What is GSTIN?

Goods and Services Tax Identification Number or GSTIN is a 15-digit alphanumeric given to every person who gives the GST rate tax and is allotted after completing the GST registration. This GST number is given to the taxpayer, coupled with the GST registration certificate. The GSTIN number functions the same way, like the TIN allotted for VAT payment or the value-added tax.

the GST rate tax and is allotted after completing the GST registration. This GST number is given to the taxpayer, coupled with the GST registration certificate. The GSTIN number functions the same way, like the TIN allotted for VAT payment or the value-added tax.

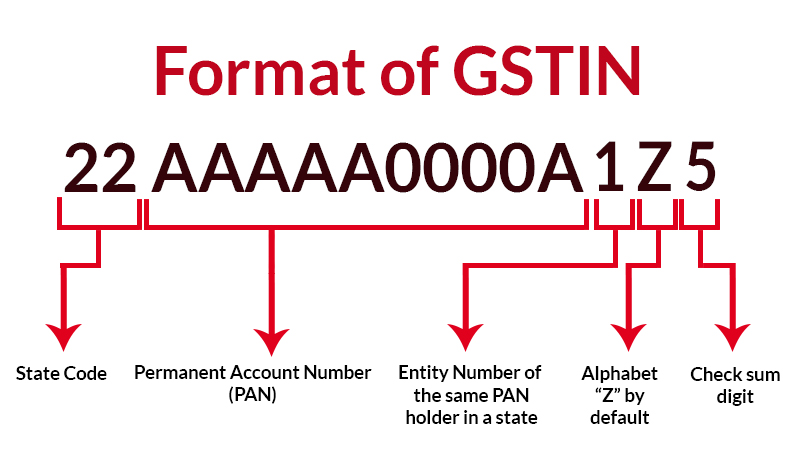

GST Number Format

GST number format is stored in an alphanumeric form. It can be disintegrated as follows:

- The first 2 digits of the GST code are numeric and represent how the concerned business is operated.

- The next 10 digits from the third to twelfth digits of the GST number represent the GST paying individual or entity’s detail, and thus is the PAN number of the entity.

- Further, the 13th character indicates the frequency of the registration done by the person. As per the regulations, a total of up to 35 registrations are permitted per person. For the first 9 registrations, the code is distributed in numbers from 1 to 9; after the 10th registration, the code is allotted from the letter A.

- The 14th digit is kept Z by default in every case.

- Lastly, the 15th digit is the check number, allotted in digits or alphabets.

GST Number Search

The GST number search is an online device available on the Government of India’s official GST portal. Through this portal, one can gain access to the GSTIN free of cost.

GST Number Search through PAN

- Visit the official website of GST by the Government.

- On the home page, click the ‘Search Taxpayer’ option.

- Now, select the ‘Search by PAN’ option.

- After clicking, the site leads you to a new page, wherein you are requested to enter your PAN and the displayed captcha code.

- After filling in the details properly, select the ‘Search’ option to get your GSTIN number.

GST Number Search through Name

- Search for an online GST search tool by name.

- On the portal, type the company’s name, the unit, or the employee for which you need the GST number.

- To proceed further, enter the state code or state name to look out for the business unit’s registration inside the state.

- Select the ‘Search’ icon to get your GSTIN number generated.

GST Number Online Verification

GST validation is required for all GST payers. This allows the taxpayer to double-check the validity of other business units and the importance of one’s own. GST online verification is a free and dependable tool that provides accurate results in a short period of time.