What Is A GSTR-3B?

It is nothing complex, but a simple self-declared summary of the GST return filed every month or quarterly for the QRMP scheme. It has to be filed by a registered taxpayer from the month of July 2017.

- A separate GSTR has to be filed for each and every GSTIN.

- The liability of the GST must be paid on the date or before the date of filing it.

- Once filed, it cannot be revised.

- It must be filed even in case of zero liability.

Who Should Not File A GSTR-3B?

It should be filed by each and every person who is registered under the GST. Following are the people who do not have to file this: –

- Input service distributors.

- Taxpayers registered under the Composition Scheme.

- Non-resident taxable persons.

- Non-resident suppliers of OIDAR service.

Penalty and Late Fee

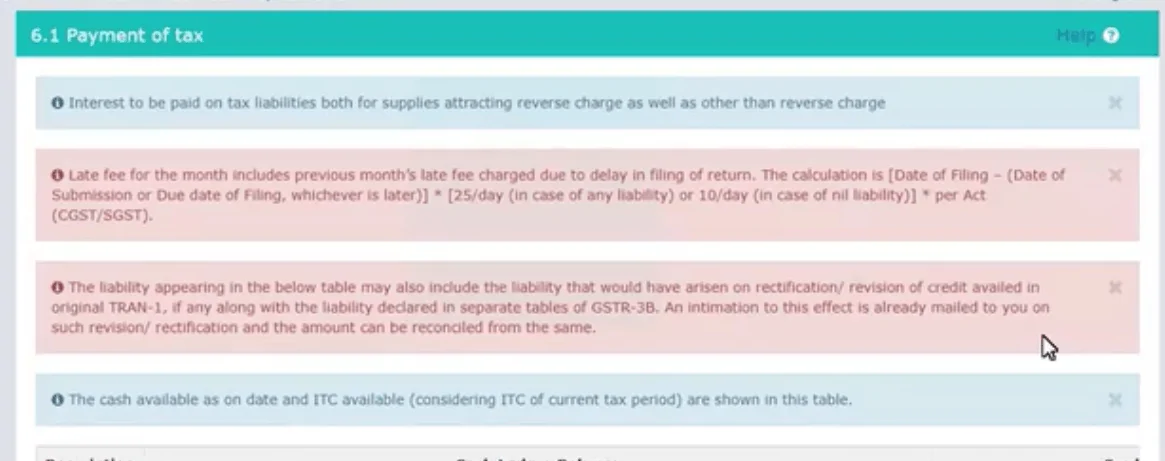

A penalty or late fee is charged for the filing of GSTR after the due date. The penalty is: –

- Rs. 50/- per day for the delay.

- Rs. 20/- per day for the delay for the taxpayers who have a nil tax liability for a month.

In case, the dues of the GST are not paid within the time period as in before the due date, an interest of 18% per annum has to be paid on the amount of the outstanding tax.

What is the Last Date To File?

This form is like a monthly return form and the due date for the submission of this form for every month is the 20th of the next month. For instance, for the month of September 2019, the due date is 20th October 2019. The due dates are summarized in the table as under:-

| Category of the Person Registered | Type of Form | Due Date |

| Regular taxpayers with a turnover of more than Rs. 5 crores | Monthly | 20th of the succeeding month |

| Small taxpayers with a turnover of up to Rs. 5 crores and not opting for the QRMP scheme | Monthly | 20th of the succeeding month |

| Small taxpayers with a turnover of up to Rs. 5 crores and opting for the QRMP scheme (Specified States-1) | Quarterly | 22nd of the month succeeding that quarter |

| Small taxpayers with a turnover of up to Rs. 5 crores and opting for the QRMP scheme (Specified States-2) | Quarterly | 24th of the month succeeding that quarter |

What Is the Format of GSTR-3B?

