What is EPFO?

Employee’s Provident Fund Organization (EPFO), was founded on 4th March 1952. Its main function is to assist the central government to manage the necessary contribution to the Provident Fund Scheme, Pension Scheme, and an Insurance Scheme for the workers in the organized sector. It carries on its work under the Ministry of Labour and Employment.

When you want to make an EPFO login, first you need to create your ID and password on the EPFO portal. The official website of EPFO is suitable and easy to access.

Steps to Login to EPFO Portal

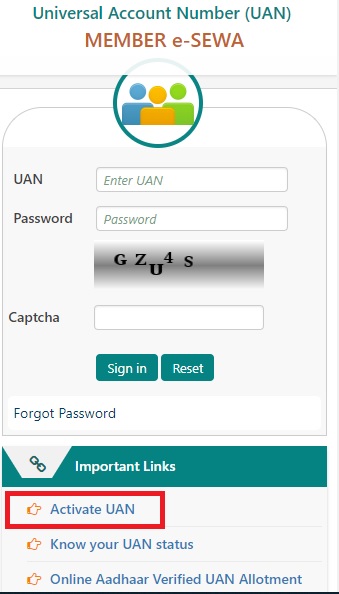

The first step to login into the EPFO portal is to activate their Universal Account Number (UAN), Every member of the EPF scheme whether employee or employer is allotted this number. You might find it on your salary slip or If you are an employee, then you can take your UAN from your employer. Let us understand the EPFO member login process.

EPFO Employer Login

EPFO helps every industry to facilitate and help employers of every industry to transfer claims conveniently, EPFO or Employee Provident Fund Organisation is an online platform to help employers. Employers can log in to the web portal of EPFO to avail online services. The various services provided to them include online registration of the establishments, filing monthly returns, and online payments of different charges. Member passbook, Establishment Search, TRRN ( Temporary Return Reference Number), and Employer Dashboards are some of the most frequent services which are available on the portal.

The steps for EPFO employer login are:

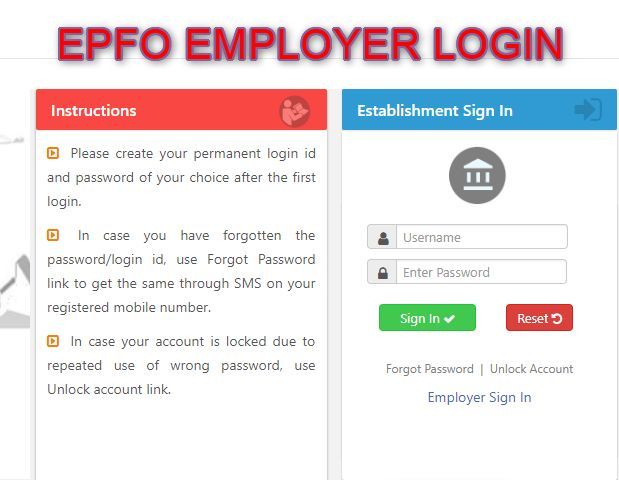

Step 1: The first step is to visit the EPFO employer login page. The link to reach EPFO unified portal login is https://unifiedportal-emp.epfindia.gov.in/epfo/#

Step 2: After that ‘Sign In’ using the username and password.

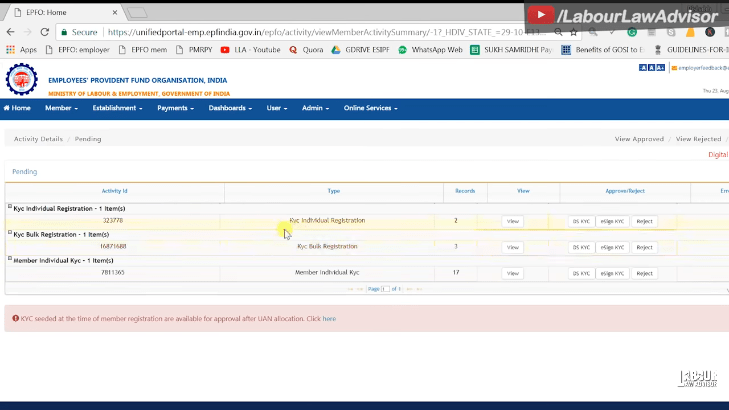

Step 3: proceeding to the next page you will get the main page of the employer’s EPFO portal. On this, you can approve the KYC details of employees

Some of the major Functions of EPFO Employer Portal:

EPFO Employee Login

EPFO provides us with information regarding all the available services online on its web portal. Employees can avail themselves of various benefits by downloading the forms from the portal which the scheme offers. Employees can also view their passbooks online as well as they can know their status claim. EPFO also has a separate portal for pensioners. Pensioners can also know their pension status and can also raise any query through the portal.

