SBI Balance Enquiry Toll-Free Number

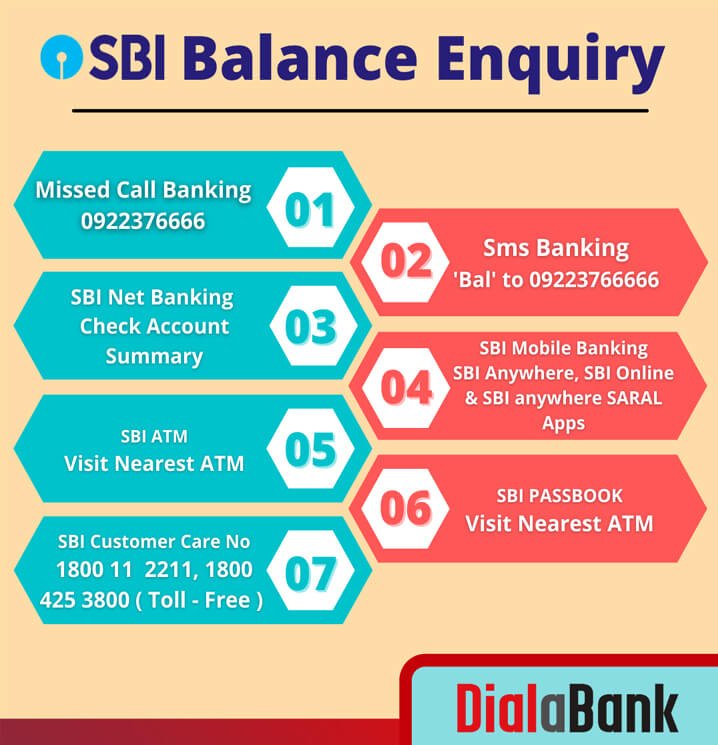

Customers with a State Bank of India (SBI) bank account can check their account balance in various ways. SBI Balance Enquiry is available via a toll-free line, SMS Banking, SBI Quick, Net Banking, Mobile Banking, ATMs, and other methods.

SBI Balance Enquiry Toll-Free Number

GOLD LOAN @ 0.75%*

APPLY NOW

Customers of SBI can utilize the bank’s SMS banking services to check their account balance or obtain a mini-statement. All customers must make a missed call or send an SMS to the SBI Balance Enquiry toll-free number from their registered mobile number. They will get their balance information on their phone in a matter of seconds.

-

To check the account balance, customers can give a missed call on 09223766666 SBI balance enquiry toll-free number or SMS “BAL” to 09223766666

-

The toll-free (missed call service) SBI number for mini statement 09223866666 or SMS “MSTMT” to 09223866666

Different Options for SBI Balance Enquiry

Below there are some ways through which customers can do an SBI Balance Enquiry check:

- ATM

- Net Banking

- SMS Banking

- SBI Card Balance Enquiry

- Passbook

- Missed Call Banking

- Mobile Banking using the State Bank of India (SBI) Mobile Apps

GOLD LOAN @ 0.75%*

APPLY NOW

- SBI YONO

- SBI Quick

- SBI Online

- SBI Anywhere Saral (SBI passbook)

The above mentioned SBI balance enquiry options have been discussed below:

SBI ATM

Customers with an SBI account can utilise the ATM-cum-debit card provided to them to access the money in their account. They must go to a State Bank of India ATM and complete the following steps:

- Swipe your SBI ATM/debit card.

- Use the ATM PIN, which is four digits long.

- Select “Balance Enquiry” from the drop-down menu.

- Complete the transaction.

Customers can also review their previous 10 transactions at the ATM by selecting the “Mini Statement” option. The SBI ATM will issue a receipt with information on the past 10 account transactions. SBI account users can also check their account balance at a non-SBI or third-party ATM.

It’s worth noting that the RBI has set a restriction on the number of free transactions per ATM card. A balance enquiry is also counted as a transaction. Once your free transactions have been used up, you will have to pay transaction fees for each transaction you make during the month. Remember that the total number of transactions includes both SBI and non-SBI ATM transactions.

GOLD LOAN @ 0.75%*

APPLY NOW

One of the main reasons why account users should use SBI Balance Enquiry online is this. As a result, ATMs should only be utilised for cash withdrawals or other services. SBI Balance Enquiry or any other bank account balance check should be made via mobile or online means because they are more convenient and time and cost-effective.

