in Guwahati 9878981166.

Our customer care representative will provide you with the best guidance and assistance to solve your all sort of queries about a two-wheeler loan.

Pre Calculated EMI Table for Two Wheeler Loan Guwahati

Rate

4 yrs

3 yrs

2 yrs

1 yr

11.83%

2625

3313

4699

8876

12.00%

2633

3321

4707

8884

12.50%

2658

3345

4730

8908

13.00%

2682

3369

4754

8931

13.50%

2707

3393

4777

8955

14.00%

2732

3417

4801

8978

14.50%

2757

3442

4824

9002

15.00%

2783

3466

4848

9025

15.50%

2808

3491

4872

9049

16.00%

2834

3515

4896

9073

16.50%

2859

3540

4920

9096

17.00%

2885

3565

4944

9120

Two Wheeler Loan EMI Calculator Guwahati

About Guwahati

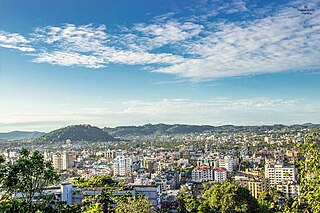

Guwahati is the greatest city in the Indian state of Assam in India and also the most magnificent metropolis in northeastern India. A larger riverine harbour city along with hills, and one of the fastest-growing cities in India, Guwahati is located on the south bank of the Brahmaputra. It is termed as the ‘Gateway to North-East India’.

Two Wheeler Loan in Other Cities