The format is divided into the following sections: –

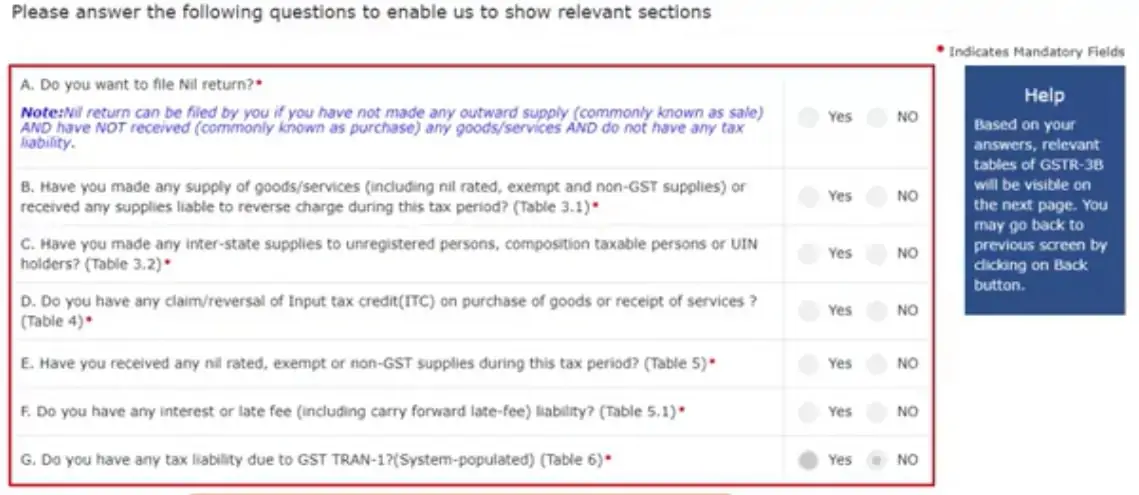

Section-1: The first section includes the Questionnaire which is related to the business activities and the tax liabilities for the current period of tax.

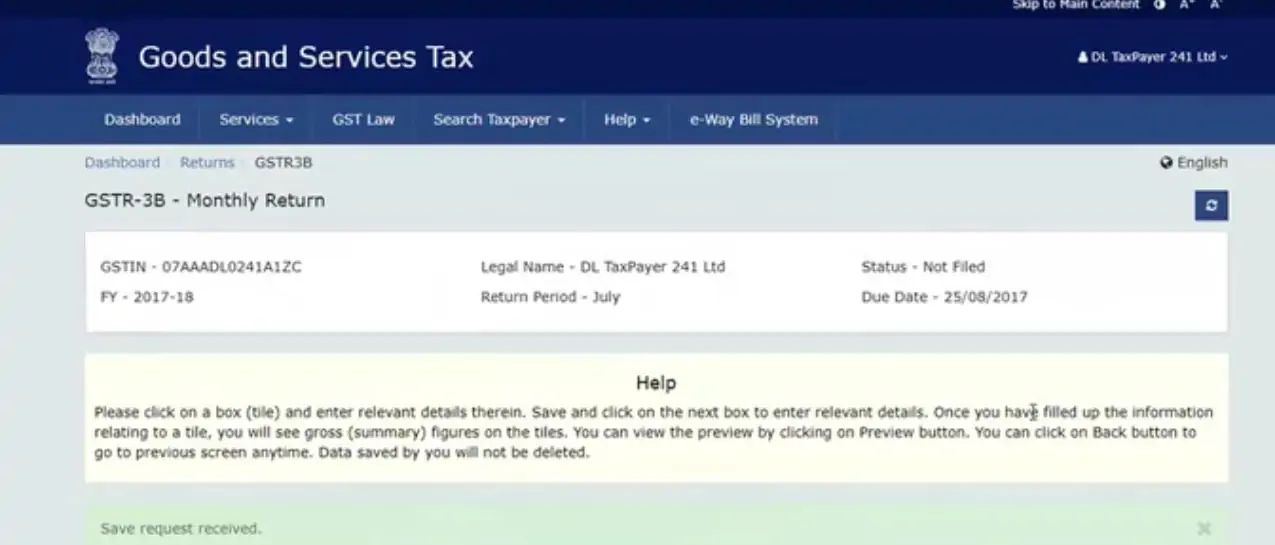

Section-2: The second section consists of a box that shows the information related to GST return including the Return Status.

