Finance Minister announced the first installment of the mega Rs20 lakh crore package with the core focus on providing the relief to the MSME sector. The Prime Minister had declared the Aatmanirbhar Bharat package that will focus on making India self-reliant during his national address on Tuesday.

Finance Minister announced the first installment of the mega Rs20 lakh crore package with the core focus on providing the relief to the MSME sector. The Prime Minister had declared the Aatmanirbhar Bharat package that will focus on making India self-reliant during his national address on Tuesday.

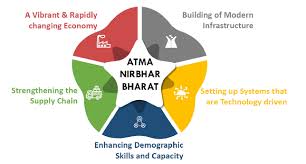

The finance minister, who was regulated by the MOS Anurag Thakur and the finance ministry officials, said that the Aatmanirbhar Bharat is based on five basic pillars, which are: Economy, Infrastructure, Technology-driven systems, Demography, and Demand. The focus will be on production factors: Land, Labor, liquidity, and Laws. The sole purpose of this whole framework is to make local brands global.

Six major steps for the revival of the MSME sector

- Facilitation of collateral-free loan of Rs3 lakh crores for MSMEs. This will turn out to be an advantage for 45 lakh units so that they can resume work and save jobs.

- For stressed MSMEs, the Subordinate debt provision of Rs20,000 crore has been announced for 2 lakh MSMEs. It will benefit those which are NPAs or stressed MSMEs.

- Rs50,000 crore equity infusion through Mother fund-Daughter fund for MSMEs that are viable but need handholding.

- A fund of funds with a corpus of Rs10,000 crore will be set up to help these units expand capacity and help them list on Markets if they choose.

- The Definition of MSMEs has been revised to allow MSMEs to aim for expansion and not lose benefits.

- There is going to be no distinction between the manufacturing & services sector MSMEs.

For Employees

- A liquidity relief of ₹2,500 crores EPF support is being given to all EPF establishments, EPF contribution will be paid by the Govt. of India for another 3 months till August and will benefit a population of 72 lakh employees.

- Statutory EPF contribution for all organizations and their employees covered by EPFO has been reduced to 10% from 12% earlier. This doesn’t apply to govt organizations. This will infuse Rs6,750 crore liquidity into these organizations.

For NBFCs/HFCs/MFIs

turnover up to Rs50 cr. Medium units with investment till Rs20 crore, turnover up to Rs100 crore.

- Global tenders will be disallowed up to Rs200 crore for government contracts.

- Will ensure e-market connections are provided across the board in the absence of non-participation in trade fairs due to COVID. The Govt of India and PSUs will clear all the receivables in the next 45 days.

Other Details

- Relief of up to 6 months (without costs to the contractor) to be provided by all Central Government Agencies like Railways, Ministry of Road Transport & Highways, Central Public Works Dept.

- In the real estate segment, the urban development ministry will provide an advisory to states/UTs so that the regulators can invoke force majeure. The regulators can suo-moto extend completion/registration dates for six months for projects expiring on or after March 25, 2020.

- A reduction of 25% of existing rates of Tax Deducted at Source (TDS) & Tax Collection at Sources (TCS) from tomorrow till March 31, 2021. This will release Rs50,000 crores.

- The due date of all the ITR filings has extended from July 31 to November 30. The Vivaad se Vishwas scheme extended till December 31, 2020. Date of assessments getting closed as on Sep 30, 2020, extended to December 31, 2020. The Date of assessments getting barred as on March 31, 2021, extended to September 30, 2021.