Non-banks and amortized moneylenders are fighting bashful of expanding large extensive loans, choosing instead to center on individual borrowers succeeding the coronavirus pandemic.

Non-bank lenders like Piramal Enterprises, Indostar Capital Finance, and Indiabulls Housing Finance have recapitulated their intention to cut loans to companies. The trend started last year after the pandemic broke out when Edelweiss Financial Services and IIFL Finance said they want to gradually withdraw from extensive lending. It was said by some of the experts that some of it is being operated by the fact that investors and money-lenders are more pleasant with retail vulnerability. Retail loans are seen to be shielded as moneylenders find it easier to recuperate from personnel.

One needs to be definite that Non-Banking Financial Companies are not just adjusting trade receivable policies, instead of moving out indiscriminately. There have been analyzing concerns about how an NBFC categorizes a certain loan—retail or wholesale—and how impermeable those compartments are on condition of impartiality.

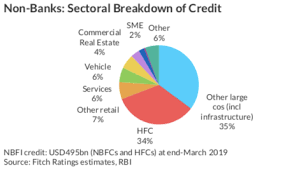

According to a Report of RBI, the gross proceeds of non-bank moneylenders rose to 1.9% in 2020 in comparison to 2019 to ₹23.6 trillion—and this was attributed to a 21.6% rise in retail loans. Loans to industries and services diminished by 0.3% and 3.3% over the same time. RBI said that there was a sharp depletion in credit growth in all sectors, with the exception of retail. During 2019-20, retail loans were operated up by housing loans and vehicle loans.

Piramal Enterprises has been working to substitute its financial services model from a freehold wholesale NBFC to an expanded lender. Its wholesale loan book contracted 20% between March 2019 and December 2020. Non-bank lenders have overlooked multiple situations with harder growth since Infrastructure Leasing and Financial Services backslid in September 2018, obstructing the contradictory economic slowdown. During covid-19 struck, the situation aggravated as borrowers got regulatory tolerance but NBFCs weren’t being able to avail similar benefits from their lenders.