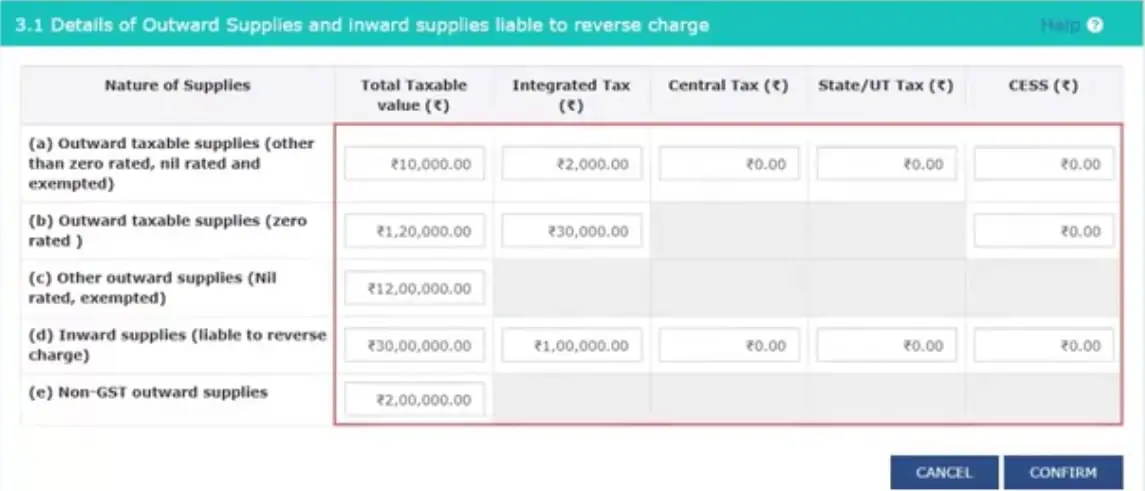

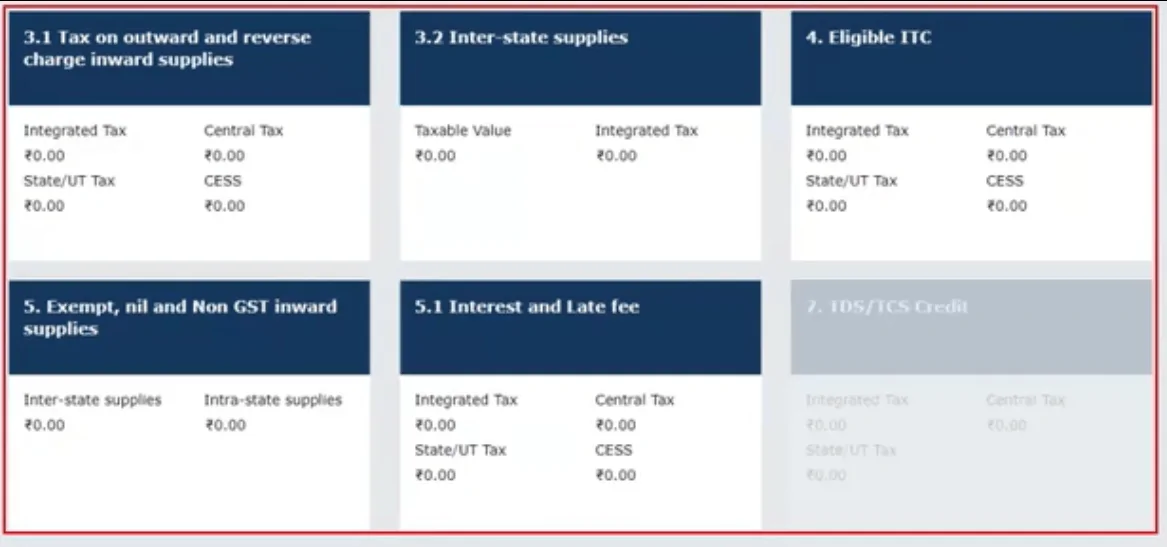

Section 3.1: The first part of the third section consists of a box that has to be filled with the details of tax on the inward and outward supplies.

