IFSC Code (Indian Financial System Code)

The Indian Financial System Code (IFSC) is an 11-digit alphanumeric key used to recognize your branch’s specific branch. The first 4 figures of the IFSC code signify the bank’s name, the fifth character is 0, and the latter 6 numbers specify the bank’s code. This code is applied at the time of online funds transferal activities like NEFT (National Electronic Fund Transfer), IMPS (Immediate Payment System), and RTGS (Real Time Gross Settlement). IFSC code diminishes the scope of error during transactions.

Where can I search for IFSC Code?

The IFSC Code of a bank can be searched for in multiple ways:

What are the features and importance of IFSC?

IFSC code serves to recognize a bank’s branch. It is an essential means to make several online banking services smooth and hassle-free. IFSC facilitates instant fund transfer and faultless NEFT and RTGS transfer of capital with quick validation and verification. Some key features of IFSC are listed below:

- It permits easy branch location and identification.

- Simplifies digitalization of bank activities.

- Immediate transfer of funds

- It saves time and promotes safety.

- It helps in NEFT and RTGS.

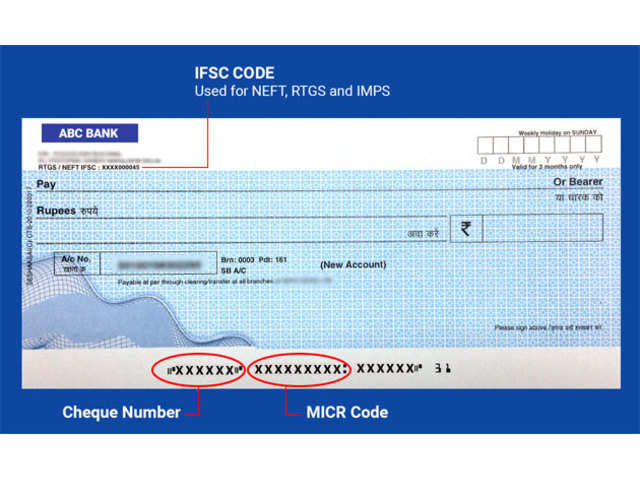

MICR Code

The Magnetic Ink Character Recognition Code (MICR) is a 9-digit key imprinted at the cheque’s footer. The first 3 characters define the city code, the next 3 represent the bank code, and the latter 3 characters are your bank branch’s code. A specialized machine is employed to read these digits and can also be understood by humans. MICR Code assists in recognizing the legitimacy of cheques and making cheque processing easier and quicker. Every branch has a specific MICR code that benefits RBI to know the bank branch.

Where can I find the MICR Code?

You can find the MICR Code of your bank in numerous ways:

What are the methods of online fund transfer using IFSC?

IFSC code is used to transfer funds online by using three main quick payment systems in India: IMPS, NEFT, and RTGS. You can use these 3 fund transfer techniques through mobile banking or net banking.

- NEFT – NEFT means National Electronic Fund Transfer is an electronic payment system used in India for quick interbank transfer funds.

- IMPS – IMPS means Immediate Payment System is an electronic money transfer facility where the money is transferred to the beneficiary’s account within a few seconds.

- RTGS – RTGS means Real Time Gross Settlement is one of India’s fastest interbank money transfer facilities.

FAQs about IFSC

✅ How can I find the IFSC code from the account number?

All accounts in the same branch of the bank have the same IFSC code. It is an 11-character alphanumeric code in which the first four characters reflect the bank’s name, the fifth character is 0, and the last six numbers identify the bank’s code. The IFSC Code can be located on the cheque and passbook issued by the bank, or you can check for it on the respective bank’s or RBI’s website.

✅ What is the IFSC example?

The IFSC code is an 11-digit code in which the first four characters reflect the bank’s name, the fifth character is zero, and the last six digits identify the bank’s bank code. The first four letters will be ‘SBIN,’ and the last six digits will reflect a particular branch code for India’s State Bank. The IFSC code of the SBI branch in Azadpur, Delhi, is SBIN0001707′, where 001707′ is the branch code.

✅ Is sharing IFSC code safe?

The IFSC Code is particular and is necessary for online fund transfers in India. The unique code given to each bank ensures the transfer’s security. However, no one can use the IFSC code to commit fraud or theft.

✅ Why is the IFSC code necessary?

The IFSC Code is required when transferring funds online between banks in India. It allows instant fund transfers via NEFT, RTGS, and IMPS, ensuring safety and speeding up fund transfers.

✅ Who issues the IFSC?

The Reserve Bank of India issues the 11-digit alphanumeric code IFSC, which is used to move India funds.

✅ Is Swift code and IFSC the same?

No, the Swift Code and the IFSC are not the same things. Within India, IFSC is used to transfer funds through payment systems such as IMPS, NEFT, and RTGS, while Swift Code is used to transfer funds internationally between different banks.

✅ How can I know my bank branch’s IFSC?

There are many ways to find out a bank’s IFSC code:

- The IFSC code can be found on the bank’s cheque and passbook.

- Navigate to the respective bank’s website.

- The IFSC code can also be found on the RBI’s website.

- Select Bank, State, District, and then Branches on the Dialabank website to find the IFSC code.