SBI Net Banking

SBI account holders registered for the net banking facility can use their SBI net banking login id and password to log into their net banking account. They can choose a range of banking facilities provided by SBI to its customers, including a balance enquiry, home loans, mortgage loans, funds transfer, personal loans, etc.

| Extra Saving on Online Shopping is Just One Click Away | Get SBI SimplyCLICK Card in 7 Days* |

SBI SMS Service

SBI can subscribe to the SMS service with their mobile numbers and then use it to check their account balance. They can register by following the steps outlined below. The SMS should be formatted as follows:

“REG<space>Account Number.”

to

09223488888

SBI will send you an email confirming your registration. Customers can now check their SBI account balances, mini statements, cheque book requests, e-statements, education loan interest certificates, and home loan interest certificates using this facility.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Balance Check SBI Balance Enquiry

SBI Card Balance Enquiry

Users of SBI credit cards can utilise the SMS service to check SBI Balance Enquiry and other information. Sending an SMS to the number 5676791 in the manner below will get a variety of information:

| Service/Information | SMS Format |

| Balance enquiry | BAL XXXX |

| Available credit and cash limit | AVAIL XXXX |

| Block your lost or stolen card | BLOCK XXXX |

| Last payment status | PAYMENT XXXX |

| Reward point summary | REWARD XXXX |

| Subscribe to e-statement | ESTMT XXXX |

| Request for duplicate statement | DSTMT XXXX MM |

| (Statement Month in MM) |

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Passbook

- When consumers open a bank account with the State Bank of India, they are given a passbook.

- Customers must keep their passbooks up to date to ensure that they have the most up-to-current information on all transactions.

- Customers can check their current balance and see a record of both debit and credit transactions by opening their updated passbooks.

- Each passbook update necessitates a visit to the bank branch.

- Although many customers are still hesitant to use the bank’s net banking or mobile banking services, this technique of checking balances is still available.

SBI Mobile Banking

SBI provides mobile banking services to its consumers through SBI Anywhere, SBI Online, SBI Anywhere Saral, and other mobile apps. Account users can check their SBI account balance using their smartphones in the following ways:

- SBI YONO

- Customers of SBI can use the SBI YONO app on their Android or iOS devices to use mobile banking services.

- The mobile banking credentials can be used to log in.

- Customers have access to various banking services, including balance inquiries, account statement checks, and cash transfers, among others.

- SBI Online

- Account-holders of the State Bank of India can use their smartphones to access SBI banking services such as funds transfer, balance check, account statement, NEFT, IMPS, and more.

- This app has a user interface that is similar to the SBI desktop website.

- Customers can instantly access all of these financial services by just inputting their net banking credentials.

- SBI Anywhere Saral

- Customers of SBI corporate internet banking can use this app to conduct banking activities.

- They can make a money transfer, a mobile recharge, check their balance, see the past 10 transactions, and get a mini account summary, among other things.

- This app is not available to SBI retail customers who want to check their balance.

- However, because SBI Card manages credit card services, the balance inquiry process for SBI credit cards is different. For SBI credit cards, the mobile app is also different.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Account Balance through Missed Call Banking

Missed call banking allows you to complete various banking transactions by dialling the SBI Balance Enquiry Toll-Free Number or sending an SMS. SBI also offers SBI Balance Check, mini-statement, E-statement (last 6 months), education loan certificate statement, house loan certificate statement, ATM setup, ATM PIN generation, home and vehicle loan details, social security scheme details, and other services. The RBI facilitates this service, which is offered by the majority of banks in the country.

There may be some small fees associated with the service, especially for sending and receiving SMS. The bank’s policies govern the fees. On the other hand, most banks do not charge for balance inquiries made through SBI Balance Enquiry Toll-Free Number. The most significant benefit of this service is for customers who have multiple accounts with the same bank. The bank will send a message with the balance information for all of the accounts and the account number and type.

Customers are recommended to wait and try again after some time if this service does not work due to a technical issue.

Missed Call Banking Registration

- Customers must index their registered cellphone number to use the service.

- This is a one-time process that requires sending an SMS to 09223488888 with the phrase “REGSPACE>Account Number.” The bank will send a confirmation message stating that the service has been activated for the account.

SBI Balance Enquiry using USSD

Unstructured Supplementary Service Data, or USSD, is a GSM communication method that allows information to be sent between a mobile phone and a network application program. The service is available to SBI customers who have a current or savings account.

Features:

- One can know about account balance

- Get the brief statement (last 5 transactions)

- Transferring money to different accounts

- Mobile recharging

- Bureau meter

- Your Credit Score Is Now Available For No Cost

- Request a Report

GOLD LOAN @ 0.75%*

APPLY NOW

How to start the USSD Session?

This is significant since clients who currently use Mobile Banking via Application or WAP will not use the service via USSD. If a current user wants to use the service, he or she must first de-register from the App or WAP-based service before signing up for the USSD service.

To register for SBI Balance Enquiry using USSD, dial

*595#

The user will be greeted with a message that says, “Welcome to State Bank Mobile Application.” The consumer will receive the following response after entering the right User ID. Select from the following options for the desired service:

- Enquiry

- Fund Transfer

- Mobile Top-up

- Change MPIN

- Forgot MPIN

- De-Register

The user must respond with the appropriate option number. Select ‘Answer’ and then ‘Send,’ selecting the serial number from the list of possibilities above.

