Pragathi Krishna Gramin Bank Savings Account

Pragathi Krishna Gramin Bank Savings Account

Save while you can, and draw when the time comes. Individuals, non-trading companies, and licensed entities may all have accounts. With or without the use of a checkbook, the minimum monthly average balance sum is Rs.500/-. Minors above the age of 10 can also open a Zero balance SB account and get Junior Debit cards with cash withdrawal of Rs. 5,000/- (daily limit) and POS limit of Rs. 2000/- can be availed. However, they are not entitled to Cheque Book, Overdraft/TOD. They do not, however, have access to a Cheque Book or an Overdraft/TOD account.

GOLD LOAN @ 0.75%*

APPLY NOW

Features and Benefits of Pragathi Krishna Grama Bank Savings Account

- With KYC proofs, an account can be opened with a minimum balance depending on the location (urban, metro, or rural).

- Regularly, the deposit would receive 3.25 percent p.a. interest.

Pragathi Krishna Bank Savings account Charges

Pragathi Krishna Grama Bank needs a minimum deposit of Rs.500 to open a savings account with a checkbook. A minimum average balance of Rs.500 must be maintained in such an account. The minimum amount needed to open a savings account without a checkbook in Pandyan Grama bank is Rs.100, and the minimum average balance required to maintain the account is Rs.100.

Pragathi Krishna Bank Savings Account Products

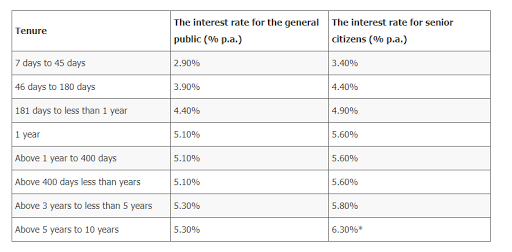

Pragathi Krishna Grama Bank provides Fixed Deposit (FD) products with a variety of terms and interest rates, as well as a variety of other advantages such as a loan or overdraft facility against the Fixed Deposit. Pandyan Grama Bank makes it easy to open a Fixed Deposit Account.

Pragathi Krishna Grama Bank Savings Account Welcome Kit

After7–8 working days from the date of opening a specific savings account, Bank mails a Welcome Kit containing a personalized checkbook and ATM Card to the customers’ postal address chosen for correspondence.

Pragathi Krishna Bank Documents Required to Open Savings Account

- Go to the Pragathi Krishna Grama Bank Branch in person. You must go to the branch of Pandyan Grama Bank where you want to open your FD account.

- Complete the Form for Opening a Fixed Deposit Account (FD-AOF)

- Obtain the Fixed Deposit Account Opening Form and complete all necessary customer information and other details in the various sections of the prescribed form, such as name, address, contact number, email address, PAN, type of account to be opened, nominee’s name, and so on.

- PAN and KYC (Know Your Customer) documents

- Photograph of passport size

- HUF Deed of Declaration

Firm of Partnership

- Partnership documents (PAN and KYC)

- Deed letter from partners authorizing the account to be opened and operated

- Photographs of all partners in passport size PAN and KYC (Know Your Customer) documents a duplicate of the trust deed Copy of the Certificate of Registration A copy of the Trustees’ Resolution allowing the account to be opened and operated by the members concerned Photographs of the account’s administrators PAN and KYC (Know Your Customer) documents Board Resolution to open and run the account according to the Association’s Bylaws Photographs in passport scale PAN and KYC (Know Your Customer) documents Memorandum and Articles of Association Certificate of Incorporation Resolution of the Board of Directors to open and run the account Authorized signatories’ identification proofs Photographs of the directors in passport scale

GOLD LOAN @ 0.75%*

APPLY NOW

Savings Account Opening Process at Pragathi Gramin Bank

Go to the Pragathi Krishna Gramin Bank Branch in person. You must go to the bank branch where you want to open an account. For a savings account, complete the Account Opening Form (AOF). Obtain the Savings Bank Account Opening Form and complete all of the required customer information fields.

FAQs

✅What is the concept of a business loan?

A business loan is an unsecured loan provided by almost all banks, non-banking finance companies (NBFCs), and other financial institutions that does not require any collateral, guarantor, or asset hypothecation. Its duration varies from one to three years.

✅What is the significance of obtaining a business loan?

A business loan is a type of credit issued by banks and non-bank financial institutions (NBFCs) to help a company obtain funds for growth, asset acquisition, or operating expenses. It can be used for any reason in your company, whether short or long term.

✅What are the applications for a business loan?

A business loan may be used for a variety of purposes, depending on the borrower. This loan can be used for working capital or to meet short-term cash flow needs, or it can be a term loan for investments in plant and machinery, equipment purchases, and other purposes.

For further information, please visit the official page of Dialabank