Checking PAN Card

- You can track the details of the PAN card on the Department of Revenue’s e-filing site.

- The PAN number can be viewed using name and DOB after PAN verification.

- The status of the PAN application can easily be checked offline and offline.

- A 15-digit acknowledgment number will be required to check the status of the request.

GOLD LOAN @ 0.75%*

APPLY NOW

Know your PAN Card

A Permanent Account Number or PAN is the unique alpha-numeric account number of a person in the Tax Department. PAN assists in tracking free financial transactions for individuals and organizations. The Indian Tax Department issues and monitors the Permanent Account Number under section 139 of the Income Tax Act of 1961. It is not a legal obligation; however, access to many services is required from opening a bank account to filing a tax refund claim.

Checking the PAN card with the Income Tax filling port is a futile task. The site-enabled PAN verification service can be used to track false PANs. One can know the PAN and verify the PAN details in a few steps on the Department of Tax Department’s e-filling website.

Know Your PAN Number by Name and DOB

The Income Tax Filling Site has previously provided an option called ‘Know Your Pan’ which can be used to view a PAN number. You just need to log in to the website and enter the correct name and birthday. However, the website does not indicate an option. To know your PAN by name and date of birth, you will need to complete the PAN verification first and enter your name and date of birth.

The next step is to verify the PAN and trace it by entering the name and DOB.

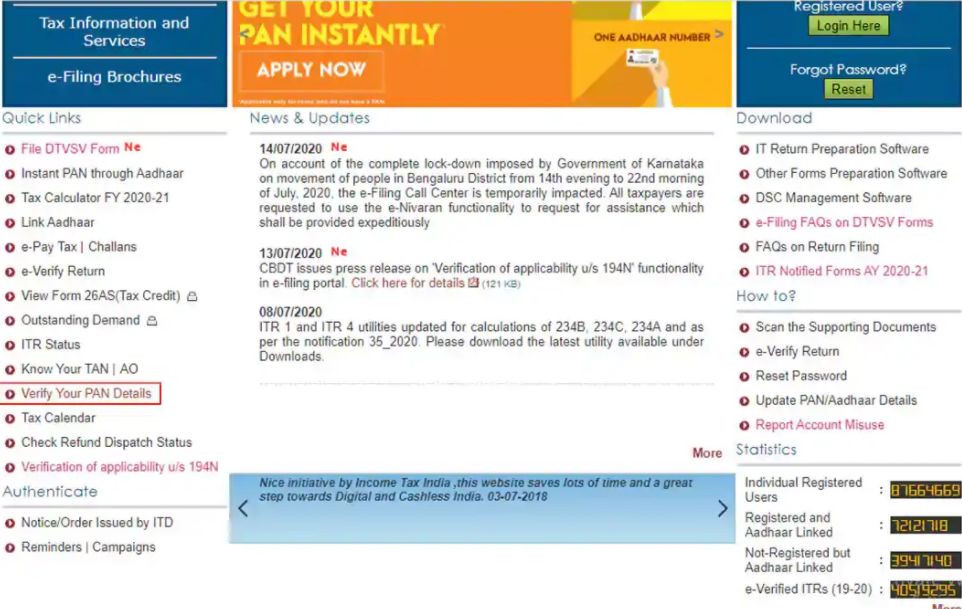

1. Go to the e-filling site, https://www.incometaxindiaefiling.gov.in/home.

2. In the left-hand corner of the page, in the ‘Quick Links’ section, tap ‘Verify your Pan details’ and move to your ‘Verified Pan’ screen.

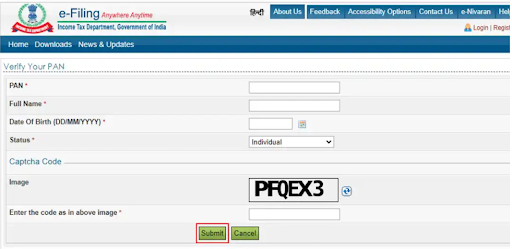

3. On the ‘Verify Your PAN’ page, enter the following personal details.

3. On the ‘Verify Your PAN’ page, enter the following personal details.

- IPAN

- Full name

- Birthday (select calendar)

- Status (select from the drop-down menu)

4. Type in ‘Captcha Code’ as shown in the picture and then tap ‘Send’.

You will be able to know your PAN number after following the steps above. The page will show, ‘Your PAN is active and the details are the same as the PAN database. However, if the information you provided is incorrect, the page will display the message, “No PAN record found provided”. The process mentioned above is now known as your PAN by name and DOB.