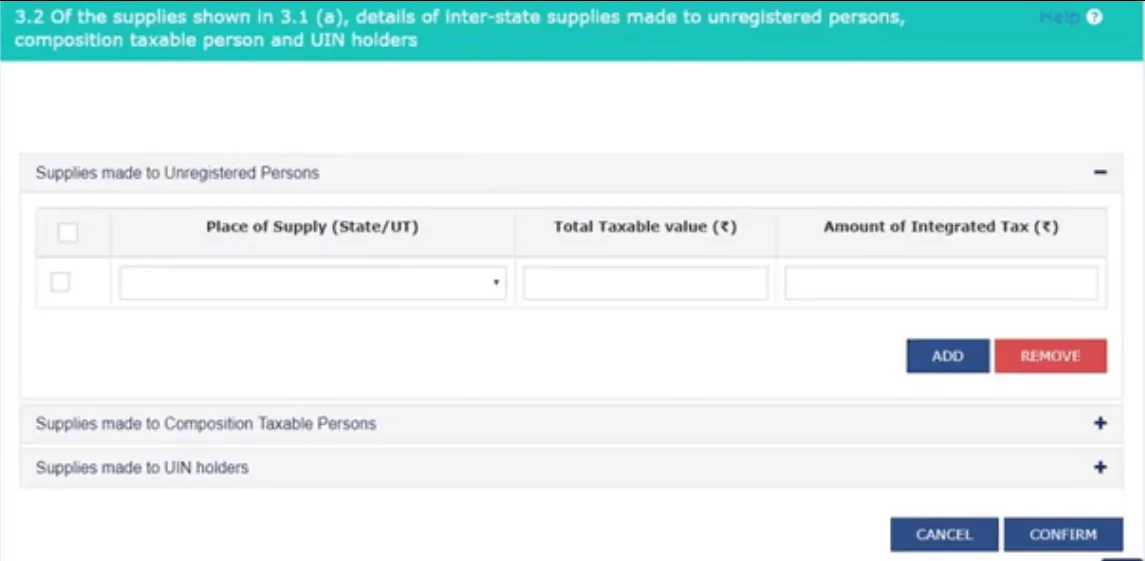

Section 3.2: The second part of the third section has the interstate supplies. These are the supplies that are made to unregistered persons, UIN Holders and composition taxable persons.

Section-4: It contains the details pertaining to eligible Input Tax Credit (ITC).

Section- 5.1: It has the non-GST inward supplies.

Section 5.2: Late fee and interest.

Section 6.1: Payment of the tax

Section-7 that was related to TCS/TDS credit is not applicable now.

FAQs on GSTR-3B

✅Can I file the GSTR-3B return using the ClearTax Software?

You can prepare it with DSC without going to any other portal. You can also import data from Tally into ClearTax with a single click.

✅Is there any invoice matching in GSTR-3B?

It is not available as it is a summarised self-declaration return.

✅If I am not having any sales or purchases in a month, Should I still file for it?

Yes, it has to be filed by each and every person irrespective of any sales and purchases.

✅Is filing GSTR-3B mandatory?

Yes, it is mandatory for all the casual and the normal taxpayers, including those with no business in that particular period.

✅What is the due date to file?

As it is a monthly return, the due date to file for a month is the 20th of the next month.

✅Can I file GSTR-3B online?

Yes, it can be easily be filed online.