How to Analyze the CIBIL Report?

Understanding the significance of a CIBIL report, it is vital to realize how to understand one. A CIBIL report is a piece of various collected information that is proficiently arranged to assist the peruser with understanding it easily.

These six sections have various roles and are similarly significant. Their purpose is to give the customer’s total and genuine information to the bank or the financial institution to assemble a trustful relationship. Here is a brief on the significance and use of each section:

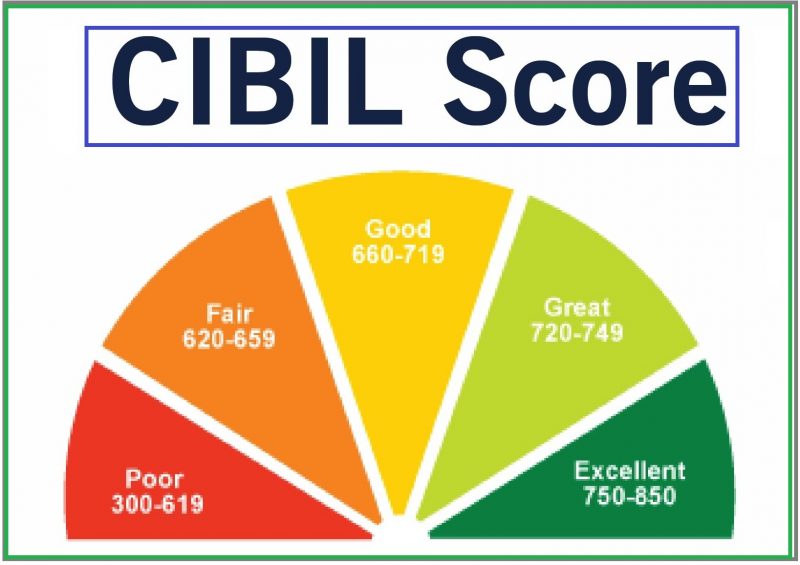

CIBIL Score: The CIBIL FICO assessment is the general study of one’s credit report and how commendable the person is of getting an advance or a Mastercard.

As of now explained above, it is a score somewhere in the range of 300 and 900 that briefly describes a person’s financial conduct. A decent FICO assessment is one over 750. A score over that increases an individual’s chances or an organization getting an advance and negotiating their pace of interest.

Personal Information: It is a typical misunderstanding to imagine that personal information is not identified with financial information. In any case, personal information collected by CIBIL is confirmation of accurate and genuine information. It helps banks and financial institutions check the customer’s information with the given one. Personal information consists of PAN card details, name, date of birth, voter’s ID, and other ID proofs. The information is collected through various means. The information collected from previous advance lenders is set apart with an ‘a’ to demonstrate its accuracy.

Contact Information: Contact information forms the third section of the CIBIL report that occupies all the person’s contact information. This is another evidence of the genuine personality of a person. The contact information consists of various addresses and contact information to give all the customer’s possible contact services. Contact information canvassed in contact information section addresses (home, work, temporary and perpetual), email IDs, contact numbers (portable and home). The previous and current lenders give information to ensure accuracy.

Employment Information: Employment information contains the relative multitude of jobs and companies a person has worked in. They check their records at those companies and how oftentimes they have switched from one work environment to the next. This helps the loan specialist understand the pay example of the customer. Any individual who skips too now and again between jobs has a slim likelihood of getting credit because of continuous pay changes and an adjustment in earnings recurrence.

Account Information: This is perhaps the most significant section of a credit report. This connects the bank or financial institution to a person’s financial status. It has all the records of a person’s previous and progressing loans and financial records. It also contains information about how much of the time the person makes repayments and if the individual in question has missed any dates. The account information also holds the financial balance details of the person. The details consist of the person’s sort of account, savings or current, single, or a joint account. This helps them understand their conduct and decide whether they should be loaned cash.

Enquiry Information: The Enquiry information section consists of the details of the multitude of banks that are considering the person for lending loans or charge cards. Various banks make these enquiries, and NBFC keeps your FICO rating at the top of the priority list.

So, to be a commendable candidate for getting an advance, ensure you maintain a decent FICO rating.