GOLD LOAN @ 0.75%*

APPLY NOW

Know Your PAN Card Details from Income Tax Website

On the Income Tax website, you can find out the details of your PAN card in a few steps mentioned below:

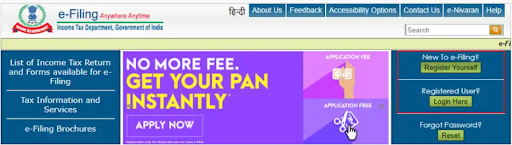

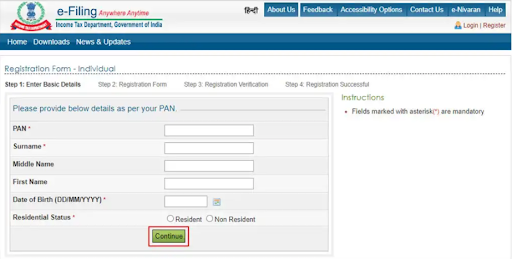

1. Visit the Income Tax website (https://www.incometaxindiaefiling.gov.in/home) and sign in.

- If you are new to the portal, just sign up by clicking on ‘Register yourself’ in the top right corner of the page.

- If you are a registered user, tap on ‘Sign In’ which is located below ‘Sign Up’.

2. Once signed in, go to ‘Profile Settings’ and click the ‘My Account’ option.

3. This page will show details of your PAN card and PAN number.

As mentioned above, you will need to be a registered user to check the PAN card on the Income Tax website. You can sign up for yourself by following these steps.

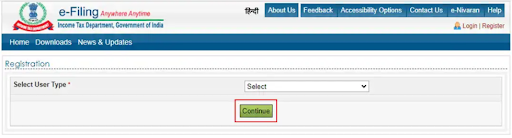

4. Tab on ‘Subscribe’.

5. Select ‘User Type’ to get the registration form.

6. Complete the registration form with valid details.

Type OTP received by post or SMS and the process will be completed.

GOLD LOAN @ 0.75%*

APPLY NOW

How to Track PAN Card Status?

Once you have applied for your PAN card, it may take up to 15 days to produce a PAN card. In the meantime, you can determine your PAN system status by using the 15-digit consent number you received after applying.

You can determine your PAN card application status in the following ways:

- By SMS

- By phone

- Through the NSDL website

Track PAN Card Status via SMS Facility

To easily find out the status of your PAN number via SMS center, follow these two steps.

Enter the NSDLPAN and the 15-digit acknowledgment number you received while performing the PAN program.

Send an SMS to 57575 and get the current status on the same mobile phone number via SMS.

How to Track PAN Status through Call?

Track your PAN status by phone, follow these steps.

- Call 020-27218080.

- Provide a 15-digit acknowledgment number.

GOLD LOAN @ 0.75%*

APPLY NOW

How to Track PAN Status Online?

You can track your app status online by visiting their official PAN TIN-NSDL card website (https://www.tin-nsdl.com/guided/guide-pan-introduction.html). Take the ‘Track Track’ option found in the ‘PAN Application’ section. After this, follow these steps:

- On the new page click on ‘Track Status of your PAN / TAN Application online’.

- In the next step select the application type such as ‘PAN – New / Change Application’ from the drop-down menu in front of ‘Application Type’.

- Now, enter ‘Admission Number’ and trace it by entering a captcha.

- Lastly, click on ‘Submit’ to find out the status of your PAN application.

PAN Transaction Status

The PAN transaction status is less of a concern for those who use online payment methods. To track transaction status, visit the official NSDL website and go to ‘Transaction Status’

GOLD LOAN @ 0.75%*

APPLY NOW

FAQS

✅ When should one check the status of a PAN?

One should check the status of the PAN after 5 days of receiving a 15-digit acknowledgment number or 10-digit UTI coupon.

✅ What is required to check the status of PAN?

The following is necessary to check the status of the PAN.

- A 15-digit acknowledgment number (in the case of a PAN application made through the NSDL).

- 10-digit UTI coupon number (in case PAN request is made through UTI).

✅ Who can check PAN Status?

Anyone who has applied for the PAN card can check the status of the PAN online or offline using his or her consent number or UTI coupon number.

✅ Can the applicant check his or her PAN status by name?

Yes, one can check his or her PAN status on his or her name in the IT filling portal. However, the process has changed recently. In the meantime, one has to complete the PAN verification before viewing the situation using the name.

✅ How can I know my PAN number by name and date of birth?

You can check your PAN number from name and birthday online in the following steps.

- Go to the IT filling site.

- Tap on ‘Confirm your Pan details’.

- Just enter the all the required information on the next page.

- Type in ‘Captcha Code’ and then tap ‘Send’.

✅ How do I know my mobile number from the PAN card?

You can check your mobile number from the PAN card online in the following steps.

- Log in to the Income Tax e-filling portal.

- Go to ‘My Profile’ and go to ‘Contact Details’.

- ‘Contact details’ will contain all the details, including the registered mobile number.

✅ Can I see my PAN card online?

Yes, you can see the PAN card online by visiting the Indian Tax Payment Department e’s website. Sign up for the portal, and you can view the PAN card in ‘My Profile’ in ‘Profile Settings’.