The steps to EPFO login for the employee are:

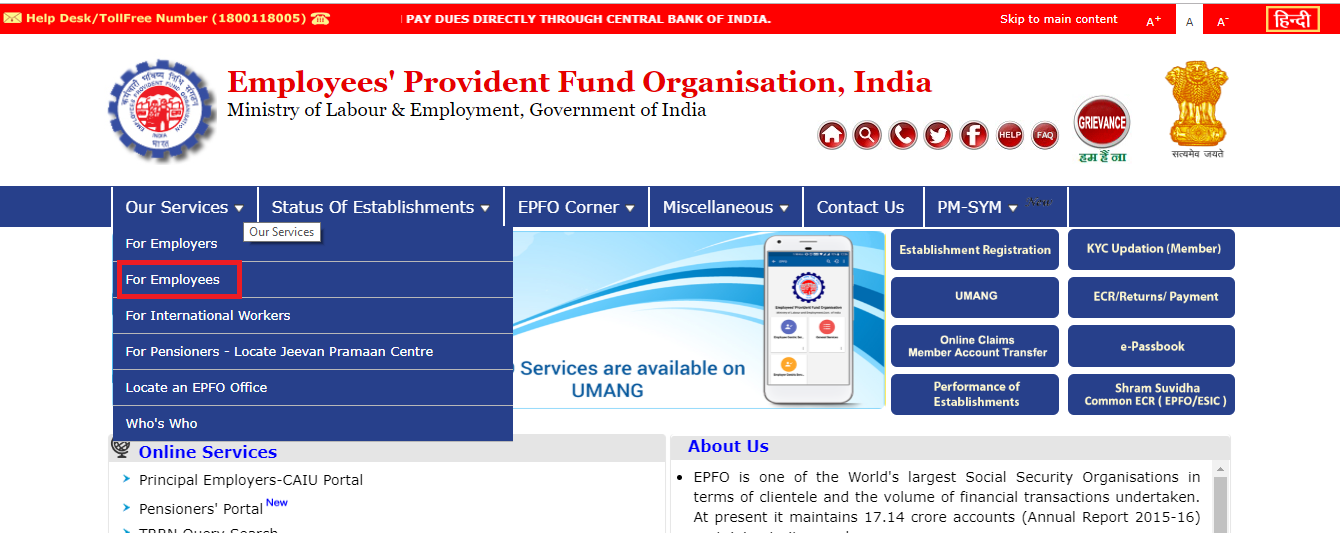

Step 1: First of all, visit the EPFO website: https://www.epfindia.gov.in/site_en/index.phpEPF

Step 2: After that click on ‘For Employees’ under ‘Our Services’.

Step 3: Then click on ‘Member UAN/Online Service (OCS/OTCP) under the services tab.

Step 4: Then on the next page, enter the UAN, password, and captcha and click on ‘Sign In’.

Now, you will be followed to the main page of the Employee’s EPFO portal. Here you can do your EPF balance check, claim PF amount, transfer PF amount, and update KYC.

Employees now will be able to change their exit date from the previous organization. As of January 2020, EPFO launched a new feature through. For transferring the funds online the exit date is needed to be updated on the EPF employee login along with the date of joining with a new employer.

EPFO Schemes

EPFO is one of the world’s largest Social Security Organizations in the world as we consider the number of members and the financial transactions involved. It consists of three schemes:

a) Employee’s Pension Scheme: In this scheme, Contribution is for those members who have retired or for nominees to receive the money after the member has passed away. Form 10D is used for monthly pension, and Form 10C for withdrawal benefits and scheme certificate

b) Employees Provident Fund: Under this scheme, each month’s contribution is summed up from employee and employer and is used by the individual at the time of retirement. However, partial withdrawals are also allowed in certain cases.

Under this scheme, Form 19 is used for the final settlement. Form 31 for withdrawal in certain cases, Form 13 for transfer of an old account to a new one. Form 20 for final settlement in support of nominee or beneficiary of the deceased member, and Form 14 for financing LIC policy.

c) Employees Deposit Linked Scheme: Under this scheme, family members of the individual are benefitted, in case he/she passes away while being a member of EPFO. The benefit is up to 20 times the salary of the employee or ₹ 6,00,000 whichever is lower.

Form 5IF for claiming the insurance benefit in case of a member’s death is used under this scheme. It can either be used by the beneficiary or nominee.

EPFO Help Desk

EPFO has its own separate portal for solving the queries related to UAN and EPF related issues. For using their services, you need to register on the portal by entering details like UAN, PAN, and Aadhaar numbers.

The toll-free number of the EPFO help desk is 1800118005.

FAQ

✅Is it possible that a member pays more than the mandatory 12% share towards EPF?

Yes, a member, can contribute more than the mandatory 12% share towards your EPF. However, the total contribution in a month cannot exceed ₹ 15,000.

✅What is the benefit of having a UAN?

You can use UAN for multiple things like getting a printed passbook, checking EPF balance through various channels like SMS, online login, missed call, or the mobile app.

✅Is registration needed on the member portal, in case I want to file a transfer claim?

Yes, to file a transfer claim, you have to register on the member portal.

✅Can I edit details such as the father’s name, date of joining, and relationship on the EPFO portal?

No, you cannot edit details such as father’s name, date of joining, relationship, date of birth, as it is entered in the EPFO database.

✅Who will go to receive the pension in case of a member’s death?

In case of a member’s death, his/her spouse and children, a maximum of 2 at a time, will receive a pension till the age of 25.

✅In case the settlement of the PF amount is not done within 20 days, where can I report it?

You can report the matter to the Regional P.F. Commissioner in charge of the grievances department. You can also file a complaint on the website using the EPFiGMS feature under ‘For Employees’. You can also opt for appearing before the Commissioner on the 10th of every month under the ‘Nidhi Apke Nikat’ program.

✅How to transfer my account if I have changed job?

In case of a job change, you can submit Form 13(R) and submit the claim for transfer online on the unified portal by logging in to his/her account.

✅Till what time the employee contribute towards his EPF?

There is no specific limit with regards to the period till which an employee can contribute towards EPF. However, if no contribution is made in EPF for 3 consecutive years, then no interest will be earned after the said period.