What is a Universal Account Number?

UAN or Universal Account Number is a distinct 12-digit key assigned to every Employee Provident Fund (EPF) member for his/her EPF account. With UAN, workers can easily obtain information regarding the balance in their EPF accounts with past and current employers and several other facilities like transaction of funds from one PF account to another, view and maintain EPF passbook, track claim situation etc.

Features & Advantages of Universal Account Number (UAN)

The Universal Account number helps the workers and companies to track multiple PF related exercises. Some advantages of UAN are listed as follows:

- UAN serves EPFO to determine the change in the profession of the employee.

- As the employee switches to a new job, the EPFO can efficiently update the information as all the PF accounts are connected in one place.

- With the UAN, it has become easy to recognise genuine PF accounts.

- Workers can access UAN amenities like transfer and withdrawal of funds online.

Why is the Universal Account Number essential?

- UAN is a distinct key assigned to every employee and is free of employer type.

- Companies can easily verify employees if it is KYC (Know- your-customer) authenticated.

- With an online tool of PF fund transfer, employers can’t subtract or hold back PF.

- Workers can easily track the monthly deposit if he/she has enrolled on the EPFO portal using UAN.

- Employees can also easily obtain the EPF passbook through the EPFO gateway.

UAN Benefits for Employees

Representatives can view EPF profile and access data such as name, DOB, and managing service records of previous and current companies through UAN. These are some benefits of the Universal Account number:

Representatives can view EPF profile and access data such as name, DOB, and managing service records of previous and current companies through UAN. These are some benefits of the Universal Account number:

- Through UAN, employees no longer need to depend on employers to access different PF accounts facilities as they can be obtained easily with the help of an online UAN member gateway.

- After verifying the UAN Member account details, funds from the old PF account can be transferred to the new PF account without any trouble.

- Employees can also avail of SMS assistance to get alerts as and when employers provide the PF.

Online Universal Account Number Allotment Process

The online UAN allotment process is done in the following steps:

- EPFO allot UAN key to PF account owners.

- The Employer then downloads the information of UAN.

- The UAN is then transferred to the responsible employee.

- Lastly, the employee can check, maintain PF accounts through UAN.

Documents Required for UAN Registration

Following documents would be needed by the employers for UAN enrollment of the employees:

- Latest Aadhar Card of the employee

- Bank account details and IFSC

- PAN Card

- ID Proof- Driving License, Voter ID, Passport, etc.

- ESIC Card

- Proof of Residence

How has UAN assisted in making the Withdrawal/Transfer of Funds easily?

With the initiation of UAN, it has become straightforward to withdraw/transfer funds from various PF accounts in one place. Below are some ways the exchange of funds has become easier and simpler for EPF accounts:

- Employees can link all the PF accounts without any trouble.

- Once employees provide UAN to the Employer, they can maintain their account online after the KYC confirmation.

- Employees can now get a monthly update on their registered mobiles on the Employer’s deposits in the PF account.

- If UAN is linked with the PF account, the Employer’s interference and necessity are much less.

- The process of withdrawal of funds has become less with the possibility of availing PF services online.

To know more about the Universal Account Number and other EPF features, visit Dialabank and get all your queries answered.

FAQs about the Universal Account Number

✅ How can I know my universal account number?

While employers provide a UAN number to the employees or the same is mentioned on the salary slips. You can know your Universal Account Number on the official UAN portal using your PF number or member ID.

✅ Is the UAN and PF account number the same?

No, UAN is a universal number allotted to every employee, unlike the PF number and can be used to link all PF accounts in one place.

✅ How can I activate my UAN?

To activate your UAN, you need to follow the steps mentioned below:

✅ Is UAN mandatory for online claims?

Yes, to submit online claims, you must have a UAN number.

✅ How has UAN made it Easy to Manage EPF?

With UAN, all PF accounts are linked in one place, and thus it is easy to view and manage PF related services online without much intervention from employers.

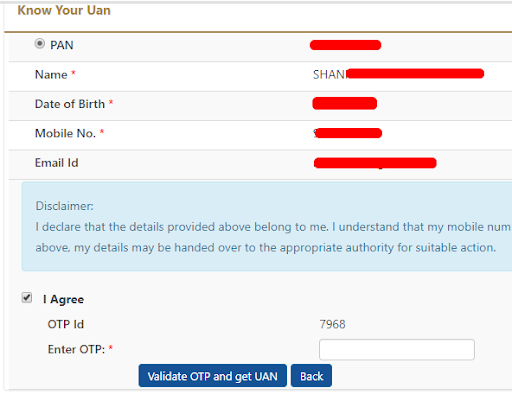

✅ Did I forget my UAN? How to retrieve?

To retrieve your UAN, your Aadhaar or PAN must be linked with UAN. Follow these steps to recover your UAN.

✅ How to link Aadhaar with UAN?

You can link your Aadhaar with UAN using the following ways as mentioned below:

✅ What to do if two UANs get allotted?

Every employee has a unique UAN, and in case you are allotted two UAN, the same must be reported to EPFO. After successful verification, the old UAN will be blocked.