Best Banks for Two Wheeler Loan Jind

|

Feature

|

HDFC Bank

|

Private Bank

|

Kotak Mahindra Bank

|

|

Interest Rate

|

8% - 8.4 %

|

8.5 - 9.5 %

|

11%

|

|

Min Loan Amt

|

Metro : 1 Lac & Non Metro: 75000

|

75000

|

75000

|

|

Max Loan Amt

|

1 Cr

|

1 Cr

|

1 Cr

|

|

Loan Tenure

|

Upto 7 Years

|

Upto 5 Years

|

Upto 5 Years

|

|

Processing Fee

|

1999 - 4999 + Tax

|

0.25% to 1.50%

|

0.25% to 1.50%

|

|

Preclosure Chgs

|

2%, Nil after 24 months

|

2%, Nil after 36 months

|

Nil

|

|

Loan to Value (LTV)

|

Upto 100% on Ex- showroom

|

Upto 95% on Ex- showroom

|

Upto 90% on Ex- showroom

|

Two Wheeler Loan Jind Features

With ever-growing demands, two-wheelers have also become a need. Two-wheelers are the best solution for an efficient medium to run errands anytime anywhere. Now even if your bank balance does not allow you to go out and buy a two-wheeler, Dialabank got your back, with the easiest answers to all your two wheeler loan related queries.

Get instant Two wheeler loan from Dialabank in simple hassle-free steps. Dialabank helps you to avail of a Two Wheeler Loan Jind with a loan tenure of 1 year to 4 years with fringe benefits that include; basic loan documents, lowest EMI, and flexibility to choose a two wheeler of your own choice.

Here you go on roads with your personal (bike, scooter, superbikes, etc.) on roads with Dialabank since we allow you to go through all options from efficient to luxurious with the most transparent loan procedure. With such a simple procedure acquiring a two-wheeler is no more a forbidden dream.

Two Wheeler Loan Interest Rates

The interest rate for Two Wheeler Loan Jind Starts at 11.83% p.a.

To check Two Wheeler Loan Interest Rate for all major banks you can visit: Two Wheeler Loan Interest Rate

Two wheeler Loan Jind Documents Required

Essential Documents required for Two Wheeler Loan Jind:

For Salaried:-

- Identity Proof can be any of the following: PAN Card, Voters ID card, Passport copy, Driving License any one of these

- Compulsory Document: PAN Card is mandatory to submit

- Address Proof can be any of the following: Driving license / Voters card / Passport Copy / Telephone Bill / Ration card / Electricity Bill / Life Insurance Policy can be anyone of these

- Bank Statement is compulsory: Last 6 months of the applicant from Jind.

For Self Employed:-

- Identity Proof can be any of the following: PAN Card, Voters ID card, Passport copy, Driving License can be any of these

- Required Document: PAN Card is mandatory to submit

- Address Proof can be any of the following: Voters card / Passport Copy / Ration card / Telephone Bill / Driving license / Electricity Bill / Life Insurance Policy

- Bank Statement is compulsory: Last 6 months of the applicant from Jind.

Click here to know more about Two Wheeler Loan Documents Required

Two Wheeler Loan Jind Eligibility Criteria

The essential criteria for Two Wheeler Loan Jind:

For Salaried:-

- The applicant should be of at least 21 years of age and a maximum of 65 years of age is a compulsory criterion.

- The average monthly income of Rs 7000.

- CIBIL Score has a direct impact on your eligibility for the loan. If you have a high CIBIL score, you can get the approval for the loan easily.

For Self-Employed:-

- The applicant should be of at least 21 years of age and a maximum of 65 years of age is strictly required.

- The income average of Rs 6000 on monthly basis.

- CIBIL Score has a direct impact on your eligibility for the loan. If you have a high CIBIL score, you can get the approval for the loan easily.

Click here to know more about Two Wheeler Loan Eligibility

Two Wheeler Loan for Top Selling Bikes in Jind

Processing Fees / Prepayment Charges on Two Wheeler Loan Jind

The Processing Fee required for availing Two Wheeler Loan Jind is 3% of the loan amount (maximum).

The Payment Charges required for availing Two wheeler Loan Jind are simply processed from 3% to 10% of the outstanding principal.

And Prepayment Charges for Two wheeler loan Jind include:

- Within 4 to 6 months – 10% of principal outstanding

- Within 7 to 12 months – 6% of principal outstanding

- 13-24 months – 5% of principal outstanding

- Post 24 months – 3% of principal outstanding

- Prepayment is not allowed within three months of EMI repayment.

Two Wheeler Loan Jind Contact Number

In case of any queries regarding the Two Wheeler Loan Jind, you may contact on the number 9878981166 for any sort of assistance or you can also visit us at Dialabank.

Pre Calculated EMI Table for Two Wheeler Loan Jind

Rate

4 yrs

3 yrs

2 yrs

1 yr

11.83%

2625

3313

4699

8876

12.00%

2633

3321

4707

8884

12.50%

2658

3345

4730

8908

13.00%

2682

3369

4754

8931

13.50%

2707

3393

4777

8955

14.00%

2732

3417

4801

8978

14.50%

2757

3442

4824

9002

15.00%

2783

3466

4848

9025

15.50%

2808

3491

4872

9049

16.00%

2834

3515

4896

9073

16.50%

2859

3540

4920

9096

17.00%

2885

3565

4944

9120

About Jind

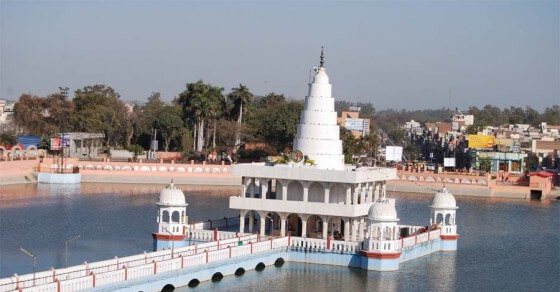

Jind is one of the most extensive and adored cities in the Indian state of Haryana. Rani Talab is the main goal for tourists while Pandu-Pindara and Ramrai are the central religious spots, attracting fans for the holy bath during Amavasya.

Two Wheeler Loan EMI Calculator

Other Cities For Two Wheeler Loan

| Two Wheeler Loan Nellore | Two Wheeler Loan Guntur |

| Two Wheeler Loan Nandyal | Two Wheeler Loan Andhra Pradesh |

FAQs for Two Wheeler Loan Jind:

✅ Why should I apply for a Two Wheeler Loan Jind?

Owning a Two Wheeler Loan Jind can make you feel confident and independent. However, to pay for it out of your own pocket can make it a financial burden for you and the Jind Two Wheeler Loan loan helps you pay for the vehicle through easily affordable monthly payments.

✅ Can a Two Wheeler Loan loan from Jind fund my vehicle purchase completely?

Most banks in Jind offer to fund up to 85% or even 90% of the vehicle cost. However, few lenders in Jind even fund for the 100% amount but charge some additional costs and add some conditions to it.

✅ What costs will a Two Wheeler Loan Jind cover?

A Two Wheeler Loan loan from Jind will cover the registration charges, insurance, as well as accessories. You can get even more benefits in Jind if your bank has a tie-up with a particular Two Wheeler Loan company.