How to use the SBI USSD service?

Below mentioned is a detailed explanation of the mobile banking services one can avail of over USSD:

| Service via USSD | USSD Code |

| Balance Enquiry & Mini Statement | Enter *595# and Enter the User ID |

| Press ‘Answer’ and Choose ‘Option 1’ | |

| Choose from ‘balance enquiry’ or ‘mini statement.’ | |

| Enter the MPIN and Send | |

| Fund Transfer | Enter *595# and Enter the User ID |

| Press ‘Answer’ and Choose ‘Option 2’ | |

| Register Payee by entering the Payee account no. | |

| Enter MPIN & Send | |

| Prepaid Mobile Top-up | Enter *595# and Enter the User ID |

| Press ‘Answer’ and Choose ‘Option 3’ & Send | |

| Enter the name of the service provider | |

| Press ‘Answer’ & Enter the Mobile Number | |

| Enter the Top-up amount & Press ‘Send.’ | |

| Enter the MPIN and Send | |

| De-Register | Enter *595# and Enter the User ID |

| Press ‘Answer’ and Choose ‘Option 6’ & Send | |

| Enter the MPIN and Send | |

GOLD LOAN @ 0.75%*

APPLY NOW

How to Register for SBI Balance Enquiry using USSD?

Any account holder who wishes to register for the SBI Balance Enquiry using USSD service is required to send an SMS in the following format:

<MBSREG>

to

9223440000 or 567676

SMS will be sent to SBI account holders with a “User ID” and a default “MPIN.”

To register for SBI Balance Enquiry through USSD, the customer must first modify their MPIN and complete the registration process at their local ATM or bank. Follow the steps outlined below:

- Dial *595#

- Enter ‘4’ and Send

- Accept the displayed terms & conditions

- Click ‘Answer’ & Enter ‘1’

- Enter old MPIN and Click ‘Send.’

- Enter new MPIN and Click ‘Send.’

The user’s MPIN will be modified, and a validation message will be sent to them by SMS. The user must go to the nearest ATM or Bank Branch to complete the activation process.

For activation at ATM, follow the given steps:

- Choose the ‘Mobile Registration’ option after swiping the debit card.

- Choose ‘Mobile Banking’ after entering your ATM PIN.

- Select ‘Registration and Enter Your Mobile Number’ from the drop-down menu.

- Select “Yes” first, then “Confirm.”

- Take the transaction slip with the message “Mobile Registration Successful” on it.

Significance of Regular SBI Balance Check

Most public and private banks provide efficient and simple ways for customers to check their account balances from anywhere and anytime. Checking your bank balance regularly is a good way to remain on top of your finances.

Balance inquiry is often one of the most popular services, as it is used for a variety of purposes –

- To verify that the account has enough funds for money transfers, check payments, and other transactions.

- To determine whether the money sent by the receiver has been credited to the account.

- To ensure that the amount debited for a failed transaction has been refunded.

- Check to determine if the interest (in a savings account) has been deposited on time by the bank.

GOLD LOAN @ 0.75%*

APPLY NOW

Why should one carry out balance enquiry more often?

It’s a good idea to undertake SBI Balance Enquiry for your account balance now and make sure there haven’t been any unauthorized transactions. Also, review your monthly bill to identify any needless spending that you can eliminate to save even more money. Keeping track of account balances and transactions can also aid in creating a manageable monthly budget.

FAQs

✅ Does USSD support for SBI Balance Enquiry available?

Yes, SBI also offers a USSD balance inquiry service. Account-holders can access information such as their SBI account balance, mini statement, and fund transfer, among other services.

✅ What does the SBI Balance Enquiry Toll-Free Number stand for?

Account-holders can check their SBI balance by calling the SBI balance enquiry toll-free number 09223766666. Account-holders can also inquire about their balance by calling the SBI customer service numbers 1800112211 and 18004253800.

✅ How can an account holder check the balance of their SBI account using SMS Banking?

Account-holders can get a quick SBI balance inquiry by texting “BAL” to 09223766666 from their registered cellphone number. Account-holders can get an SBI Mini Statement by texting “MSTMT” to 09223866666.

✅ Will SBI Quick notify you if you have multiple bank accounts at the same branch?

No, SBI Quick only delivers communications related to the account that is linked to the service. The customer must deregister the previous account and register with another SBI account to use this service.

✅ Is SBI Quick accessible from any bank account?

SBI Quick is only available for certain accounts. A savings account, a current account, an overdraft account, and a cash credit account are included.

✅ What distinguishes SBI Quick from the State Bank Anywhere and State Bank Freedom apps?

SBI Quick is distinct from State Bank Anywhere and State Bank Freedom in two important ways. The first is that SBI fast is not a money transfer service, which means it cannot expedite a financial transaction. The second significant distinction is that the service does not require a login ID and password to utilize.